Hi investor! 👋🏻

In this article, we will share 5 different quality stock screens and their top results so you can get new ideas to research.

Screeners are a great way to find new ideas that match quality criteria such as a high return on invested capital, growth in revenue, earnings, free cash flow, and solidity.

The screening tool used is called Stockopeida.

Try it 14 days for free and get 30% off your subscription by using our link:

Let’s get into it 👇🏻

Quality at a reasonable price

Criteria:

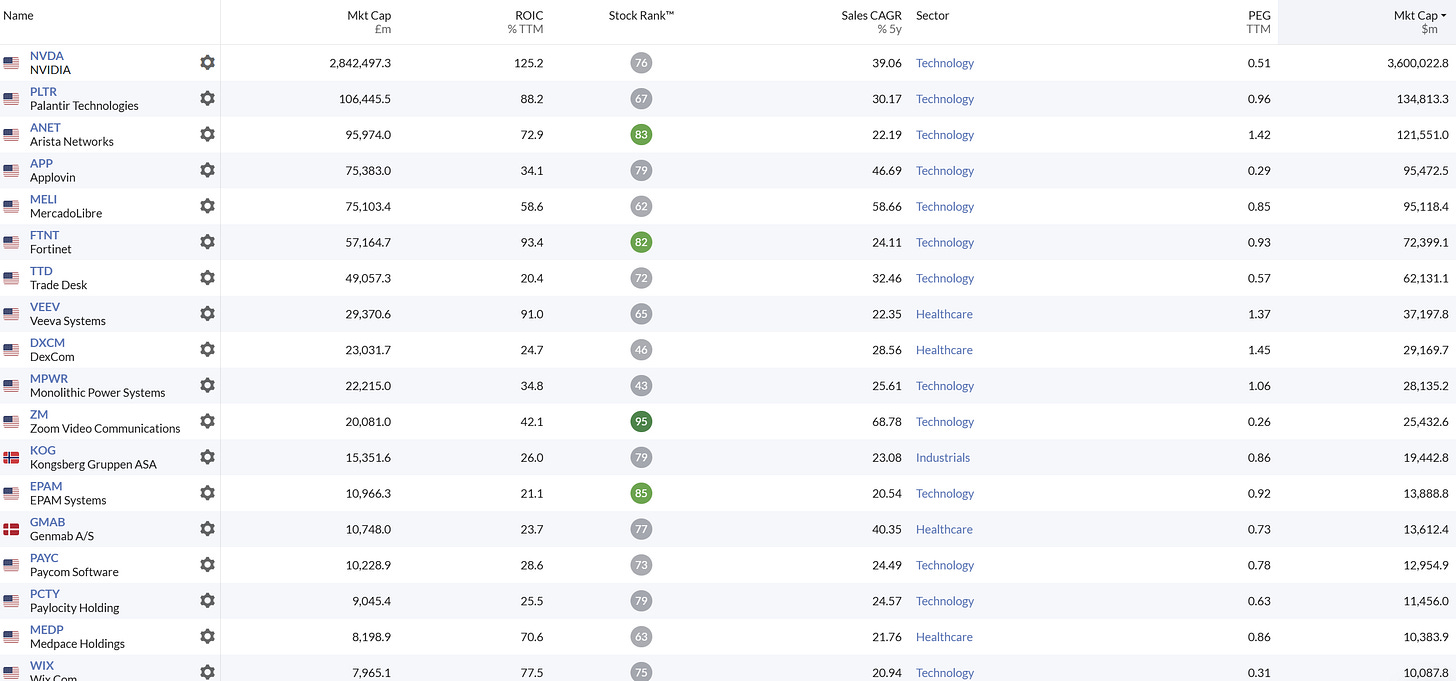

Top results (Sorted by Market Capitalization):

Quality growth

Criteria:

Top results (Sorted by Market Capitalization):

Terry Smith

Criteria:

Top results (Sorted by Market Capitalization):

Peter Lynch

Criteria:

Top results (Sorted by Market Capitalization):

Fast growing quality

Criteria:

Top results (Sorted by Market Capitalization):

These screeners were made with Stockopedia.

You can try Stockopedia for 14 days for free by clicking here.

If you like it, you will get a 30% discount on your subscription (Only available in November).

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 300 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +15.000 stock market investors (42% open rate) — Contact us via: investinassets20@gmail.com

Your pricing is ridiculously high. Here is one of my finviz screeners. For FREE!

https://finviz.com/screener.ashx?v=111&f=cap_small,fa_eps5years_o5,fa_epsyoy_pos,fa_epsyoy1_pos,fa_netmargin_o15,fa_opermargin_o15,fa_roa_o20,fa_roe_o15,fa_roi_o20,fa_sales5years_o5,ipodate_more5&ft=4