I’m creating a digital course for investors, I would love your feedback on what subjects you want me to cover, be kind and take the survey (Less than 2m): Click here

As a thank you, here is a free Guide on how to Read & Analyze the financial statements: Click here

Boring is beautiful.

We want businesses in boring, unexciting, and unsexy industries that are less likely to gain the attention of Wall Street & investors like Jim Cramer.

Why?

Well, several reasons:

Better valuations (Less hype premium)

Lower levels of competition

Long-term stable & consistent

If you want excitement, you should go play poker or blackjack. But for investing, you want it to be boring, consistent, and uneventful.

A bonus to these kinds of businesses is that it is easier to stay invested, as they keep on compounding the intrinsic value per share. You are less likely to fall victim to psychological biases that plague investors (insert bias article).

Without further ado:

6 Boring Quality Businesses 📊

Pool Corp.

Danaher Corp

Mettler Toledo

Terravest industries

Waste Management

Alimentation Couche Tard

Boring is subjective, but these stocks are unlikely to be featured on CNN as "hot". Let's take a look:

Pool Corporation POOL 0.00%↑

Pool Corp distributes swimming pool supplies and related products. It sells national-brand and private-label products to approximately 120000 customers. The products include pool-maintenance products, like chemicals and replacement parts, as well as pool equipment, like packaged pools (kits to build swimming pools), cleaners, filters, heaters, pumps, and lights. Customers include pool builders and remodelers, independent retail stores, and pool repair and service companies.

Financial Rundown:

This article is sponsored by the Premium newsletter.

Upgrade today, and get:

💎Full access to my quality growth portfolio where I invest 80% of my net worth

📈Monthly factsheets of the portfolio, performance, buys, and sells.

🎯Notification in advance, or the same day I buy or sell a position.

🧾Upcoming courses on financial statement analysis and valuations

🏰All my research (Investable universe, ranking, valuations, quality)

👑Weekly breakdowns of quality compounders and valuations

🤵Access to me: I will be available to answer all the questions and concerns my paid subscribers might have about investing

The newsletter is currently priced at $12 per month or $100 per year.

The price will increase to $25 per month & $200 per year on March 1.

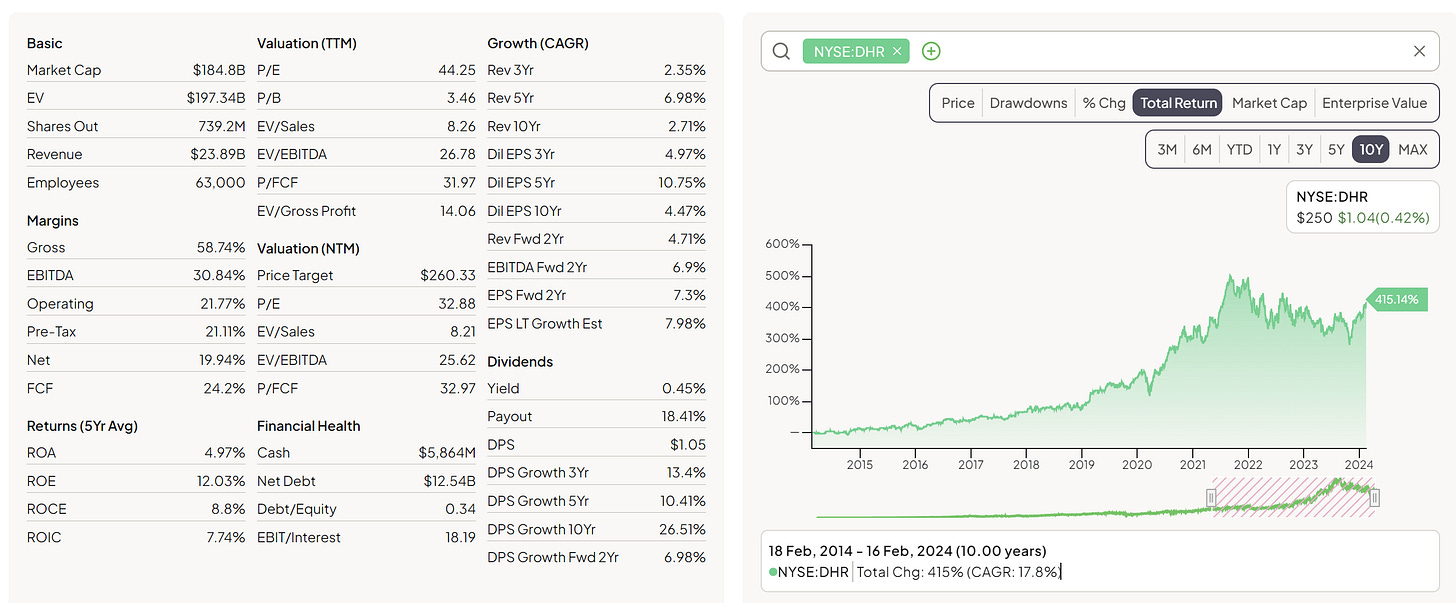

Danaher Corp DHR 0.00%↑

Danaher Corp Danaher is a multinational conglomerate with headquarters in the US. The company operates in various sectors, including life sciences, diagnostics, dental, and environmental and applied solutions.

Danaher is known for its portfolio of high-quality, precision instruments and technologies that enable scientific research, medical diagnostics, and industrial processes.

Financial Rundown:

Mettler Toledo MTD 0.00%↑

Mettler Toledo is a leading global manufacturer of precision instruments and services.

The company focuses on the development and production of weighing scales, analytical instruments, and process analytics equipment.

Mettler Toledo's products are used in laboratories, industrial manufacturing, and retail applications, providing accurate measurements and ensuring compliance with quality and regulatory standards.

Financial Rundown

Terravest Industries $TVK.TO

Terravest is a Canadian investment firm that specializes in alternative asset management.

The company focuses on acquiring and managing strategic businesses in sectors such as energy services, waste management, and natural gas.

Terravest Capital aims to generate long-term value for its investors by identifying and nurturing companies with strong growth potential and sustainable business models.

Financial Rundown

Waste Management WM 0.00%↑

Waste Management is a prominent waste management and environmental services company based in the US. The company offers comprehensive waste collection, recycling, and disposal solutions for residential, commercial, and industrial customers.

Waste Management is committed to sustainability and environmental stewardship, working towards reducing waste and promoting recycling and renewable energy initiatives. Their services contribute to the efficient and responsible management of waste materials.

Financial Rundown

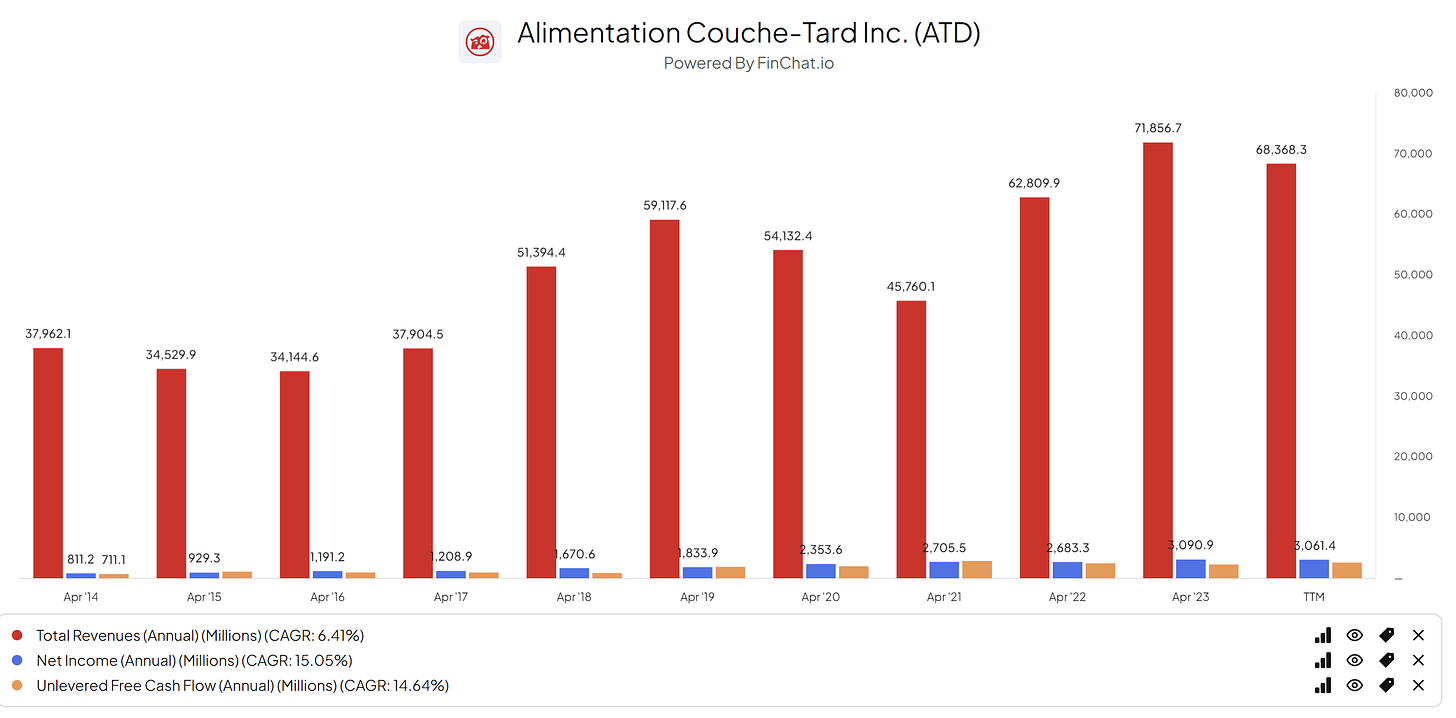

Alimentation Couche-Tard $ATD.TO

Alimentation Couche-Tard is a Canadian convenience store and fuel retailer with a global presence. The company operates a vast network of convenience stores under various brands, including Circle K and Mac's.

Couche-Tard focuses on providing customers with a wide range of products and services, including fuel, snacks, beverages, and other convenience items. Their strategic acquisitions and operational expertise have contributed to the company's growth and market expansion.

Financial Rundown

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio - Read more here.

Essentials of Quality Growth — Join +250 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

Promote yourself to +6,000 stock market investors (46% open rate) — Contact us via: investinassets20@gmail.com

Simple, boring, consistent.

Formula to be successful in the markets.

All just incredible compounders. They're companies I'd feel confident parking a lot of money and trusting it grows steadily over the next decade (outperforming the index).