How Warren Buffett identifies compounding machines 📈

2 Steps process to find a compounding machine

Hi investors! 👋🏻

Warren Buffett 🐐 once said:

"The ideal business is one that earns very high returns on capital and that keeps using lots of capital at those high returns. That becomes a compounding machine.”

And luckily for us, we can learn to find these.

Let's break it down 👇🏻

Step 1: Return on capital

The ROC measures a company's profitability and value-creating potential relative to the amount of capital invested by shareholders.

The ratio tells us how efficiently a company turns capital into profits.

ROC is important because it gives us an idea of what returns we can expect from a business.

After 20 years, it's hard for a business that has an ROC of 6% to deliver anything better than 6% annually to shareholders, the same goes for 20%.

Return on capital can be calculated in several ways:

Return on Equity (ROE): Net income/shareholder’s equity

Return on invested capital (ROIC): Net operating profit after taxes / Total invested Capital (Total assets - non-interest-bearing current liabilities)

Return on capital employed (ROCE): Earnings before interest & Taxes/Total assets - Current liabilities.

Like Terry Smith, I prefer to use ROCE as this profitability metric is broader and considers all capital employed, and not just operating assets like ROIC does. ROE can too easily be manipulated with debt to make the numbers look better.

Microsoft Example

Let’s use a real-life example of Microsoft, and calculate its ROCE:

The formula:

Return on capital employed (ROCE): Earnings before interest & Taxes/Total assets - Current liabilities.

Earnings before Interest & Taxes (EBIT) can be found on the company’s Income Statement.

From their 2022 Income statement, I can find $83.577 Billion in Microsoft’s 2022 Income statement.

Total assets can be found on the company’s balance sheet. The total assets for Microsoft in 2022 is $364.840 Billion.

Current Liabilities can also be found on the balance sheet within “Total liabilities Net minority Interest”.

The current liabilities for Microsoft in 2022 are $95.082 billion.

Microsoft’s return on capital employed for 2022 is:

83,577 / (364,84-95,082) x 100 = 30,98%

A return on capital employed of ~31% is way above the S&P average of about 15%.

As investors, we are looking for businesses with returns on capital above 15%, ideally above 20%.

However, we also want to see the return on capital being sustained for long periods (What Mauboussin refers to as “sustainable value creation”).

That’s why as a part of our analysis, we should aim to look at ROCE for a 5 and 10-year period.

If the ROCE is inconsistent, meaning it jumps from 5% to 25%, and down again to 10%, we should try to understand why.

Most likely, it reflects low consistency in the company’s earnings and is often a sign of a cyclical business.

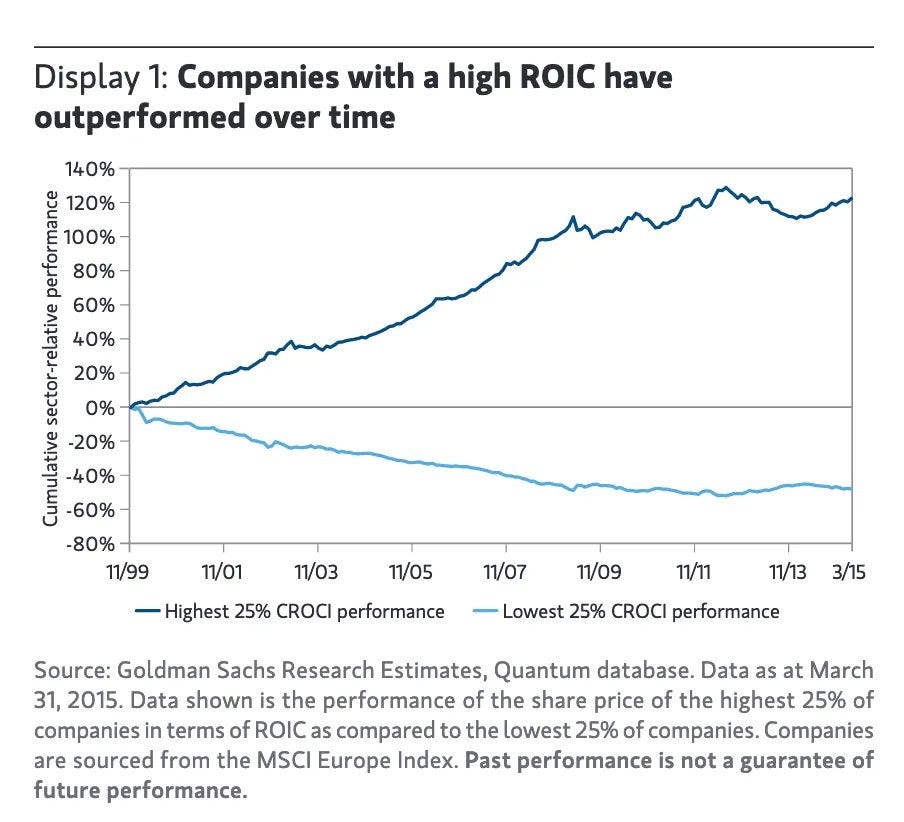

The result of long-term high returns on capital vs. low:

7 Quality Businesses with a High Return on Capital:

Apple +51.6%

Nvidia +44.6%

Lululemon +46.5%

Mastercard +60.2%

Kinsale Capital +37.2%

O’Reilly Automotive +50%

Cadence Design Systems +27.2%

Step 2: Reinvestment rates

Return on capital is the most important financial metric.

BUT, an important caveat is that this is only true if the company also has a high reinvestment rate.

This means that for every $1 the company retains, it can reinvest most of this into the business, creating what Warren Buffett refers to as a "compounding machine".

A company that reinvests most of its cash at low returns (Below its WACC) on capital is destroying value for shareholders.

These businesses are better off paying out a dividend or repurchasing shares if the business is undervalued.

Let us now consider two companies:

Blue Corp. has a ROC of 30% and a 100% reinvestment rate.

Orange Corp. also has a ROC of 30% and a 50% reinvestment rate.

Although Orange provides a satisfactory result, with a net return of 15% annually, it cannot be compared to Blue, with its 30% annual return.

The result after 10 years is huge.

This effect is better illustrated the lower the reinvestment rate is.

A company with an ROIC of 30%, and with 0 reinvestment opportunities will have to create shareholder value somehow else, either by paying a dividend, acquiring new businesses, or buying back shares.

At this point, the investment will rely on the management's ability to create shareholder value with cash, and most management teams cannot do this. Which means we should look elsewhere to park our capital.

How do we calculate the reinvestment rate?

The calculation we use is backward-looking (like all financial metrics), we have to look at the financials of the business we look at and identify how much is used for reinvestments. Then divide it by the earnings in that same period.

There are many ways to get to the reinvestment rate, but here is a simple calculation:

Note: Net CapEx = Capital expenditure - Depreciation.

Now that we can calculate the reinvestment rate, we have to think about the possibilities moving forward.

Will the reinvestment opportunities rise, decline, or stay the same?

This estimation will affect our next calculation:

Intrinsic Value Compounding Rate = ROIC x Reinvestment Rate

This calculation will give us a good approximation of the future returns of the operations of the business.

Using the same example as previously, we know that Orange has a consistent ROIC of 30% and a 100% reinvestment rate.

Orange can invest all its earnings into the business at high returns on capital.

Applying the calculation above to the case of Orange:

Orange Intrinsic Value Compounding Rate = 30% x 100% (Decimal: 0.3 x 1 = 30%)

Orange Corp.’s Compounding Rate: 30% CAGR

Now, let’s apply the same calculation to Blue Corp:

Blue Intrinsic Value Compounding Rate = 30% x 50% (Decimal: 0.3 x 0.5 = 15%)

Blue Corp.’s Compounding rate: 15% CAGR

The bottom line

As previously stated, this calculation looks at historical data.

We can to some extent expect similar returns in the future, but we have to look at many more factors before determining if the company we’re analyzing can I) sustain a high return on capital, and II) sustain a high reinvestment rate.

We have to look at the competitive landscape and the barriers to entry in the industry the company operates.

Usually, where there is significant economic profit, capital and competition will be allocated and often the superior returns (+15% ROC) are competed away over time.

The competitive landscape and barriers to entry will also affect a company’s ability to reinvest.

Reinvestment is only a smart capital allocation move, if the company can earn a superior return on the capital reinvested.

With increased competition, this opportunity disappears.

This is also why a sustainable moat or competitive advantage is important.

This moat can protect the superior returns for years or decades.

Read our article on moats here:

If you enjoyed this educational article, please leave a LIKE and a COMMENT.

It means the world to us!

Happy compounding.

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 250 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +15.000 stock market investors (42% open rate) — Contact us via: investinassets20@gmail.com

Fantastic and super helpful breakdown of some key concepts. Thanks for taking the time to write and post this.

I have a lot of respect for Buffet, but I think his strategy has lost its zeal, little by little, year by year.