🏰3 Micro Caps to Buy

3 undervalued micro caps 🧠

Hi dear investor 👋

In this article, we’re exploring 3 high-quality micro-caps that might be of interest to you.

You might want to become a premium subscriber

Here’s why:

💎 Save time by leveraging our research and stock picks. Follow our market-beating quality growth portfolio.

🏆 Get high-quality ideas from our Top 5 Buys of the Month, Top 10 buys for 2024, Investable Universe, and continuous updates on the most promising investments.

🏰 Detailed business breakdowns of top-performing compounders and their valuations.

Introduction

A micro-cap stock is a publicly traded company with a market capitalization between approximately $50 million and $300 million.

These stocks are typically found on smaller exchanges or over-the-counter markets. Micro-cap stocks can offer high growth potential but come with significant risks due to their limited resources, less regulatory oversight, and lower liquidity compared to larger companies.

They are often more volatile and can be more susceptible to market manipulation. Investors in micro-cap stocks need to conduct thorough research and be prepared for higher levels of risk and potential reward.

Definition: A micro-capitalization stock is a business worth between $50M - $300M. However, this is sometimes stretched to $500 million.

Micro-caps sorted by FCF 5 Year CAGR below $500M market cap

Sample from our Investable Universe

The list above contains some of the top-quality micro-cap names from our investable universe. The list is sorted by FCF 5 year CAGR as we believe this is the purest measure of growth for a business.

3 Quality Micro Caps 💎

Brødrene A & O Johansen A/S

Brødrene A & O Johansen is a Danish wholesale distributor specializing in technical installation materials, including plumbing, heating, and electrical supplies.

Founded in 1914, the company serves professionals in construction and industry with a wide range of high-quality products and comprehensive service solutions.

Thesis: AOJ is a market leader trading at 12.55 times earnings, and 6.47 times free cash flows. The business is growing at a steady phase with a high dividend yield of 4.83% with a 5 year dividend growth rate of 44.27%.

AOJ has made automation upgrades for their warehouses to boost efficiencies and increase operating margins in the years to come. This offers a good risk reward opportunity with limited downside (Due to the low valuation & high dividend yield).

Financial Performance

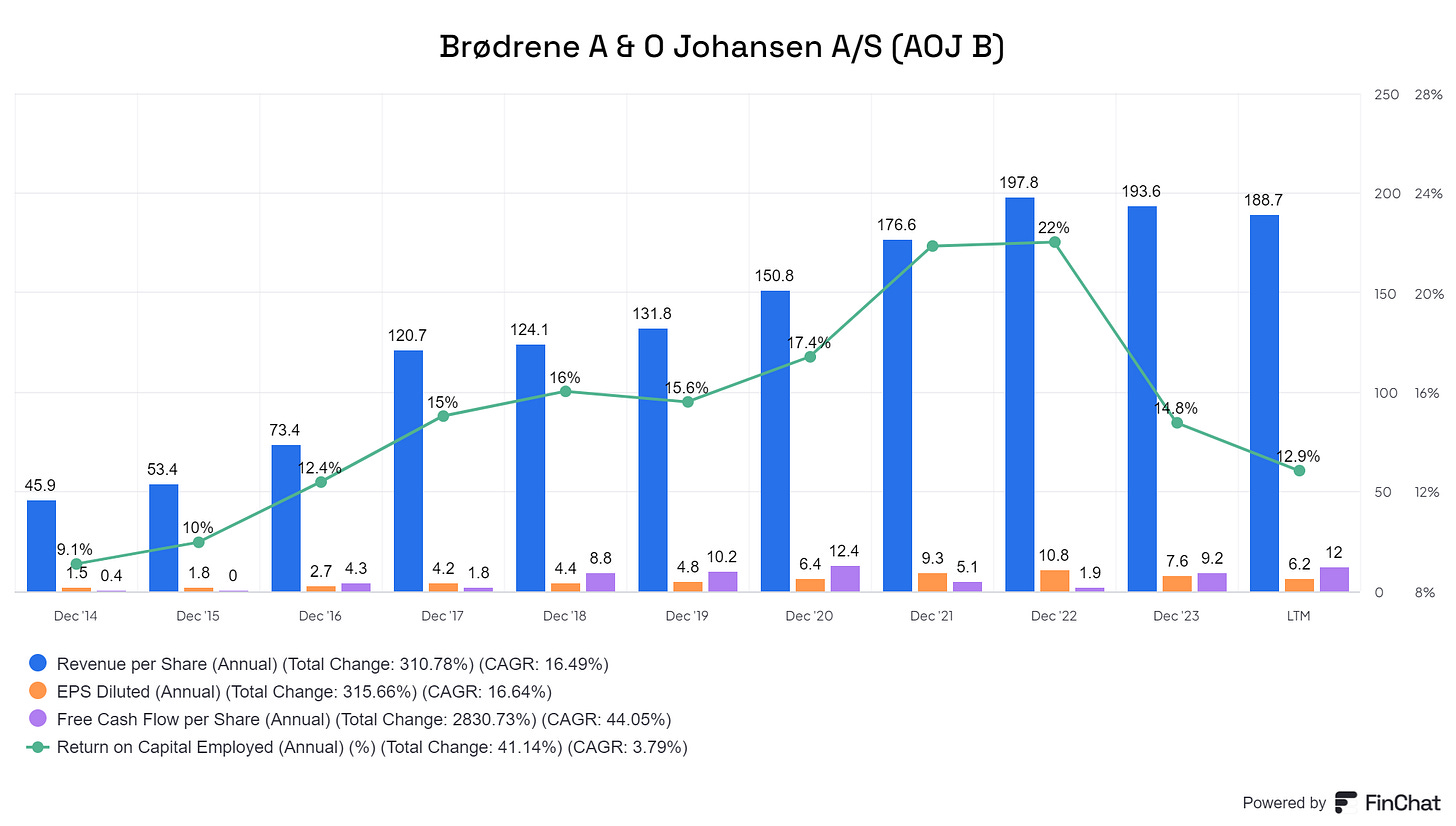

Since 2014, AOJ has grown its revenue by 16.49% annually, its EPS by 16.64%, and free cash flows by 44.05%.

In addition, the company boasts solid returns on capital with a 12.9% ROCE in the last twelve months: