📈 How Peter Lynch Beat the Market

🚀 Invaluable Lessons from one of the Greatest Investors of our Time

How Peter Lynch Beat the Market

"The person who turns over the most rocks wins the game." — Peter Lynch

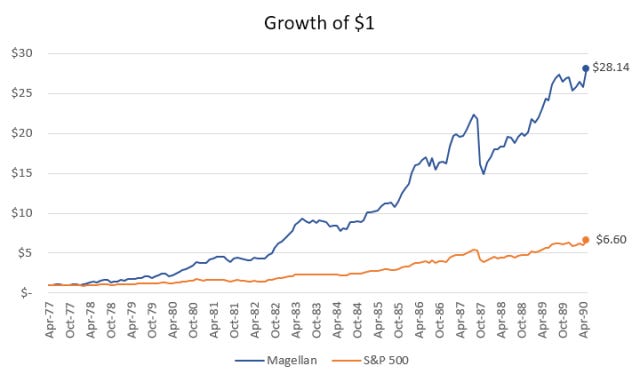

In just 13 years, Peter Lynch transformed Fidelity's Magellan Fund from a sleepy $18 million vehicle into a $14 billion monster — delivering an astonishing 29.2% annualized return from 1977 to 1990.

That's nearly double the S&P 500, year after year. But what made Lynch different wasn't just performance. It was how he did it. Lynch was looking where others didn’t, believing retail investors could spot winners before Wall Street, and trusting earnings over economic forecasts.

Today, we unpack the exact strategies Lynch used to beat the market — and why his approach still holds timeless lessons for investors.

Background: The Magellan Miracle

When Lynch took over the Fidelity Magellan Fund in 1977, it had just $18 million in assets. When he stepped down in 1990, it had ballooned to $14 billion. More impressive? He beat the S&P 500 in 11 of those 13 years.

Lynch didn’t rely on macro predictions. He didn’t care about GDP growth or interest rate estimates. His edge came from relentless research, a flexible framework, and the belief that "ordinary investors" had more tools than they realized.

1. His Main Strategy: Growth at a Reasonable Price (GARP)

Peter Lynch categorized his stocks. Every pick fits into a "bucket":

Fast growers (20%+ earnings growth)

Stalwarts (blue chips growing 10-12%)

Turnarounds (sick companies that might recover)

Asset plays (hidden real estate, cash, patents)

Cyclicals (tied to economic cycles)

Slow growers (often dividend plays)

Lynch wasn’t married to any style — value, growth, momentum. He cared about one thing: earnings. If they were growing and the stock wasn’t expensive (i.e., low PEG ratio), he was interested.

"You don't have to be right on every stock. If you're right 6 out of 10, you're going to do very well."

At peak, he held more than 1,400 stocks — but not randomly. He’d bet bigger on high-conviction names, using small positions as “probationary investments.”

2. How Peter Lynch Found Multi-baggers: Taco Bell, Dunkin', and Hanes

Lynch famously told investors to “buy what you know.”

But he didn’t mean to buy blindly. He meant: start your research from your own life.

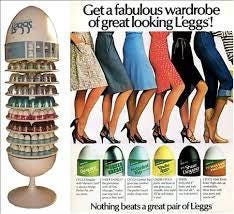

L’eggs Pantyhose and Hanes

His wife noticed the success of L'eggs pantyhose sold in grocery stores. This was a revolutionary product sold in egg-shaped containers—designed for distribution in grocery stores (Not just department stores). Women could not buy pantyhose during their weekly grocery shopping run, increasing the convenience of this purchase (Reducing friction). The unique packaging and massive visibility led to massive attention for the product and brand.

Peter Lynch discovered this product through his wife’s shopping habits, not through an advanced industry report or a broker. He saw:

Consumers loved it (Demand)

Smart distribution of the product: Grocery and drug stores increased the frequency of women buying pantyhose. The velocity of people in these stores is much higher than in a department store, increasing the number of people being exposed to the product.

Innovative packaging: The egg-shaped container was unique and stood out.

Recurring revenue model: Pantyhose is a consumable that women often replenish (Especially at the time). This created an attractive economic model for the product, which, in combination with its demand, was very attractive.

Hanes’ core business was growing steadily, and the L’eggs success was driving a new wave of growth for the business. The business had strong margins, distribution, and brand power before the L’eggs success, and it was not expensive, trading below a PEG og 1 (Lynch loved buying cheap growth stocks).

4 Key lessons from the Hanes investment:

The best ideas are out there in the real world (Not in the spreadsheets, but in stores, at work, or in conversations with consumers).

Simple products that solve real consumer problems in a new and unique way can drive massive returns

Great investments come from understanding consumer behavior better than the number crunchers at Wall Street

Matching product insight with financial strength and valuation discipline is how Lynch found 10, 20, 100 baggers.

Taco Bell: Fast (Food) Compounder

In the early 1980s, Taco Bell was one of the first chains to successfully popularize Mexican fast food in the US. Taco Bell’s key value proposition was:

Unique food that consumers craved

Low-priced meals meant more Americans could buy them regularly

A simple, profitable, and scalable business model

Lynch (Of course) visited Taco Bell’s locations; his observations were:

Packed restaurants in multiple cities

Simple and low-cost menu (With high margins)

Franchise potential for scaling profitably in the US

No real competition in the Mexican food space

This was Lynch’s real-world observation; he combined this with financial / Key performance indicator data:

Same-store sales were growing at attractive rates

Margins were rising (Gross and operating margins)

Low CapEx business model with high returns on capital

A PEG below 1

The successful investment

Lynch found Taco Bell before Wall Street, when it was an underappreciated small-cap stock.

He held the stock for multiple years and was patient in watching the earnings compound.

“They sold burritos and tacos for 59 cents, but they were printing money.”

Taco Bell was eventually acquired by Pepsico. The acquisition gave Lynch a massive return of +7x for his Taco Bell investment.

3 Lessons from the Taco Bell investment:

Big winners often come from boring businesses — Taco Bell was not sexy, but the demand was real and the business model was profitable and scalable.

Look for businesses that Wall Street ignores — this can create immense value later when Wall Street gets its eyes up for the business.

Undervalued, high-quality compounders are often acquired at a steep premium (Rewarding patient investors).

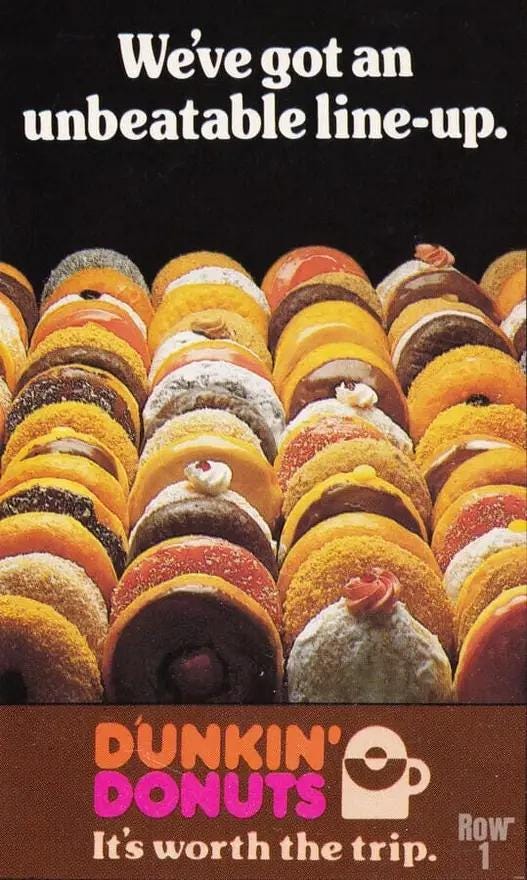

Dunkin’ Donuts: Coffee & Donut compounder

In the early 1980s, Dunkin’ Donuts was a modestly fast-growing regional brand focused on selling coffee and donuts through small franchise stores with quick service (speed) and low cost. Loyal morning customers served as a repeat purchase segment for the stores.

Dunkin’ Donuts sold coffee before Starbucks, and before this became an attractive theme on Wall Street. At the time, Dunkin’ Donuts was a boring, simple, and steady business — which Lynch loved.

Lynch’s observations:

Dunkin’ stores were always full in the morning on his commute to work

He noticed the same customers there every day (Repeat purchase and habitual loyalty)

The franchise model of the stores meant it had a low capital requirement from Dunkin’ business.

The menu and operations were simple, and margins were solid.

When Lynch dug into the numbers, he saw a business with high returns on equity, strong unit economics, recurring revenue, predictable royalties from the franchise model, and trading at a low valuation.

Dunkin’ Donuts was eventually acquired by private equity in the late 1980s, giving Lynch and the Magallan fund a 5-7x return.

3 lessons from the Dunkin’ Donut investment:

Franchise models can be compounding machines with limited risk (Low Capex model)

Repeatable consumer habits create reliable cash flow (Morning customers)

Undervalued small-cap compounders often get acquired, providing an attractive return for the shareholders.

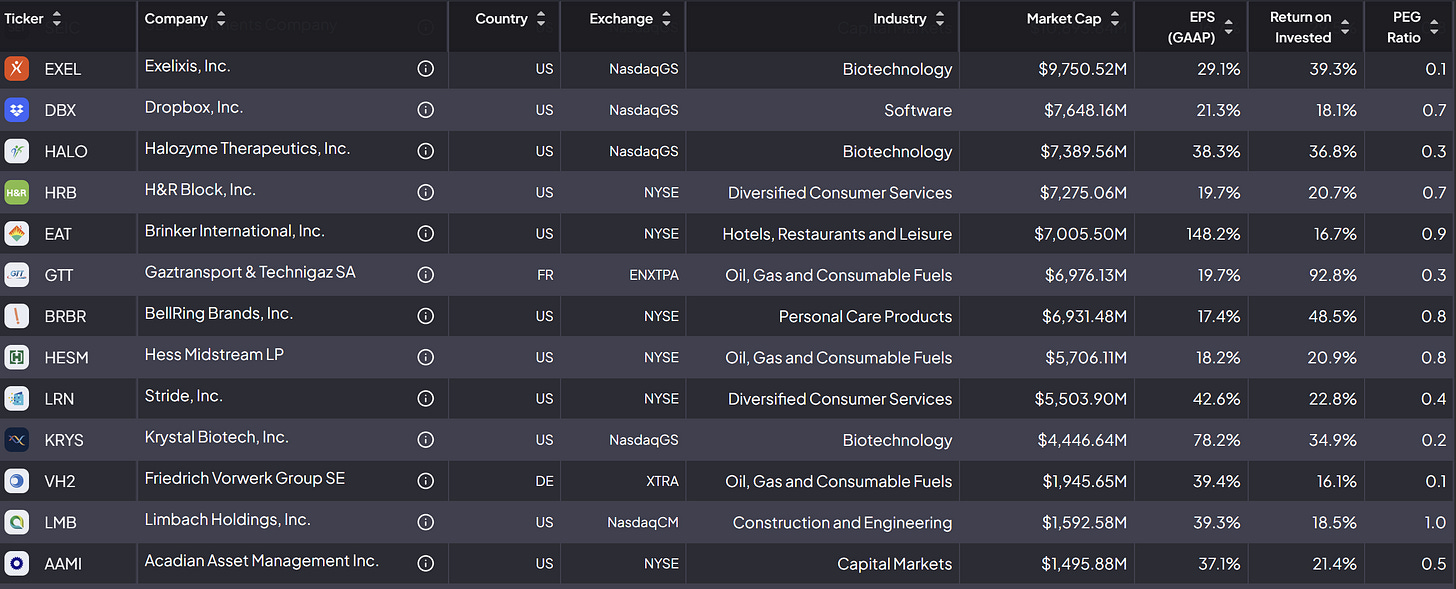

3. What He Measured: PEG, Earnings Line, Debt

Lynch pioneered the PEG ratio: Price-to-Earnings divided by Earnings Growth.

A PEG below 1.0? Cheap growth.

Example: a stock with a 15 P/E and 20% earnings growth = PEG of 0.75. Very attractive.

Here is a list of businesses valued below $10Bn with a PEG below 1:

He also looked at:

Profit margins (rising = good)

Debt levels (he avoided debt-laden companies)

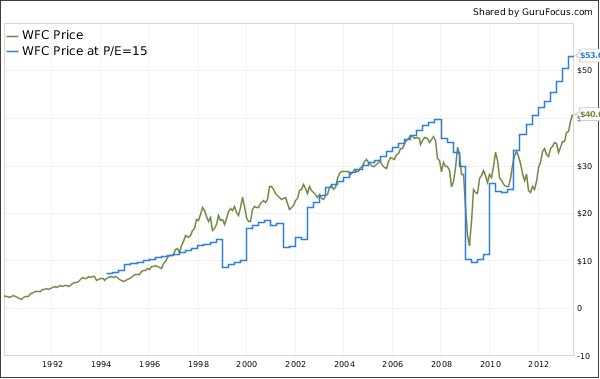

Price vs. Earnings Line (stock price plotted against earnings growth — if the stock lagged the earnings line, it was likely undervalued)

"Most of the money I make is in the third or fourth year that I’ve owned something."

Lynch didn’t need complicated models — he trusted numbers and common sense.

4. How He Thought About Valuation

Lynch wasn’t a deep value guy — but he loved bargains.

He believed great companies could still be overvalued, and bad ones could look cheap. His edge came from identifying companies where earnings growth wasn’t yet reflected in the stock price.

He’d happily pay a P/E of 20 for a company growing 25-30% — but only if he believed that growth was real and sustainable.

He avoided story stocks. If a company needed a narrative but had no earnings, it was a no.

5. A Unique Lesson: You Are Your Own Edge

Perhaps Lynch’s most powerful insight:

He believed individuals had the edge over professionals. Why? You can shop at the mall, try products, and talk to customers. Pros are often too busy, too benchmarked, or too bureaucratic to act on large opportunities.

The Magellan Fund returned ~29% per year — but the average investor in Magellan made only ~7%.

Why? They chased performance and fell for the oldest mistake in the book: Buying high and selling low.

Lynch’s real message: Stick with what you understand. Think long term. Don’t get shaken out.

Conclusion

Peter Lynch didn’t just beat the market — he redefined what it meant to be an investor.

He showed that observation, patience, and thinking outside the Wall Street box could outsmart portfolio managers with much more resources. His lessons still resonate because they empower the individual investor.

I’ll leave you with a final quote:

The person who turns over the most rocks wins the game. And that’s always been my philosophy — Peter Lynch

Ready to take the next step? Here’s how I can help you grow your investing journey:

Go Premium — Unlock exclusive content and follow our market-beating Quality Growth portfolio. Learn more here.

Essentials of Quality Growth — Join over 300 investors who have built winning portfolios with this step-by-step guide to identifying top-quality compounders. Get the guide.

Free Valuation Cheat Sheet — Discover a simple, reliable way to value businesses and set your margin of safety. Download now.

Free Guide: How to Identify a Compounder — Learn the key traits of companies worth holding for the long term. Access it here.

Free Guide: How to Analyze Financial Statements — Master reading balance sheets, income statements, and cash flows. Start learning.

Get Featured — Promote yourself to over 15,000 active stock market investors with a 42% open rate. Reach out: investinassets20@gmail.com

Disclaimer:

This newsletter is for informational purposes only and does not constitute financial, investment, or other professional advice. The views expressed are solely the author’s opinions and may change without notice.

Investing in securities involves risk, including the potential loss of capital. Past performance is not indicative of future results.

The author may hold positions in the securities mentioned. Readers should do their own research and consult a licensed financial advisor before making investment decisions.

https://open.substack.com/pub/maandhunter/p/how-i-captured-248-in-80-minutes?r=1gxvgt&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true

why beat the market when you can have the same market rate? Just a minority beats the market but a majority gets the same market rate.