Driving Success: AutoZone's Winning Business Model 💎

Quality compounder with attractive economics and steady growth 🧠

Hi investor!👋🏻

Want to build a high-quality stock portfolio of compounders in 2025?

Join Invest In Quality Premium

In this article, we’re breaking down the cannibal compounder: AutoZone.

Let’s get into it 👇🏻

Autozone AZO 0.00%↑ 🚗

Investment thesis

AutoZone has an attractive business model with a high return on invested capital and has been a consistent compounder since its inception in 1993.

Positive growth drivers for Autozone include increasing miles driven and aging vehicle fleets. The business is well positioned with a strong brand to benefit from the emerging segment of “Do it for me.”

The emerging risk of EVs that use fewer parts than a traditional combustion vehicle is present but remains small, as most registered vehicles in the US are not EVs. Only 6.8% of US cars are EVs, but this is growing and likely to be much higher in the next 10 years.

The investment thesis for AutoZone is that the business will continue to grow, increasing total stores and increasing net sales per store over time. The attractive store economics, profitability of the company, and its stock repurchasing make it interesting for long-term investors who want a multi-year compounder in their portfolio.

Let’s look closer into AutoZone’s business, growth prospects, and valuation.

The Business

AutoZone was founded in 1979 and is a leading retailer and distributor of automotive replacement parts and accessories in the United States, Mexico, and Brazil.

Catering to both do-it-yourself (DIY) and professional customers, AutoZone operates +7,353 stores, offering a wide range of products, including automotive parts, maintenance tools, chemicals, and accessories for light and heavy vehicles.

The AutoZone stores deliver a valuable shopping experience for consumers by having a wide assortment of products with a mix of brick-and-mortar stores and e-commerce sales channels.

AutoZone focuses on leveraging its comprehensive supply chain, competitive pricing, and award-winning customer support to drive sales and foster customer loyalty. Through its "AutoZone Commercial" program, it serves mechanics and repair shops, further solidifying its position as a key player in the automotive aftermarket industry.

The Fundamentals

The company’s return on invested capital is 29.7% and has been consistently high for years, ranging from 27-35%.

Gross margins and operating margins have been steady over the last decade, indicating that Autozone has a strong competitive position.

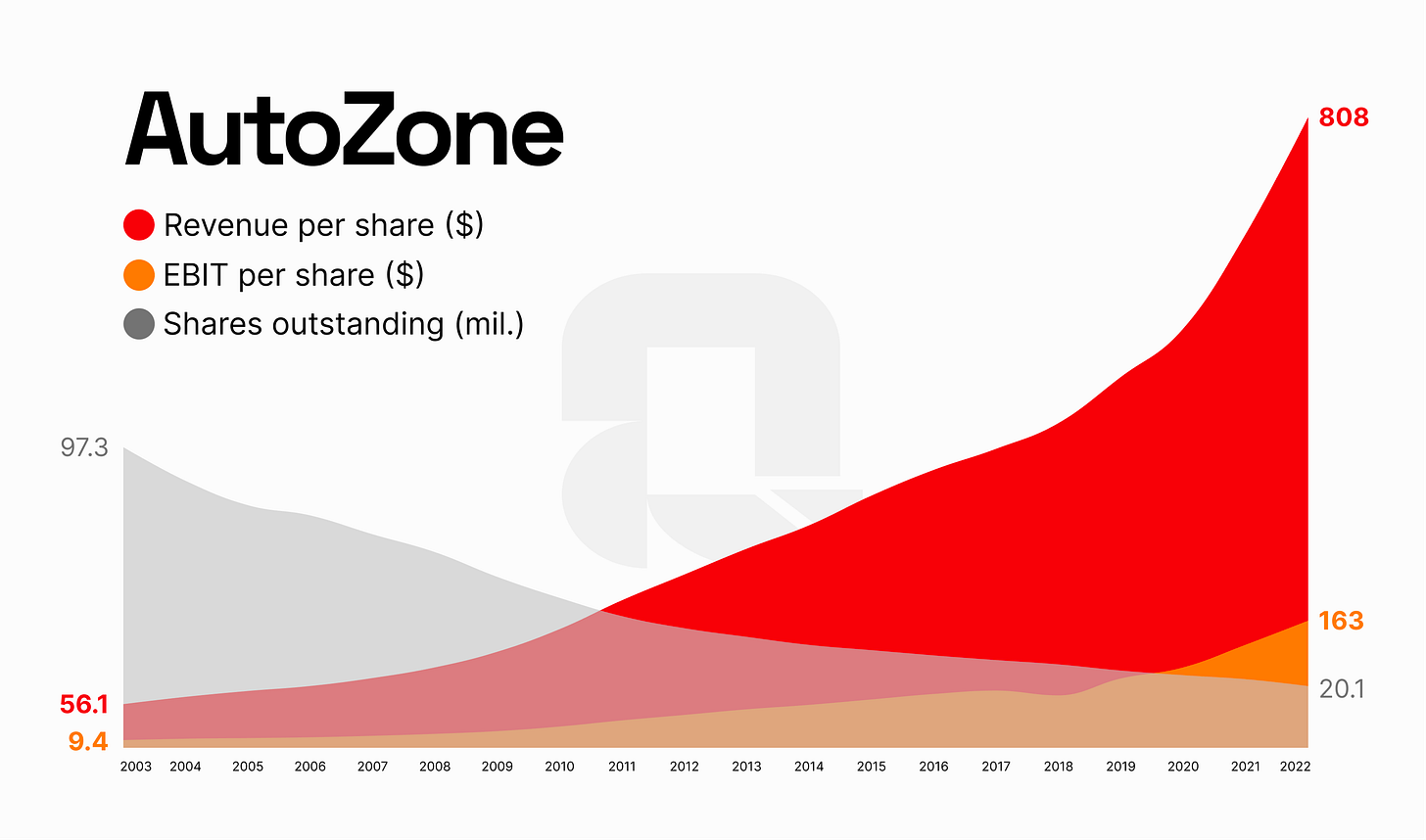

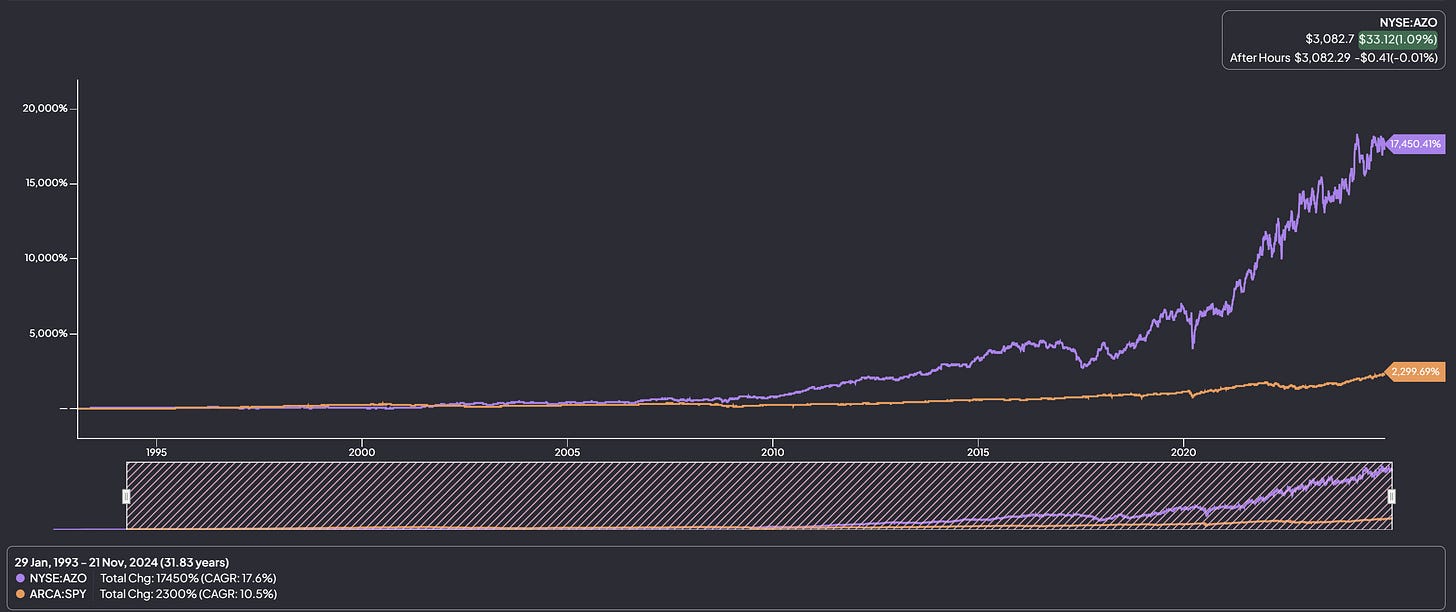

The stock

The stock has been a big winner since its inception in 1993, with a total return of +17.450%%. This is a compounded annual growth rate of 17.6%.

Autozone has outperformed the S&P500 by a mile in the last decade and since its inception.

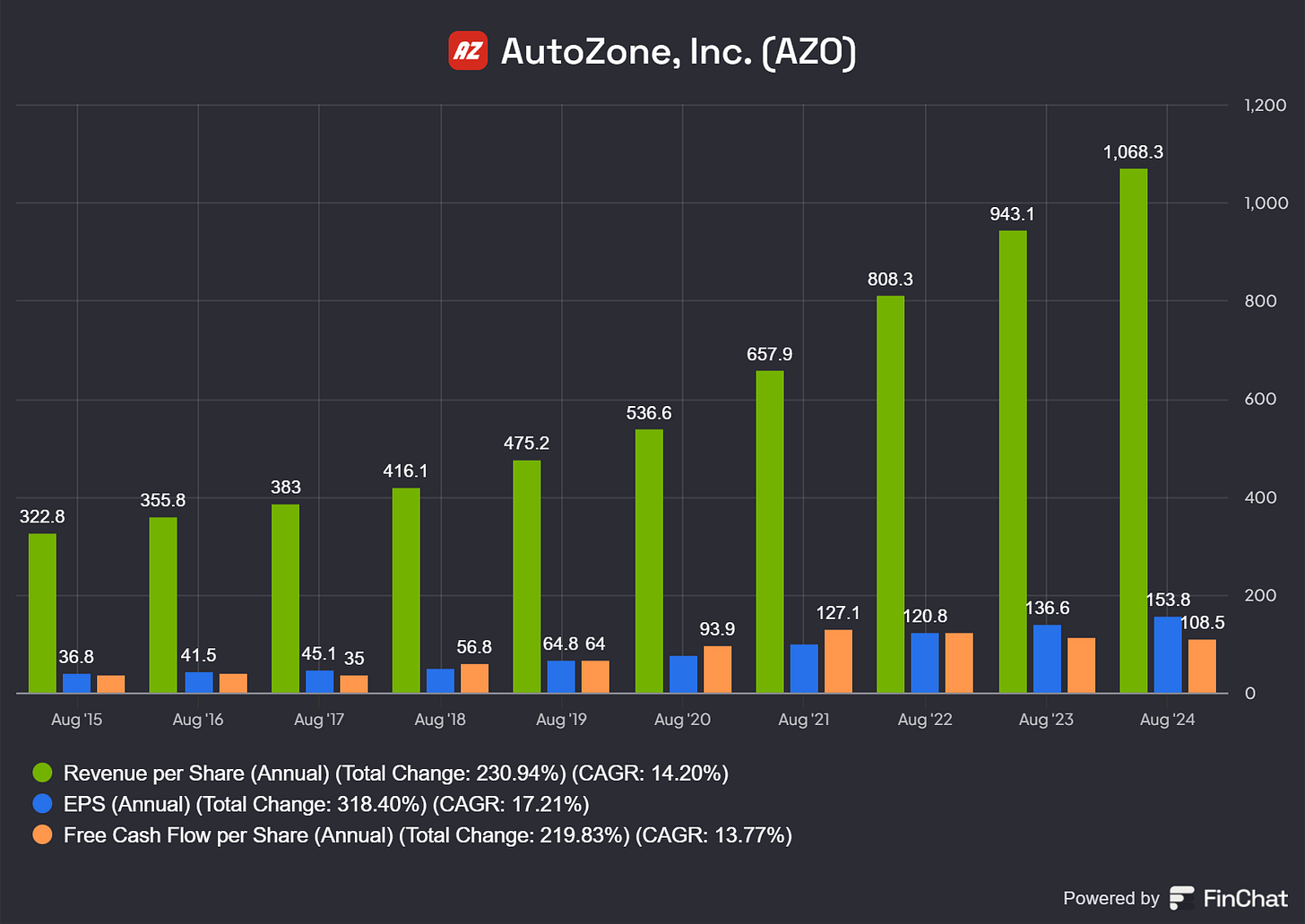

The Growth

Autozone has compounded revenue, cash flows, and earnings at a rapid rate for the last 10 years.

10-year CAGR:

Revenue per share: +14.20%

Earnings per share: 17.21%

Free cash flow per share: 13.77%

Sustainable Competitive Advantage

Autozone has a wide moat rating at Morningstar. This rating was given due to the company’s ability to have a stable return on invested capital way above its weighted cost of capital for more than 20 years.

Autozone’s moat is built through its store footprint, customer service systems, strong brand image, and part availability. The Autozone business system is hard to replicate and compete with, and it is likely that this will continue to drive its success in the coming years.

Autozone continues to scale its operations. If we look at their KPIs, we can see an increase in total store locations, store square footage, average net sales per store, and net sales per Autozone store square.

This means that Autozone is opening more new stores (hence more store squares) and increasing its per-store net sales. This is a very attractive combination and shows that its product is in high demand.

Market share: Strong player in a fragmented market

According to CSImarket, Autozone has an 11.20% market share. This is slightly behind Genuine Parts co, Autonation, Carmax, and The Goodyear Tire and Rubber Company.

We’ve seen super investors like Rochon Francois prefer the market leader Carmax over any other player, so why is AutoZone interesting?

For one, I believe it is interesting that Autozone has increased its market share to 14.84% in the most recent quarter, a significant increase from the previous 12-month period.

It is clear that Autozone is one of the top players in this market, and the fragmented market allows it to grow and consolidate over time.

Market growth: Slow but steady

The automotive aftermarket is expected to grow 3.5% annually until 2032.

The growth is driven by an increased purchase of used cars and because consumers keep their cars for longer. This means they are more likely to purchase DIY automotive parts from retailers like Autozone.

Another growth driver in the market is “Do it for me”, also known as DIFM.

This segment of the market is growing as vehicle advancements make it more complex for consumers to fix their car issues.

The market is large with attractive economics, but the slowing growth means that Autozone has to steal market share from competitors to grow above 3.5% p.a.

Why own Autozone?

Strong business model with attractive store economics

Wide moat with a strong brand and a winning store concept

High and consistent return on invested capital

+20 years of outperformance and strong per-share growth

Main Risk

The main risks I see for ASML

Slowing market growth: Automakers are building service into their business model, meaning the future demand for DIY services is likely to be lower than in the previous two decades.

Electric vehicles: EVs have fewer spare parts compared to internal combustion vehicles and require less maintenance and repair.

Lack of growth initiatives: Management has not addressed how it will continue to grow despite the slowing growth and EV risks. The lack of growth initiatives is worrisome for the future.

Valuation: Despite the above-mentioned risks, the stock is trading at a historically high price to earnings. This is a risk for shareholders, if the PE contracts in the future due to slowing growth, the stock might decline rapidly from the current levels.

Valuation

Autozone is trading above its historical median PE at 20.52 times earnings.

This is close to its 10-year high PE ratio.

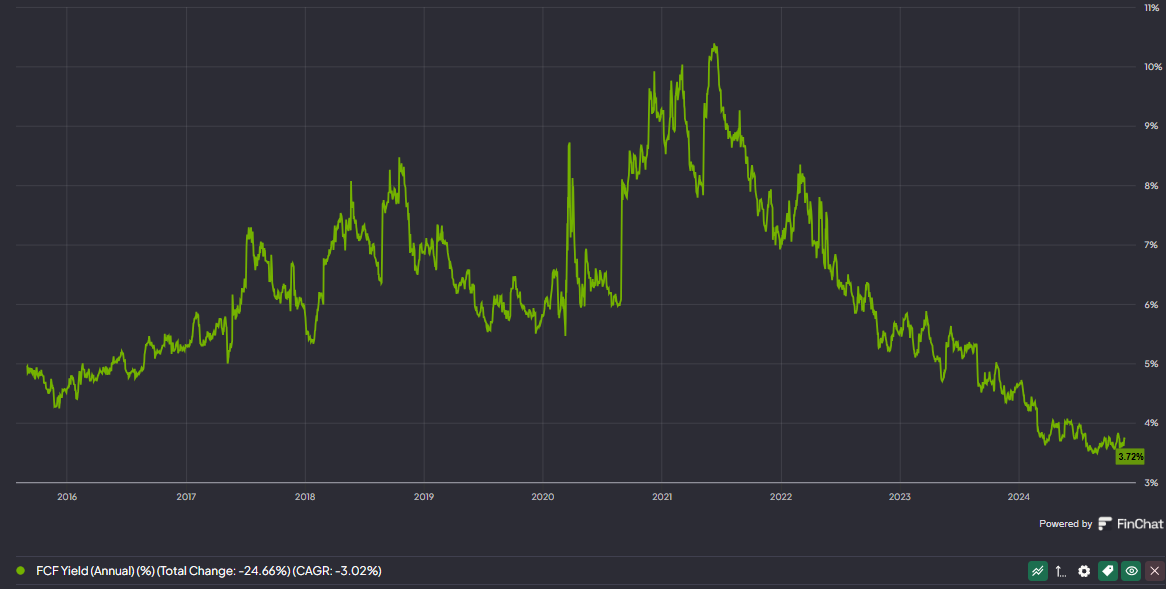

The Free cash flow yield is currently 3.72%, way lower than its median and well below its 10-year high of +10%.

Discounted cash flow analysis

Autozone has historically grown its EPS quicker than the market, indicating that they are gaining market share.

The CAGR of the market is expected to be 3.5%, but we’ll assume that Autozone can continue to take market share from other actors and grow its EPS between 5% and 12%.

Fair intrinsic value: $3183.98

Current price: $3068.69

Upside from fair value: +3.75%

Best case scenario upside: +53.6%

Conclusion

AutoZone is a fantastic business with attractive store economics. Their ability to grow faster than the market while keeping their ROIC high and costs relatively low is a testament to their strong market position and operational excellence.

The track record since inception in 1993 is great, compounding shareholders’ capital by +17.6% annually. This was achieved by growing and expanding rapidly and using excess cash to buy back shares, creating an attractive cannibal effect for shareholders.

The automotive aftermarket is currently in an uncertain phase, where the fear of EVs and lack of DIY-willing consumers create new challenges for Autozone. I want to see the management put out a clear strategy and plan on how to tackle these risks and continue to grow steadily like in previous decades. This can be done by focusing on the emerging “do it for me” segment, but there might also be other growth drivers that can counteract the emerging risks.

The valuation does not look very compelling at the current price. Autozone is trading close to its 10-year high on a PE basis and a multi-year low on an FCF yield basis. This coupled with the risks makes the current price not particularly attractive.

If we see a solid plan for future growth from the management, coupled with a lower valuation, we might revisit this great business, but currently, it is on our watchlist.

If you like our investing style, consider going premium to see our entire portfolio:

Join Invest In Quality Premium

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 250 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +10.000 stock market investors (45% open rate) — Contact us via: investinassets20@gmail.com