5 Wide Moat Businesses 🏰

And how to analyze a moat 🧠

Hi there investor! 👋

In this article, you will learn how to analyze a competitive advantage (moat) by using the Morningstar framework.

The Data on Competitive Advantages

Before we get into the framework, let’s take a look at the data supporting competitive advantages being important:

Morningstar’s Wide Moat Focus Index has performed well versus the S&P 500 since its inception in 2007:

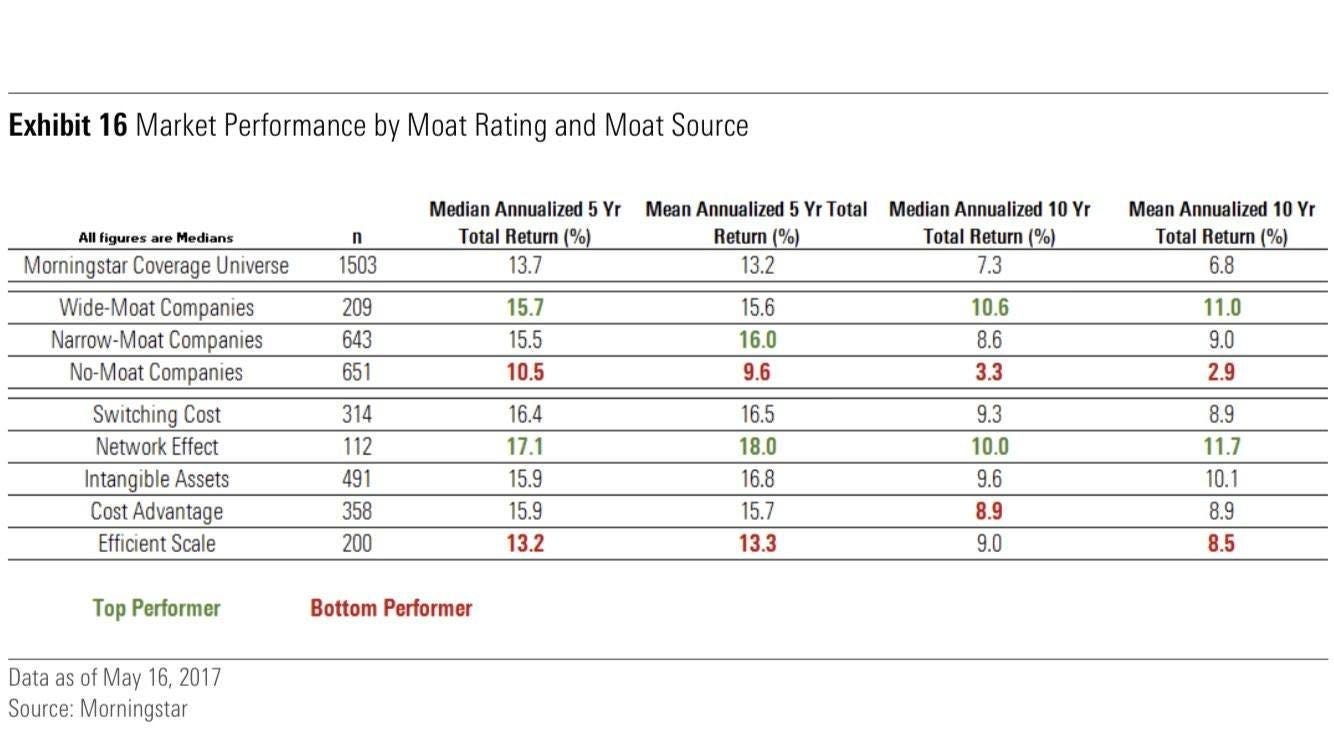

Morningstar’s research suggests that the median annualized 10-year total return is:

+10.6% for wide moat businesses

+8.6% for narrow moat businesses

+3.3% for no moat businesses

A key characteristic of a quality business is that there is an economic moat that protects the above-average return from competitors.

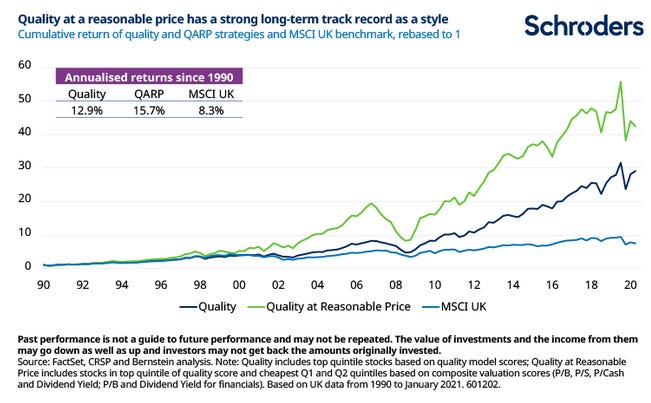

Data from Schroders suggest that Quality and Quality at a reasonable price outperform the Index (MSCI UK) over 30 years.

Assumption: Most of the quality companies in the study have a wide or narrow moat

The Morningstar framework

The framework is built on 5 “moat sources”:

Intangible assets (Coca-Cola)

Switching Costs (Oracle)

Network Effects (CME Group)

Cost Advantages (UPS)

Efficient Scale (Kinder Morgan)

Intangible Assets

One of the strongest moat sources in the framework.

Intangible assets include brand value, patents, and licenses. These are by definition hard/impossible to replicate.

Imagine trying to compete with Coca-Cola. Coca-Cola has built its brand over millennia. This value is hard to value, but it the brand value makes consumers pick their products over other soft drinks.

Examples: Johnson & Johnson, Unilever, Sanofi, Coca-Cola.

Switching Costs

Another strong moat source happens when the expected value of switching to another vendor is lower than the perceived costs of making the change.

Companies that deliver software to a business often have switching costs moat. The software might not be fantastic, but it gets the job done, and the business is busy with more important projects than changing the ERP system for example.

Example: Intuitive Surgical, ADP, Oracle.

Network Effects

The strongest moat source occurs when the value of the product or service increases as more customers join.

For example, the more customers that shop on Amazon, the more companies want to sell their products on Amazon. And the more products Amazon has, the more customers want to join as the number of products increases.

Examples: Mastercard, eBay, Meta Platforms, CME Group.

Cost Advantage

Cost advantage is the second lowest-performing moat source and occurs when businesses have a structural advantage that allows them to produce their products at a lower cost than their competitors.

The moat source is not the strongest, but the sustainability of the moat can be held for longer than other sources.

Examples: Amazon, Abinbev, Novo Nordisk, Shell.

Efficient Scale

Generally, the lowest-performing moat source occurs when a market is limited in size, and the participants efficiently meet the market demand.

Incumbents generate economic profits.

Examples: UPS, National Grid, Carnival

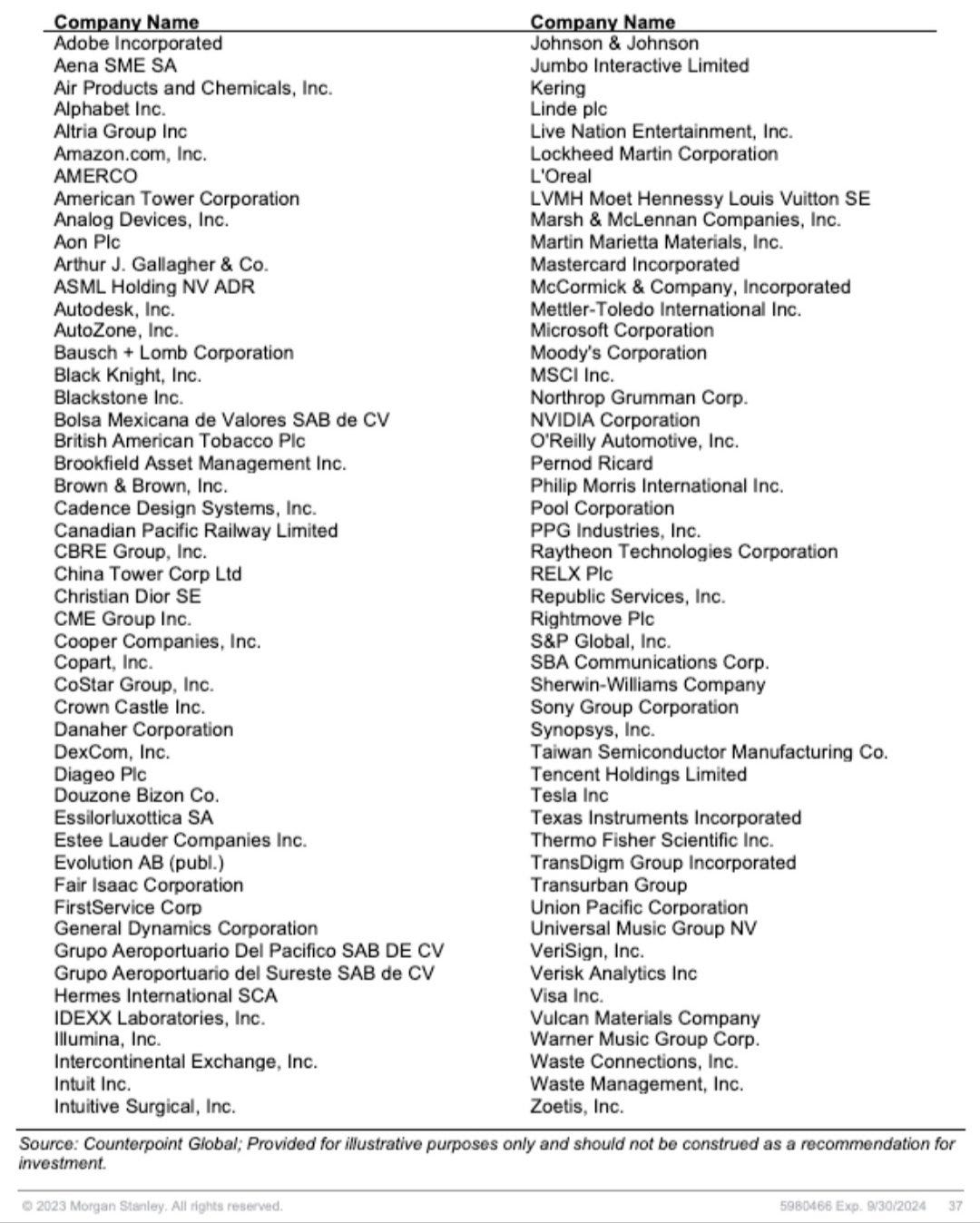

Counterpoint Global’s wide moat list

A list of companies with competitive advantages:

Want to see our market-beating Quality Growth Portfolio focused on wide-moat businesses?

Get access to premium content and notifications when we make moves in the market.

Join us now to receive our Top 10 Buys 2024 report.

Our 5 favorites from the list:

Amazon AMZN 0.00%↑

Alphabet GOOGL 0.00%↑

ASML ASML 0.00%↑

Evolution AB $EVVTY

LVMH $LVMHF

Read our other article on wide moat businesses:

That’s it for today! If you enjoyed it, please leave a like and a comment!

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 300 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +10.000 stock market investors (45% open rate) — Contact us via: investinassets20@gmail.com

Good 101 breakdown. But moats aren’t static — regulators, tech shifts, or new competitors can tear them down quick. That’s the part investors miss.

The Buffett-Munger Profitability_And_Assets_Productivity_Investing Truism Dharma 168:

CompROA Ratio and FPR

i.

CompROA Ratio (Competitive Return On Asset Ratio, by ATC)

= ∛(Revenue × Gross Profit × Net Profit) ÷ Total Assets

FPR (Finance Pressure Ratio, by ATC)

= Total Assets ÷ ∛(Revenue × Gross Profit × Net Profit)

= Inverse of CompROA

= 1 ÷ CompROA

ii.

If CompROA Ratio ≤ 0.2109 or FPR ≥ 4.743

= It implies Weak Competitive Advantage with Weak Profitability & High Finance Pressure

= Not a Compounder

iii.

If CompROA Ratio ≥ 0.4217 or FPR ≤ 2.371

= It implies Strong Competitive Advantage with Strong Profitability & Low Finance Pressure

= Poised to be a Multi-bagger Compounder, the magnitude depends on the synergy between the ROIC & Gnp

= Having a long compounding runway time horizon

Reference:

Profitability_And_Assets_Productivity_Investing Truism Dharma 162