💎Stop Copying other Investors Blindly

The Importance of Individual Thought in Investing

Hi there, investor 👋

Warren Buffett has stated on multiple occasions the importance of individual thought. If you get caught up in what the street tells you, you will be sucked into the herd. You might sound smart and be respected in your circle, but your results are likely to be average at best.

Buffett emphasizes independent thinking, long-term focus, and discipline in investing, rejecting market fads and external opinions.

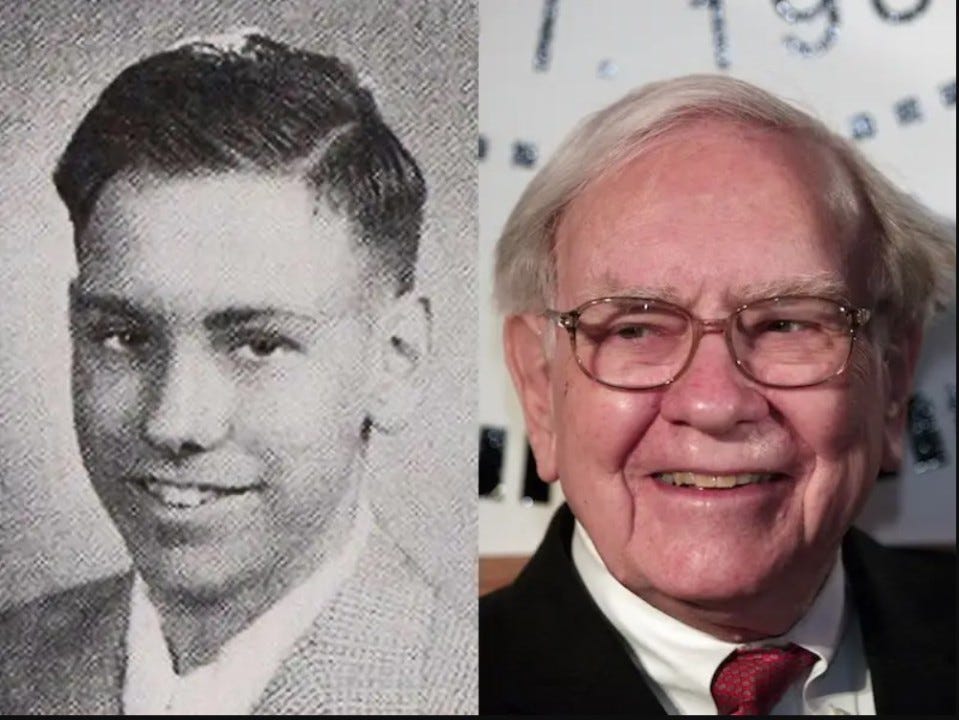

Buffett’s Early Life & Career

Buffett started his compounding at the age of 13 years when he earned money on paper rounds.

In 1956, Buffett formed Buffett Partnership Ltd. with $105.000. The structure was that he only took profits of 25% made above an annual return of 6%.

Berkshire Hathaway was a failed business that Buffett bought. This became his infamous holding company and investment vehicle that would compound Buffett to +$150 billion in 2025.

Pioneering the Decentralized Model

Buffett empowered managers to run their own show. He strongly believed in the entrepreneurial spirit of the businesses he owned (Often founder- or family-owned).

Buffett’s entrepreneurial genius landed him in the position of owning Berkshire Hathaway. Instead of believing he would make smarter decisions than the managers of the businesses he owned, he would let them continue to make mistakes and push the business forward.

There are plenty of famous examples, such as Nebraska Furniture Mart, Borsheims, and See’s Candies, that exemplify Berkshire’s focus on strong local leadership, integrity, and simplicity.

Why following the crowd rarely leads to superior results

What has defined Warren Buffett as an investor since the very start is his ability to think for himself.

His investments have been far from the standard “fund manager” favorite stocks. He is not swayed by analysts’ up- or downgrades. Buffett's view on being as far away from Wall Street as possible to be an edge and not a disadvantage.

Buffett once said:

“You can’t get rich if you need a consensus to act.”

While others looked for confirmation from other fund managers, Buffett looked for mispriced assets. He didn’t care whether Wall Street agreed, only whether the math did.

This mindset allowed him to buy American Express after the “Salad Oil Scandal,” the Washington Post during a crisis, and Apple when most thought it was a washed-up hardware company.

Independent thinking doesn’t mean being contrarian for the sake of it. It means being willing to be contrarian when the facts demand it.

Thinking in probabilities, not headlines

Buffett’s independence comes from a rational framework, not emotion.

“You are neither right nor wrong because the crowd disagrees with you. You are right because your facts and reasoning are right.”

This is the essence of investing: to have a rational judgement under uncertain circumstances. Buffett's mind operates with odds and numbers, not opinions or newsletter headlines. And he is willing to take massive action based on his own rationality, without the support of others. This is a superpower in investing and one of the key factors to Buffett’s success.

Detaching from the Collective Thought Bubble

Buffett has always spent the majority of his time reading, thinking, and waiting for the fat pitch to get across his desk.

He avoids falling into the collective thought bubble of Wall Street or thinking like the sheep herd does when it comes to stocks and businesses.

You can’t be independent if you’re always plugged into the herd.

As he puts it:

“The stock market is there to serve you, not instruct you.”

From time to time, Mr. Market will offer you an opportunity so compelling that you should act decisively. But you will only see these opportunities if you I) have the skills to identify what others can’t, and II) detach yourself from the collective fear and emotion and only look at the rationality in the investment case.

Warren Buffett and Charlie Munger share a great trait in any entrepreneur, investor, or business leader: A clear and rational mind.

5 Lessons on How to Become an Independent Thinker