Hello! 👋

In case you missed our previous articles:

Let’s get into today’s article! 👇

Medpace Holdings

Key Highlights

Medpace is a fast-growing clinical research organization (CRO) compounding its free cash flow (FCF) per share by 29.89% in the last 5 years.

Medpace Holding has outperformed the market in the last 5 years with a 47.4% compounded annual growth rate.

Biotech funding is expected to recover in 2024 with 44% of the industry assuming a positive outlook.

Medpace holds a competitive advantage and looks attractive compared to its peers.

The company is founder-led, and the CEO & Founder owns 17.42% of the company (Although he has been reducing his position by 15.39% in 2024).

We are building a video course on quality growth investing 👨🏫

It will teach you:

How to find quality ideas 💡

How to analyze a business 🏰

How to value a business 📊

How to build your portfolio 🧠

Sign up for an early release offer when the course releases:

Medpace Holdings: A Leader in Clinical Research Services

Medpace Holdings is a leading provider of clinical research-based drug and medical device development services.

Established in Cincinnati, Ohio, Medpace has earned a reputation for delivering high-quality, full-service clinical research services across various therapeutic areas.

Contract research organizations (CROs) develop clinical studies for pharmaceutical companies. These studies are needed to get new drugs approved.

The process takes 1-7 years per stage and is costly. The drug development process can cost as much as +$2 billion, with a ~10% probability of success. The large capital requirements make the pharma companies less attractive to invest in.

However, supporting industries like CROs have much more appealing economics.

Sartorius’ process for drug discovery:

According to GlobalData, venture financing for US-based innovator drugs peaked in 2021. During 2023, funding decreased by 43.2% compared to 2022 and by 52.3% compared to 2021, attributed to macroeconomic pressures causing investors to be more cautious and prioritize existing portfolios.

However, 44% of healthcare industry professionals surveyed globally are “optimistic” or “very optimistic” about the next 12 months in terms of recovery for biopharma.

This is good news for Medpace if it comes to fruition.

What Medpace Does

Medpace specializes in providing comprehensive clinical development services to pharmaceutical, biotechnology, and medical device companies worldwide.

Their services span the entire drug development process, including Phase I-IV clinical trial management, regulatory consulting, medical writing, data management, and biostatistics.

Medpace’s integrated approach ensures that clinical trials are conducted efficiently and meet the highest standards of quality and regulatory compliance.

Medpace’s Business Model

Medpace’s business model revolves around offering end-to-end clinical development services. By integrating various clinical trial services under one roof, Medpace streamlines the development process for its clients, reducing complexity and enhancing efficiency. This full-service model appeals to clients looking for a seamless, comprehensive solution to their clinical development needs.

Another benefit of Medpace’s business model is that it collects cash from its contract before delivering the research. This, in turn, provides Medpace with cash conversions consistently above 100% and enables them to reinvest cash before delivering the product. This cash is used to buy back shares and reinvest in the operations.

How Medpace Makes Money

Medpace generates revenue primarily through service fees charged to clients for managing and conducting clinical trials. These fees are typically based on the scope, duration, and complexity of the trial.

The company operates on a fee-for-service model, providing a predictable revenue stream while maintaining flexibility to scale services based on client needs.

Since 2020, Medpace has seen a significant increase in demand for its services, driven by the growing complexity of clinical trials and the increasing regulatory requirements. The company has leveraged its expertise and global infrastructure to attract a diverse client base.

Medpace’s clients come from the small & mid-sized biopharma markets with a 79%, and 17% allocation respectively. Large pharma only makes up 4% of total revenues.

The company is concentrated on its top customers, with 22% of revenues from the top 5 clients, and 29% from its top 10 clients.

Global Expansion

Medpace has expanded its global footprint to better serve its clients’ needs. The company operates in key markets around the world, including North America, Europe, Asia-Pacific, and Latin America. This global presence enables Medpace to conduct clinical trials in diverse regulatory environments and access a wide range of patient populations.

Growth Drivers

Medpace’s growth is driven by 3 key factors:

Increasing R&D Spending & Funding: Pharmaceutical and biotechnology companies are investing heavily in research and development, driving demand for clinical research services.

Complexity of Clinical Trials: As clinical trials become more complex and require specialized expertise to meet regulatory needs, Medpace’s integrated service model becomes increasingly valuable to clients.

Therapeutic Specialization: Medpace’s focus on specific therapeutic areas, such as oncology, cardiovascular, and metabolic diseases, positions it as a leader in these high-growth areas.

Financial Performance

We want to invest in businesses with great historic performance, and bright future outlooks for continued growth.

Revenue

Medpace has grown its revenues by 22.95% CAGR since 2014. Since 2021, the growth has been +20% annually.

The company likes to use EBITDA as a proxy for earnings growth, compounding between +19.7% and 21.1% CAGR since 2018:

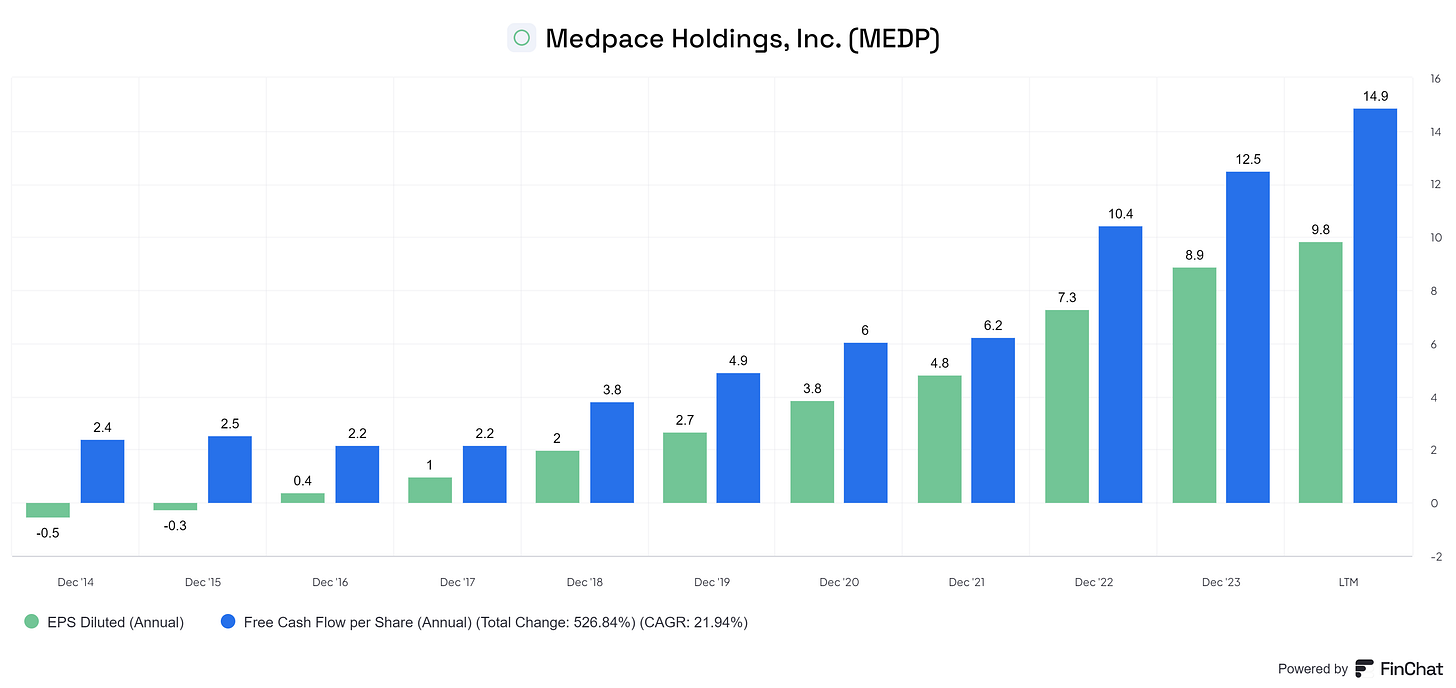

Earnings & FCF per share

Free cash flow per share has compounded by 21.94% since 2014. Earnings per share turned positive in 2016 and have compounded by 57.15% since then.

Medpace is guiding for 21.5 - 30.5% growth in Net Income and EPS for 2024.

Margins

Gross margins are steady and slightly expanding. The same can be said for FCF and operating margins. This indicates that Medpace has a strong competitive position.

Return on Capital

Returns on invested capital (ROIC) and returns on capital employed (ROCE) have expanded significantly since 2016. This indicates that Medpace has improved its competitive position and can get a much larger return on the investments it makes.

Financial Health

Medpace converts 127.3% of its accounting earnings into free cash flow.

Medpace has a net debt of -$407 million. This indicates that Medpace’s cash position is larger than the total debt.

In addition, interest coverage is +690x.

Medpace will not go bankrupt anytime soon.

Competitive advantage

Medpace’s ROIC indicates that it can get an increasingly better return on the capital it invests in the business. This is often a sign of a strong competitive position and a moat.

If we compare Medpace’s ROIC to the rest of its competitors — The business has an ROIC and ROCE of 18.1% and 52.4% respectively. Compare this to IQVIA of 8.3% and 10.7%, and Syneos Health of 4% and 5.3%.

The Seeking Alpha peers comparison shows that Medpace has a return on total capital of 30.5%, while the closest peer is BRKR with an ROTC of 10.15%.

Not even close.

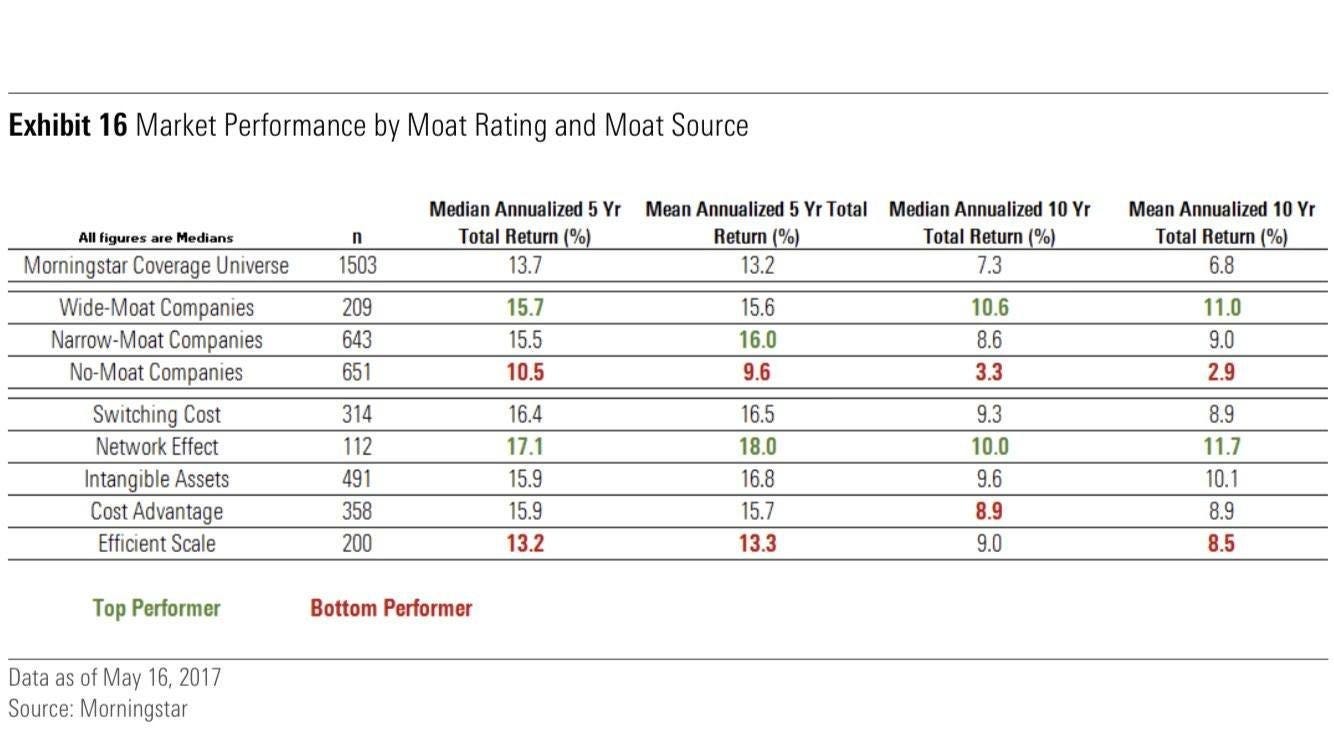

Morningstar attributes Medpace with a narrow moat with strong intangible assets and high switching costs.

Intangible assets are the second strongest moat source in the Morningstar moat framework:

Management

Medpace is a founder-led business. Dr. Troendle is the CEO and founder. He has previous experience from Novartis where he was responsible for the clinical development of lipid-altering agents.

Dr. Troendle is not just a strong CEO, he knows the ins and outs of the business better than most people. This is a rare trait in executive management.

Insider ownership

CEO owns 17.42% of the company (Valued at $2.1B)

Board member Carley owns 0.07% (Valued at $8.47M)

Board member McCarthy owns 0.02% (Valued at $2.42M)

Chief compliance officer owns 0.04% (Valued at $4.84M)

Insider activity

Dr. Troendle has reduced his position by 24.93% since 2022 with multiple sales. At one point, he owned 23.52% of the company (Sept 2022), as the price has increased, he has reduced his position to 17.42% :

Troendle had not increased his position since 2022 when he added to his position:

Assuming that the founder & CEO knows what he’s doing, we can see that he increased his position strategically by 25.37% in 2022. The share price has more than doubled since then.

The CEO has since reduced his position, with selling in 2023, and a reduction of 15.39% in 2024 after the positive reaction share prices had after the last earnings report.

The reduction in shares of 24.93% since 2022 can be explained by many factors. Maybe he needed the capital for something personal or wanted to diversify.

However, looking at the price and timing of the purchases, we believe these reductions and additions are strategic based on the prospects of the business.

Therefore, we view it as a negative that management has reduced its position by this much in the stock.

Insider selling ⛔

Founder-led business ✅

Significant insider ownership ✅

Competent with deep industry knowledge ✅

Key Performance Indicators (KPIs)

Medpace is concentrated in small biopharma businesses, but they offer a wide range of services. The largest segment is Oncology, followed by Other Sources, and Metabolic.

The top 3 segments are growing with a CAGR above 20%. The smaller segments, namely Cardiology, Central Nervous System, and AVAI are growing at 20.65%, 14.88%, and 17.98% respectively.

Backlogs & Net New Business Awards

Since 2018, the total backlog has compounded by 21.21%, totaling $2.907.1M in the last twelve months (LTM). The backlog indicates how much Medpace will have in future business.

Net new business awards have compounded at a similar pace at 20.48%, totaling $2.416.6M. This is important, as new clients are an important source of future growth. A company that can attract new customers will likely grow over time.

Risks and Challenges

Despite its strong position in the market, Medpace faces several risks and challenges:

Competition: The CRO industry is highly competitive, with numerous players vying for market share. Medpace must continue to innovate and differentiate its services to maintain its competitive edge.

Regulatory Changes: Changes in regulatory requirements can impact the design and conduct of clinical trials, potentially increasing costs and timelines.

Economic Downturns: Economic uncertainties and budget constraints can affect clients’ R&D spending, impacting demand for Medpace’s services.

Technological Advances: Rapid advancements in technology and digital health can disrupt traditional clinical research models, requiring Medpace to adapt and innovate continuously.

Valuation

Multiple comparisons — Price to earnings ratio

Medpace Holding’s PE of 39.79, is in the upper range of what it has been trading for in recent years. On a PE basis, Medpace looks expensive.

Price to free cash flow — Medpace currently trades for 25.51 x FCF. On a historical level, this is high for Medpace.

Compared to the risk-free rate (10-year treasury yield of 4.47%), a 3.92% FCF yield growing at a rapid pace looks attractive.

Discounted cash flow (DCF) analysis

Using the free cash flow per share in the last twelve months of $14.90 as a proxy.

We use 3 scenarioes for our DCF:

Worst case: 10% growth for the next 5 years, followed by 8% growth, with an exit multiple of 15 times FCF at the end of the period.

Best case: 16% growth, followed by 14% growth, with an exit multiple of 24x.

Normal case: 13% growth, followed by 11% growth, with an exit multiple of 20x.

Fair value estimate: $462.5

Current share price: $390.55

Suggested upside: 18.42%

Normal scenario suggests a 13% CAGR (With conservative inputs)

Conclusion

Medpace Holdings stands out in the clinical research industry due to its scientific expertise, integrated service model, and commitment to client satisfaction.

The company’s strong financial performance, global presence, and focus on therapeutic specialization position it well for continued growth.

While facing competitive and regulatory challenges, Medpace’s ability to innovate and deliver high-quality services will be key to maintaining its leadership in the CRO market.

Investors considering Medpace should weigh the company’s growth prospects against the inherent risks in the clinical research industry.

In addition, the management selling in recent times is a sign of caution, as it might indicate that Medpace is somewhat overvalued.

Overall, Medpace offers a compelling investment case for those looking to gain exposure to the growing demand for clinical research services.

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 250 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +8.000 stock market investors (48% open rate) — Contact us via: investinassets20@gmail.com

Interesting stock. This one even held up in the bear market of 2022.

Great company bad investement at this price