How Bill Ackman Beats the Market 💎

Steal Ackman's investing strategy to become a better investor 📈

Investor Breakdown: How Bill Ackman beats the market

Hi investor! 👋

Bill Ackman is known as the billionaire activist investor of Wall Street.

Bill is the founder and CEO of Pershing Square Capital Management, which he founded in 2004. He also holds Pershing Capital Holdings, incorporated in 2012. It has a whopping $19.01 billion in assets under management. Pershing Square USA was also planned to be launched by Ackman in mid-2024. It was supposed to be listed on the NYSE with a $50 IPO, but Bill later scrapped the plan due to low investor demand and structural concerns.

Despite making a few blunders, Bill Ackman is a great investor we can learn from.

Let’s dive into how Bill Ackman beats the market👇

Performance

Since its inception, Bill Ackman’s funds have significantly outperformed the S&P 500. This outperformance is net of fees. Ackman charges 20%/16% performance fee.

Interestingly, Ackman divides the performance into two different periods in his most recent letter to shareholders:

Periode 1: From inception (1 jan 2004) to March 2025

Periode 2: 31 Dec. 2012 to March 2025

In period 1, we can see a significant outperformance with 15.9% and 15.1% CAGR, compared to the S&P 500’s CAGR of 10%.

However, in period 2, the S&P 500 has outperformed with a CAGR of 13.9%, compared to 12.7% and 11.3%.

This means that Bill Ackman has underperformed the market in more recent times. Has he lost his touch? Let’s find out.

Investing Style

Pershing Square runs a concentrated quality strategy with an element of activism to attempt to force value by influencing companies’ strategic decisions (E.g., Canadian Pacific, Chipotle, and Starbucks).

The focus is on undervalued companies that trade below intrinsic value. Ackman targets large-cap businesses with strong moats, attractive business models supported by underlying trends.

To take advantage of market trends, Pershing Square also uses hedging and options to boost performance. The best example came during COVID, when Ackman went on TV to say the end is near, only to make millions of dollars from his short position (questionable morals).

Ackman is known to be persuasive; he is highly intelligent and educated, and can often manage to win over investors due to these traits.

Here is an overview of what Pershing Square has bought and shorted since its inception:

Ackman’s portfolio is mostly concentrated in 4 industries;

Media (Alphabet)

Restaurants (QSR & Chipotle)

Financial Services (Brookfield)

Consumer products (Nike & Hilton Hotels)

This is similar to other quality investors.

Pershing Square does not provide a detailed overview of its portfolio. Here is the portfolio from Finchat.io (Does not include holdings outside the US):

In addition, Pershing Square holds Universal Music Group N.V. and Uber Technologies.

How Ackman Identifies Quality Companies

Bill Ackman is thoroughly focused on companies that are undervalued in the market. He always keeps an eye out for businesses that have good brand recognition and financials, but due to poor management decisions, have lost their way.

Ackman prefers stocks that are easy to understand and show good long-term potential. According to Bill, short-term market noise is a distraction, so he keeps his focus on stocks that can withstand volatility periods and provide consistent returns.

To quote Bill:

“Short-term market and economic prognostication is largely a fool’s errand; we invest according to a strategy that makes the need to rely on short-term market or economic assessments largely irrelevant”.

Unlike most hedge funds, Pershing Square Capital Management holds only a few stocks, varying from 5 to 15, within its portfolio. Here is what he says about holding multiple companies:

“As a result of overdiversification, their (active managers) returns get watered down. Diversification covers up ignorance. Active managers haven't done enough research into any of their companies. If managers have 200 positions, do you think they know what's going on at any one of those companies at this moment?”

It’s a strategy that blends elements of Warren Buffett’s value investing with a hands-on, activist mindset, aimed at achieving superior long-term returns with a strong focus on risk-adjusted performance.

Now, let’s dive into Ackman’s investing principles:

Core Investing Principles

Key Business Characteristics

Simple, predictable, free-cash-flow-generative business.

Investors tend to overestimate complex, high-risk companies and underestimate simple and predictable companies.

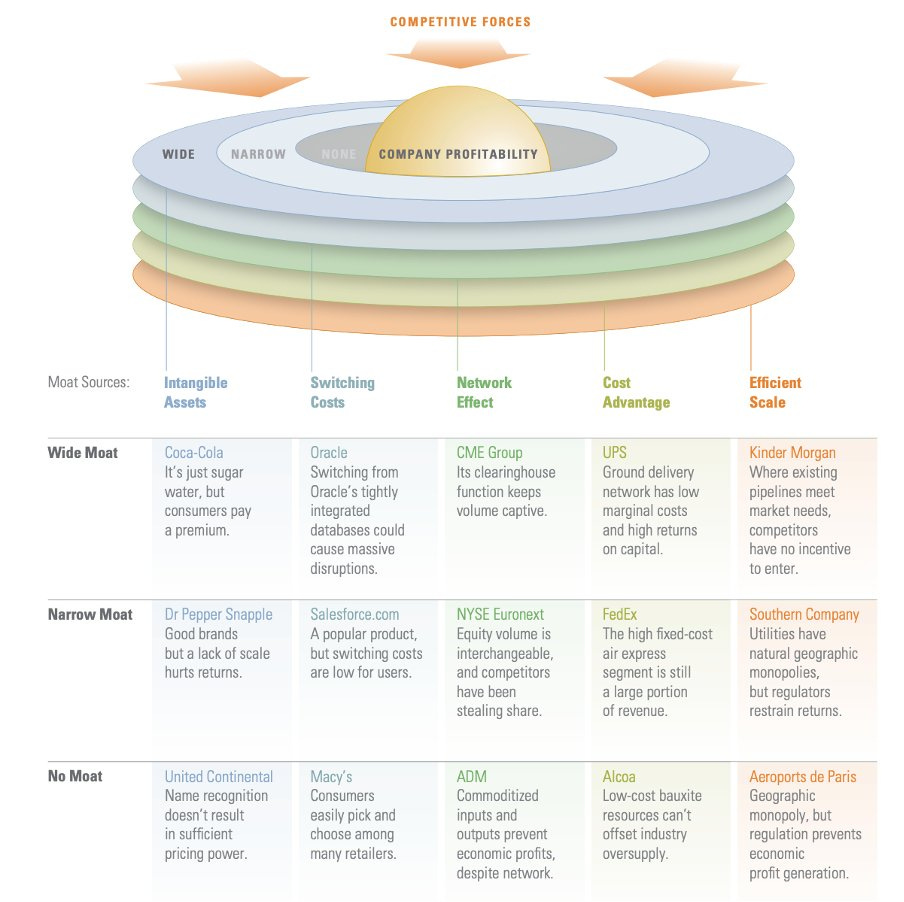

Formidable barriers to entry

The hardest barriers to entry tend to be intangibles and network effects:

Limited exposure to extrinsic factors that we cannot control

Avoid companies that are overly affected by external variables like commodity prices or regulation.

This includes any commodity business like oil & gas related companies and companies in a highly uncertain regulatory environment.

Strong balance sheet: low financial leverage levels

Favor companies with low debt and solid financial health.

Typically, companies with high interest coverage and low debt-to-equity ratios.

Minimal capital markets dependency

Companies should not need frequent access to capital markets to sustain operations.

Large market capitalization (Typically highly liquid, mid- and large-cap companies)

Focus on well-established, liquid businesses to reduce risk.

Attractive Valuation

Attractive valuation (Fair price “as is,” discounted to optimized value)

Buy companies at a price lower than their intrinsic or long-term value.

Base case valuation not reliant on future M&A or platform value

Investment returns should be justified by current fundamentals, not speculative future events. This criterion excludes most hyped growth stocks.

Good Management & Governance

Exceptional management & governance

Look for companies with competent, ethical management teams and solid governance practices.

No controlling shareholder (Typically)

Prefer businesses without dominant shareholders who might make decisions misaligned with minority investors.

Occasional Mispriced Probabilistic Investments

High-risk, high-reward opportunities (selectively)

Will consider rare investments with asymmetric risk/reward potential, within the team’s area of expertise, and only with strong justification. This includes his short in the market when COVID hit.

4 Examples of Ackman’s Big Wins

Bill Ackman can unlock big wins by I) being an activist and getting involved in how the business is run, II) buying and holding great business models, III) making the occasional hedge bets. Here are 4 of his biggest wins:

Canadian Pacific Railway: Activist campaign to overhaul leadership → stock multiplied several times.

Restaurant Brands (Burger King, Tim Hortons, Popeyes): Early investment in a franchising powerhouse.

COVID Hedge: Timed the March 2020 crash with a clever CDS (credit default swap) position.

Chipotle: Helped restructure after their food safety crises → strong rebound.

Valuation: Value investing vs. quality investing

Before making investments, Pershing Square Capital Investment goes through rigorous scrutiny. It involves going through fundamentals, cash flow generation, balance sheets, and industry position to unlock the true fair price of the business. The major question they try to solve is why a company is trading below its potential value.

The stake in Howard Hughes Holdings is a testament to this. The rationale is that the true value of the real estate development is not fully reflected in the stock. Bill even plans to become the CEO of HHH and raise his stake in the holding.

While Bill has moved away from activist campaigns, he still aims to target companies with improved operating margins through efficiency gains. Due to the complexity of his strategy, he often requires a good discount between the market price and the potential intrinsic value.

A good example is Bill's stake in Alphabet stock. While he has slashed his holding, it's still the fifth-largest position in his portfolio. GOOGL is a high-margin, high-quality digital advertising business with a good moat and cash flow generation.

Unique Lesson

Ackman’s approach is to buy high-quality, stable businesses with durable advantages. If he is right, he wants to buy these companies at fair prices and with catalysts that can unlock more upside.

Ackman lives by the “focused investing” philosophy, where you only own between 10-15 positions. Each position matters as the weighting is high, which makes it even more important that the positions held are well researched and likely to play out in Ackman’s favor.

Bill is a fan of strong royalty businesses; Hilton Hotels is an example. They own the brand and the systems associated with running a Hilton Hotel. Hotel owners can pay Hilton to use their brand and systems. Hilton then collects a royalty on every booking that the hotel does, but the risk of investing in real estate and operating the business is on the hotel owner, and not on Hilton Hotels. Hence, they get the upside, with no downside, a pretty good deal, right?

Conclusion: Ackman has crushed the market over time

Ackman follows a simple strategy. The hardest part of this strategy is to stay committed to it over 10, 20, 30 years. Buying well-known, durable, steadily growing businesses for decades might not be enough action for many investors. But it certainly works out, as showcased by Ackman’s returns.

Despite a few massive blunders (Especially the Herbalife short), this strategy has worked well over the decades. Multiple other investors follow the same strategy, such as Terry Smith, Warren Buffett, and AKO Capital, to name a few.

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 300 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +13.000 stock market investors (42% open rate) — Contact us via: investinassets20@gmail.com

The analysis of Ackman's concentrated portfolio approach is particularly insightful. I've been following a similar strategy with 10-15 positions, and the emphasis on thorough research really resonates.

However, I'm curious about how you handle the psychological pressure of concentrated positions during market downturns. The article mentions Ackman's performance during different periods - how do you think individual investors can better manage the emotional aspects of this strategy?

Very insightful 👏