LVMH - The Luxury Power House 👜

5 min business break down

Save Time & Make Better Investing Decisions

I’m launching a paid version of Invest in Quality to provide more value to investors who want to build serious wealth in the stock.

By subscribing you get:

💎Full access to my quality growth portfolio where I invest 80% of my net worth

📈Monthly factsheets of the portfolio, performance, buys and sells.

🎯Notification in advance, or the same day I buy or sell a position.

🧾Upcoming courses on financial statement analysis and valuations

🏰All my research (Investable universe, ranking, valuations, quality)

👑Weekly breakdowns of quality compounders and valuations

🤵Access to me: I will be available to answer all the questions and concerns my paid subscribers might have about investing

The service costs $12 per month or $100 per year. Get 20% off that price forever. This offer will expire by the end of the day:

Introduction to LVMH

Louis Vuitton Moët Hennessy (LVMH) stands as a powerhouse of luxury in the world of business. The business was founded in 1987 through the merger of Louis Vuitton and Moët Hennessy, the conglomerate has not just thrived but has set new standards in the luxury industry. Its growth and success are attributed to a combination of factors that we will explore in this article.

Portfolio of high performing Luxury brands

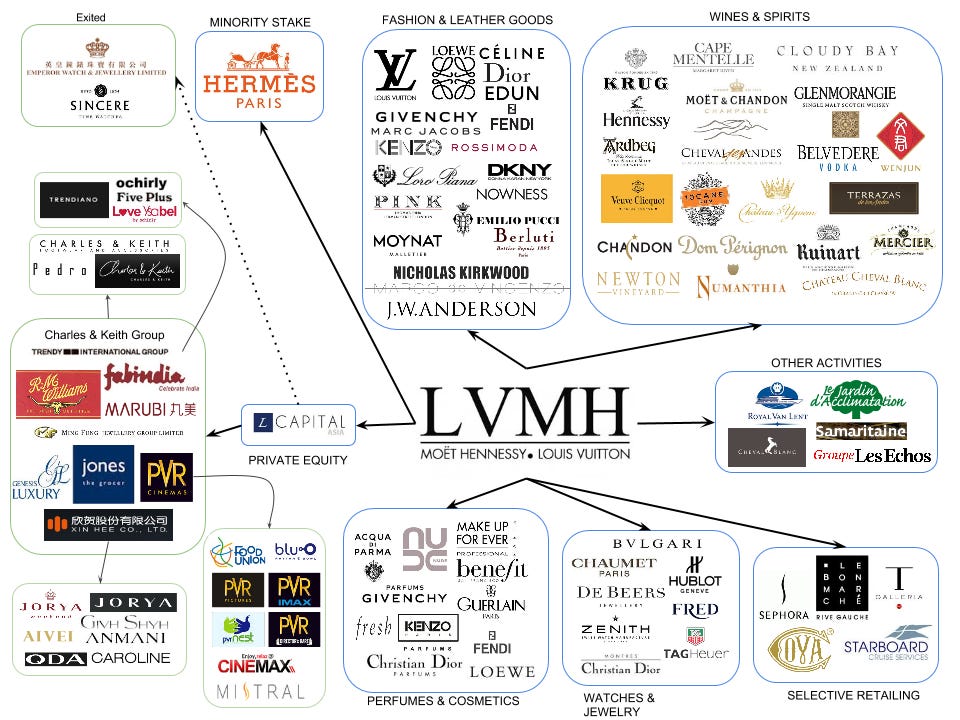

LVMH is made up of 75 luxury brands spanning different sectors, such as fashion & leather goods, wines & spirits, perfumes, and cosmetics, watches, and jewelry.

This diversification minimizes risks associated with fluctuations in any one market and allows LVMH to capitalize on varying consumer preferences across different regions and demographics.

LVMH’s revenue split between business segments:

Geographic revenue split:

Global Expansion and Market Penetration

A key growth driver of LVMH is its strategic expansion into emerging markets while maintaining a strong presence in established markets like Europe and the United States. The company has successfully tapped into the growing affluence of consumers in regions like China and Southeast Asia, leveraging their increasing demand for luxury goods. Asia has been a large growth lever for LVMH for the last decade and is now the top segment by revenue.

Strategic Acquisitions & Decentralized Model

Part of LVMH’s growth story has been strategic acquisitions that have strengthened the brand portfolio. Notable acquisitions like the purchase of Tiffany & Co., Tag Heuer, and Sephora have expanded the conglomerate's reach and diversified its offerings, further fueling growth.

LVMH has a decentralized model, meaning that each of the underlying businesses they buy can keep operating their business as they want to. The decentralized model is something we also see in successful serial acquirers like Constellation Software, Teqnion, and Lifco AB.

Notable acquisitions since 1989:

The fundamentals look solid

ROCE: 22%

Gross margin: 69%

Operating margin: 26.4%

FCF/Net Income: 114%

Net debt / FCF: 2.05x

Interest coverage: 34x

LVMH has steadily increased its capital efficiencies over the last decade, improving its ROCE from 14% to 22% and its ROIC from 9.2% to 14%:

Whenever you are ready, this is how I can help you:

Essentials of Quality Growth — Join more than 200 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

Promote yourself to +5,000 stock market investors (48% open rate) — Contact us via: investinassets20@gmail.com

The growth has been steady & profitable

Revenue per share has compounded by 11.92% annually over the last decade, EPS has compounded by 17.64%, and Free cash flow per share has compounded by 15%:

The Stock has compounded by 20.9%

Over the last 10 years, the stock has seen a total return of 569%, that is 20.9% annually, far outpacing any of the indexes.

LVMH is founder-led by Bernard Arnault

Bernard Arnault is the founder and CEO of the business, and he owns 48% of the company according to Stockopedia. He keeps on purchasing more stock in the open market:

Tenure: 34 years

Since taking over the reins in 1989, Arnault has created one of the strongest companies in the world with world-famous luxury brands that are seen in popular culture all over the world.

LVMH has a wide moat that is hard to penetrate

Intangible assets: Brand value

At the core of LVMH’s business lies its remarkable portfolio of over 75 luxury brands. From iconic fashion houses like Louis Vuitton, Christian Dior, and Fendi to esteemed names in perfumes and cosmetics such as Sephora, Givenchy, and Benefit Cosmetics, LVMH has strong brands in multiple segments of the market.

The 75 brands secure LVMH’s revenue streams, providing a well-diversified mix and brands with different strengths and market opportunities.

Vertical Integration & Supply Chain Management

One of LVMH's lesser-discussed yet crucial competitive advantages lies in its vertical integration and superior supply chain management. Owning key elements of its production process grants the conglomerate greater control over quality, innovation, and agility in responding to market demands.

From sourcing raw materials to crafting the final product, LVMH exercises meticulous oversight, ensuring a level of craftsmanship and authenticity that resonates with luxury consumers worldwide. This integrated approach also streamlines operations, fosters synergies between brands, and enables LVMH to adapt swiftly to evolving consumer preferences.

Why own LVMH?

Growing demand for its product

Wide moat

Doesn’t need debt to achieve superior returns

Solid returns on capital employed

High and expanding margins

Skin in the game & founder-led

The business seems to be more resilient to recessions than other consumer product businesses

The Risk of LVMH and Luxury

Concentration risk: LVMH’s 10-year growth has mostly come from Asia. Now that we see weakness in the Asian economy, we might see a contraction in this segment, resulting in reduced revenues and earnings for LVMH.

Political risk: Asia is a political area, and there might be future events that make it harder for LVMH to sell its products there. We have seen the Chinese government’s willingness to cut Western multinational companies as they please.

For investors, there is a risk of paying up for past growth, which might not be realistic in the near future if we see a weakness in global disposable income as a result of inflation, higher rates, and competition.