How to consistently beat the market 🎯

5 min read

Seeking Alpha will have a Spring Sale from March 27th - April 3rd!

Seeking Alpha Premium will be priced at

$239$179/year (25% off).Seeking Alpha gives you access to some of the best analysts in the business, screeners, financial data, and much more.

In this article, we will break down the 2023 annual shareholders’ letter from Giverny Capital, led by the brilliant Francois Rochon.

The Strategy

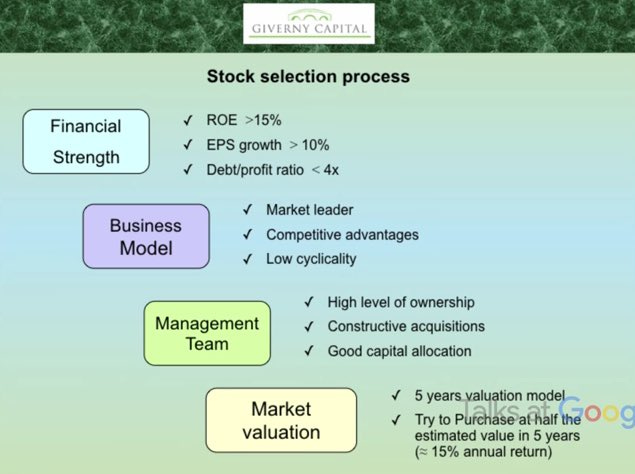

Giverny Capital follows a Quality at a reasonable price strategy. Their stock selection process is summarized in the image below. They want high returns on capital and per-share growth. Moderate leverage. Superior business models - they want to invest in the market leader with a wide moat and low cyclicality. They focus on strong management teams with insider ownership and great capital allocation skills. And they want to buy these companies at reasonable valuations.

Download Rochon’s 5-year valuation model methodology here (Free).

More details on their strategy from the 2023 annual shareholder’s letter:

The Performance

Giverny manage 3 funds. One that invests in US equities, one that invests in Canadian equities, and one that invests in global equities. All 3 funds have significantly outperformed its benchmark - which is very impressive.

$100.000 invested in Rochon Global Portfolio in 1993, would be worth $6.782.193 by the end of 2023. The same amount invested in the index would be $1.500.975.

The Global Fund has outperformed by 5.5% for 30 years. Resulting in a 6682.2% return vs. 1401% from the index. Looking at the year-to-year comparison to the index, the fund tends to do much better in the good years, and less worse in the off years, such as 2001, 2002, 2008, 2011, and 2022 with few exceptions.

The Portfolio

Giverny Capital’s current portfolio according to Dataroma (Only US-listed companies). We know for example that they have been an investor in Constellation Software since the early 2010s.

The Magnificent Seven

In the 2023 letters to shareholders, Rochon writes about the magnificent seven’s impact on the S&P 500’s returns in 2023. The Mag7 makes up 29% of the S&P 500, and Microsoft alone makes up 7.2%.

A few things to note about this concentration:

An S&P 500 index fund is not as diversified as you might believe.

The Mag7 stocks are much more highly rated than the rest of the S&P.

The top 10 by market cap businesses have historically not been the winners over the next 10 years.

7 Stocks make up 29% of the S&P, which means that the remaining 493 companies make up the remaining 71%.

In 2023, the S&P 500 returned 26%. 16% of this return came from the Mag7. Only 7 out of 500 companies are driving 61.5% of the performance. The remaining 10% comes from the remaining 493 companies. Rochon notes that most companies in the US had an OK 2023, while the Mag7 had a fantastic run. The 493 companies better represent the underlying US economy.

Rochon urges a warning to index investors and to those fund managers who are tired of underperforming only to go heavily into the Mag7.

Yes, the companies are amazing. But valuations, and therefore risks, are higher now than in the past.

Rochon owns 2 of the Mag7: Alphabet and Meta Platforms. These are the most sensibly priced according to Rochon with a 20 and 25 times price-to-earnings ratio.

Podium of Errors

Rochon is a big fan of Charlie Munger, and dedicated one section of the letter to Charlie, which passed away in 2023.

Mr. Munger was always adamant about rubbing your nose in your mistakes. Rochon has taken this to heart and has a section in his letters called “The Podium of Errors” - which I find genius.

In 2023, he highlighted 3 major mistakes he has made:

I have fallen victim to the same mistake in my investing - I owned Apple from 2015 to 2017. After this, I thought the price was too high, and I sold a fantastic business before it took off, missing out on massive gains.

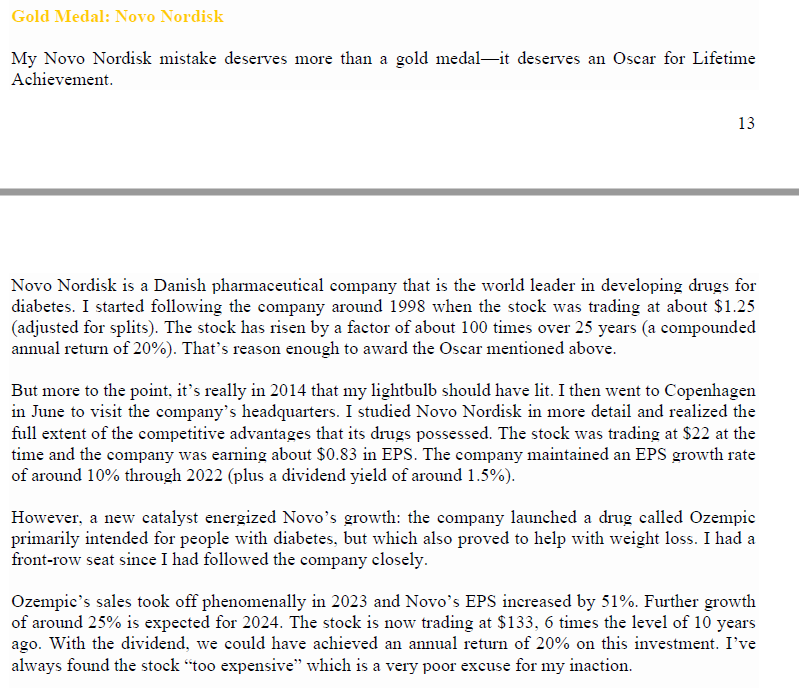

Both the Chipotle Mexican Grill and Novo Nordisk examples are mistakes of omission. Where Rochon failed to execute on an opportunity for whatever reason. These mistakes hurt the most. However, we inevitably fail to invest in most of our ideas. We have to be selective and choose only what we deem the best ideas based on quality and valuation.

For both of these, Rochon considered the valuation to be too high. Which he deems a bad excuse to not invest.

2 Take Aways

Even when you sell a business from your portfolio, continue to track it. Things could turn around, and you might want to reinvest at another stage.

If your analysis points you to the possibility of explosive future growth that is not yet priced into the stock, it is worth taking a position (however small) to get the potential upside of your analysis.

Seeking Alpha will have a Spring Sale from March 27th - April 3rd!

Seeking Alpha Premium will be priced at

$239$179/year (25% off).Seeking Alpha gives you access to some of the best analysts in the business, screeners, financial data, and much more.

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 250 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +6.500 stock market investors (48% open rate) — Contact us via: investinassets20@gmail.com