Netflix: An Unstoppable Success Story📈🍿

Netflix is up 4X since 2022🍿

Hi there investor! 👋🏻

In this article, we’re breaking down the business of Netflix.

Build a high-quality stock portfolio of compounders in 2024💎

Netflix: Introduction ( NFLX 0.00%↑ )

Netflix was founded in 1997 by its founders Reed Hastings and Marc Randolph. The company has revolutionized how people consume entertainment globally. Netflix started as a DVD rental service but transitioned into streaming in 2007. It eventually became the world’s largest streaming platform with now +280 million subscribers. Today, Netflix is a leading streaming service and content powerhouse. The business has seen major success over the last 2 decades from it being the first mover into streaming.

Netflix has been one of the most impactful companies of this century. It has redefined how we consume movies and series, and it has pioneered data-driven content creation.

The Business Model

What does Netflix do?

Netflix is a subscription-based streaming platform offering TV shows, movies, and original programming globally. It produces and licenses diverse content across multiple genres and languages.

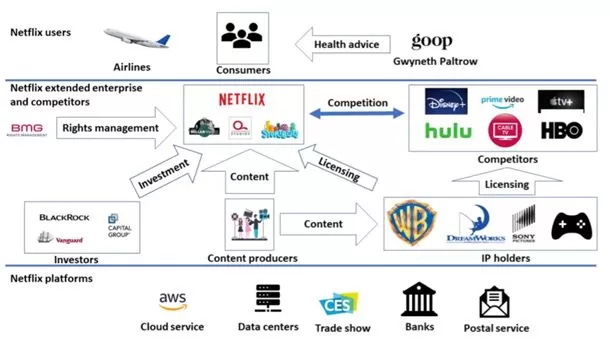

Here is a simple ecosystem overview from Research-Methodologt.net:

Netflix produces and buys the license for some of the most viewed content globally:

The content portfolio is continuously updated with great movies and series that keep the subscribers coming back for more.

How does Netflix make money?

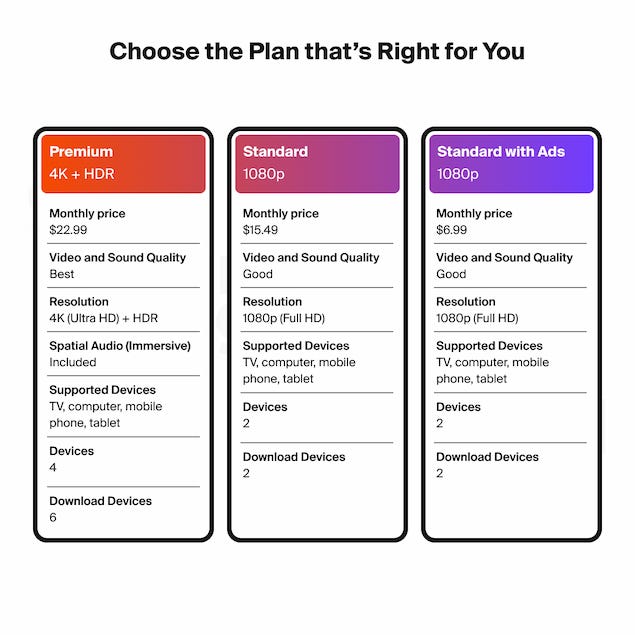

Netflix operates on a subscription-based revenue model, offering three tiers: Basic, Standard, and Premium. In 2023, Netflix introduced ad-supported plans, tapping into the advertising revenue stream (Like we’ve also seen Amazon do with its Prime streaming service).

The different plans vary in price in terms of what region or country you are buying the service from but generally range from $6.99 to $22.99 (According to their own website).

With +282 million recurring subscribers, it is obvious that Netflix has a good business model.

Business Segments

Streaming Services: Primary revenue driver.

Content Production: Original content through Netflix Studios.

Licensing & Distribution: Revenue from selling rights to its original content.

Netflix is an innovator and pioneer in the streaming industry, but they have not expanded its business segments outside of its core competency (Like Amazon, Alphabet, and other large technology companies).

Netflix uses new technology like AI to deliver an even better streaming service, this in turn creates pricing power as customers are willing to pay up to get the best entertainment solutions.

Data-driven personalization to reduce churn

Netflix’s algorithm-driven personalization and data analytics provide best-in-class viewer recommendations, enhancing user engagement. Increased engagement also decreases churn. This aspect is vital for a business that gets a significant economic effect of lowering its churn rates.

From Q1 2024, Netflix has the lowest churn rate of any streaming service by a wide margin:

Growth Drivers

Key Drivers

Original Content Expansion: Netflix’s consistent release of exclusive, high-budget originals like Stranger Things and The Crown.

Global Market Penetration: Localization strategies and investments in non-English content.

Ad-Supported Plans: New pricing models attracting budget-conscious viewers and advertisers.

Netflix has grown its revenue per share at a CAGR of 21.44% over the past decade, driven by international expansion and consistent subscriber growth.

Historic Financial Growth

The company has expanded its margins and ROIC over the same period, resulting in a 40.95% CAGR in EPS and a negative FCF of +$16.2B in FCF.

Competitive Advantage

Moat Source: Network Effect

The definition of network effects is the embodiment of a company's ability to elevate its worth exponentially as its network expands.

How does Netflix do this? By collecting data and user behavior on +280 million subscribers and by having the analytics capabilities to make better decisions for their service based on the data collected.

Netflix uses advanced data analytics and AI to create a personalized experience that engages and retains subscribers.

The company uses data to find new problems and to solve those problems for its subscribers. In addition, many of their new ideas come from their analytics and data departments.

By continuously using a data-driven decision model, Netflix is able to deliver better content that the subscribers want more of, deliver the right content at the right time in front of the right subscriber to increase engagement (and hence reduce churn), and quickly eliminate investments or initiatives that does not work.

“What gets measured gets managed” - Peter Drucker (Management guru).

Netflix’s focus on data and analytics ensures that they find the correct measurements and drivers for whatever KPI they want to maximize.

Most companies will tell you they are data-driven, but most are not. Netflix has had data in its DNA since the days of selling DVDs - analytics and data have always been central to how it makes decisions.

A visual overview of how Netflix personalizes streaming for its users:

Moat Source: Intangible assets

Intangible assets are non-physical assets that bring value to a company but lack a physical presence. Unlike tangible assets, intangible assets are not easily quantifiable and can be more challenging to evaluate.

Netflix’s moat lies in its I) strong brand equity, II) proprietary technology, and III) Intellectual Property (Trademarks, copyrights).

Strong brand equity

Estimating a company’s brand equity can be difficult. Looking at the Net-promoter scores gives us an idea of what brand the customers prefer. This is ultimately what causes brand equity to increase or decrease.

Netflix has an NPS of 43 with 60% promoters (High) and 17% contractors.

Netflix scores higher than its streaming competitors and with an NPS of 43 is considered a “great score”.

Proprietary technologies

As mentioned in the previous moat source of network effects. Netflix’s data capabilities, software systems, algorithms, and other specialized tools and processes to optimize user experience are the proprietary technology that sets them apart from other streaming services.

Intellectual Property

Netflix has a lot of IP from its original content. Much of this content attracts new subscribers to the service, and new seasons retain existing subscribers. This original content cannot be accessed anywhere else than on Netflix.

In addition, the Word of Mouth effect is in full motion for Netflix’s original content. Subscribers will see “Stranger Things”, “Dahmer”, and “Bridgerton” and talk about it the next day at work. This creates a virtuous cycle of Netflix creating great content → Subscribers talking about the content in their circles → Their friends or colleagues want to see the content → Netflix gets more subscribers → Netflix can invest in even better content.

Management

Greg Peters - Co-CEO

Peters previously served as Chief Operating Officer and Chief Product Officer at Netflix. Earlier, Greg was Netflix's international development officer. Before joining Netflix in 2008, he was Senior Vice President of consumer electronics products for Macrovision Solutions Corp.

Ted Sarandos, Co-CEO

Sarandos has been responsible for all content operations since 2000, and led the company's transition into original content production that began in 2013 with the launch of the series ‘House of Cards,’ ‘Arrested Development’ and ‘Orange Is the New Black’ among numerous others. Ted was named one of Time Magazine’s 100 Most Influential People of 2013 and received the Producers Guild of America Milestone Award in 2019.

Insider Ownership

Reed Hastings is one of the founders of Netflix and is still active as the Executive Chairman of the board. According to Stockopedia, Hastings owns 0.5% of Netflix and still has some skin in the game.

According to Yahoo Finance, insiders own less than 1% of the business. Although 1% is a lot in dollar value, there have been no insider purchases in the last +5 years. The executive team receives stock-based compensation based on their performance, so their incentives are somewhat aligned with shareholders. However, we’d like to see more insider ownership and insiders purchasing the stock indicating their belief in the company.

Risk Factors

3 main risks for Netflix’s business:

Increasing Competition: Competitors like Disney+, Amazon Prime, and Hulu offer comparable services, pressuring Netflix’s market share.

Rising Content Costs: High investment in original content may impact margins if subscriber growth slows.

Regulatory Challenges: Global expansion exposes Netflix to varying legal and regulatory requirements.

The result of these risks is that subscriber growth slows down or stops. This is something Wall Street hates, just look at what happened in 2022.

The stock tumbled -75% on slowing growth:

Valuation

Price to Gross Profit

Netflix is hard to value based on its historic Price-to-earnings or price-to-free cash flow because its focus on growth has meant lower profitability and hence very high PE/PCF levels. The Price to gross profits has been more stable over time.

Netflix currently trades at 22.29x gross profits, versus its 10-year median of 20.4x. This is slightly higher than its average, but well above its 2022 lows of ~5.5x.

Price-to-sales ratio

Similar to P/GP, the PS has been more stable over time.

Netflix currently trades at 10.03x sales, this is higher than its 10-year median of 7.46x, and significantly higher than its 2022 lows of ~2.5x.

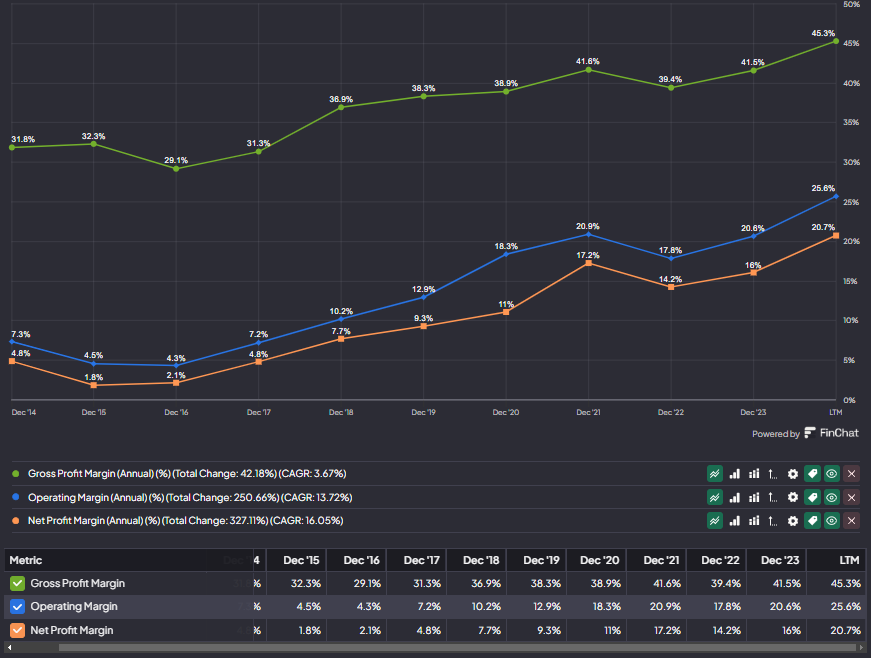

Margin expansion

Netflix has improved its business significantly over the last 10 years.

A significant increase in gross, operating, and net margins showcases Netflix’s strength and competitive moat. This also means that for every 100 dollars in sales, it makes in 2024, I earned ~$20.7 in net profits, while for every 100 dollars it made in 2014 provided only $7.3 in net profits.

This means that Netflix should be able to get a premium multiple in 2024 with much higher margins.

On the flip side, it also could mean that Netflix’s margins are closing in on a ceiling and that we won’t have the same increased margin effects in the next 5-10 years.

Simple Discounted Cash Flow Analysis

Using earnings per share as a proxy for growth.

Last twelve months of Earnings per share: $18

Netflix is estimated to grow its long-term EPS by 25.51%

Using 3 different growth scenarios for Netflix, with EPS growth between 10% - 22% we receive 3 different fair values:

Worst case: $599.17

Best case: $1402.39

Normal case: $952.22

We weigh the probabilities of the 3 different scenarios as follows:

Worst case 30% chance

Best case 10% chance

Normal case 60% chance

The fair value based on our DCF analysis is $891.32

The current price is $888

This means that we can expect a 10% CAGR for Netflix based on the inputs above.

If you believe Netflix will be able to sustain a 22% - 25% CAGR for its EPS in the next +5 years, we can expect an above 15% CAGR from Netflix stock.

Be mindful: If any of the risks materialize for Netflix, we are likely to see a significant multiple contraction like in 2022. In that case, a linear DCF analysis will not be sufficient.

Conclusion

Netflix is a trailblazer, a first mover, a data-driver content powerhouse with multiple growth levers and a competitive advantage. It is for sure a premium business and it deserves a premium multiple.

As it stands now, we don’t believe any other streaming service can compete with Netflix and its original content. Netflix has also shown its pricing power over time and is now taking action towards account sharing. This could have a positive effect in terms of more subscribers having to purchase their own subscriptions.

Netflix has a large penetration in “Western” countries, and moving forward it will have to penetrate emerging markets to sustain its growth (Asia, Latin America, Indonesia).

The company is currently fairly valued with high expectations for growth baked into the stock.

We believe there will come a better time to own this great business and remain patient.

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 250 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +10.000 stock market investors (45% open rate) — Contact us via: investinassets20@gmail.com

Hey! I sent you a message if you are interested to look at it!

Hello. I have a question. The percentages of the 3 different scenario’s aren’t adding up to 100%. Are you suggesting a 10% chance of bankruptcy?