LVMH Earnings Results 👜

<3 min read 🧠

Join us as a premium member to get access to our full research, our portfolio, and all our moves, read more here:

«Discounts is what Pernod and Remi do.”

-Bernard Arnault

Solid Q4 results for LVMH despite a challenging backdrop

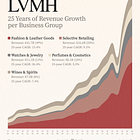

LVMH delivered solid results for the final quarter of 2024 (Organic growth):

Fashion & Leather Goods +9%

Perfumes & Cosmetics +10%

Wines & Spirits +4%

Watches & Jewelry +3%

Selective Retailing +21%

The stock went up +13.30% on the news, indicating that LVMH surpassed the market expectations for the quarter.

Here is a visual representation of Q4 2024:

Record Year for LVMH in 2023

The results for the entire year of 2023 show a drop in Wines & Spirits by -4% (Organic), +14% for Fashion & Leather Goods, +11% for Perfumes & Cosmetics, +7% for Watches & Jewelry, and +25% for Selective Retailing. A total of +13% YoY for LVMH in organic growth. The negative 4% on organic vs. reported comes from negative currency effects. We like to look at organic numbers, as these tell the story of the actual customer demand - currencies fluctuate, and next time we might see a 4% positive effect from currencies.

LVMH has been growing its top line by 9.1% over the last 35 years, so a 9% growth in revenues is in line with its historical average. While this is good, it is clear that Bernard's sole focus is on making its brands attractive and desirable. He is not so worried about the specific growth for a single quarter or year. If their brands are not desired, they will fail in the long term. This focus tells us that the management is long-term-oriented and does not care about short-term fluctuations.

LVMH posted a record year in 2023 with revenues of £86.2 billion (+9% YoY), and £22.9 billion of profits from recurring operations (+8% YoY).

Wines & Spirits had a tough year, with a 10% decrease in demand in Europe. Nonetheless, the profits decreased by only 2% due to “significant cost controlling efforts” according to their CFO.

LVMH’s revenues, net income, and free cash flow over the last 12 quarters:

ROIC & ROE has been consistently increasing over the last 12 quarters:

LVMH’s well-diversified geographic mix

LVMH sells its products all over the world. It is not reliant on one market but has split its revenue globally, providing robust revenue and earnings streams. The large exposure to Asia can pose a threat, but Asians love their European luxury products. The geographic revenue mix:

US: 25% (vs. 27% in 2022)

Europe: 25% (vs. 24% in 2022)

Asia: 31% (vs. 30% in 2022)

Japan: 7% (vs. 7% in 2022)

Other markets: 12% (vs. 12% in 2022)

US growth has been rather stagnant in 2023, but Asia, Europe, and Japan are growing rapidly:

Cash Flow

LVMH increased its cash from operations before changes in working capital of 10.27%. Working capital affected cash from operations negatively by £1.558 billion. Additionally, operating investments increased by £2.509 billion. This resulted in a negative Operating Free Cash Flow of -£2.009 billion YoY.

Dividends

The annual growth rate of the dividend has been +17% over the last 5 years. In 2023 LVMH paid out £13 per share in dividends. And it will increase its dividend by 8% in 2024.

Conclusion

Overall, 2023 was a record year for LVMH. The final quarter was above expectations, and the stock went up +8.5% on the quarterly earnings news. Although there were some slowdowns in the business, other segments kept firing despite a difficult economic backdrop. This is a good sign for investors, as it indicates that LVMH’s revenues & earnings are robust and will continue to deliver despite lower levels of disposable income.

If you want to read more about LVMH, read my articles breaking down the business here:

And my recent purchase of LVMH here (For premium members):

Whenever you are ready, this is how I can help you:

Essentials of Quality Growth — Join more than 200 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

Promote yourself to +5,000 stock market investors (48% open rate) — Contact us via: investinassets20@gmail.com

Excellent analysis. Bernard Arnault is one of the most underrated CEOs in the world. Very rarely studied but now the richest man on the planet.

Great analysis! Stock that's been on my radar for a while, always interesting to read how it's doing given its lead in the luxury space.