🏰Google: Full-Stack AI & New Valuation

Google stock has almost doubled since its April lows 💎

Hi partner 👋

In this article, we’re breaking down Alphabet’s most recent earnings report and putting together a valuation model for the business.

Let’s get into it 👇

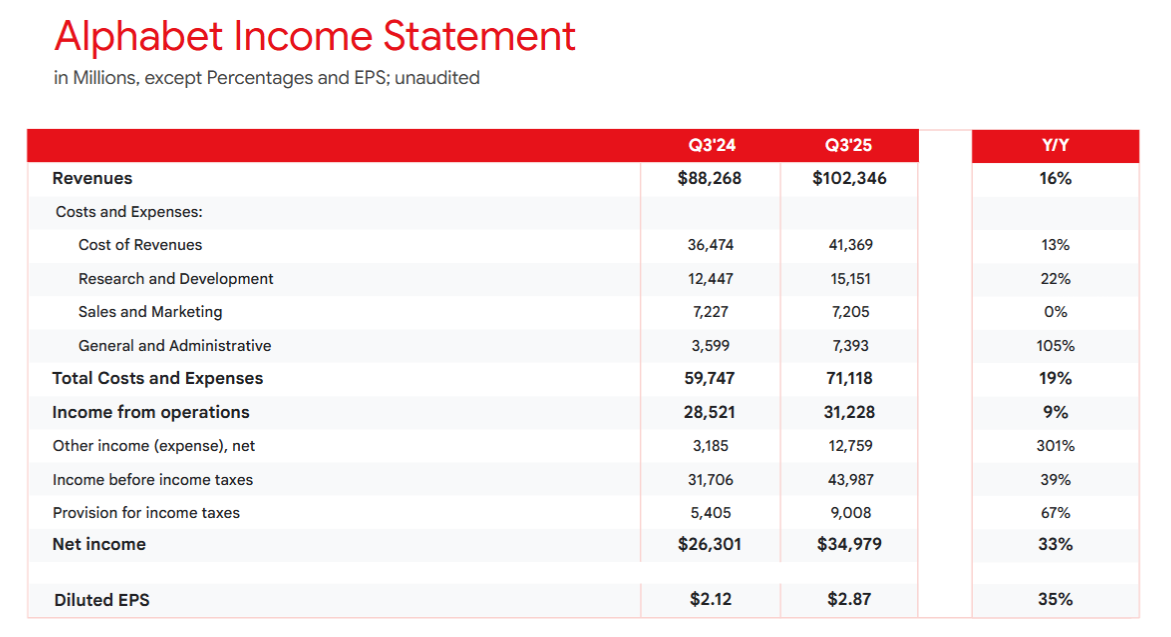

Alphabet Crosses $100 Billion for the First Time

Alphabet just posted its first-ever quarter above $100 billion in revenue, up 16% year-over-year to $102.3 billion.

Operating income came in at $31.2 billion (or $34.7 billion excluding the European Commission fine), while EPS rose 35% to $2.87.

Free cash flow reached $24.5 billion, and CFO Anat Ashkenazi raised 2025 CapEx plans to $91–93 billion, up from $85 billion previously, reflecting AI infrastructure demand.

Two dynamics are shaping the story for Alphabet’s next decade:

Search and YouTube are compounding again, driven by AI-powered experiences that increase engagement.

Google Cloud has entered a new phase: scaling enterprise AI with expanding margins and record backlog.

Search, YouTube & Subscriptions

Google Services revenue grew 14% to $87.1 billion, with Search up 15%, YouTube up 15%, and subscription revenue up 21%.

Even after absorbing a $3.5 billion regulatory charge, operating margins remained strong; excluding it, operating margins were nearly 34%.

CEO Sundar Pichai put it simply during the call:

“We delivered our first-ever $100 billion quarter. AI now drives real results across the company.”

The key insight this quarter is that AI isn’t eroding search; it’s expanding it.

The rollout of AI Overviews and AI Mode is producing more queries and deeper engagement. Management said monetization of AI-enhanced results is roughly in line with traditional formats, a strong sign that the ad model remains intact.

AI Mode is now available in 40 languages, with 75 million daily active users, and Alphabet says early engagement metrics are “encouraging.”

At the same time, YouTube continues to fire on both cylinders: ads and subscriptions. Direct-response advertising, Shorts engagement, and connected-TV viewing are all accelerating. Subscription growth across YouTube Premium, YouTube TV, and Google One provides a stable, recurring cash flow that cushions the heavy CapEx cycle ahead.

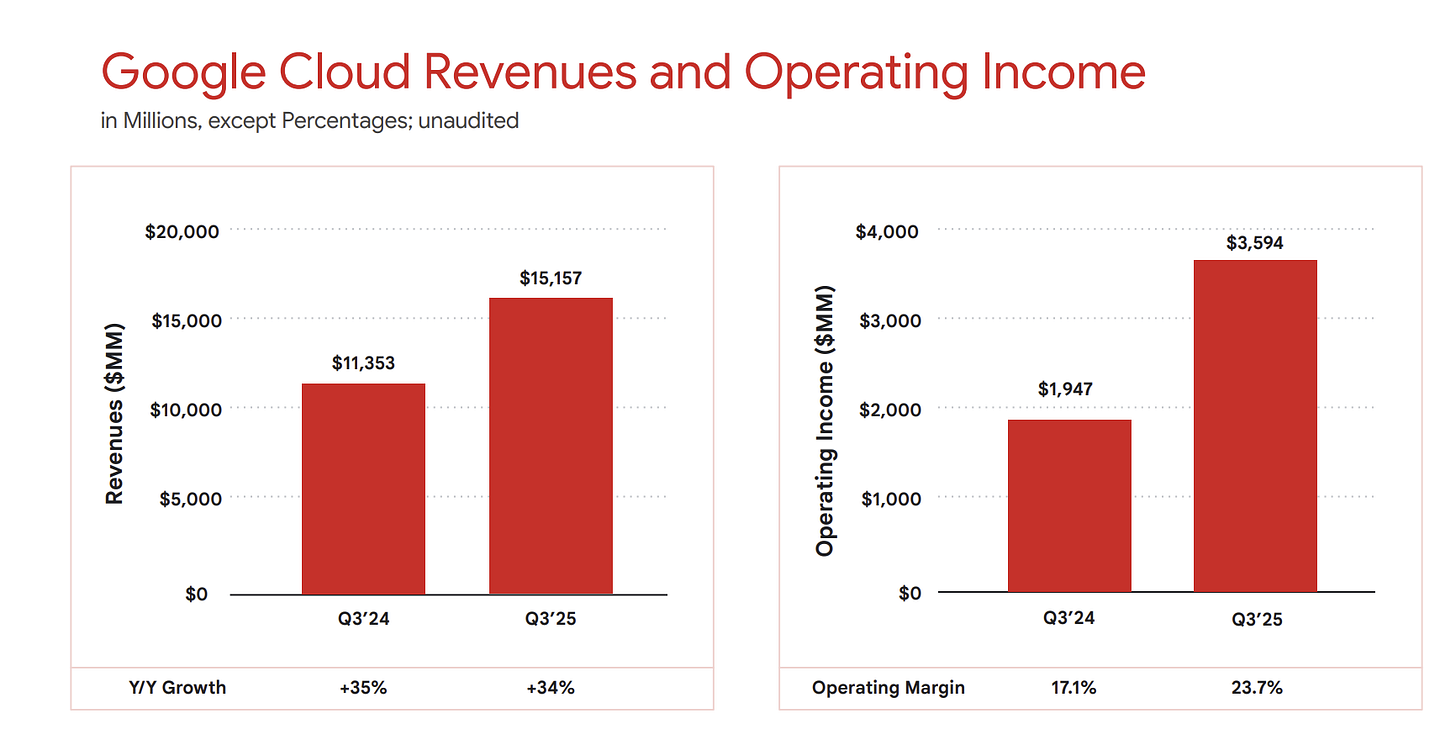

Google Cloud: Enterprise AI at Scale

Search is Alphabet’s cash-generating machine, Cloud is the growth engine.

Revenue rose 34% to $15.2 billion, with operating income jumping to $3.6 billion (+84.6%) and margins improving from 17% to 23.7%.

The Cloud backlog surged to $155 billion, up 82% year-over-year, as more customers signed multi-year AI infrastructure and software deals.

Pichai told investors:

“We’ve signed more billion-dollar Cloud deals this year than in the last two years combined. Demand for our AI stack is extraordinary.”

The value proposition is clear: a full-stack AI platform that combines Alphabet’s TPU chips, Gemini foundation models, Vertex AI, and Gemini for Workspace into a single ecosystem. Generative-AI product revenue has grown more than 200% year-on-year, and over 70% of Cloud customers now use Google AI tools.

What Could Drive the Next Leg

Search surfaces monetize better. Alphabet is creating new ad inventory through richer, AI-driven query formats. Early data shows billions of net-new searches and a rapidly growing advertiser base.

Cloud AI mix shift. Enterprise AI workloads are scaling rapidly, and the shift toward higher-margin software and security services is boosting profitability.

Subscription expansion. With over 300 million paid subscribers, Alphabet now has a recurring-revenue base that stabilizes cash flow across cycles.

Risks to Watch

Capital intensity. 2025 CapEx is expected to reach up to $93 billion and rise again in 2026, meaning depreciation will weigh on margins in the short term.

Regulatory and legal risk. Fines and ongoing investigations remain a distraction and could affect reported results.

Changing search behavior. If AI-driven results shift user behavior faster than ad formats evolve, revenue per query could decline temporarily. Alphabet says current monetization trends are holding steady but acknowledges the transition risk.

Supply constraints. Management expects AI infrastructure to remain supply-tight through 2026, which could limit near-term growth.

The rest of the article is for Premium subscribers. Read more about the service here.

Updated Valuation for Alphabet