Constellation Software $CSU.TO

I recently started a new service for my most engaged members, check it out:

The Business Model

Constellation Software is a software juggernaut from Canada that has seen sustained and remarkable growth. CSI focuses on Vertical Market Software (VMS) businesses in the North American markets. These companies are often mission-critical to their clients and have pricing power. Great businesses that CSI can pick up at a fraction of what they can buy other companies for in the public markets.

Constellation’s business model is to acquire small and micro-cap businesses, let these companies operate as they did before (decentralized approach), and try to apply their knowledge and expertise to grow the companies organically over time.

The decentralized approach lets the companies keep their independence, identity, culture, and management team. In practice, this means that CSI can keep all the things that make the businesses they acquire great while adding value in capital allocation, operational improvements, and access to Constellation resources and expertise.

Growth Drivers

Disciplined Acquisition Strategy

Constellation relies on acquisitions of niche software businesses with strong market positions. They leverage their financial strength and operational expertise to integrate these businesses into their robust portfolio of software businesses.

CSI famously has a hurdle rate of 20%. This means that they only buy great businesses they find, that will provide an expected return of 20% annually. Mark Leonard, the CEO, is known for not wanting to budge on this hurdle rate. He believes that if they start to accept hurdle rates of 15%, it will dilute the business, and eventually end up with market average results.

Operational Excellence:

Constellation will use its know-how of best practices to streamline a company’s operations, potentially improving its margin by increasing its revenues and decreasing its overhead.

In practice, the organic growth has been limited to 3-5% per year. This is decent, but not compared to their spin-out Topicus that have known for its focus and expertise in organic growth.

Diversification and Sticky revenue

CSI has a diversified portfolio of niche software businesses, and they expand their portfolio every year by entering into new niche businesses. This creates a robust revenue stream that is likely to continue. Moreover, the revenue they earn from their subsidiaries is very sticky. Their clients often have no real alternative, or if they do, the switching costs are massive. They would rather keep the CSI business as a supplier and pay a bit more than change their entire software system.

For investors, this is very good, as it ensures that our recurring revenue comes in every month. This capital is used by Constellation’s skilled management to invest in new businesses and keep compounding the machine.

Revenue streams

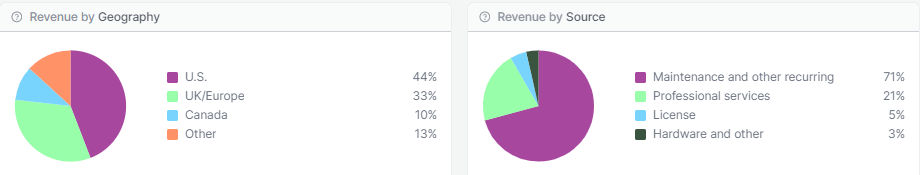

Geographic split: 44% of CSI’s revenue comes from the U.S., 33% from UK & Europe, 10% from Canada, and 13% from “other”.

Revenue Type: 71% of CSI’s revenue comes from “Maintenance & other recurring”, 21% from “Professional services”, 5% from “Licesenes”, and 3% from “Hardware & Other”.

Constellation is split into 6 operating groups:

The Fundamentals

ROCE: 24.5%

Gross Margin: 34.7%

Operating Margin: 13.6%

FCF/Net Income 5Y: 272%

Net debt / EBITDA: 1.8x

Interest coverage: 7.3x

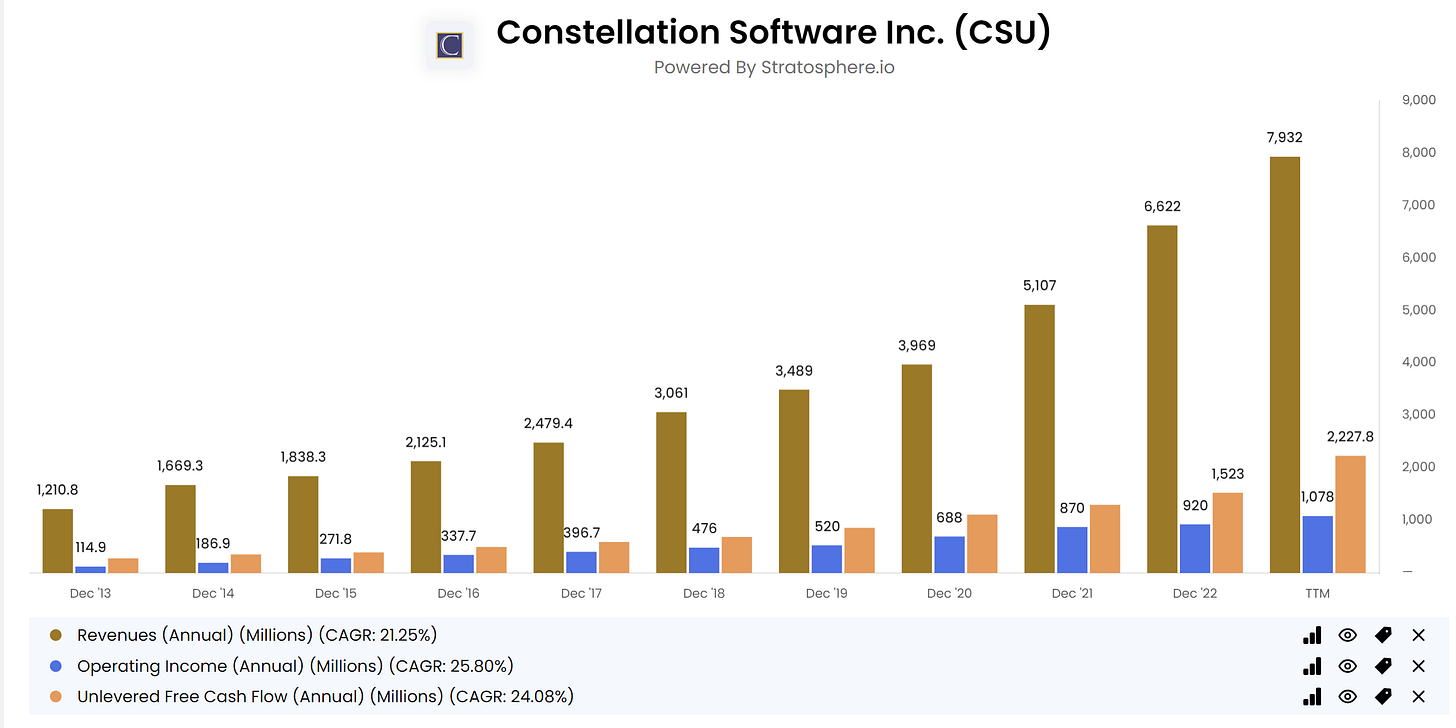

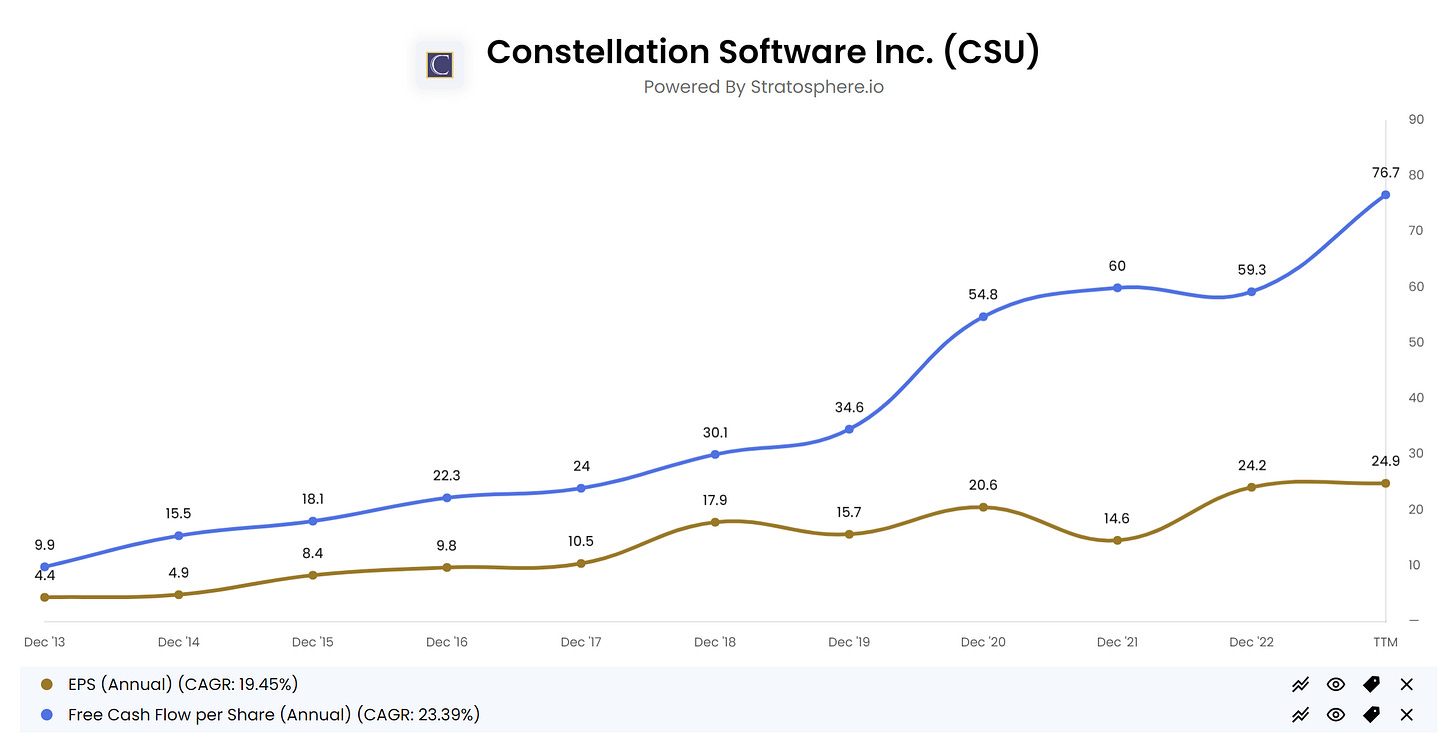

10-year CAGR growth rates

Revenues: 21.25%

Operating Income: 25.90%

Free cash flow: 24.08%

Earnings per share: 19.45%

Free cash flow per share: 23.39%

The Stock

Constellation has returned 1955.5% in the last 10 years. That is a compounded annual growth rate of 35.3%. The linearity of the stock price is incredible. The largest drawdown the stock has had is ~25% over the last decade.

Management

Mark Leonard is Constellation’s CEO and founder. Leonard founded CSI in 1995. Prior to starting CSI, Mr. Leonard worked in the venture capital business for 11 years. This is where he discovered a small niche part of the market called vertical market software. Venture capital was not particularly interested in these businesses, as they usually had limited growth potential. They were good businesses, that were available at attractive prices, but there was no way that VC was going to make these kinds of businesses the next Facebook or Uber, their “TAM” was just way too narrow.

Track record: Since CSI’s inception, the stock has compounded by 36.7%. Leonard has led the business with a focus on:

High returns on invested capital

Capital allocation

Reinvestment opportunities

Skin in the game: Mr. Leonard together with members of his family owns about 7% of the business. He no longer takes a salary for running CSI, and will only live off the proceeds of his holdings. In other words, Leonard’s incentives are 100% aligned with shareholders.

Sustainable competitive advantage

CSI’s competitive advantage lies in its acquisition strategy. By focusing on smaller niche businesses with limited growth potential, they are focusing on a part of the market that is in most cases left untouched by other players. The idea is that you need size to be able to grow, but CSI is defying that logic by keeping the businesses they buy at a small to medium range.

The decentralized business model allows the acquired business to keep its identity, culture, and management. This is often a crucial part of the businesses in the first place, and something you’d want to protect. Additionally, CSI can leverage its scale to provide resources (Capital, suppliers, tools) to the business at a cheaper cost than the business would be able to acquire itself. Finally, the acquired businesses can benefit from CSI’s know-how in running VMS businesses that they have built up over decades in the space.

Why own Constellation Software?

CSI is likely to continue its growth by acquiring VMS businesses at fair prices

High reinvestment opportunity at attractive hurdle rates

A favorable competitive edge over competitors

High returns on capital employed

Fantastic track record

An outlier founder and CEO with skin in the game (7% ownership)

Great capital allocation

The Risk

Disruption: New technology and subsidiaries in a dynamic industry.

Reinvestment opportunity: As CSI gets bigger, it might become progressively harder to find investments that will move the needle.

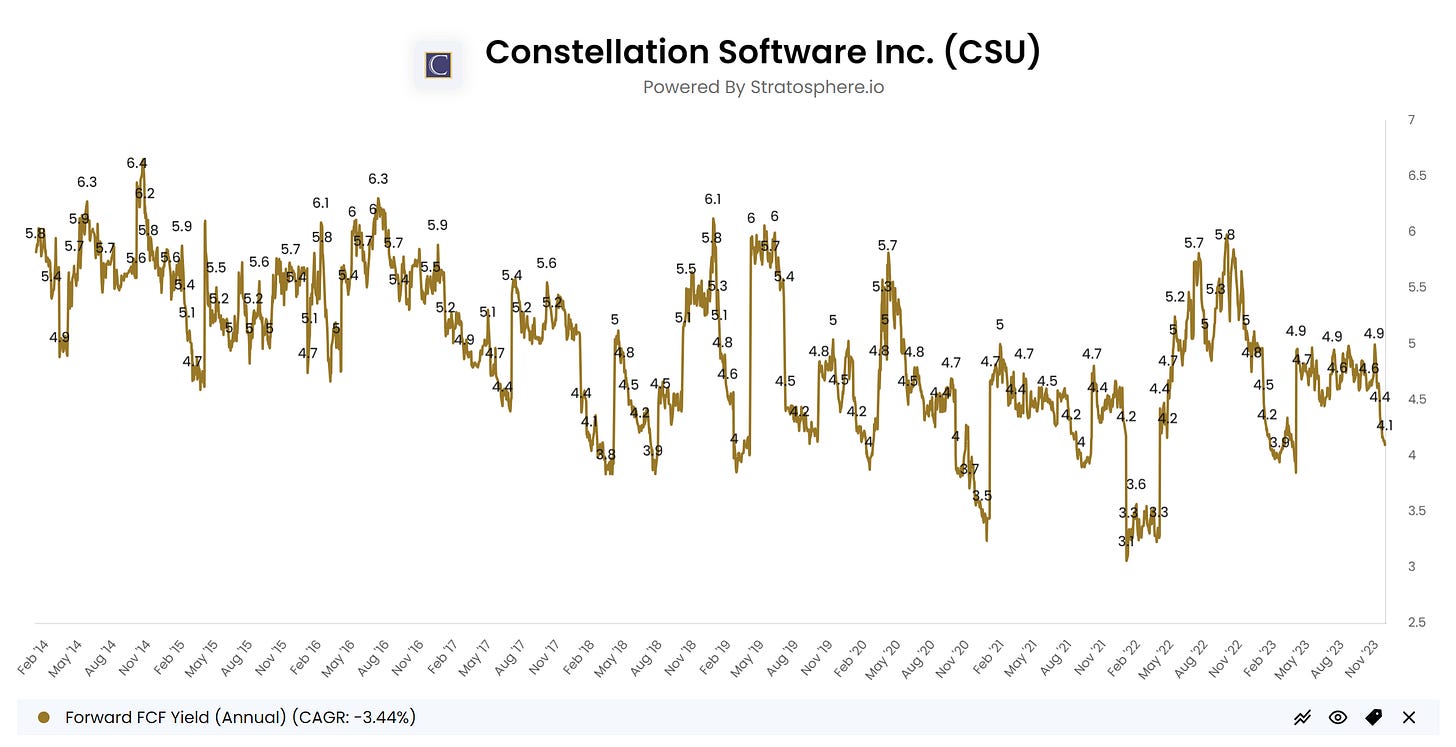

For investors, there is always the risk of paying too much, even for a great business. CSI has seen its multiples expand quite a bit over the last decade.

Valuation

Constellation Software is trading at a forward free cash flow yield of 4.1% vs. the risk-free rate of 4.4%. Historically, this yield is a bit below average:

I prefer to look at CSI’s free cash flow as opposed to net income. Earlier in this article we disclosed that the 5-year average FCF/Net income was 272%, indicating that the FCF always is much higher than the reported Net Income.

Looking at CSI’s forward PE, it has risen from ~17 to ~34 in the last 10 years. I don’t however think this is the best proxy for value in this case.

Discounted cash flow analysis

I set the following scenarios for CSI using the TTM FCF of $2.23 billion:

Worst case: 12% growth for the next 5 years, followed by 10% growth and an exit multiple of 20.

Best case: 16% growth for the next 5 years, followed by 14% growth and an exit multiple of 30.

Normal case: 14% growth for the next 5 years, followed by 12% growth and an exit multiple of 25.

The growth rates are based on what I believe the business will be able to do in the next 5-10 years. Software is becoming an essential part of the business world, and the great thing about software is that it can be used in all parts of value creation in the economy. Additionally, the exit multiples reflect the quality of the business in terms of its fundamentals, management, and competitive advantage.

CSI is currently trading at CA$67 billion. Our fair value estimate of Constellation Software is $87,44, suggesting a 30% upside in the stock. Our worst-case scenario matches the current stock price, and our best case suggests an 80% upside.

At the current market cap of CAD67 billion, I expect a ~14% annual growth from Constellation Software:

A 14% expected annual return from a great business like Constellation Software is solid. I do believe CSI still has plenty of reinvestment opportunities and room to grow.

There is much to like about CSI. For one, it is a long-term compounder with superior capital allocators at the wheel, they own a lot of stock too. When I find a business to park my capital into that is likely to perform well over the next decade, I usually take it. The alternative of moving in and out of stocks over the years is a lot of work and stress, and my thesis is that your returns are likely to be much worse if you choose a strategy like that.

Conclusion

Constellation Software is a rare business. The founder and CEO, Mark Leonard, has gradually built this software juggernaut from the ground up. His principles of investing and his letters to shareholders are an absolute gold mine of investing knowledge. I don’t think there are many CEOs in the world like Leonard. His mindset and way of thinking have set the culture in CSI, and their incentive programs reflect his values regarding having skin in the game and focusing on high-quality investments that do not dilute the business.

The business model emphasizes a decentralized approach and their acquisition strategy takes advantage of niche markets that are often overlooked by other “acquirers”. CSI unlocks synergies and provides “best practices” to the businesses they acquire without ruining the culture of the business.

Finally, the business is not cheap, but a forward FCF close to the risk-free rate suggests that you can get a fast-growing software conglomerate at a fair price.

Whenever you are ready, this is how I can help you:

Essentials of Quality Growth — Join more than 200 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

Promote yourself to +5,000 stock market investors (48% open rate) — Contact us via: investinassets20@gmail.com

great coverage, great business quality, thank you!

Hi, can you explain your rationale why would you assign a higher terminal multiple for CSU (25x normal case) than FTNT (20x)? Just wondering since FTNT it's a higher grower business. Thanks again.