💎3 Mid-Cap Stocks to Buy

3 investing ideas to consider 🚀

Good morning! 👋

Wondering what stocks to buy this weekend? Good news, we have 3 ideas for you to consider.

Historically, mid-cap stocks have outperformed larger capitalization companies:

But why? We’ve always been told that small caps are the place to be long term. Why are mid-caps in the “sweet spot”?

Well, we believe there are a few reasons why mid-caps have performed well:

Balanced Growth and Risk Profile: Mid-cap companies offer higher growth potential than large-cap firms, which often face growth constraints due to their size, while presenting lower risk than small-cap companies, whose business models may still be unproven.

Attractive Risk-Adjusted Returns: Mid-caps strike an attractive balance, combining the scalability and operational maturity absent in many small-caps with greater flexibility and innovation potential than their large-cap counterparts.

Market Inefficiencies and Opportunity: With comparatively less analyst coverage than large-cap stocks, mid-caps often experience pricing inefficiencies, creating opportunities for investors to identify undervalued assets.

Note: The exact periods of performance matter—during tech booms or financial crises, different cap sizes perform differently. There is no guarantee that mid-caps will perform as well as it has in the past moving forward.

Let’s get into our 3 mid-cap picks 👇

#1 Upwork – Powering the Freelance Economy

Revenue CAGR 5-Year: +19.6%

Earnings per share CAGR 5-Year: +53.8%

ROIC: 43.2%

Gross Margin: 77.8%

Operating margin: 14.2%

Interest Cover: 39.8x

5 Year Price CARG: 4.6%

The Business

Upwork is a leading online talent marketplace that connects businesses with freelancers, independent professionals, and agencies around the world.

Upwork is a pioneer in the remote work economy. The platform enables companies of all sizes to find skilled professionals for both short-term gigs and long-term engagements across categories like software development, design, writing, marketing, customer support, and more.

How It Upwork makes Money:

Upwork’s revenue model is primarily transaction-based, supported by value-added services. Key revenue streams include:

Service Fees from Freelancers – Upwork charges freelancers a sliding service fee (typically 10% for most projects) based on lifetime billings with each client.

Client Marketplace Fees – Clients pay a fee (usually 5%) on payments made to freelancers through the platform.

Subscription Revenue – Upwork offers premium plans like Upwork Plus for freelancers and Upwork Enterprise for large businesses, which include enhanced tools, analytics, and support.

Talent Solutions and Project Catalog – These include pre-scoped projects and end-to-end talent curation for enterprise clients, creating additional monetization opportunities.

Does Upwork have a moat?

Upwork’s competitive moat is built on network effects, brand equity, and technological capabilities (Intangible assets):

Two-Sided Network Effect – The more freelancers on the platform, the more attractive it is to clients, and vice versa. This creates self-reinforcing growth flywheel.

Global Talent Pool – Upwork hosts one of the largest, most diverse pools of remote talent, making it the go-to for companies needing flexibility and global reach.

Reputation System & Data – Upwork’s proprietary matching algorithms, work history, and user ratings create trust and reduce friction in hiring.

While competition is intense (e.g., Fiverr, Toptal), Upwork’s comprehensive service offerings and enterprise segment give it staying power.

Unlike its competitors, Upwork reached profitability in 2023. In the LTM Upwork had a return on invested capital of 43.2%, indicating a strong competitive position:

3 Reasons to Own Upwork:

Tailwind from Remote Work and Freelancing Trends

The rise of remote work, digital nomadism, and gig-based employment is a secular trend. Upwork is ideally positioned to benefit as businesses seek cost-effective, flexible workforce solutions.Enterprise Growth Potential

Upwork has increasingly focused on attracting larger clients through its Enterprise Suite. These clients offer longer-term, higher-value contracts and lower churn, key for revenue durability and margin expansion.Operating Leverage and Scalability

As the platform scales, margins are expected to improve. Investments in automation, AI-based matching, and self-service tools can reduce costs and increase user retention. Recent progress in profitability (EBITDA improvements) signals stronger financial discipline.

Upwork benefitted significantly from the post covid boom. Compared to its peers, Upwork has been able to stabilize at the high post-covid levels, with GSV per active client trending up:

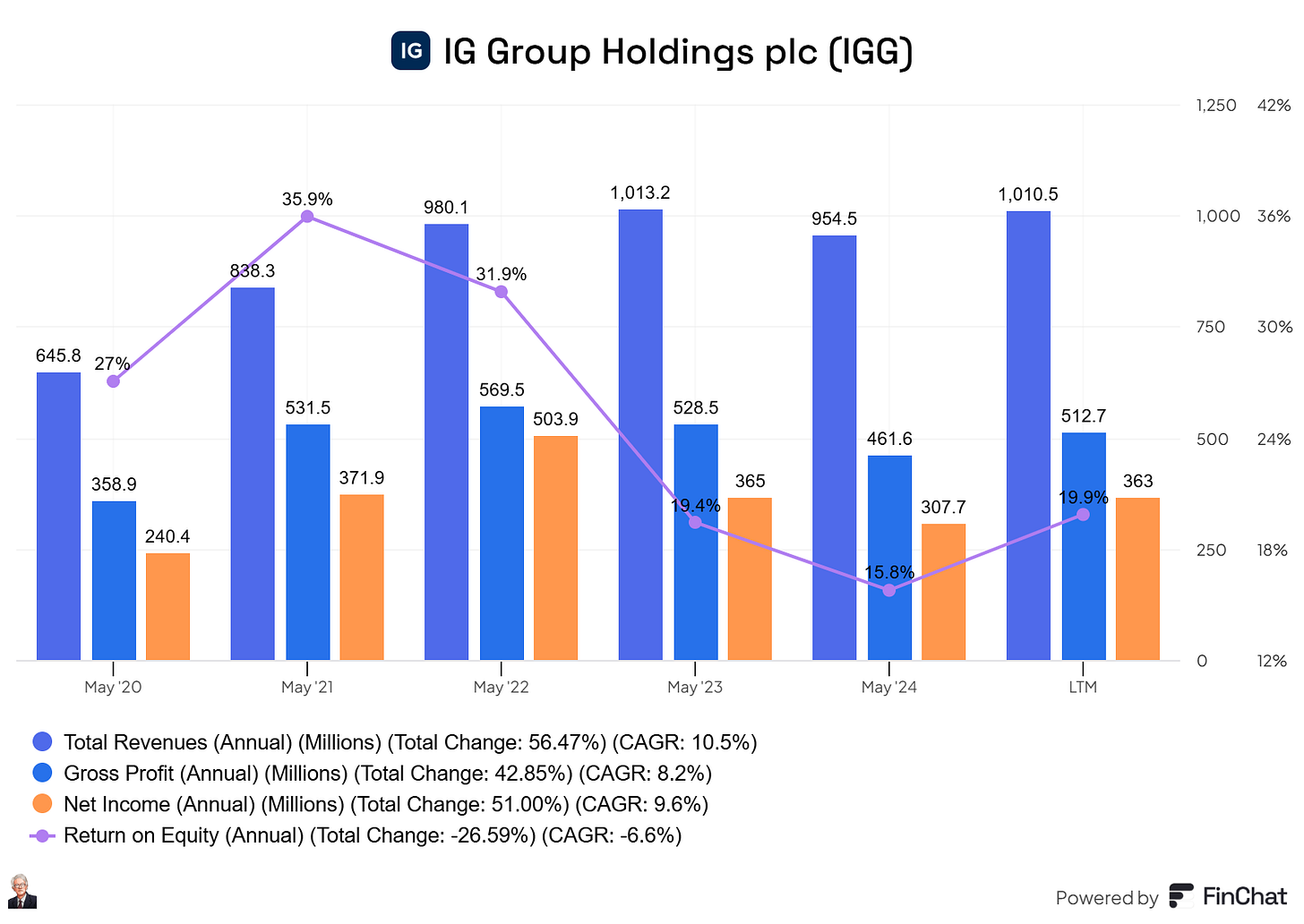

#2 IG Group Holdings – A Global Leader in Online Trading

Revenue CAGR 5-Year: +3.9%

Earnings per share CAGR 5-Year: +19%

ROIC: 25.4%

Gross Margin: 50.7%

Net margin: 35.9%

Interest Cover: -

5 Year Price CARG: 13.3%

The Business

IG Group Holdings plc is a UK-based financial services firm specializing in online trading and investments.

Founded in 1974 and headquartered in London, the company enables retail and professional investors to trade a wide array of financial instruments, including forex, indices, shares, commodities, cryptocurrencies, and options.

It operates globally, with a strong presence in Europe, Asia-Pacific, and North America through its IG, tastytrade, and Spectrum brands.

How IG Group Makes Money:

IG Group earns revenue primarily through:

Spread and Commission Fees – Clients pay a spread (the difference between buy and sell prices) or commission on each trade across products like CFDs (contracts for difference), forex, and equity derivatives.

Financing Charges – For leveraged positions held overnight, IG charges a financing fee, contributing to recurring income.

Interest Income – The firm earns interest on client deposits held in segregated accounts.

Subscription & Platform Fees – In some markets, IG offers premium services, data feeds, and trading platforms with associated fees.

Notably, IG has increasingly diversified into longer-term investing and educational tools, attracting a broader client base beyond active day traders.

IG Group generates a lot of cash from its business with a 55% FCF margin in the LTM:

Does IG Group have a Moat?

IG Group’s economic moat is based on its technological platform, regulatory status, and brand equity:

Proprietary Trading Platform – IG’s robust, user-friendly, and fast trading systems are a major differentiator. Their infrastructure supports real-time execution, complex order types, and mobile trading.

Strong Regulatory Position – Operating under the oversight of the FCA (UK), ASIC (Australia), and other top-tier regulators, IG’s trust and compliance standards are a competitive edge.

Brand and Scale – With over 300,000 active clients globally and decades of operational history, IG has a well-established reputation and global recognition that newer players struggle to match.

3 Reasons to Own IG Group Holdings:

Resilient Business Model with High Margins

IG enjoys robust free cash flow margins (often 40%+), supported by its scalable trading platform and diverse global customer base. The capital-light nature of the business allows for strong free cash flow generation.Attractive Dividend and Shareholder Returns

The company is committed to returning capital to shareholders through regular dividends and buybacks. Its dividend yield has historically been attractive, especially for income-focused investors. The current diviend yield is 4.2% with a shareholder return of 11.23%.Expanding into Growth Areas (U.S. and Options Trading)

Through the acquisition of Tastytrade in the U.S. and the growth of its options trading platform, Spectrum, IG is actively tapping into underserved, high-growth markets. This strategic pivot adds long-term growth potential beyond its traditional CFD and forex business.

IG Group is a steady, capital light grower that has managed to grow profitably for years with high returns on equity.

#3 NVR – A Resilient Force in U.S. Homebuilding

Revenue CAGR 5-Year: +8%

Earnings per share CAGR 5-Year: +17.4%

ROIC: 58%

Gross Margin: 25%

Operating margin: 19.3%

Interest Cover: 75.4x

5 Year Price CARG: 17.1%

The Business:

NVR, Inc. is a leading U.S. homebuilder and mortgage banking company, operating under well-known brands such as Ryan Homes, NVHomes, and Heartland Homes.

Unlike many of its peers, NVR takes a capital-light approach to real estate development. Instead of acquiring large tracts of land, it enters into option agreements with landowners, minimizing risk and enhancing return on capital.

Headquartered in Reston, Virginia, NVR focuses primarily on markets on the East Coast, Midwest, and Southeast U.S.

How NVR Makes Money:

NVR generates revenue through two primary segments:

Homebuilding – The core business involves constructing and selling single-family homes, townhomes, and condominiums. Revenue is driven by home deliveries and the average selling price of homes.

Mortgage Banking – Through NVR Mortgage, the company provides financing solutions to its homebuyers. This division earns through origination fees, interest income, and secondary market sales of loans.

Does NVR have a Moat?

NVR’s economic moat is centered on its capital-efficient land acquisition strategy. Rather than owning and developing land, NVR uses land option contracts, which drastically reduce its exposure to real estate market volatility. This allows the company to:

Maintain a high return on invested capital (ROIC) of +50%

Stay more agile than competitors during downturns

Keep a strong balance sheet with minimal land risk with a net debt position of -$1.11B, and an EBIT/Interest payments of 75.4x.

Additionally, its vertically integrated mortgage operations and strong regional brand recognition reinforce its competitive edge.

NVR has been a steady compounder for its shareholders, compounding at ~17% since its inception:

3 Reasons to Own NVR:

Capital Discipline and Financial Strength

NVR consistently posts industry-leading return metrics and maintains a rock-solid balance sheet. Its land-light model gives it resilience in both bull and bear housing markets.Shareholder-Friendly Practices

The company is known for aggressive share buybacks, significantly reducing share count over the years and enhancing per-share value for long-term investors.Proven Track Record Across Cycles

With a history of outperforming peers during housing booms and busts, NVR has shown remarkable consistency in earnings, margins, and capital returns, demonstrating management’s ability to navigate cyclical risks.

NVR is growing its revenues, EPS, and free cash flows consitently in the mid teens. Add a +50% ROIC on top of that and you have yourself a compounding machine:

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 300 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +15.000 stock market investors (42% open rate) — Contact us via: investinassets20@gmail.com

Great post, thanks for highlighting these. Didn't realize Upwork had such good roic now.

Wow!