How Terry Smith Beats the Market 🏆

Hi there friend 👋

Terry Smith is considered the Warren Buffett of Britain.

Terry is the founder of “Fundsmith”. His fund has produced market-beating returns since its inception in 2010, with an annual performance of 15.3% and more than £20B under management.

Studying his investing strategy is more valuable than a degree in Finance

Let's break it down 👇

Background

Fundsmith is a London-based investment firm founded in 2010 by Terry Smith. The fund has 24.7 Billion GBP under management.

For its size, Fundsmith has outperformed the index by a wide margin, showcasing impressive performance:

So, how does Terry Smith continue to beat the index year after year?

It is simple, he focuses on:

Buying great businesses

Not overpaying for these businesses

And do nothing

What does this mean? Let’s take a look…

1. Fundsmith identifies fantastic businesses at fair prices 🏰

“It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” — Warren Buffett

The Buffett quote is at the heart of Fundsmith’s investing strategy.

They don’t look for low price-to-earnings (PE) bargains.

They look for high-quality, multinational, growing companies with wide moats.

These companies are often only available at higher PEs, in the 20x - 30x range.

Let’s look at the PEs of some of their largest positions:

Novo Nordisk: 49

Microsoft: 36

Meta Platforms: 28

L’Oréal: 39

Stryker: 39

Keep in mind: Fundsmith did not make their purchases at these levels, rather their investments have seen multiple expansions over time.

Despite having a portfolio of "expensive" stocks in their portfolio, Fundsmith's measurable risk is lower than the market. Sharpe Ratio:

Fundsmith: 1,11

Index: 0,56

The shape ratio is a “risk-adjusted” return metric, it measures your performance in relation to the volatility of your portfolio (How much it goes up and down).

Taking on “less risk” and getting a better return, sounds pretty good (Risk and volatility are not the same in my opinion, but that is the topic for another article).

2. Identify companies that consistently create value for their shareholder📊

Fundsmith avoids companies that only create value in 1 out of 5 years.

Instead, they buy companies that consistently create value over 2, 5, 10, and 20 years.

Fundsmith wants to buy companies that have a higher return on invested capital (ROIC) than their weighted average cost of capital (WACC) over long periods.

If the ROIC is higher than the WACC, the company is creating value for shareholders. Because the cost of capital is lower than the return they can get on that capital. If you can get capital at 5%, and invest it to return 15%, your spread is +10%.

Terry says that they might not get the share price right when they buy a company, but the continuance of value creation is a hedge against paying too much.

A company able to grow by reinvesting capital at a high rate of return will continuously create shareholder value.

The counter-example is airlines. These companies might create value in 1 year when all the stars align. The share price might rise rapidly in this period, but in the coming years, the capital-heavy business will destroy value.

Why?

Because it invests at a very low return on invested capital while having a very high WACC.

3. Fundsmith measures the Business Quality by using 5 Quality Variables:

Fundsmith refers to 5 measures of quality when assessing their holdings versus the FTSE 100 (British index).

3.1. Return on Capital employed (ROCE)

Terry (Along with most super investors) claims this to be the single most important variable

Fundsmith has a 32% ROCE versus the S&P 500 (18%) and the FTSE 100 (17%).

Paying a higher PE for a company that has a substantially higher ROCE can be a bargain in Terry's eyes

When we look at an investment, and only see the “price”, we have no idea what we are getting. How will you know if it’s a good deal or not? As Terry says:

“You can’t compare Fords to Ferraris”.

3.2. Gross Margin

Terry explains Gross Margin like this: "Fundsmith buys stuff for 37, and sells it for 100. The index buys stuff for 55 and sells it for 100"

A high gross margin company is a capital-light company. Just imagine if you have to pay $85 for the goods you need, and you sell them for $100. This only leaves $15 of the “margin” BEFORE your operating expenses.

Gross margin is also a good protection against inflation.

Fundsmiths Gross margin: 63% vs 41-45% for the FTSE 100 and S&P 500.

Example of a high and expanding gross margin business:

3.3. Operating Profit Margin

Fundsmith wants to own companies that have consistently delivered a high operating profit margin

OM above the industry average over time suggests that the business has a durable moat

Fundsmiths profit margin: 28% vs. 18% of the index

Example of high and expanding operating margin business:

3.4. Cash Conversion

How much of the income a company makes it keeps in cash

Cash can be used to reinvest in the business, hopefully at a high return

A company can create shareholder value by paying out cash dividends, or by buying back the stock when it's undervalued

Example of high and expanding cash conversion (Defined as FCF / Net Income):

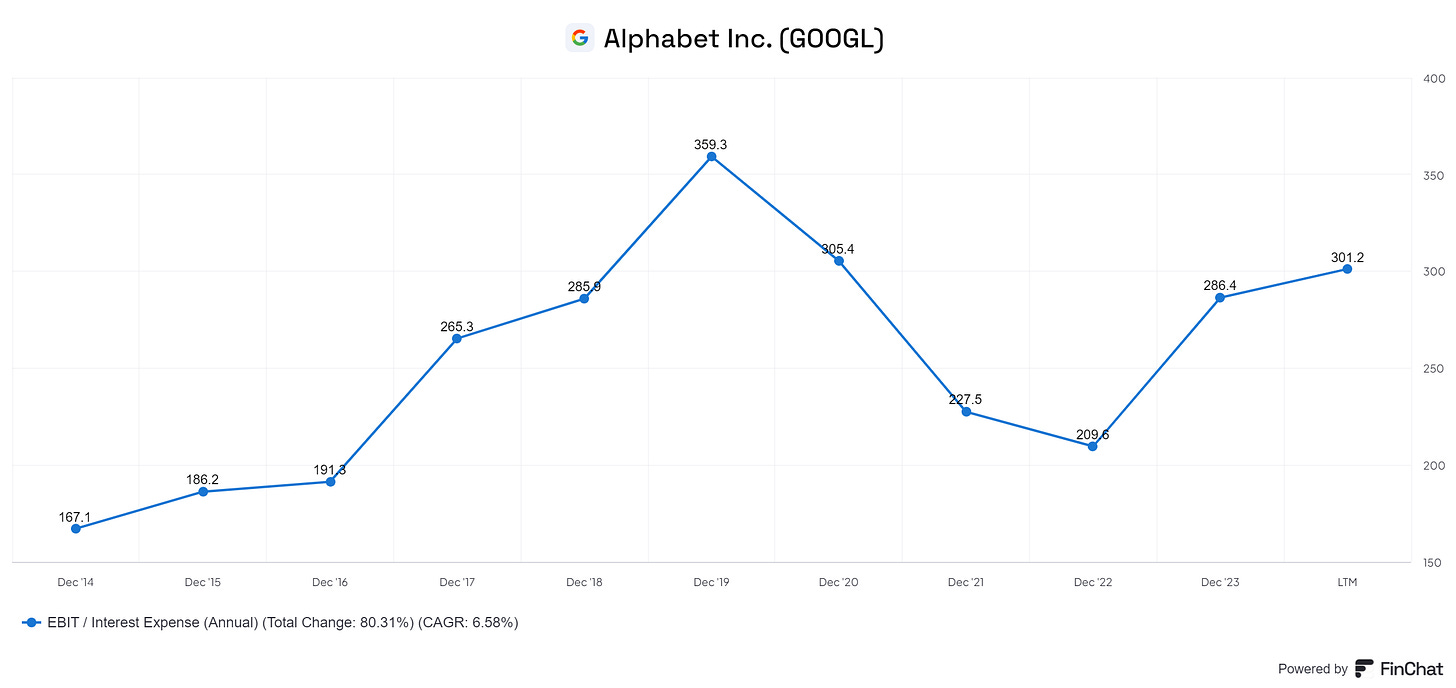

3.5. Interest coverage

To quote Terry: “To ensure that the company doesn’t use financial shenanigans to achieve high returns”.

A measure of profits vs. what they pay out in interest and lease payments. Fundsmith has a 20x on this metric vs. the index of 10x.

Example of a high interest coverage business:

4. Fundsmith buys Quality when it is Priced Fairly📉

No business is worth any price, it has to be seen in relation to the cash it produces

Fundsmiths aim to buy quality stocks when they are out of favor

An example is when they bought Microsoft in 2010 at a PE of 10.

Terry's philosophy is that it is more important to identify a superior business, than a cheap one.

Terry believes their portfolio is cheaper than the index because their companies have:

Stickiness

Moats

Stability

High ROC

Cash generation

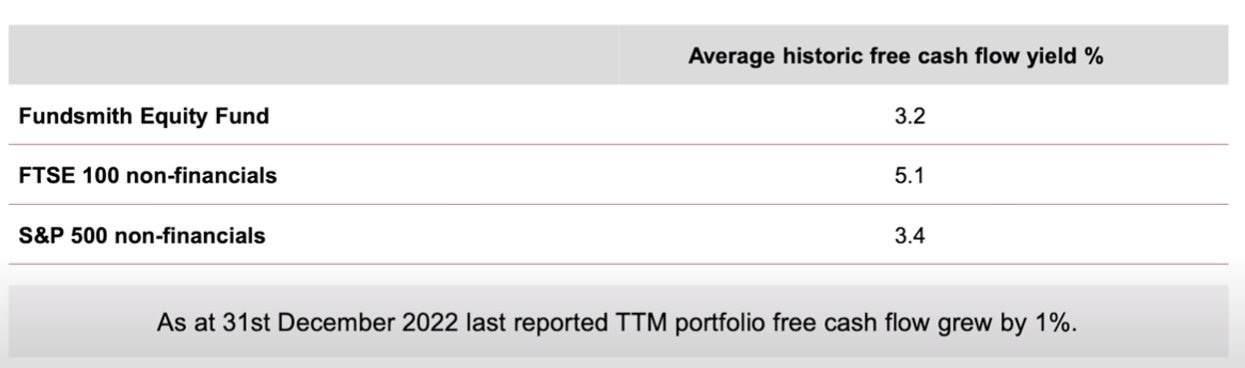

Terry likes to compare the free cash flow yield of his portfolio to the index.

As Fundsmith doesn't invest in financials, they are excluded.

Their portfolio has an FCF close to the S&P500, but the quality variables mentioned above are far superior.

Fundsmith's portfolio is cheaper than the index when you look at:

FCF growth rate of 20% vs. the index of 4%

ROCE of 32% vs. ~16% -Gross margins of 64% vs. 45%

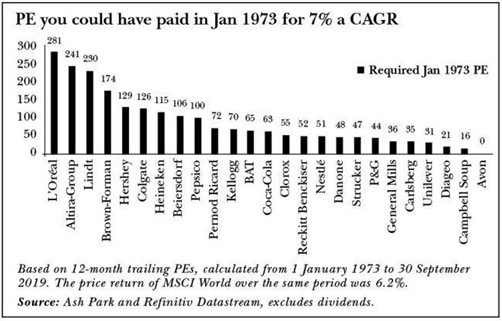

5. PE tells you Nothing about the Value💡

Terry: “Like everything else in life, it depends on what you get for the price. Fords don't cost the same as Ferraris, the fact that the one is priced lower than the other doesn’t tell you anything about the bargain you’re getting”.

Don’t make the mistake of believing a stock is overvalued just because of its PE ratio.

It is often worth looking deeper into companies that have sustained growth over decades, like Constellation Software.

In 2019, Constellation's PE was over 60 times its earnings.

For most investors that looked quite expensive. Nonetheless, the stock has returned 29.8%. Read our full breakdown of Constellation Software as a compounder here.

That’s it for today, if you enjoyed this article, leave a like and a comment! 👇

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 250 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +8.000 stock market investors (48% open rate) — Contact us via: investinassets20@gmail.com

Great article. A variation on the quote 'You can’t compare Fords to Ferraris': in real estate, the three most important factors are location, location, and location. Similarly, for a quality investor, ROIC/ROCE is as crucial as location is for a real estate investor.

With his killer eyebrows, right?