Lessons From 10 Timeless Investing Books 📚

10 Lessons to improve your investing process 📊

Hi partner 👋

Over the years, I’ve built my investment philosophy around a core set of books that taught not just what to look for, but how to think like long-term compounders.

Below are specific, actionable lessons from 10 of the most influential investing books I’ve read, with clear takeaways you can apply to portfolio construction, business analysis, and valuation.

1) Quality Investing: Strong Economics + Durable Competitive Advantages

Book: Quality Investing: Owning the Best Companies for the Long Term

Core Lesson: A quality company is defined not just by metrics, but by repeatable economic outcomes, strong cash generation, high returns on capital, and durable growth opportunities is the pillars of a quality business. Key takeaways:

A quality compounder exhibits a virtuous cash cycle: predictable cash flows → high ROIC → reinvestment → more cash → more investments at high ROIC.

Look beyond simple profitability; assess industry structure (barriers to entry, supplier/customer bargaining power) as a determinant of persistent ROIC (Porter’s five forces is a great analysis tool for this).

Recurring revenue models (maintenance contracts, subscriptions, consumables) smooth volatility and make growth more predictable.

Use checklists to avoid confirmation bias, and conduct “inertia analysis”, compare how a portfolio would have performed if unchanged, because often doing nothing is the highest-probability correct decision.

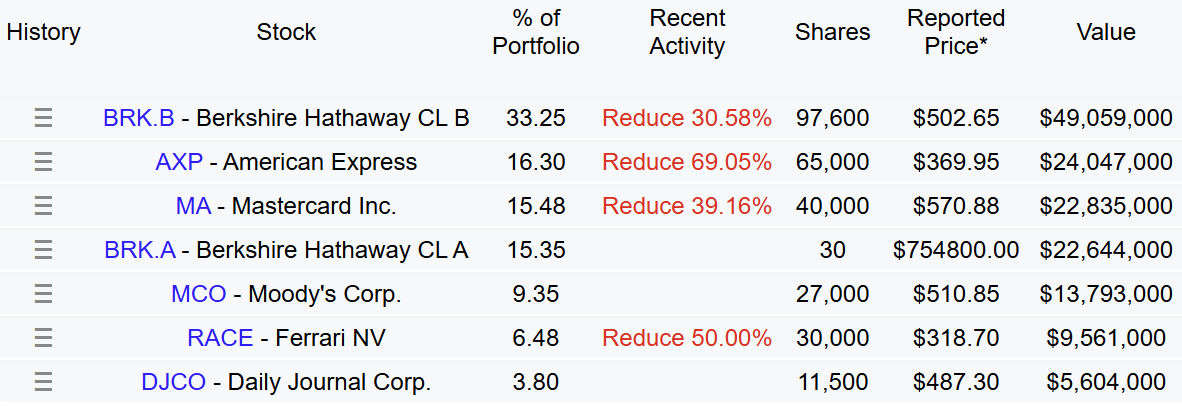

Repeatable rule: Quality = cash flow growth + capital efficiency + competitive advantge The authors of Quality Investing are, and used to run AKO Capital. Here is the fund’s current US holdings:

2) 100 Baggers: Growth + Multiple Expansion + Time

Book: 100 Baggers: Stocks That Return 100-to-1 and How to Find Them

Core Lesson: To achieve 100x returns, a company must combine sustained growth with P/E expansion over decades.Key takeaways:

The average 100-bagger needs 20–30+ years to reach that outcome; short time frames rarely deliver this magnitude of compounding.

High returns on invested capital (ROIC) and the ability to reinvest profitably over time are the dual engines of compounding.

Owner-operators: founders or executives with substantial equity, align incentives, and consistently make long-term decisions.

Don’t chase valuation heuristics alone; quality and growth potential can justify higher multiples if fundamentals sustain.

Repeatable rule: Time and compounding trump short-term valuation calls.Chris Mayer, the author of 100-baggers, does not share his portfolio, but he has shared a number of companies he owns. Here is the most updated list:

3) The Essays of Warren Buffett: Temperament and Competitive Psyche

Book: The Essays of Warren Buffett

Core Lesson: The investor’s psychology is as important as the investment’s economics.Key takeaways:

Buffett reframes investing as business ownership, not stock speculation; you should ask: “Would I buy the whole company at this price?”

Margin of safety isn’t just valuation; it’s behavioral discipline to resist market noise when fundamentals hold.

Buffett’s letters highlight avoiding the “most dangerous words in investing”: This time it’s different.

Repeatable rule: Control your mind before you try to control your portfolio.4) The Warren Buffett Portfolio: Concentration and Capital Allocation

Book: The Warren Buffett Portfolio: Mastering the Power of the Focus Investment Strategy

Core Lesson: A focused portfolio built on best ideas delivers better compounding outcomes than broad, undifferentiated bets. Key takeaways:

Buffett’s principles emphasize capital allocation; the allocation decisions within a business matter just as much as the allocation between securities.

Identify a few high-conviction ideas rather than dozens of mediocre ones.

Real competitive advantages are rare and durable, and finding them justifies concentrated positions.

The book argues for the benefits of concentrating on your best stock ideas. A too broadly diversified portfolio will never substantially beat the index.

Repeatable rule: Focus your capital where your highest conviction persists.A reminder from the book: Noone outperforms every year. Not a single portfolio in the study from 1987 to 1996 outperformed all 10 years:

5) What Works on Wall Street: Proven Investment Strategies Backed by Decades of Data

Book: What Works on Wall Street (by James P. O’Shaughnessy)

Core Lesson: The most reliable path to market outperformance isn’t intuition or “hot stock picks”, it’s systematic, evidence-based investing using quantitative, historically tested factors and rules that have shown superior returns over time.Key takeaways:

Historical data beats opinion. The book rigorously analyzes nearly a century of market performance to show which stock-picking rules have actually worked, separating fact from intuitive but ineffective strategies.

Quantitative factors matter. Simple, measurable metrics like price-to-sales, price-to-book, price-to-cash flow, and momentum have historically delivered better returns than relying on subjective judgments alone.

Small-caps exhibit edge. Historically, smaller-capitalization stocks with value characteristics have delivered higher returns than large, glamour stocks over long periods.

Rules must be applied consistently. The book teaches that following clearly defined, repeatable rules and rebalancing on schedule is far more effective than ad-hoc decisions or market timing.

Evidence over narratives. O’Shaughnessy’s work debunks many popular investment myths and emphasizes that what feels right often underperforms what proves right in data.

This isn’t a philosophy book; it’s a data-driven playbook for building investment strategies that have stood up to long periods of market history and multiple market cycles.

Repeatable rule: Use simple, historically validated quantitative screens and follow them with discipline. Don’t deviate based on emotion or short-term market noise.A nugget from the book is the comparison between companies that translated most of their earnings into the most free cash flow, outperformed by 18% per year from highest to lowest:

6) One Up On Wall Street: Invest What You Know Early

Book: One Up On Wall Street

Core Lesson: Everyday life gives you an informational edge, spot businesses you understand before Wall Street does. Key takeaways:

Many winners show tangible early signals through customer adoption long before Wall Street catches on.

Focus on understanding business models deeply, not charts or short-term news.

Lynch’s stock categorization (stalwarts, cyclicals, fast growers) forces you to diagnose the business.

Repeatable rule: If you can’t explain the business simply, you don’t understand it well enough.Great businesses will perform well way before it shows up in the financials (When Wall Street spots them). Look for:

Enthusiastic customers: Maybe your friend tells you about it.

Crowded stores / Restaurants

Switching suppliers at work

Word of mouth from multiple sources

These are all factors to look deeper into a business from Peter Lynch’s frame of mind.

7) The Education of a Value Investor: Humility & Process

Book: The Education of a Value Investor

Core Lesson: Value investing is less about formulas and more about continuous learning and feedback loops.Key takeaways:

Guy Spier emphasizes the importance of learning from mistakes and designing a personal investment process that reduces emotional errors.

Incentives: both yours and those of management, drive outcomes far more than pure numbers.

Regular process reviews (not performance comparisons) guard against self-deception.

Stay humble; even Harvard graduates will be schooled by the markets.

Repeatable rule: Build a process that eliminates your worst instincts.8) Nothing But Net: Durable Growth, Discipline, and Long-Term Winners

Book: Nothing But Net

Core Lesson: The best tech investments come from identifying a small set of businesses with durable growth drivers, competitive advantages, and disciplined execution, and holding them long enough for compounding to do the heavy lifting.Key takeaways:

Long-term revenue growth matters more than short-term earnings noise. The biggest winners are companies that can compound sales steadily over many years.

Competitive advantages in tech do exist: network effects, switching costs, scale, data, and brand. But they must be proven in results, not stories.

Great tech stocks are built through execution and capital discipline, not hype. Management quality and operating focus are decisive.

Valuation matters, but paying a fair price for a great business beats paying a cheap price for a mediocre one; this is amplified in tech.

The biggest investing mistakes often come from selling winners too early, not from buying them.

The book argues that tech investing should be boring, repeatable, and fundamentals-driven. Investors who constantly trade, chase narratives, or react to quarterly volatility systematically underperform those who stay focused on durable leaders.

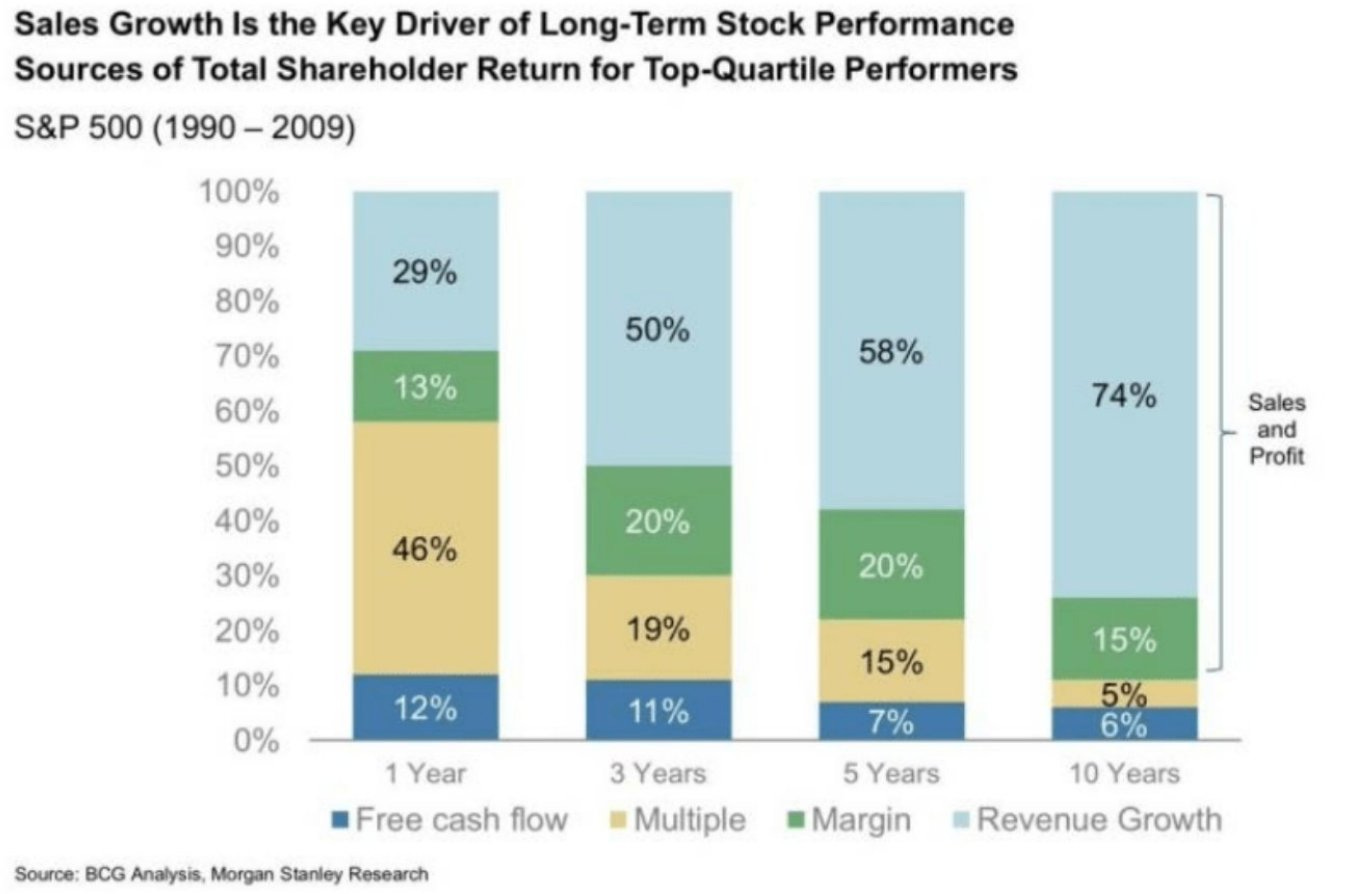

Repeatable rule: Own high-quality growth businesses with clear competitive advantages and let time drive your returns.Mark Mahaney emphasizes the importance of ‘premium growth’, which in the tech industry is considered +20% CAGR in revenues. This focus on revenue growth is also supported by research conducted by BCG and Morgan Stanley:

9) The Outsiders: Eight Unconventional CEOs and the Secrets to Great Performance

Book: The Outsiders (by William N. Thorndike)

Core Lesson: Exceptional long-term returns come from leaders who allocate capital wisely, act independently of Wall Street pressure, and focus relentlessly on building value rather than managing earnings.Key takeaways:

Capital allocation is the primary driver of value creation. The Outsiders outperform not through industry cycles but through smart decisions about where to deploy cash: buybacks, dividends, M&A, or reinvestment.

Successful CEOs think like owners. They treat every dollar of capital as if it were their own, avoiding empire-building and prioritizing return on invested capital.

Insulation from the crowd is an advantage. Outsider CEOs avoid conventional metrics that please analysts, preferring decisions that maximize intrinsic value over short-term optics.

Disciplined buybacks can be a powerful tool. When a company’s stock trades below intrinsic value, intelligently executed repurchases concentrate ownership and boost per-share economics.

Long time horizons beat quarterly horizons. Outsiders hold tests of their capital allocation choices over years, not quarters, and they resist the temptation to time markets or guide to short-term targets.

The book profiles leaders like Tom Murphy (Capital Cities), Henry Singleton (Teledyne), and Warren Buffett (Berkshire Hathaway) to show how independent thinking + rigorous capital allocation consistently beats conventional management approaches.

Repeatable rule: Allocate capital where it earns the highest return, act with independence, discipline, and a long time horizon.10) Investing for Growth: How to Make Money by Only Buying the Best Companies in the World

Book: Investing for Growth

Core Lesson: Superior long-term investment returns come from buying and holding high-quality companies that generate exceptional returns on capital, avoid needless trading, and compound wealth over time. Key takeaways:

Invest in quality, not cheapness. Focus first on the underlying business strength, consistent high returns on capital, robust cash flows, and durable competitive advantages, rather than chasing low valuation multiples.

Define quality by fundamentals, not narratives. A great business is measured by financial metrics like return on capital employed (ROCE) and cash conversion, not fictitious stories or engineered earnings figures.

Compounding is central. Companies that reinvest earnings at high rates of return create enormous shareholder value over time; this compounding effect is far more powerful than short-term gains.

Costs matter. Fees, dealing costs, and hidden charges drag on performance; minimizing these improves net returns.

Beware complexity and gimmicks. Avoid financial engineering, jargon-laden products, and strategies that obscure the true health of a business.

Stay global and selective. High-quality opportunities exist worldwide; broad diversification dilutes the impact of owning truly outstanding companies.

Smith’s thesis is simple but powerful: Buy good companies, don’t overpay, and do nothing. Over decades, this disciplined focus on quality and patience delivers compounding outcomes that most active strategies cannot match.

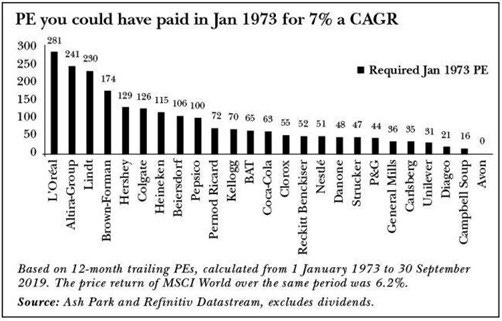

Repeatable rule: Deploy capital in a small number of high-quality compounders and hold them long enough for intrinsic business value to be realized in market returns. Terry Smith and Fundsmith shared this image to emphasize that buying a quality business is more important than getting a low PE multiple:

Final Synthesis: The Quality Growth Investor’s Checklist

Across all 10 books, the same repeatable principles emerge:

Quality economics first: strong cash generation, cash conversion, growth, and high ROIC.

Durable competitive advantages across cycles: Long-term business models and moats matter the most for compounding.

Time is your ally: Compounding needs decades, not quarters.

Management and capital allocation matter as much as fundamental numbers.

Process discipline and psychological edge protect returns.

That’s it for today. Let me know what you think in the comments below, or reply to this email! Ready to take the next step? Here’s how I can help you grow your investing journey:

Go Premium — Unlock exclusive content and follow our market-beating Quality Growth portfolio. Learn more here.

Essentials of Quality Growth — Join over 300 investors who have built winning portfolios with this step-by-step guide to identifying top-quality compounders. Get the guide.

Free Valuation Cheat Sheet — Discover a simple, reliable way to value businesses and set your margin of safety. Download now.

Free Guide: How to Identify a Compounder — Learn the key traits of companies worth holding for the long term. Access it here.

Free Guide: How to Analyze Financial Statements — Master reading balance sheets, income statements, and cash flows. Start learning.

Get Featured — Promote yourself to over 30,000 active stock market investors with a 40% open rate. Reach out: investinassets20@gmail.com

All you need to know to start is within these books. Thank you for sharing !

Thank you for sharing - what I like about this investment approach is that it shifts the focus from future potential earnings to the current situation. You focus on what is and on the degree of visibility going forward. I try to identify recurring financial patterns that exist across businesses and industries by reading financial metrics together rather than in isolation. I helps me find durable and resilient businesses with an economic moat.