Hello investor!

In case you missed our latest articles:

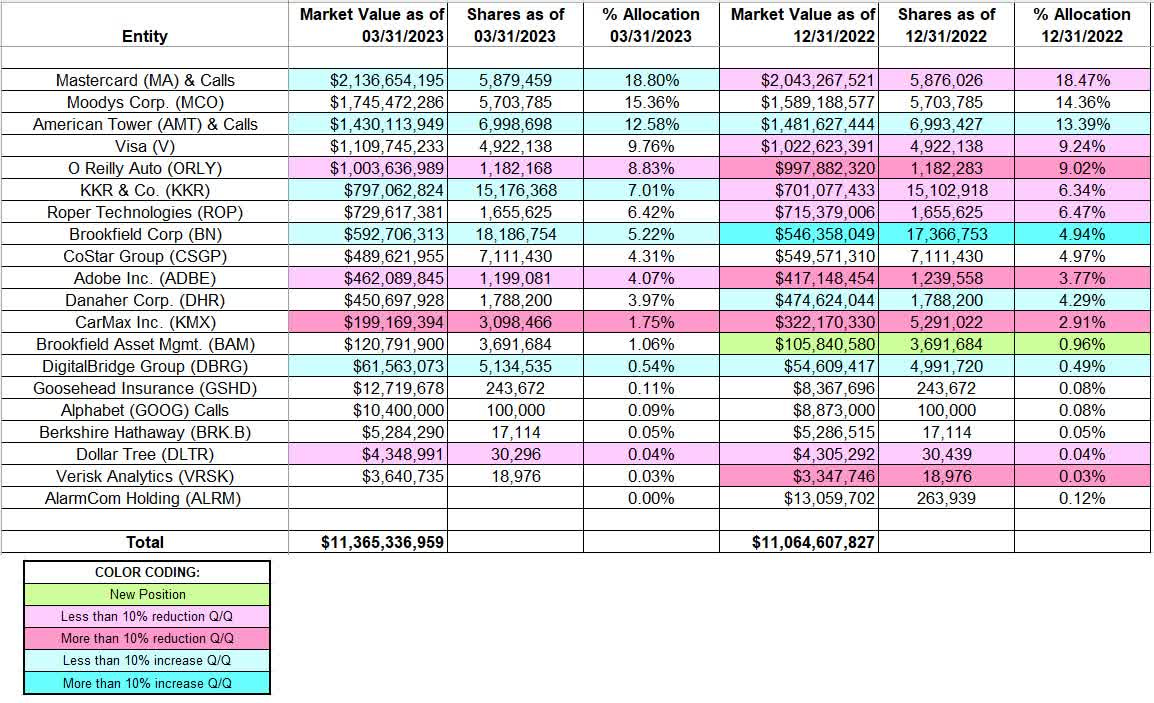

How Akre Capital Beats the Market

Akre Capital is a focused quality fund from the US. Akre Focus Mutual Fund has produced an annualized return of ~15.23% since its inception.

Download Chuck Akre’s legendary talk (transcript) — “An Investors Oddysey” here

Akre capital criteria for superior businesses:

High ROC

Capital light

Pricing power

We understand it

Predictable earnings

Shareholder-oriented mgmt

Cash profits, no shenanigans

Not dependent on a genius CEO

Not natural targets of regulations

Let’s break down each part from the list above 🏆

Return On Capital

A high return on capital is essential in Akre’s investing strategy. A high return on capital means that the business is able to compound at high rates. But this is only true if the business can reinvest its earnings into its business. Having a high ROC, but no way of investing the capital means that the business will end up spending the free cash flows of the business on less effective initiatives to drive shareholder value, like stock repurchases, dividends, debt repayments, and M&As.

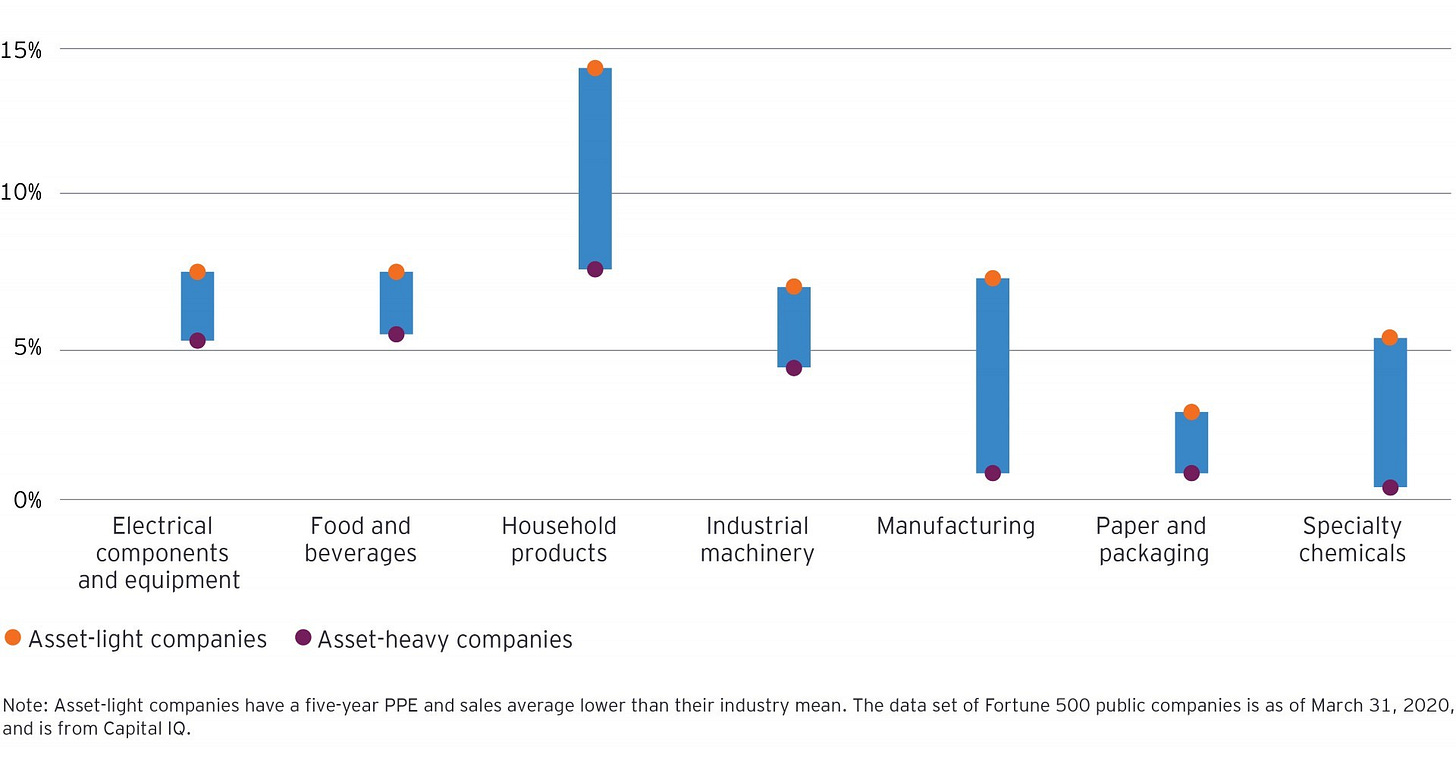

Capital Light

Akre prefers asset-light companies. This means that the company’s capital expenditures should be a small percentage of the sales and operating cash flow. A few reasons why asset-light companies are superior to their asset-heavy counterparts:

It requires less capital to fund its operation and growth

The company can focus on its core business, and outsource what is outside its field of expertise

Asset-light companies are more flexible and can scale at a more rapid rate

Thanks for reading Invest in Quality! Subscribe for free to receive new posts and support my work.

Subscribed

Pricing power

Pricing power is a popular term, often used by Warren Buffett to describe the ideal business. If a business is able to increase prices without losing demand in line with or above the rate of inflation, the business is resilient and of high quality. This also works the other way around. Companies with pricing power can resist price erosion in a competitive market. Pricing power is often a result of the company’s moat and reflects the strength of the brand, product, and its competitive position relative to its competitors.

We understand it

A lot of the edge concentrated investors like Akre Capital have, is that they know their companies better than most, and are able to add to positions and take new positions when Mr. Market is providing them with opportunities. Akre Capital knows its companies on a deep level. By knowing the company’s DNA, meaning its business model, business segments, management, management incentive programs, management alignment, what drives growth in earnings, the product economics, and its pricing power, they are able to separate temporary events, from structural declines.

Predictable earnings

Kahneman won a Nobel Prize for his work on (among other things) the prospect theory, which states that humans will overestimate low-probability events, and underestimate high-probability events. The practical implication in investing is that investors tend to believe that a fast-growing stock will continue to grow fast and even exponentially. In reality, the probability for these stocks to work out is low, but we ascribe a high multiple to them. On the other hand, we underestimate boring, stable, and predictable companies. This psychological effect is something Akre Capital and other Quality funds take advantage of.

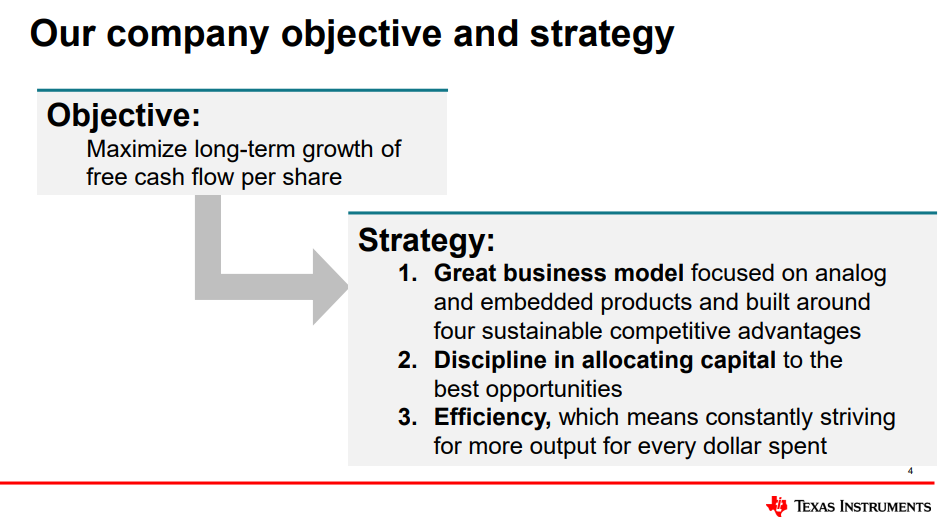

Shareholder-oriented mgmt

As investors, we should look for management teams that are aligned with the shareholders of the company. We are looking for management that wants to maximize the long-term value for shareholders. Ideally, we want to see transparency in strategies, goals, and compensation. We would also like to see incentive programs that align with shareholders. A great example is Texas Instrument which has an incentive program around free cash flow per share. There are plenty of stories where management is not shareholder-oriented, and makes decisions to benefit themselves, neglecting investors and hence providing performance that is below average.

Cash profits, no shenanigans

Cash profits hold great significance in the world of investing as they provide a clear measure of a company's financial performance and sustainability. Unlike accounting profits, which can be influenced by non-cash items and accounting practices, cash profits represent the actual cash flow generated by a business. They indicate the amount of cash available to the company after covering all expenses, including taxes and investments in the business. Cash profits are crucial because they reflect a company's ability to generate real cash and its capacity to fund future growth, repay debts, distribute dividends to shareholders, and withstand economic downturns.

Not dependent on a genius CEO

The business in and of itself must be strong enough to not be dependent on a “genius CEO”. If a business only outperforms because of the CEO, the business is not of high quality, but it just reflects how good the CEO is. The risk is if the CEO quits his role, leaving you with an underperformer. Ideally, investors want a business model that is so good that you don’t need a fantastic CEO for it to continue to outperform. However, a fantastic business, with a fantastic management team is something to behold. Examples: Apple, Berkshire Hathaway, and Lifco.

Not A Natural Target of Regulations

Companies that are natural targets of regulations are more volatile in nature because their business is constantly challenged by local authorities. Meta Platforms is a fantastic business, but they seem to be in the public crosshairs all the time. A change in the business environment due to regulations will impact revenues and earnings potential long term. It has the possibility to break businesses. However, many companies that are natural targets of regulations have continued to grow and prosper. Examples: Google, Meta, Philip Morris. Akre Capital prefers companies where the chance of a changing environment is low, providing more stability and predictability. Examples: Mastercard, American Tower, and S&P Global.

That’s it, hope you enjoyed the read. If you did, let me know what you liked in the comments below! Also, let me know what you want me to write about next.

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 250 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +8.000 stock market investors (48% open rate) — Contact us via: investinassets20@gmail.com

THX!

The fact that you're asking for email addresses in exchange for Akre's talk is extremely disappointing, to say the least. Especially since one can find it in 5 seconds with a Google search.