Invest In Quality Premium will increase its prices from

Monthly: $12/m —> $20/m

Annually: $100/yr —> $200/yr

On March 18th.

If you purchase a subscription now, you will forever hold your lower price point.

We will never increase prices on our loyal subscribers.

Make sure you subscribe before March 18th to save a boatload on your subscription!

Introduction

MercadoLibre, the Latin American e-commerce giant, has experienced a remarkable journey since its inception in 1999. Founded by Marcos Galperin in Buenos Aires, Argentina, the company has evolved into a regional powerhouse.

Early Years

In the early 2000s, MercadoLibre navigated the aftermath of the dot-com bubble burst, demonstrating resilience and adaptability. Recognizing the need for trust in online transactions, the introduction of MercadoPago, an online payment system, proved instrumental in fostering confidence among users.

Regional Expansion

MercadoLibre's strategic expansion beyond Argentina into Brazil, Mexico, and other Latin American countries marked a significant growth phase. The company tailored its services to local preferences, solidifying its position as the preferred e-commerce platform in Latin America.

Diversification & Innovation

MercadoLibre's commitment to diversification and innovation played a crucial role in its success. Introducing features like MercadoShops, MercadoEnvíos, and MercadoCredito enhanced the user experience and established the platform as a comprehensive e-commerce ecosystem.

Adaptation

Despite facing challenges such as economic downturns, regulatory hurdles, and global competition, MercadoLibre's ability to adapt, innovate, and understand local markets enabled it to overcome obstacles and thrive in the dynamic e-commerce landscape.

Current Position

MercadoLibre stands as the 5th largest e-commerce player in the world. In 2023, MercadoLibre delivered $14.4 billion in revenue, $987 million in Net Income, and a whopping $4.6 billion in Free cash flow. The growth has accelerated in recent years and is set to continue to grow at rapid rates:

Business segments

MercadoLibre strategically builds business segments to create a robust ecosystem of digital services to increase the user experience. MercadoLibre has 4 primary business segments that drive growth:

Core E-commerce:

At the heart of MercadoLibre's success lies its core e-commerce platform. Functioning as a marketplace connecting buyers and sellers, this segment has been the primary revenue driver. The company's regional expansion and market customization have solidified its position as the go-to platform for millions of users across Latin America.

The financial journey of the commerce segment has been nothing but amazing. Commerce revenue has compounded by 36.74% annually for the last decade. The number of successful items sold has increased by 31.77%, indicating that the items sold have increased in price. And the take rate has increased from 4.6% to 18.3%.

Mercardo Libre’s Q4 quarter report indicates high and sustainable growth in GMV, items sold, and total unique buyers for the commerce segment.

Credit - MercadoCredito

MercadoLibre's Credit segment is a strategic pivot into fintech, with their product, MercadoCredito. By offering working capital loans to sellers and installment payment options to buyers, MercadoCredito not only boosts transaction volumes on the platform but also taps into the lucrative financial services market.

KPI data from the most recent quarter on their Credit segment shows a well-run and growing segment:

Online Payments - MercadoPago:

MercadoPago is the company's online payment system. Facilitating secure transactions, MercadoPago has become an integral part of the user experience, contributing to increased customer loyalty and overall transaction volumes. With an increase in total payment transactions of 76.2% YoY and a growing number of unique active users for their online payment solution, MercadoPago will be an important segment in the coming years.

Logistics - MercadoEnvíos:

Efficient logistics are paramount in the e-commerce industry, and MercadoEnvíos addresses this need. Offering shipping solutions to sellers, MercadoEnvíos enhances the overall customer experience by ensuring timely and reliable deliveries. This business segment complements the core e-commerce platform, driving customer satisfaction and loyalty.

Conclusion

MercadoLibre has several segments that are benefitting from each other and creating synergy effects. Their businesses are growing rapidly and are exposed to the digitalization of Latin America, where it has a firm grip as a market leader. Looking at their two most important revenue sources, Commerce & Fintech, we can see the growth and diversification into Fintech over the last 5 years. This is remarkable, as we don’t have to rely on commerce alone to drive future growth.

MercadoLibre's Key Growth Drivers

Rapidly growing market

LatAm has more than 300 million digital buyers, this figure is set to grow by more than 20 percent per year until 2027 according to Statista. Online retail sales amounted to $168 billion in 2022 and are set to account for 20% of total retail by 2026. Brazil and Mexico are currently the largest e-commerce markets in LatAm, accounting for 30% of the total market. However, Argentina, Colombia, and Peru are growing rapidly as well. This creates an attractive market to be in for MercadoLibre.

Total e-commerce volume estimate for Latin America by PCMI:

Regional & Global Expansion

MercadoLibre's relentless pursuit of regional expansion has been a pivotal growth driver. By venturing beyond its Argentine roots into countries like Brazil, Mexico, and others, the company taps into diverse markets. MercadoLibre has been growing rapidly in Argentina, but growth in the rest of LatAm is important as it will showcase that their success can be replicated elsewhere. This can also work as a proxy to determine if global expansion is possible at a later stage.

New Verticals

At the forefront of MercadoLibre's success is its commitment to technological innovation. Constantly evolving its platform to meet the changing needs of consumers and sellers, the company embraces cutting-edge technologies. From a user-friendly interface to advanced logistics solutions, technological prowess has become a cornerstone for sustained growth. By being at the forefront of innovation, Mercadolibre has created new verticals and business segments over the years. Part of the bull case is that Mercadolibre will add additional value-added services to its product offering to achieve higher average revenue per user (ARPU).

The Stock

Since Mercadolibre’s IPO in 2007, the stock has returned 27.3% per annum to its shareholders. Over the last 10 years, it has returned 31.4% CAGR. Over the last 5 years, it has returned 25.7% CAGR. Mercadolibre has been a great investment in almost any time period (Expect 2021 peak levels).

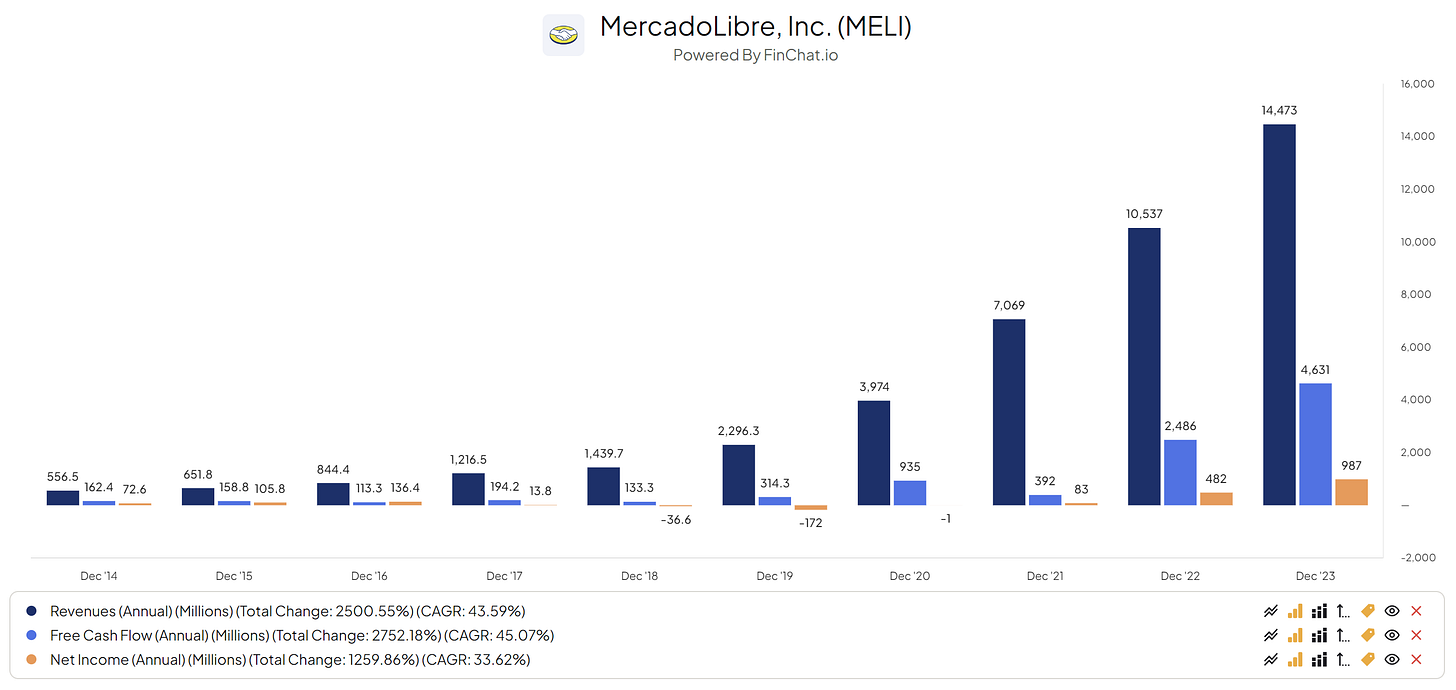

The Growth

MercadoLibre has seen an amazing growth over the last 10 years:

Revenues of $14.473 billion (43.59% CAGR)

Net Income of $987 million (33.62% CAGR)

Free Cash Flow of 4.631 billion (45.07% CAGR)

Per share compounding

MercadoLibre has been compounding the intrinsic value per share:

Earnings per share has grown to $19.6 (31.80% CAGR)

Operating cash flow per share has grown to $100.8 (41.38% CAGR)

Free cash flow per share has grown to $90.8 (42.77% CAGR)

To access the full article, you need to be a Premium Subscriber.

Upgrade today, and get:

💎Full access to my quality growth portfolio where I invest 80% of my net worth

📈Monthly factsheets of the portfolio, performance, buys and sells.

🎯Notification in advance, or the same day I buy or sell a position.

🧾Upcoming courses on financial statement analysis and valuations

🏰All my research (Investable universe, ranking, valuations, quality)

👑Weekly breakdowns of quality compounders and valuations

🤵Access to me: I will be available to answer all the questions and concerns my paid subscribers might have about investing

The newsletter is currently priced at $12 per month or $100 per year.

The price will increase to $20 per month & $200 per year on March 18th.