MSCI: The Financial Powerhouse with $15.6T in Assets 📊

Breaking down one of the best business models ever 🧠

Hi there investor! 👋🏻

In this article, we will break down the business of MSCI and showcase what makes this company so attractive.

Let’s get into it 👇🏻

Build a high-quality stock portfolio of compounders in 2024💎

Read more: Join Premium

MSCI Business Breakdown (NYSE:MSCI 0.00%↑)

Table of content

Introduction of the business

Business model

Growth Drivers

Competitive advantage

Management

Valuation

Conclusion

Introduction

MSCI (Morgan Stanley Capital International) is a market leader in the world of investment research.

The business was founded in 1969 and offers a range of stock indexes, portfolio risk and performance analytics, and governance tools. It serves institutional investors and hedge funds with insights and benchmarks.

Here are 3 interesting facts about MSCI:

MSCI Started as a Division of Morgan Stanley. The business was spun off as a standalone entity in 2007. This separation allowed MSCI to grow into one of the world’s largest index providers and analytics firms, separate from the investment banking operations of its former parent.

MSCI has been a key player in opening up international investments to emerging markets. Their Emerging Market Index was launched in 1988 and was the first index to track developing economies. The index has since been used by investors to get exposure to economies like India, Brazil, and China.

MSCI is a cash-generating machine that creates shareholder value through EPS growth, dividends, and stock repurchases. Since 2014, MSCI has repurchased 3.64% (CAGR) of its shares.

The Business Model 🏰

MSCI operates through four main segments:

1. Index (58% of Revenue)

MSCI creates a wide range of equity market indexes. These indexes track different regions and types of investments.

Investors use MSCI indexes to shape their portfolios, decide where to allocate assets, manage risks, and measure performance.

MSCI also offers specialized thematic indexes that focus on big trends like technology and sustainability, allowing investors to target specific areas of interest.

2. Analytics (24% of Revenue)

MSCI provides tools for analyzing and managing investment portfolios. These tools help asset managers, hedge funds, and investors make smart decisions about their investments.

The tools are available through APIs, partnerships, and digital platforms - MSCI Analytics offers insights into equity portfolios, multi-asset investments, and fixed income. These tools assist in portfolio construction, risk management, and optimizing investment strategies.

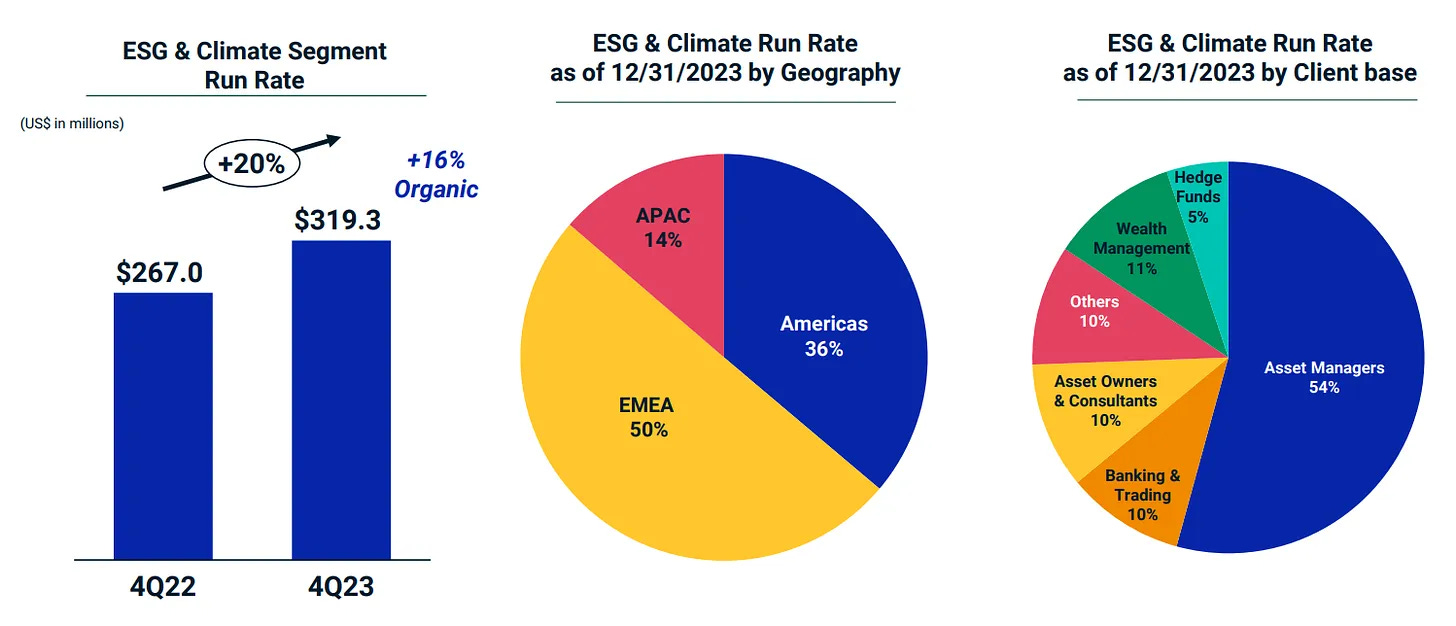

3. ESG & Climate (11% of Revenue)

MSCI is a leader in measuring ESG (Environmental, Social, and Governance) and climate factors. This segment includes ESG indexes, ratings, and climate data.

MSCI’s ESG and climate tools help businesses and investors understand their environmental impact, manage climate risks, and meet sustainability goals.

Their data covers nearly 1 million securities, making it easier to compare and evaluate different investments.

4. Other (7% of Revenue)

This segment covers MSCI Real Assets and Private Capital Solutions. MSCI Real Assets provides data and insights for investing in real estate and infrastructure. Private Capital Solutions offers analytics for private equity and debt investments.

MSCI’s attractive business model:

Recurring Revenue: 97% of MSCI’s revenue comes from recurring sources, primarily subscriptions and asset-based fees.

High Retention: The retention rate for MSCI Analytics is above 94%, indicating strong customer loyalty.

Client Spend Growth: Clients onboarded in 2018 have increased their spending by 2.7 times, showing significant growth in product usage.

Strong Cash Flow: MSCI has a free cash flow conversion rate above 100%, with an average operating cash flow conversion of 131% since its 2007 IPO.

High Margins: MSCI’s gross margin is 82.08%, operating margin is 53.72%, and free cash flow margin is 48.43% (Almost 50% of revenue is converted into free cash flow).

Growth Drivers 🚀

MSCI's impressive growth is fueled by a few key factors that highlight its leadership and ability to adapt in the market. Here are the main points:

1. Expansion of Index Offerings

MSCI offers over 280,000 indexes—covering equity, fixed income, alternatives, and ESG sectors.

This extensive range meets diverse investment needs and attracts various asset owners and fund managers.

MSCI's broad index portfolio solidifies its position as a leading benchmarking and index solutions provider.

2. Strong Market Demand for ESG and Climate Solutions

The EU’s strict ESG reporting regulations boost demand for MSCI’s ESG data and indexes.

MSCI offers specialized ESG and Climate indices that reflect objectives such as excluding controversial stocks, integrating ESG ratings, reducing carbon emissions, and mitigating climate risks.

In 2023, four of the five flagship MSCI ACWI ESG Indexes outperformed their parent indexes, with the MSCI ACWI SRI and MSCI ACWI ESG Screened Indexes leading with returns of 3.4% and 2.0%, respectively.

The table displays the gross return in USD from December 2022 to December 2023.

MSCI’s ACWI Climate Action and ACWI Climate Change Indexes delivered active returns of 2.7% and 6.5%, respectively, showcasing the strong performance of their climate-focused solutions.

3. High Switching Costs and Strong Brand Loyalty

MSCI’s established reputation and the high cost of changing indexes encourage client retention.

For instance, BlackRock’s iShares Core MSCI EAFE ETF, with $115 billion in assets, illustrates MSCI’s deep integration in major investment products.

High switching costs ensure stable revenue and reinforce MSCI’s competitive advantage.

4. Diversified Revenue Streams

MSCI’s revenue model includes 73% recurring subscription fees, offering stability and predictability.

In Q2 2024, MSCI saw 16% growth from asset-based fees driven by all-time high AUM and ETFs linked to MSCI indexes.

The analytics segment contributes 24% of revenue, diversifying income sources and providing financial stability.

These growth drivers provide organic growth in multiple business segments for MSCI. The business is well-positioned to continue to grow and return value to shareholders.

The Competitive Advantage, Management, and Valuation section is for premium subscribers 🏆, consider joining us: