🌯 Chipotle’s 43% Selloff – A Rare Chance for Long-Term Investors?

Flat comps, cost inflation, and consumer pullback spooked investors — but brand strength and unit growth could turn this dip into opportunity.

Hi there, investor 👋

In this article, we’re looking at Chipotle Mexican Grill (CMG 0.00%↑) and whether or not the large sell-off is a potential opportunity, or a warning sign of what’s to come.

Chipotle Mexican Grill: Sell-Off Signals 📉

Chipotle’s stock is down -43% from its all-time high levels this year amid multiple headwinds. The sell-off is driven by slowing transaction traffic, disappointing comps, rising costs, and macro pressures. Let’s unpack what’s going on — and whether the current downdraft looks like an overreaction (or a warning sign).

What’s Dragged the Stock Down

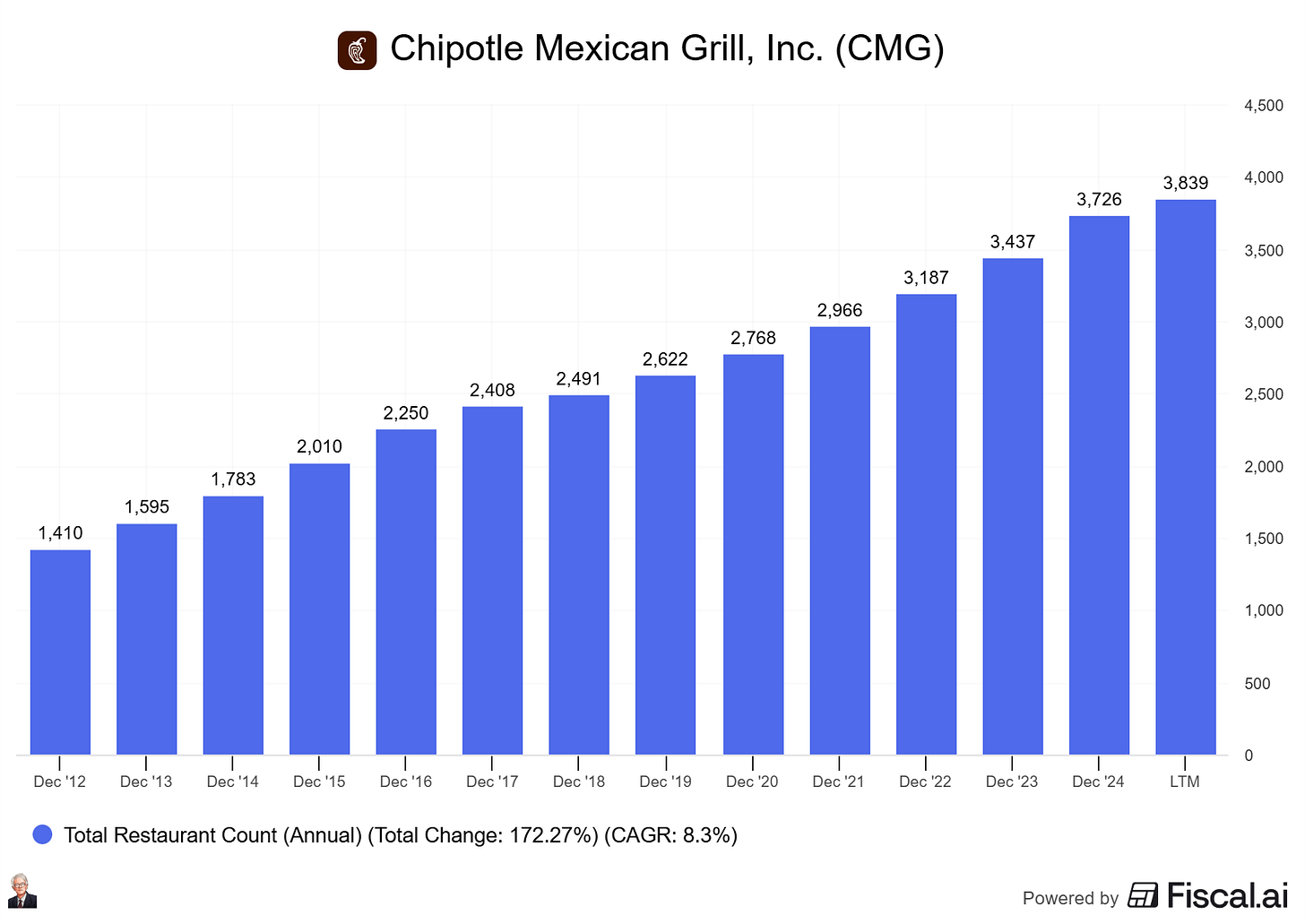

Flat to Negative Same-Store Sales & Weak Transaction Growth

In the most recent quarter, Chipotle reported a decline in comparable-restaurant sales: about –4% YoY. Transactions are down, partially offset by price increases, but customers are trending down and visiting less often.Guidance Reset & Cooling Expectations

Before the sell-off, Chipotle had guided to low single-digit comps growth. Now the outlook has been revised to about flat same-store sales for the year. That drop in expectations has hurt sentiment.Cost Pressures: Food, Labor & Tariffs

Inflation remains sticky. Food costs—especially for proteins, avocados, etc.—plus labor costs, are squeezing margin. Add potential tariff risks, and margins look even more fragile. Some relief from equipment efficiencies may be coming, but the cost burden is increasing.Consumer Behavior & Macro Uncertainty

Rising prices, inflation, and weaker consumer confidence are pushing more customers to hold back on dining out or trade down to lower-cost alternatives. Fast-casual is feeling this as households prioritize essentials.

Is the Reaction Overdone? 🤔

There’s a strong case that the market may be pricing in too much downside, though not all risk is without reason. What supports the “overdone” thesis:

Chipotle remains a powerful brand with strong loyalty (an NPS score of 17 according to Comparably), good unit economics, and a track record of operational execution. Even in soft quarters, their initiatives in digital, rewards, equipment upgrades, and innovative menus are not trivial.

The fall in valuation multiples partly reflects perimeter shifts in investor risk appetite rather than solely fundamental deterioration. Premium valuations tend to get compressed when growth slows, even by a little.

That said, the negative comps, cost pressures, and changing consumer dynamics are present. There's no denying that some of the optimism investors had baked in (steady traffic growth, margin expansion) will be delayed or made more difficult.

So — yes, likely some overreaction, but not across the board. The risk is that if comps decline further or costs accelerate suddenly, earnings could disappoint.

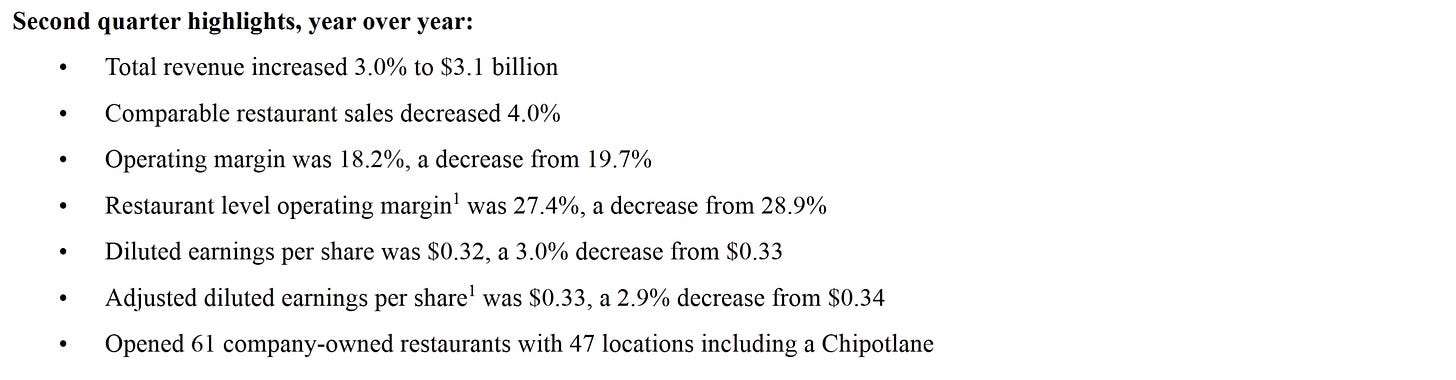

Let’s look at the historical valuation 👇

Chipotle’s forward PE is at a multi-year low of 29.85x.

This is still a premium multiple, but in the historical context for CMG, it is low.

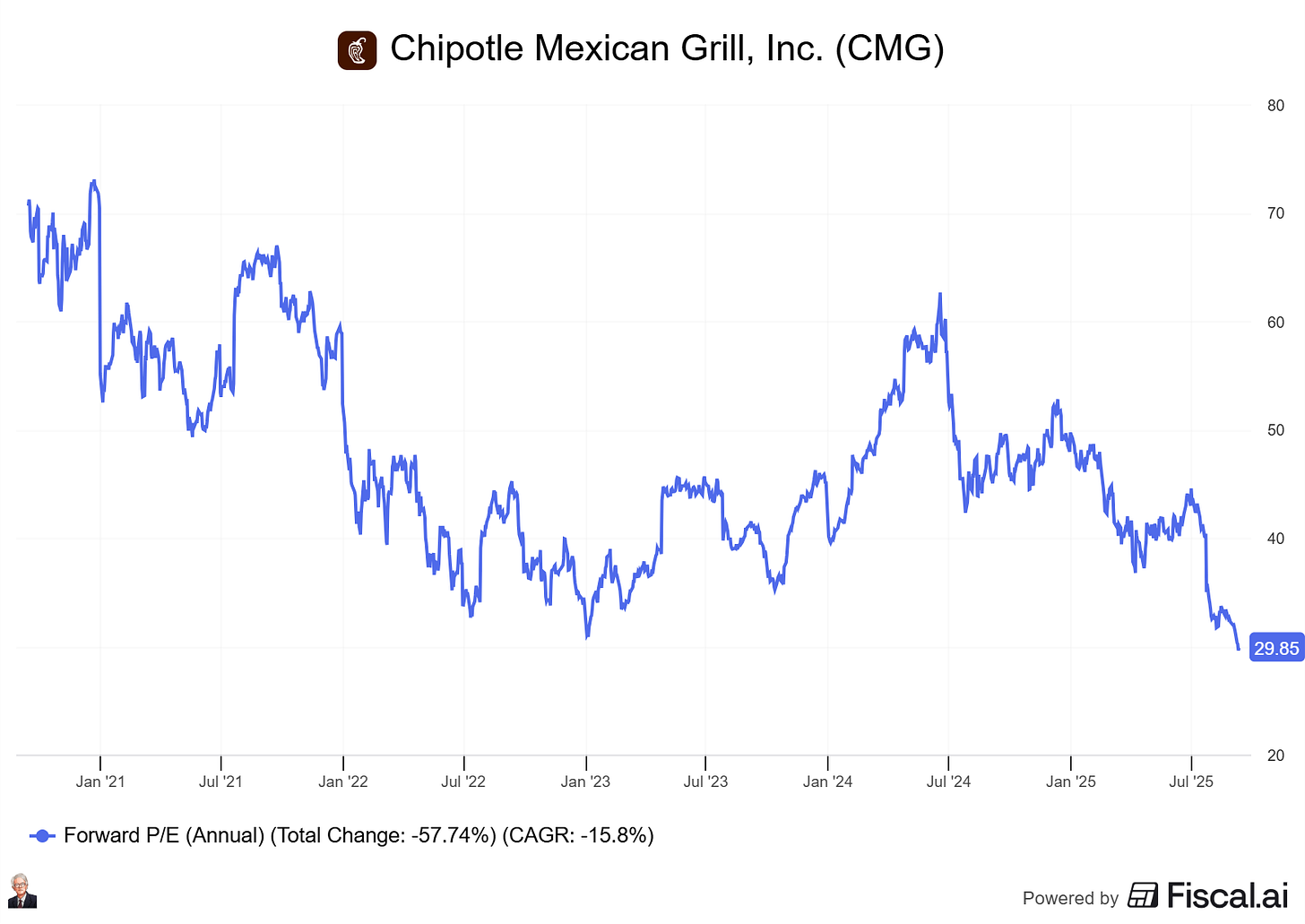

Forward Free Cash Flow yield is also on the rise, reaching 2.75%.

From a historical multiple perspective, CMG appears to be trading at a low valuation.

Growth Drivers & Silver Linings 📈

Even in the downturn, there are positive signals and potential levers Chipotle can pull.

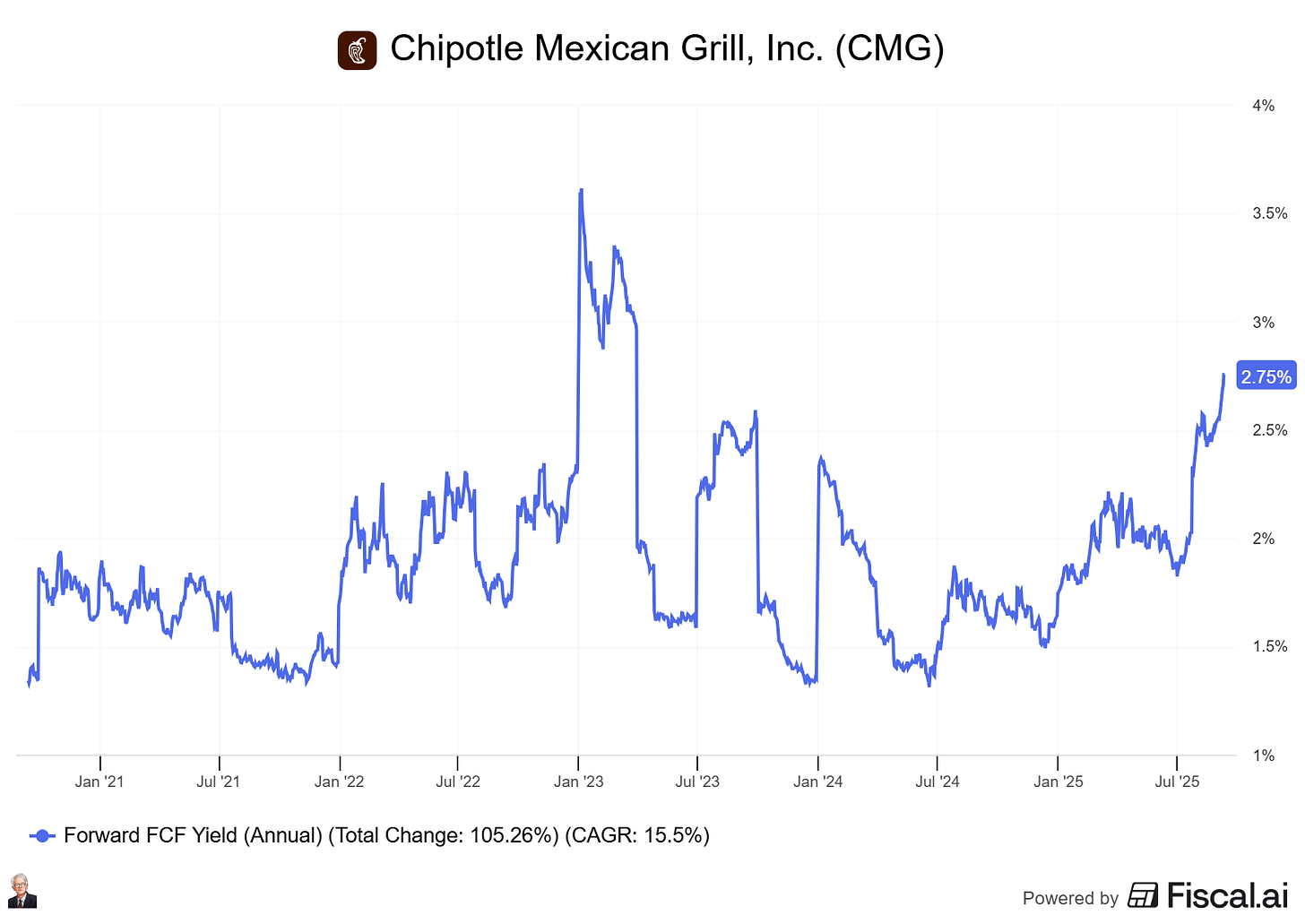

Strong Unit Growth & Store Expansion

Chipotle continues to open new restaurants; new store growth remains a key driver. They also lean into the Chipotlane (drive-thru + pickup) format, which helps with throughput and off-peak sales.Digital, Loyalty & Menu Innovation

Digital sales are a meaningful part of revenue (Chipotle has invested heavily here). Enhancements to loyalty programs, new campaign/dip/menu item launches (e.g., Honey Chicken, Adobo Ranch, etc.) are meant to drive transaction count and bring customers back.Operational Efficiency Gains

Investments in back-of-house technology, upgrades, and better equipment are intended to improve throughput, reduce waste, and control costs. These are the less flashy but potentially durable margin levers.International Expansion

While U.S. remains core, Chipotle plans international partnerships and increasing presence abroad. Also, room to expand in less saturated U.S. locations. Global expansion offers upside (though execution risk).

Competition, Positioning & Competitive Advantages 🏰

Brand Strength & Premium Positioning

Chipotle has carved a niche as somewhat more premium fast-casual: fresh ingredients, customization, food with “integrity.” Many customers are willing to pay more, which gives the company price flexibility. That said, when cost pressures rise, premium positioning becomes harder to defend.

And with strong competitors like Chick-fil-A, In-and-Out Burger, and McDonald’s that score higher on a Net-Promoter-Score and Customer loyalty basis compared to Chipotle.

Digital and Loyalty Tools

Chipotle has been ahead of many peers with strong digital ordering, rewards/loyalty programs. These help with retention, repeat business, and margin (digital orders tend to command higher costs but also can generate more frequent transactions).

Unit Economics & Expansion Format

The Chipotlane / pickup / drive format offers tools to increase throughput, reduce wait times, and improve customer convenience. This can be a competitive edge in markets with traffic or convenience expectations. Also, its store model tends to yield strong returns on investment when new stores are well-placed.

But Pressure from Value Competitors

Where Chipotle’s advantage is premium fast-casual, competitors in fast food, or even lower-priced fast casual, are stepping up promotions, value deals. When consumers get squeezed, they tend to trade down, which erodes traffic for premium casual chains. Also, rising food/labor costs hit all, but lower-cost competitors have more flexibility sometimes.

Valuation: Justified Premium? ⚖️

We’ve already looked at the multiples of Chipotle, and both forward PE and FCF yield look attractive compared to the historical averages.

Now let’s set up a simple discounted cash flow analysis.

This is the growth consensus from analysts:

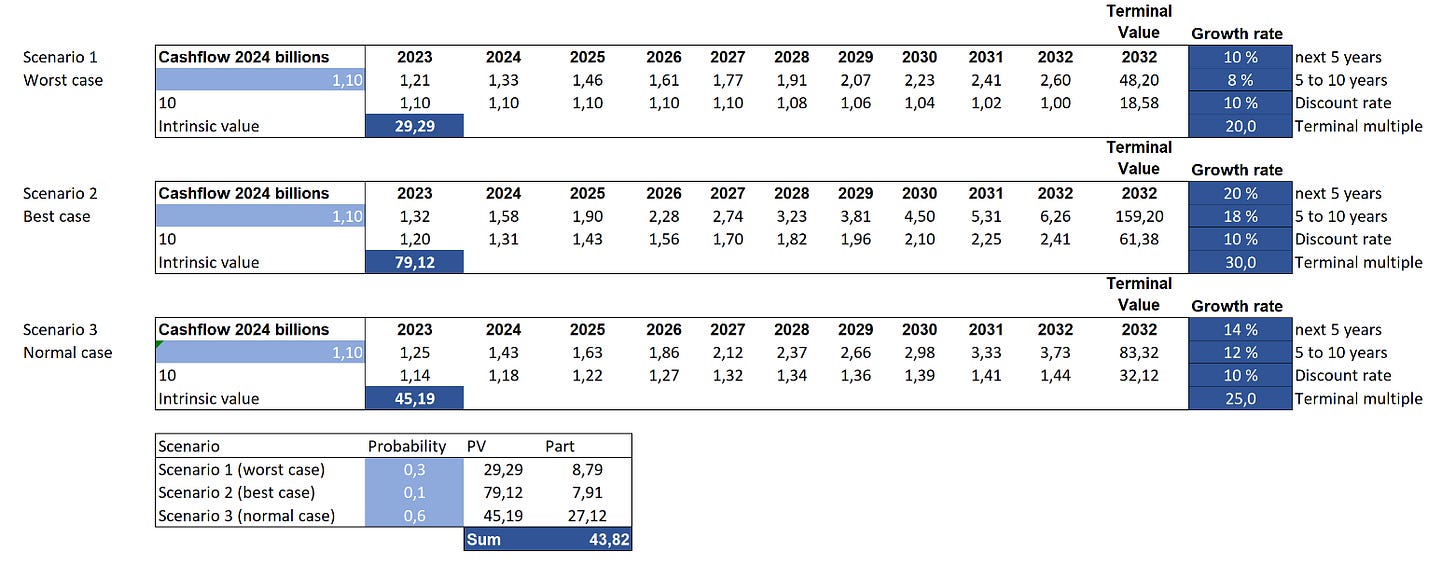

3 scenarios:

Worst case: 10% growth in the next 5 years, followed by 8% EPS growth, valued at 20x earnings by the end of the period.

Best case: 20% growth in the next 5 years, followed by 18% EPS growth, valued at 30x earnings by the end of the period.

Base case: 14% growth in the next 5 years, followed by 12% EPS growth, valued at 25x earnings by the end of the period.

Current price: $38.96

Fair value: $43.82

Suggested upside: 12.47%

Base case CAGR expectation: 12%

The best-case scenario assumes reacceleration—traffic needs to stabilize, comps need to rebound, cost inflation is controlled, and new initiatives (menu, loyalty, digital) must deliver. If any of these falter, the downside becomes apparent.

Margin of Safety Seems Narrow

At today’s price, there is less room for error. If cost pressures intensify or traffic remains weak, earnings can underperform, and the stock could fall further. On the other hand, upside is meaningful if recent negatives are transitory.

Bottom Line: Where Things Stand

Risk vs Reward: Significant risks exist—flat comps, price sensitivity among consumers, cost inflation. But Chipotle also has many levers to manage that: brand power, unit expansion, digital/loyalty, and convenience formats.

Is the sell-off overdone? In part, yes: the market seems to have over-priced in a worst-case scenario. Some of the recent negatives are cyclic or macro-driven (i.e. inflation, consumer pull-back) rather than company mismanagement.

Valuation seems high, but maybe more reasonable now: the premium multiples seem more vulnerable, but if Chipotle can show a trajectory back toward positive comps or stabilize traffic, the current valuation may be justifiable.

Chipotle is not a screaming buy, but a further decline can provide a good opportunity to enter a strong business with a long runway for growth.

Ready to take the next step? Here’s how I can help you grow your investing journey:

Go Premium — Unlock exclusive content and follow our market-beating Quality Growth portfolio. Learn more here.

Essentials of Quality Growth — Join over 300 investors who have built winning portfolios with this step-by-step guide to identifying top-quality compounders. Get the guide.

Free Valuation Cheat Sheet — Discover a simple, reliable way to value businesses and set your margin of safety. Download now.

Free Guide: How to Identify a Compounder — Learn the key traits of companies worth holding for the long term. Access it here.

Free Guide: How to Analyze Financial Statements — Master reading balance sheets, income statements, and cash flows. Start learning.

Get Featured — Promote yourself to over 15,000 active stock market investors with a 42% open rate. Reach out: investinassets20@gmail.com

CMG was long overvalued. Now it’s coming back to a more reasonable valuation.

I love how simple their menu is

And people say the food is crazy overpriced…

I’m not so sure about that compared to everything else in the fast casual dining world