15 Visual Investing Lessons 💎

15 principles to build a great stock portfolio🧠

Hi there investor 👋🏻

In this article, we will look at 15 visuals that support a quality growth-based investing style.

These visuals can be powerful reminders and form the basis of your stock investing strategy.

Let’s get into it 👇🏻

Competitive advantages are essential for long-term investing.

Without a moat to protect a superior business, the business will soon become average and produce average results over time. By a superior business, I refer to a business with an advantage in return on capital compared to its competitors. This is a great indicator of a competitive advantage.

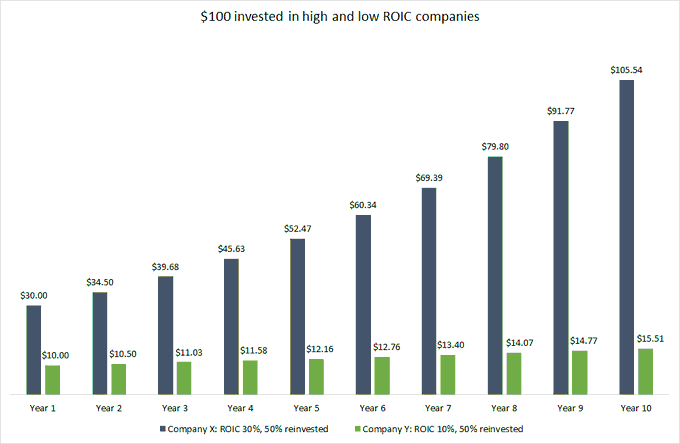

Return on invested capital is important, but reinvestment rate is how a business compounds.

A business with a ROIC of 50% with 0% reinvestment opportunities is far less attractive than a business with 30% ROIC but a +50% reinvestment rate. In theory, a business with a ROIC of 30% and a reinvestment of 50% should produce shareholder returns of around 15% annually. This is why a long runway for growth combined with a high ROIC is very attractive.

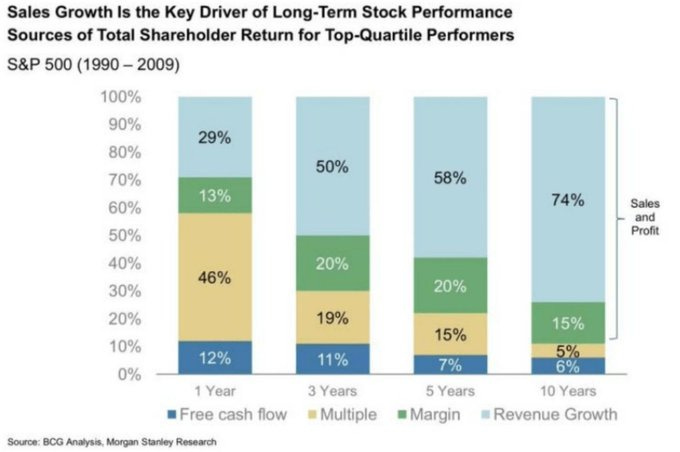

Sales growth is the #1 driver of long-term stock performance

This principle plays into the previous two, you want to invest in a business that has a long runway for growth, and this means that the potential market is large. In addition, the business should have multiple growth initiatives to sustain the growth over time. And ultimately, the growth should be organic, indicating that there is a high demand for the company’s services.

Family-owned and founder-led businesses outperform over time

The logic here is simple, if you have a stake in a business, and the performance of the business directly impacts you in terms of increased share prices, you are much more likely to act in a manner that is aligned with shareholders (Us). This means that you will make decisions to maximize long-term shareholder value, and not short-term expectations. In addition, the risk of fraudulent behavior is much lower.

Boring, stable, and predictable businesses tend to be underestimated

There is a human tendency to underweight high-probability events and overweight low-probability events. This can be translated into stock investing by looking at how investors flock to a “long-shot” investment. Yes, it might work out and provide a 10x return, but in most cases, it will end in disaster. Yet, we underestimate the “boring” and predictable business that keeps on gushing out cash and compounding over time. This effect makes it more attractive to look into boring and stable companies than to seek “long-shots”.

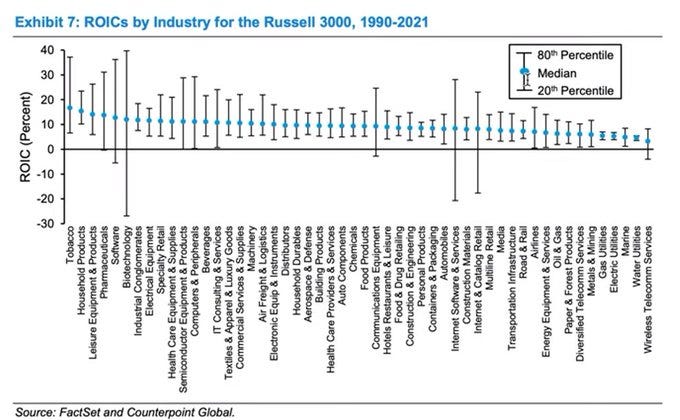

Sticking to high ROIC industries makes our job as investors easier

Fundsmith is famous for sticking to I) Healthcare, II) Consumer goods, and III) Technology. Terry Smith makes the argument that these industries have a naturally high ROIC and that this makes them a better place to position capital over the long term. Yes, you can find great opportunities elsewhere, but sticking to a few selected high-ROIC industries makes the likelihood of good investments higher.

Growing quality companies can be worth paying for

I’m not suggesting that one should pay 281 times earnings for a great business, but if your investment is between a fantastic business at 20 times earnings, and a fair business at 10 times earnings, you should probably go with the fantastic business. A fantastic business can sustain the compounding for years or decades. A cheap business will often lose its appeal once it trades at a “fair” PE ratio. In this scenario, you’d have to sell the cheap business and find a new idea - this is also time-consuming.

The average investor is clueless and significantly underperforms the market

Even investors investing in index funds underperform the market because they buy high and sell low. Learning the ropes of investing takes time, but it is surely worth it - both for your wallet and your mind. The average investor has no strategy and follows financial media for investing advice. They trade way to often and spend a lot of time thinking and worrying about investing, only to end up with a poor result.

Wealth is built over decades - patience is key.

Expecting to double your money in a year is a poor strategy for most. Yes, you can get lucky a few times, but at some point, with no risk-management, you will end up making a fatal mistake. Having a long-term view of your investments is probably the best edge you can have in investing. Wall Street and professional money managers compete to have the best results on a quarter-to-quarter basis, this often neglects the long-term benefits of holding great businesses. Warren Buffett is the best example of how immense wealth investors can create if they stay patient and true to their strategy.

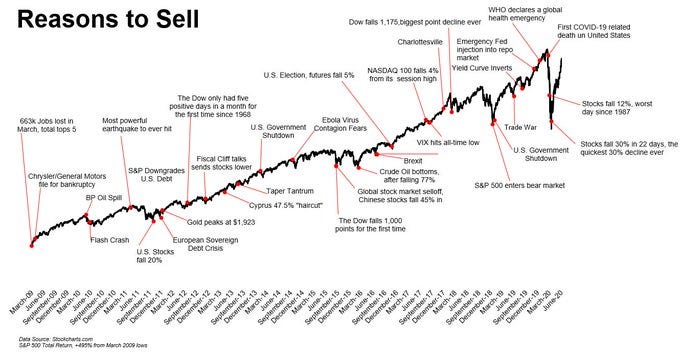

There will always be a smart-sounding reason to sell shares

As investors, we are made to believe that a new recession is around the corner. The big crash is just about to happen after a significant bull-run, therefore you should sell your stocks and wait to buy in at a better point. This sounds logical in theory, but in practice, it is close to impossible. “No one can predict the markets, and those who claim they can are liars”. Don’t believe what the so-called experts claim, focus on buying fairly priced superior businesses over time and silence the noise.

Forecasters can never get it right - let’s not spend time predicting the future

Even institutions with billions of dollars in backing are not able to consistently predict any change in the economy - so why should we listen to experts claiming the next recession is right around the corner? The fact is that no one knows and that the forecasts are completely unreliable.

The market follows a particular cycle that can be learned

The most important lesson from this visual is to understand that the point of maximum panic, capitulation, despondency, and depression is the point of “Maximum financial opportunity”. It is in times when uncertainty and negativity are at their highest that we can find the best stock opportunities. Paradoxically, it is also the hardest time to purchase stocks. Training your mind to understanding this mechanism will make you a much better investor.

Share price will follow the fundamentals over time

The best opportunities often occur when the share price gets detached from the fundamentals. Typically, a narrative will surround a company leading to the stock price falling while the earnings per share keeps on rising. Eventually, the market will adjust to the increasing EPS, but in the short term, the share price can get detached from the fundamentals - providing opportunities for savvy investors.

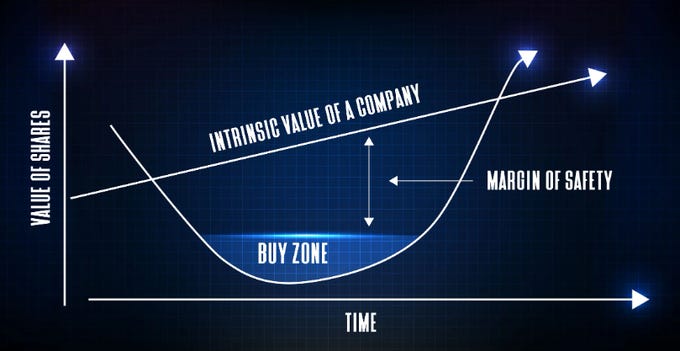

Investing with a margin of safety is important, even if you invest in great companies

You have to account for your own ignorance. As a single human being, there is no way you can understand all the variables that go into a stock increasing or decreasing in value. You can only make educated guesses based on solid investing principles and heuristics. Because of this, you should always try to get a margin of safety when purchasing a stock. This simply mean that the stock price is trading at a significant discount (E.g. -30% to -50%) of what you believe the stock is currently worth. This is a hedge on your own ignorance (Even the smartest investors need this).

Stocks is the best asset-class to invest in over time

You might be able to achieve great returns in other asset-classes, like Real Estate. But keep in mind that you use a large leverage effect in real estate, this also increase the inherent risk of the investment. From a pure real returns standpoint, stocks is the best asset-class to be invested in. Although I would argue that investors approaching their retirement should diversify into less volatile asset-classes like bonds and real estate.

That’s it for today, if you liked this article, please subscribe to the newsletter to receive more articles like this.

Read more about investing at www.investinassets.net

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 250 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +10.000 stock market investors (45% open rate) — Contact us via: investinassets20@gmail.com