🏰5 Quality Buys September

🧠 5 Quality Growth businesses trading at fair valuations

Hi partner! 👋🏻

Welcome to the September edition of Top 5 Buys ✅

You can access our Top 15 Buys for 2025 list as a premium member here.

In this article, we will discuss our top stock picks for September 2025.

Let’s get into it 👇

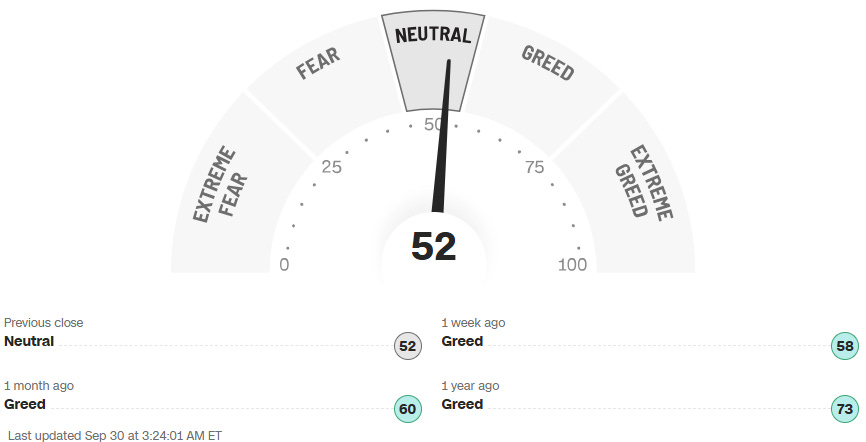

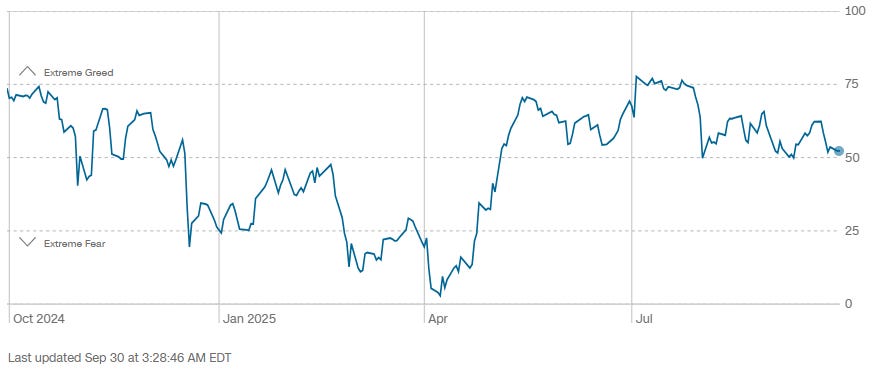

The Market Sentiment: Neutral

After a brief detour into Extreme Fear back in April, the pendulum has now swung the other way and settled right in the middle.

Investor sentiment has cooled from Greed to Neutral. That means the market is no longer euphoric, but also not panicking. The market is cautious.

The S&P 500, while still near all-time highs, is showing signs of consolidation. We’re trading above long-term moving averages, but momentum has slowed.

Those who acted when fear peaked in April have already been rewarded, but now the question is whether Neutral sentiment leads to another leg higher or a leg down.

I can’t predict the future, but I can point to 5 quality growth businesses that continue to compound regardless of market mood.

Here are this month’s Top 5 Buys 👇

Disclaimer: This is not investment advice. Always conduct your due diligence and make your own investment decisions.

Top 5 Quality Buys September 2025 🚀

#1 🧌 Games Workshop: Global IP Powerhouse

Games Workshop ($GAW.L) is the market leader in tabletop miniature wargaming, anchored by the Warhammer universes and a religious fanbase.

What started as a mail-order hobby shop in the 1970s is now a £3.5B+ market cap company that has compounded at ~22% CAGR in shareholder returns since IPO (1994) — turning $10,000 into more than $4.450.000.

This isn’t just a niche hobby. It’s a vertically integrated, IP-driven machine with one of the strongest moats in consumer entertainment.

The Model: Vertical Control + Hobby Lock-In

Unlike most consumer companies, Games Workshop controls nearly every layer of the value chain:

Lore creation → Warhammer and Warhammer 40,000 universes (since 1980s)

Miniature design & manufacturing → All produced in-house in Nottingham, UK

Distribution & sales → 500+ branded stores + direct-to-consumer e-commerce

Licensing → Expanding into video games, books, TV, and film

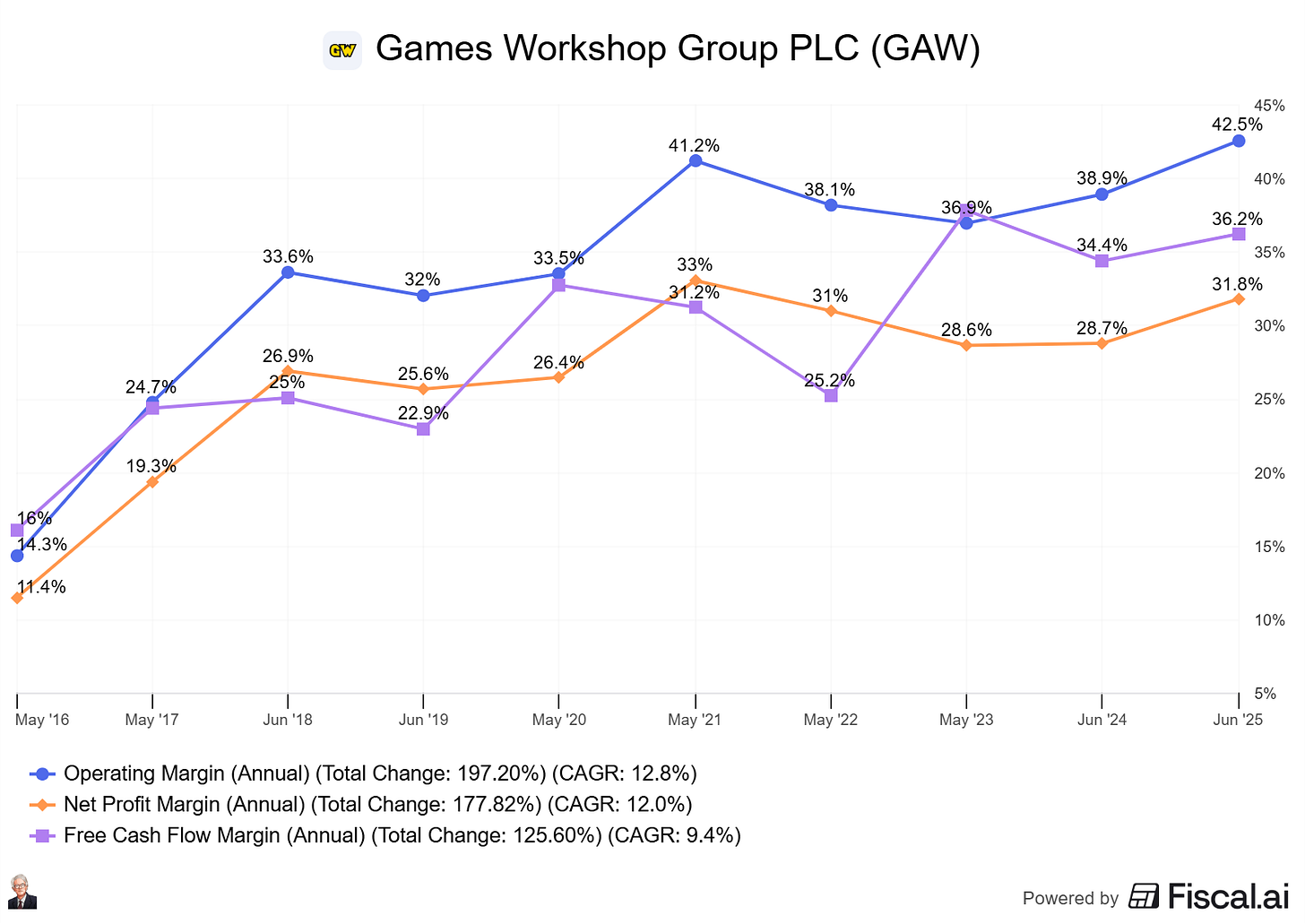

The result? Massive margin expansion over the last decade, with gross margins of +72% and net margins of ~31%, and operating margins of +36%. These are luxury goods economics, not retail.

Once a player buys in, miniatures, paints, rulebooks, lore — the switching costs are enormous. Armies take months (sometimes years) to build, painting is highly personalized, and the lore is deeply immersive. Competitors barely exist at scale.

Growth Drivers

Global fanbase expansion

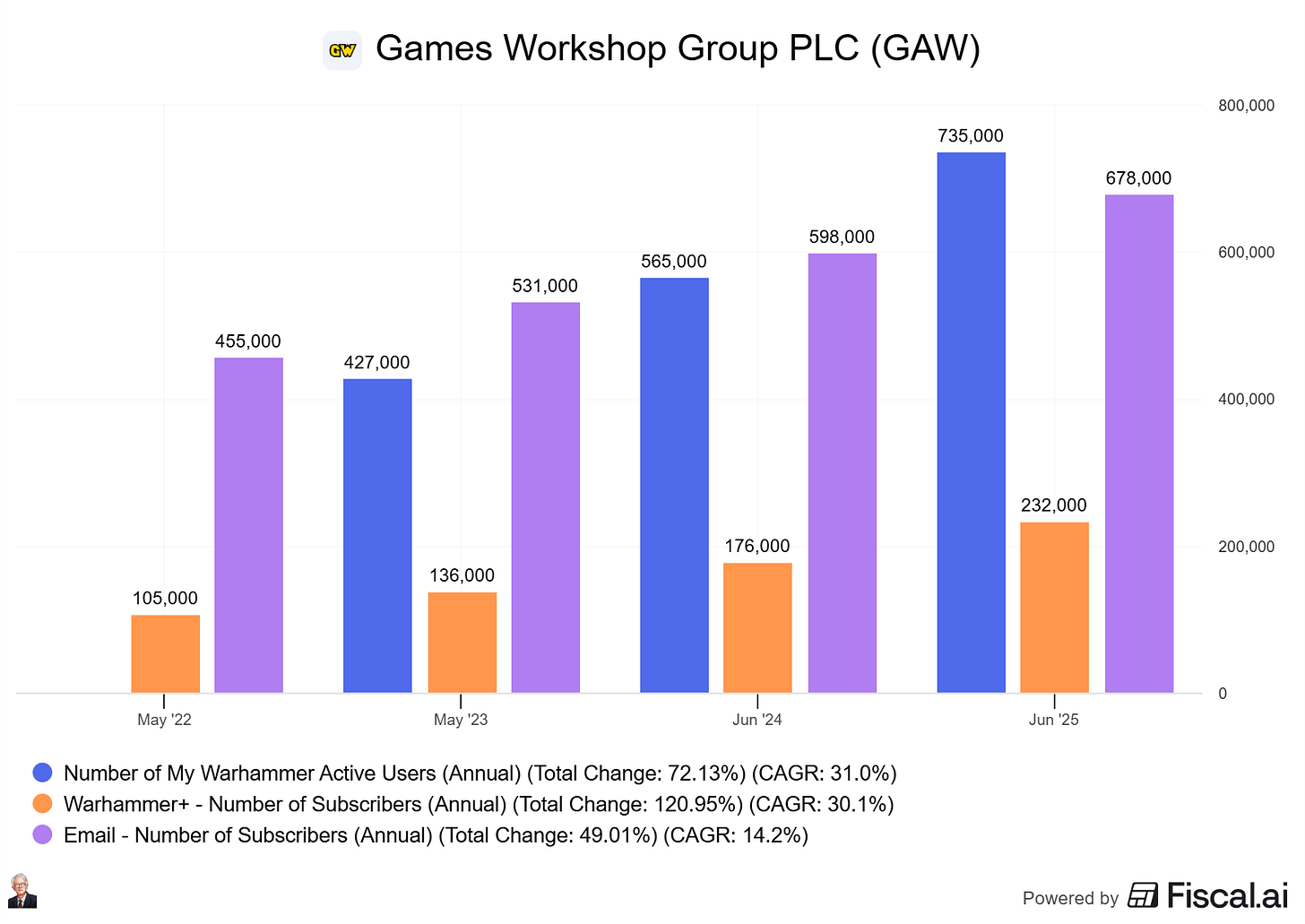

Warhammer 40k and Age of Sigmar are growing among younger demographics, accelerated by YouTube creators, Twitch, and TikTok hobby culture. The growth is clearly reflected in My Warhammer, Warhammer+, and Email subscriber KPI data:

Licensing flywheel

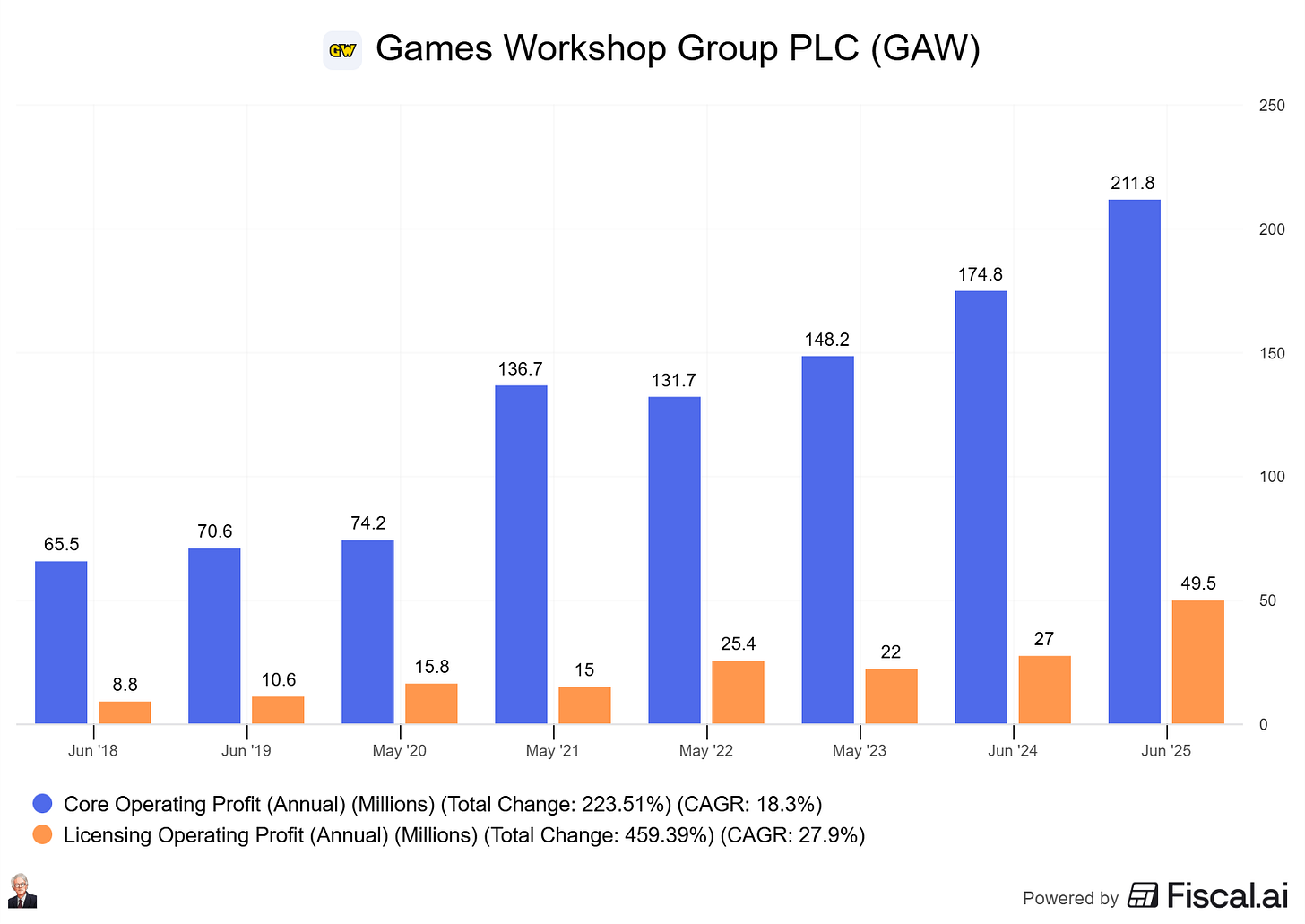

Licensing is still <5% of revenue, but high-margin and growing. The Amazon deal (Henry Cavill producing a Warhammer series) and major video game launches (Space Marine 2 in Sept 2024) could be breakout catalysts. Licensing is becoming a major part of GMW’s operating profit:

Premium direct-to-consumer economics

Retail stores aren’t optimized for profit per square foot — they’re customer acquisition hubs. A single staffer runs painting demos, game nights, and initiations into the hobby. It’s not retail, it’s community building.

Manufacturing scale

Continuous investment in Nottingham facilities ensures control over quality, capacity, and margins. This is a critical edge when global supply chains are shaky.

The result?

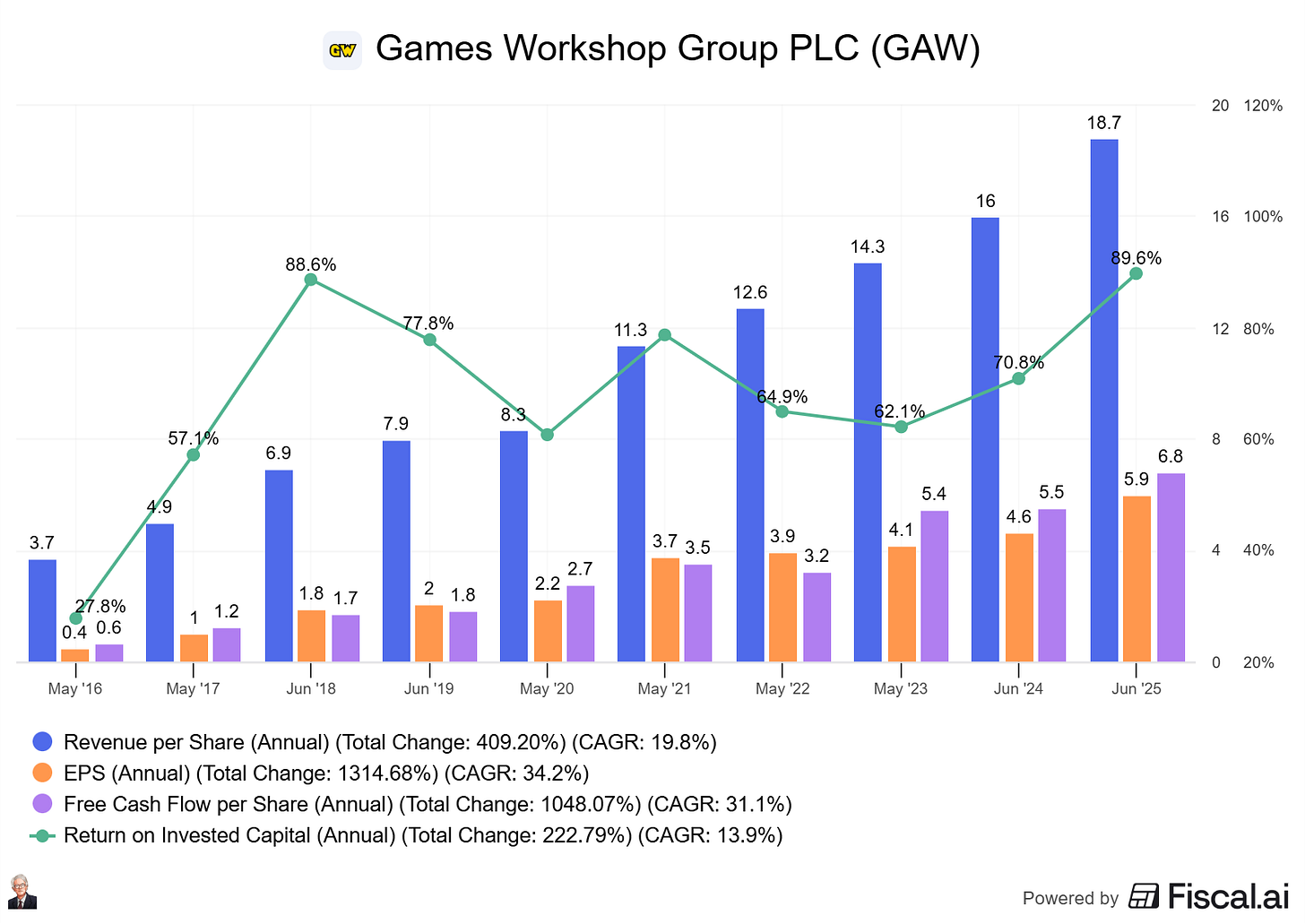

Premium growth in revenue, cash flows, and returns on invested capital of +60%.

Key Initiatives

Disciplined capital allocation: Selective new store openings, prioritizing DTC over wholesale to preserve margins.

Licensing growth: TV and film projects could move Warhammer into mainstream culture (the “Marvel moment”).

Digital & subscriptions: Warhammer+ streaming, lore archives, and tutorials deepen engagement and add recurring revenue streams.

The Numbers

Rev growth (2Y fwd): ~10–12%

EBITDA growth (2Y fwd): ~14%

EPS growth (2Y fwd): ~15%

LT EPS CAGR est.: ~13–15%

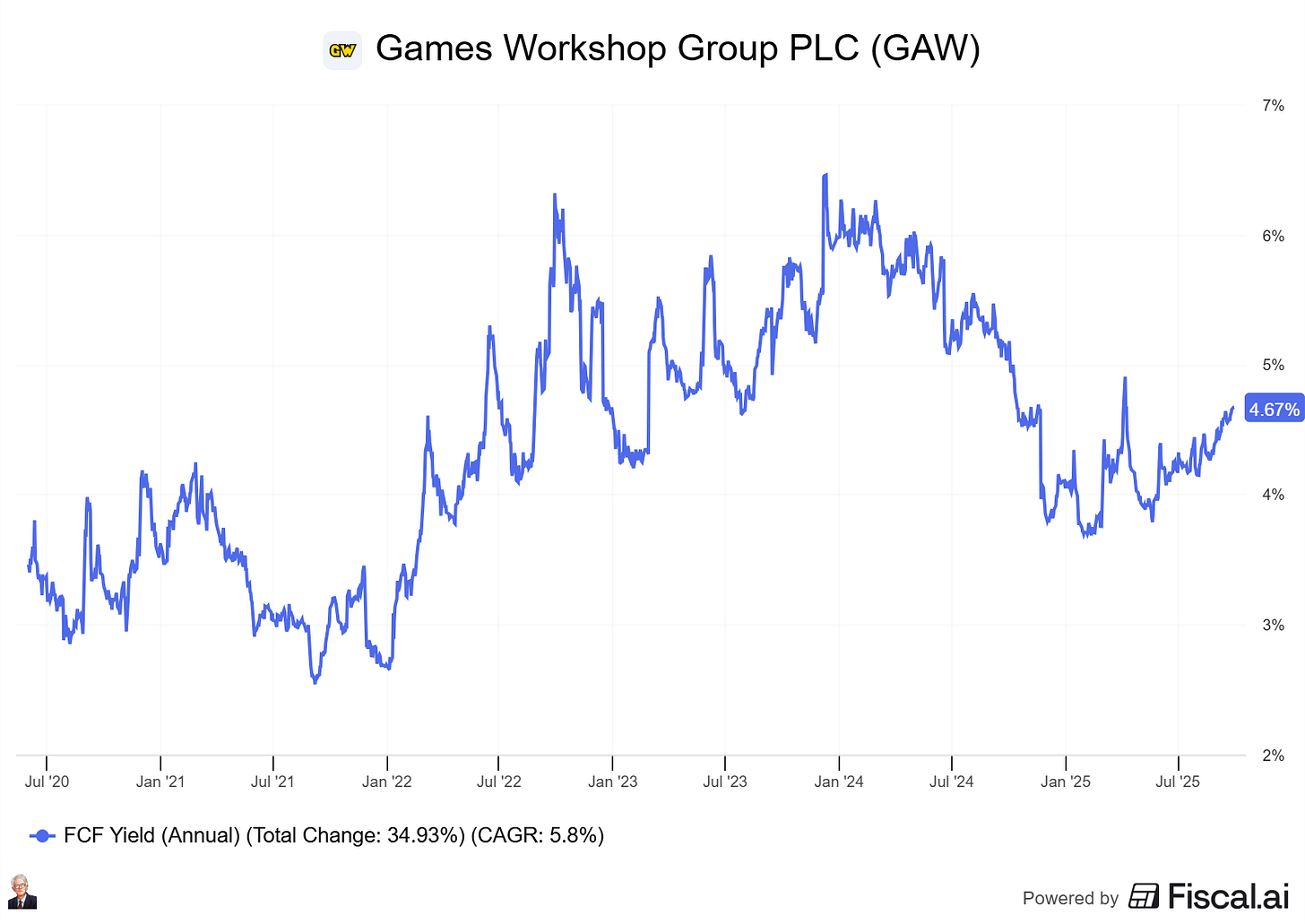

Valuation: ~28–30x earnings — premium vs retailers, but supported by IP moat, pricing power, and recurring hobbyist spend.

Conclusion

Games Workshop is no longer just a quirky UK retailer. It’s a global IP powerhouse with Disney or Marvel-like optionality. The miniatures business is sticky and cash-generative, the licensing arm is pure upside.

In investing terms: recurring cash flows + hidden IP optionality = compounding machine. The risk is fan backlash if the company mismanages its community. But with a culture that hires for passion over CVs, GW has shown it understands its tribe better than anyone.

#2 🎨 Adobe: The Creative Software Compounder

Adobe is the global leader in creative and digital media software, powering everything from Photoshop to Premiere Pro to Acrobat. Over the last decade, Adobe has transformed itself from boxed software sales to a subscription-based SaaS giant, creating one of the most durable and profitable business models in tech.

Adobe dominates with its Creative Cloud ecosystem (Photoshop, Illustrator, Premiere, After Effects), Document Cloud (Acrobat, e-signatures), and Experience Cloud (digital marketing & analytics). Its tools have become the industry standard — deeply embedded in workflows across creative professionals, enterprises, and students worldwide.

Growth drivers include:

Subscription expansion: Recurring revenue flywheel from Creative Cloud continues to scale globally.

Generative AI integration: Firefly AI is being embedded into Photoshop, Illustrator, and more. Increasing adoption and creating pricing power.

Enterprise growth: Experience Cloud strengthens Adobe’s footprint in marketing automation and analytics.

Student → professional pipeline: Strong funnel as students adopt discounted subscriptions before transitioning to full-paying pros.

Key initiatives

Embedding AI across product lines to drive efficiency and unlock new creative possibilities.

Expanding Document Cloud and e-signatures to capture the secular trend toward digital paperwork.

Continuing global expansion, especially in emerging markets, with flexible pricing models.

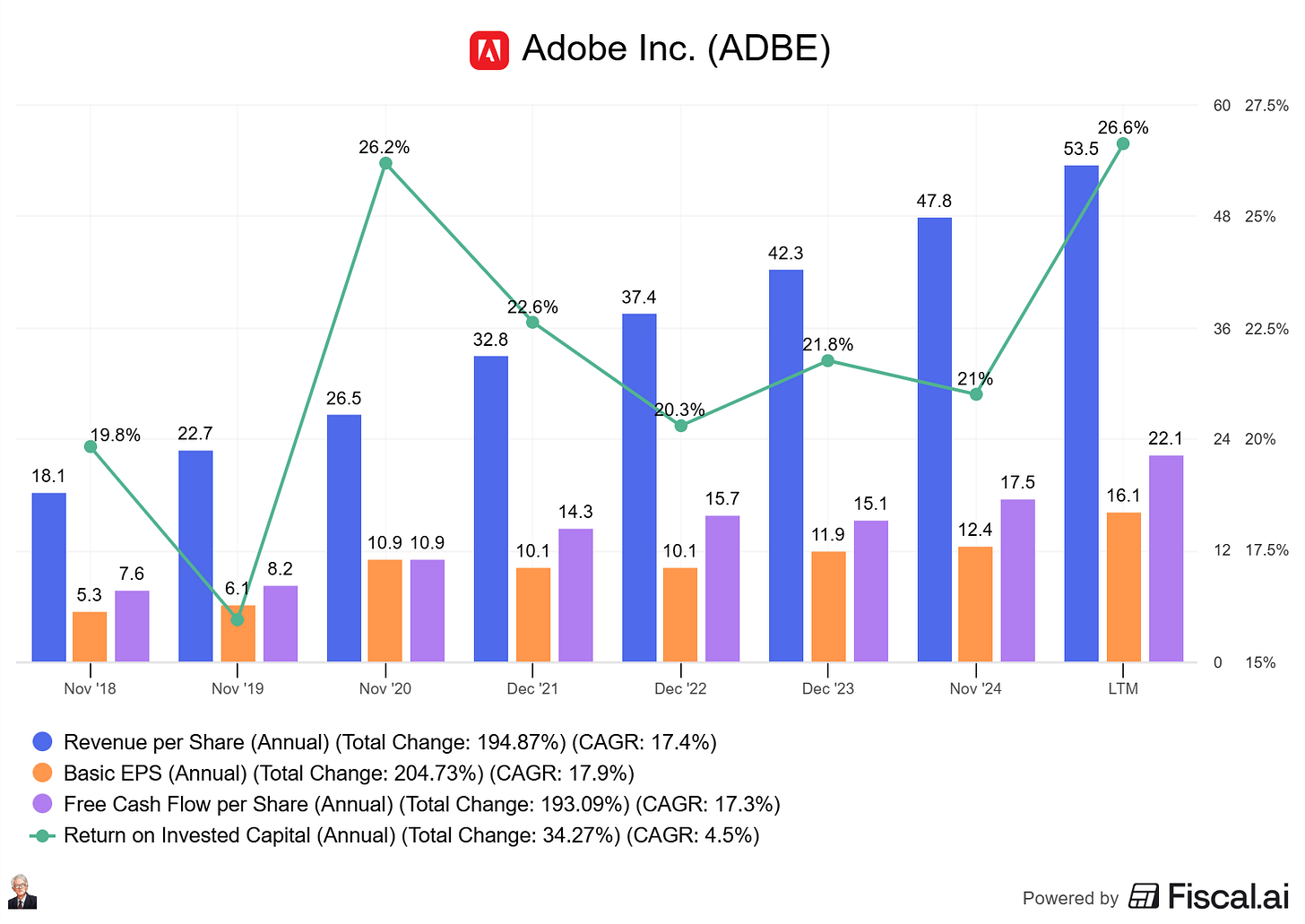

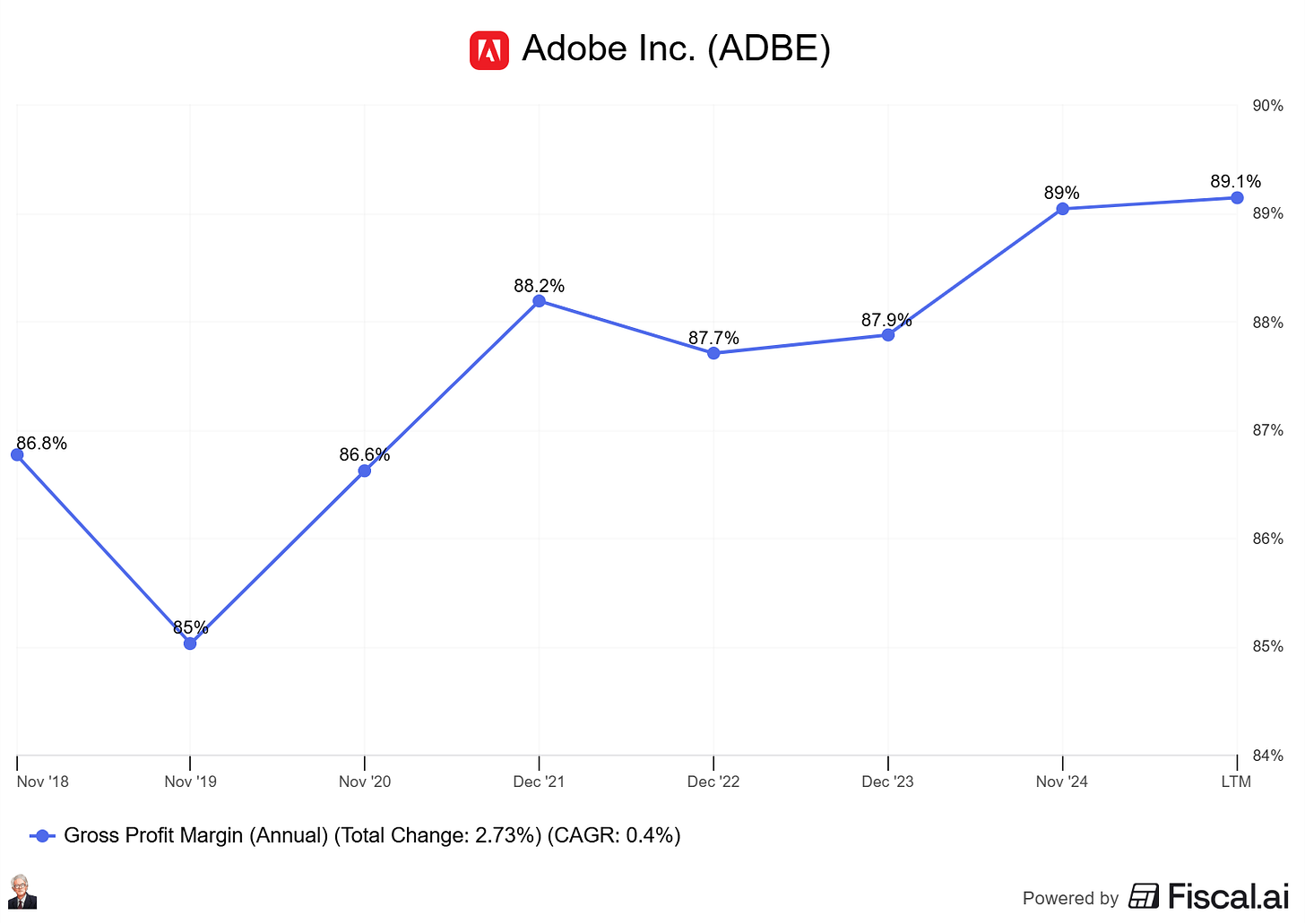

Adobe’s expanding gross margin is a testament to its business becoming more valuable. An expanding gross margin is often a sign of a wide moat business:

Expected growth for Adobe

Rev Fwd 2 Yr: ~11–12%

EBITDA Fwd 2 Yr: ~14–15%

EPS Fwd 2 Yr: ~14–15%

EPS LT Growth Est: ~14%

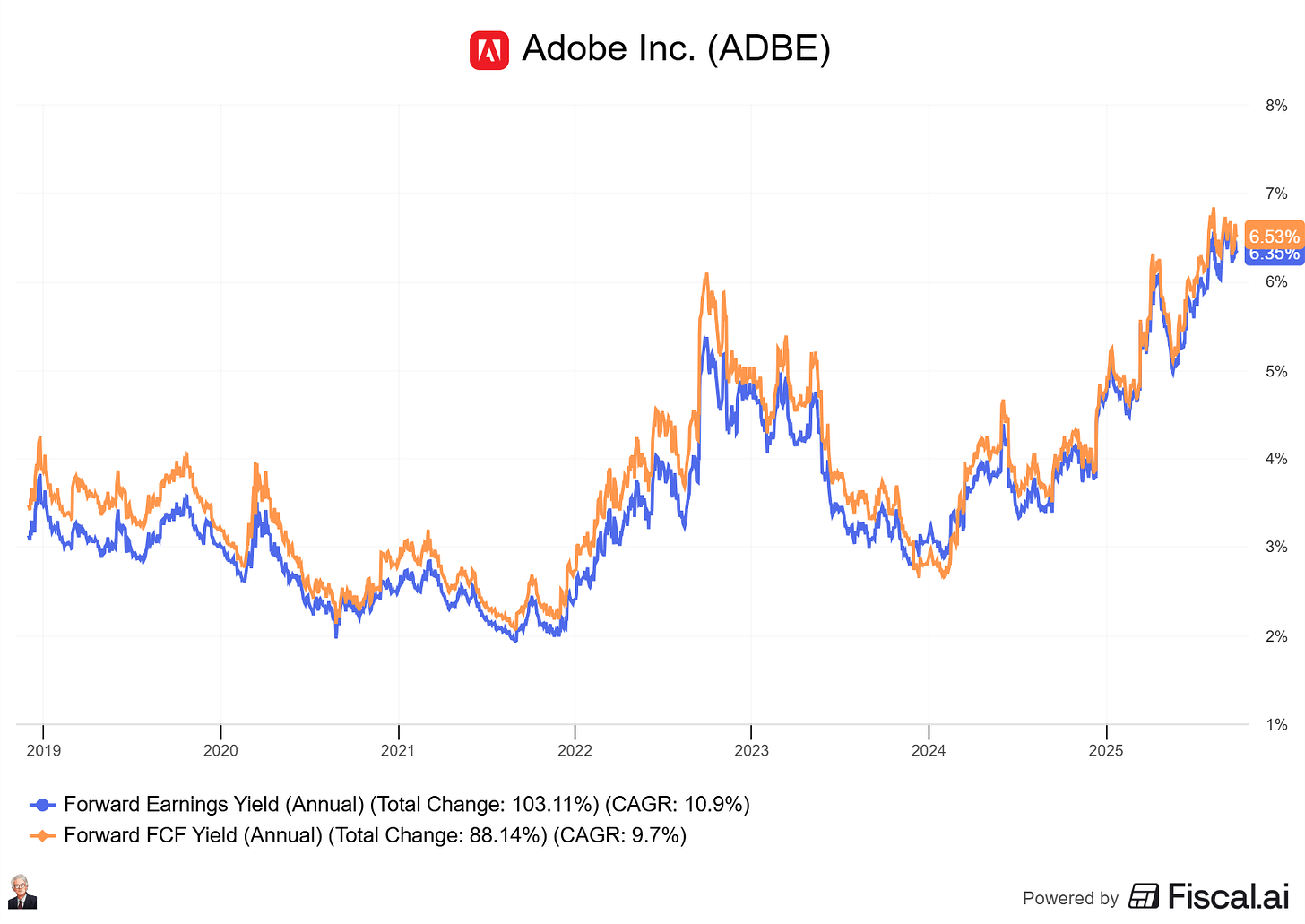

Adobe trades at a forward earnings yield of 6.3% and its FCF yield is trading at 6.5%. It once traded at a premium multiple, but now it trades like a washed-up mature business.

Conclusion

Adobe is a textbook compounder: high-margin recurring revenues, global scale, and near-monopoly status in creative workflows. AI is not a threat, it’s an accelerant, making Adobe’s ecosystem stickier while expanding use cases. Recurring revenue flywheel from Creative Cloud continues to scale globally.

#3 💊 Ipsen: The Specialty Pharma Compounder

Ipsen is a French biopharmaceutical group focused on specialty care in oncology, rare diseases, and neuroscience. Unlike the Big Pharma giants, Ipsen has carved out a profitable niche strategy: concentrate R&D and commercial efforts on targeted, high-value therapies where pricing power and barriers to entry are strongest.

Ipsen’s portfolio includes blockbusters like Somatuline (oncology), Decapeptyl (hormone therapy), and Dysport (neuromodulator), supported by a growing pipeline in rare diseases. The company complements internal R&D with bolt-on acquisitions and partnerships, creating a balanced growth model.

Growth drivers include:

Oncology leadership: Somatuline and Cabometyx drive recurring revenues, with strong positioning in neuroendocrine tumors and kidney cancer.

Rare disease expansion: Recent deals (e.g., Albireo, Epizyme) broaden Ipsen’s pipeline in liver diseases and rare oncology indications.

Geographic scaling: Stronger presence in the U.S. market (now ~40% of sales) improves margins and global diversification.

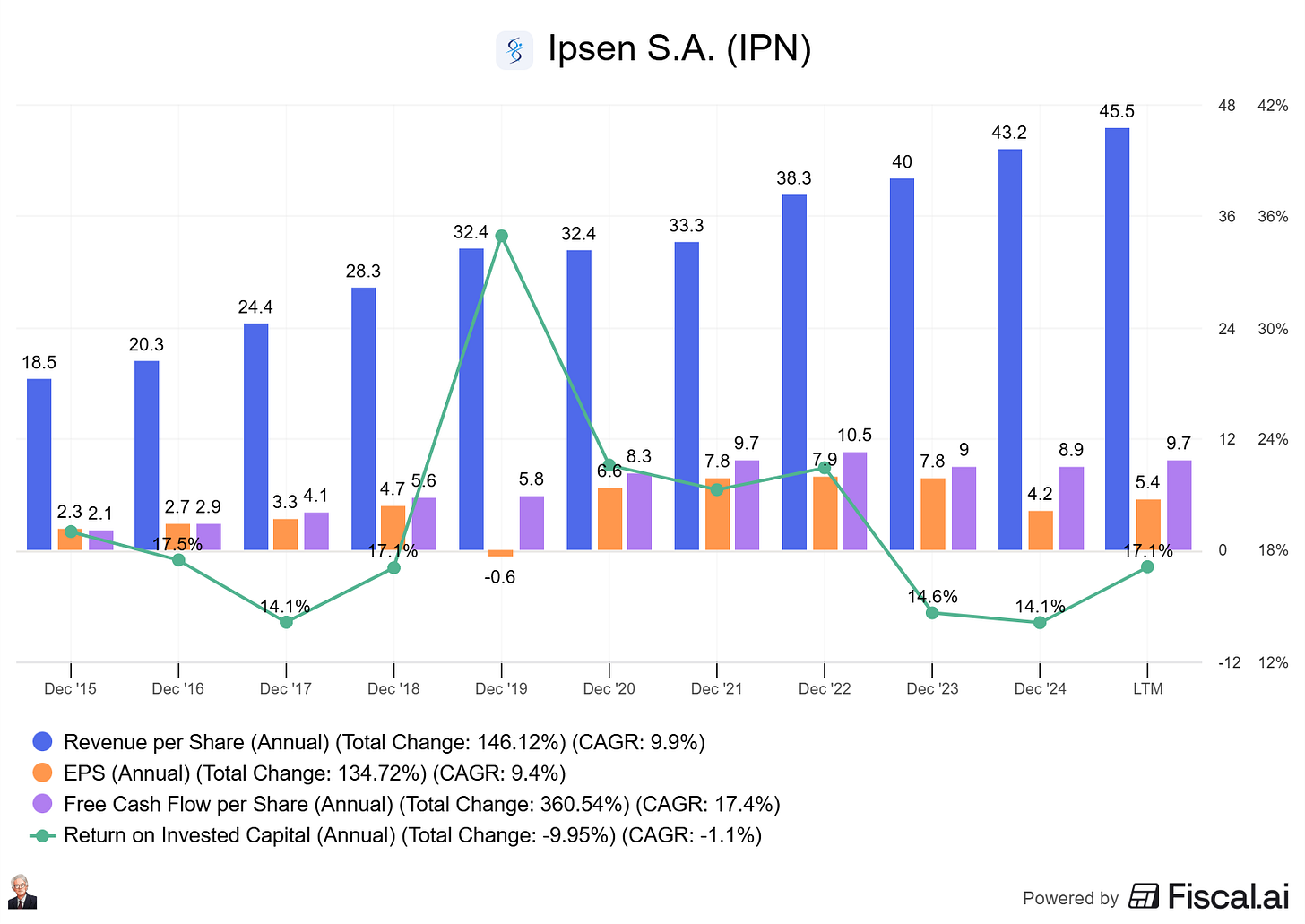

Ipsen is a steady compounder with significant free cash flow growth:

Key initiatives

Continued investments toward rare diseases and specialty oncology with high pricing power.

Expanding U.S. presence through partnerships and acquisitions, leveraging higher pricing dynamics than in Europe.

Expected growth for Ipsen

Rev Fwd 2 Yr: ~7–9%

EBITDA Fwd 2 Yr: ~9–10%

EPS Fwd 2 Yr: ~8–10%

EPS LT Growth Est: ~7–9%

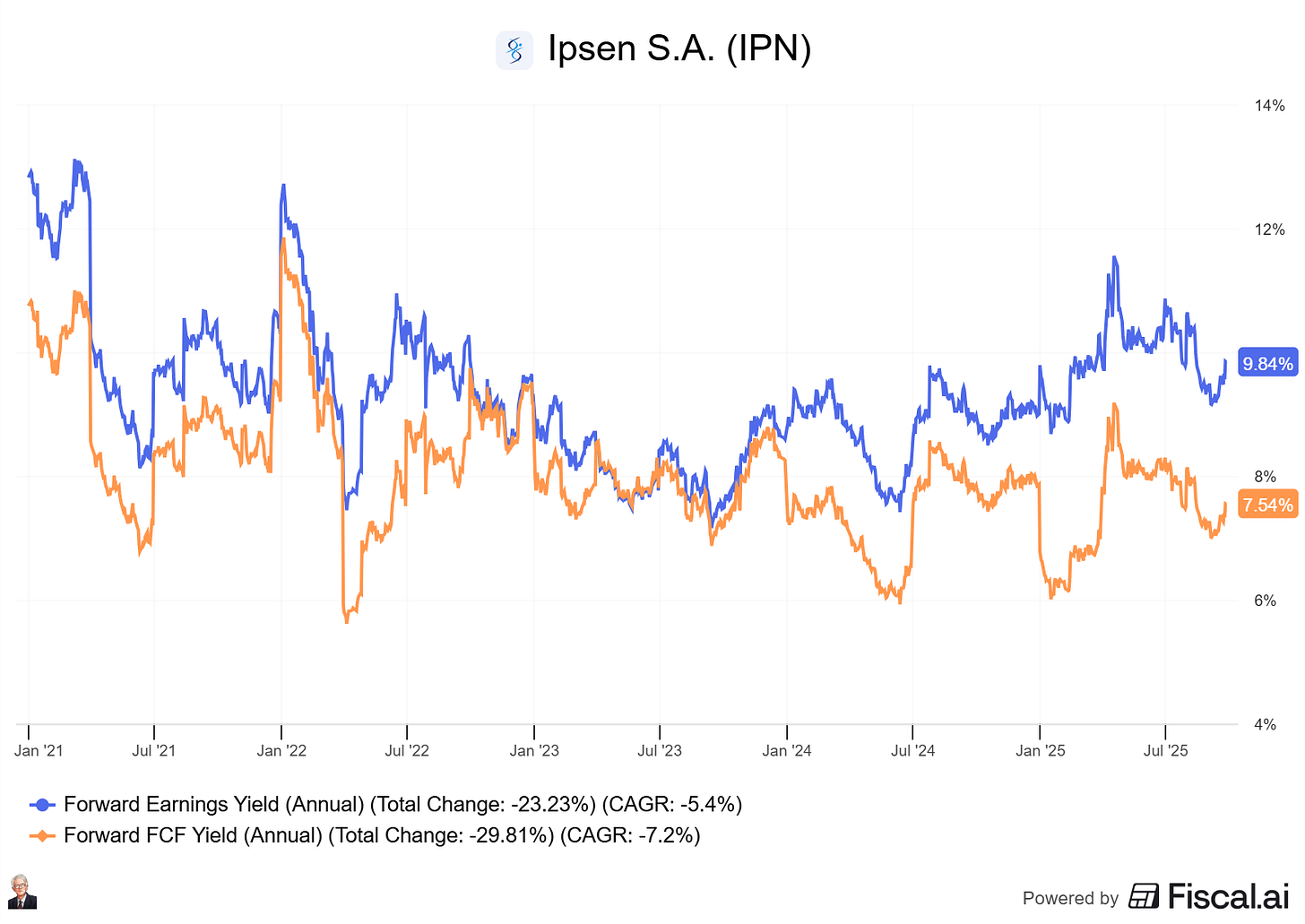

Ipsen trades at an earnings yield of ~9.8%, and a FCF yield of 7.5%, a discount to U.S. specialty peers, reflecting patent cliffs (Somatuline) but offering upside if pipeline execution succeeds.

Conclusion

Ipsen is evolving into a focused specialty pharma compounder: diversified revenues, strong U.S. footprint, and an expanding rare disease pipeline. Ipsen is not as flashy as biotech high-flyers. But the company combines strong free cash flow growth with selective growth bets. This is a mix that long-term investors often underestimate.