How I would Construct a Portfolio from Scratch 🧠

5 Steps to building a quality stock portfolio

Hi there investor! 👋🏻

A frequent question I’m often asked is how to construct a portfolio from scratch.

Let’s use a hypothetical example.

We need to make a few assumptions:

We have $100.000 (Lump sum) to invest

We can invest $1000 per month

We have an investing horizon of +20 years meaning we can stay mostly invested in stocks

Question 1: Do I just invest everything in an S&P 500 Index fund?

If you want to passively own an index fund for the next years to get a decent return, I don’t believe this is a good time to do a full lump sum investment into an index fund.

Why?

Historically high Shiller PE ratio of 35.55 (Cyclical adjusted PE ratio)

Historically high PE ratio of 26.26 vs median of ~15

The next bull run is not likely to be fueled by quantitative easing and zero interest rates (There is too much debt)

S&P 500 is expected to grow 3%-6%

The S&P 500 for example, is expected to grow at 3-6% in the coming decade. This is an ok growth rate if you can expect a multiple expansion on it (Let’s say that the S&P500 PE was 15, and we expected it to normalize at 20. This translates to a CAGR of 2.9% over 10 years).

In the multiple expansion scenario, we have a 5.9 - 8.9% return expectation + dividends of ~1.25%. So, with multiple expansions, we can assume a 7.15% - 10.15% return.

Now, let’s turn it around. If we expect the PE to contract from 26.26 to 20 in the next 10 years, we get a negative CAGR of -2.7%.

This result in an expected return of 1.55% - 4.55% (Also, inflation rates of 3% makes this return even less attractive)

Prudent investors should not assume multiple expansions from this point. This leaves us with a few unattractive scenarios for index investing.

An S&P 500 index investment is very unlikely to yield the same result as it has in the last 20-year period.

Question 2: What do I invest in?

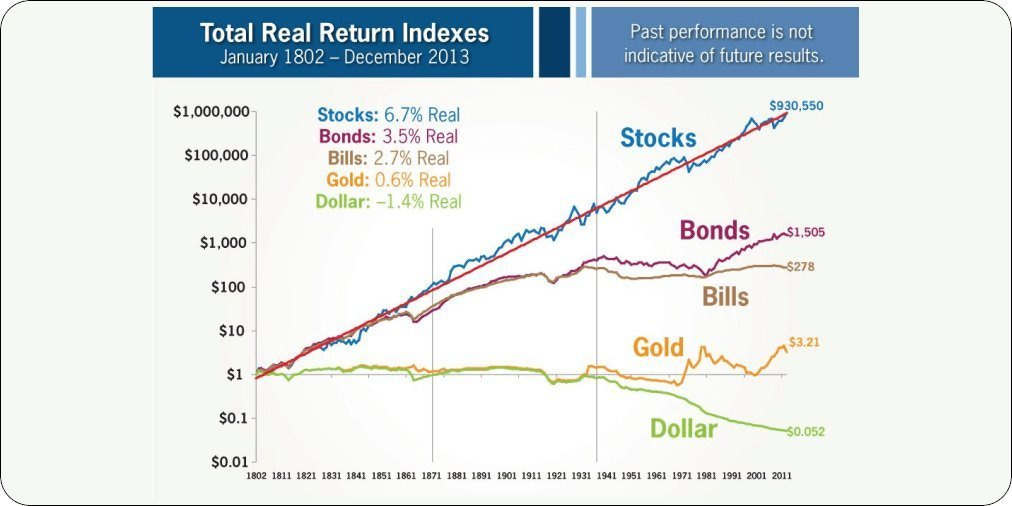

Historically, stocks have been the best place to build wealth over time.

Real estate is only comparable due to its levered nature. If you could borrow 5 to 1 in the stock market without being margin called in bad times, your return would be spectacular (Btw, this is how you lose all your money, so don’t even try it).

So, we want to primarily invest in stocks as this asset class has provided the best returns over time.

Multiple stock market strategies work wonders if you are a good investor:

Value Investing

Growth Investing

Quality Investing

Cigar Butt Investing

Micro-cap Investing

We are focused on quality growth companies, which are a combination of quality and growth investing styles.

Why?

Growth is the single most important driver of shareholder returns in the stock market:

Quality investing allows you to invest in fantastic companies with steady cash flow profiles that make it easier to hold without getting scared out of the stocks.

Quality and Quality at a reasonable price have also been great investing strategies over the last few decades:

So, we want our investing strategy to:

Provide a solid potential upside by investing in growing companies (+12%)

Limit the downside by investing in wide-moat businesses with sustainable and structural advantages

Limit the stress, anxiety, and anger that comes with too much volatility in one’s portfolio - we want stability (In our portfolio and minds).

Question 3: How much do we invest at a time?

There is no right answer to this question. It will always depend.

If you invest the entire $100.000 at one time, only to see the stock market slide by 20% over the next quarter, you could argue that this was a poor strategy because your timing was off.

However, staying on the sidelines for too long can also provide losses, as you are not taking advantage of the potential gains in the stock market. Consider Peter Lynch’s quote:

So, you want to find great investment vehicles that are likely to return more than 12% annually (We will discuss how later in this article).

When you find good investment cases, you want to allocate some of your capital to them, but how much for each position?

This is up to personal preference, but it is very hard to follow more than 15 companies as a retail investor. I think even the pros will have a hard time finding and managing more than 15-20 positions at a time.

Having too few positions in the portfolio is not smart from a risk perspective, as we never know what can happen to a specific company at any given time (Regulations, change in management, new technologies …).

The diversification effects you receive after 10-12 positions are minimal:

And what happens when you invest in 100-200 companies? You are likely to at best trail the market’s returns (At this point you should buy an ETF and call it a day), or you will underperform due to transaction costs (Depending on your broker).

Aiming for 10-15 well-thought-out positions is a good place to be for a retail investor.

Position size

10-15 companies in your portfolio mean that your position sizing should be somewhere between 5% - 10%. However, it is more logical to allocate a larger percentage of your capital to your best ideas.

You have to determine:

What return do I expect from this investment?

How likely is that this will happen?

What is the downside if I’m wrong?

A proposed position sizing strategy:

5% positions: Great business, likely to perform well, but conviction is only medium due to risk factors. It could be companies like:

Lululemon

PayPal

Alibaba

10% positions: Great business, likely to perform well, historically cheap while fundamentals are still growing, attractive risk/reward. Could be:

Evolution AB

Amazon

Alphabet

+15% positions: Great business, management, moat, and growth profile. Cheap on all accounts / depressed due to market drawdowns or temporary events. High conviction of high returns with low downside risk.

It is also smart to have a fixed stop, for example: “I will not add to a position if it crosses 15% or 20% of my portfolio”.

The position can continue to grow if it still is in an attractive spot, but you won’t add after a certain percentage.

This also applies to stocks that decrease in value. If you invested 10% in a sinking ship, adding 5% more to it might not be the best idea. You have to be mindful that a reduction in stock price often leads to a negative spiral for the business that can take a long time to get out of.

Tactical Purchases

To get to the 5%, 10%, or 15% position, a tactical approach you can use is to divide the purchase into 3-5 purchases.

This way you can spread out the short-term risk of the stock falling.

So, let’s say you want to add 10% to Amazon. You want to divide this into 4 purchases of 2.5%.

You only buy when you feel the price is within an attractive range. Sometimes this leads to the price getting away from you, other times, it leads to you getting the stock at the price you want to.

This disciplined approach works in practice due to 3 main reasons:

Psychologically easier to invest in a stock if you take smaller positions (1-2.5% instead of 5% or 10% all at once)

It protects you from short-term price deterioration (Stocks typically fall after I purchase stocks. Am I the only one?).

Promotes discipline. You don’t chase the stock, you stay disciplined until the stock hits your price targets.

Question 4: How do I find great investments?

I have plenty of resources on the subject:

Essentials of Quality Growth — A multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) Valuation Cheat Sheet — Easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

The short version:

Look for growing quality companies:

High returns on capital +15%

Organic growth +10%

High margins (Above competitors)

Converts most of its earnings to cash +75%

Wide moat

Prudent management

Market set to grow for next few decades +10%

Buy them at a fair price

Look at historical PE - Ideally below the historical median

Look at historical FCF yield - ideally above the historical median

Use a simple DCF or the Rochon method to determine the expected return from a business. - Ideally +12%

Hold, but continuously verify

Listen to quarterly calls

Look at the company presentations

Verify that the management team does what they say and stay transparent

Look at key metrics like ROIC, growth, and KPI numbers to see that the business is on track for its long-term potential

Here is a list of 50 quality businesses:

Question 5: Where do I begin?

You have multiple options here.

If you have $100.000, I would not invest it all in 1 month. I would at least wait 6-12 months to invest it all.

Why?

Because the likelihood of you investing 100% of the capital in a single month and investing only in great businesses at fair prices is very low.

These opportunities happen a few times per year. If you are happy with 5%-10% returns, you could make an argument for making a lump sum purchase of 10 great quality businesses. However, that is not the path I’d choose.

I would do the following:

Step 1: Set up a radar - Follow the best analysts on X, Linkedin, Threads, and YouTube. Subscribe to the best Substack newsletters and create an idea funnel.

Step 2: Create a watchlist of high-quality businesses that you want to follow (you have a natural interest in). These are businesses you would invest in given the right price.

If you need inspiration, check out Our Investable Universe.

Step 3: Set the right price for your watchlist. Based on your analysis, what price points seem attractive? Set it up, write it down.

Step 4: Invest - If you find a few great investments in the first month, no problem - invest. Dip your toes in and get started building the portfolio. You will learn much more about holding a business than you ever did on the sidelines.

Want to learn more?

Join the Premium newsletter to follow our market-beating Quality Growth Portfolio—be notified of all our moves and the opportunities we see in the market.

That’s it for today, I hope you enjoyed it!

Leave a ❤️ and a comment and let me know what you think below.

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 250 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +10.000 stock market investors (45% open rate) — Contact us via: investinassets20@gmail.com

Thank you so much

You have packaged a lot in an article

Super valuable, love it! 👍👍