🏰10 World-Class Compounders for the Next Decade

The Permanent Portfolio for Quality Investors

Hi there, investor! 👋

In this article, we’re breaking down how I would set up a Permanent Quality Portfolio consisting of 10 high-quality and durable businesses to hold from 2025 to 2035.

The Six Pillars of Quality Investing

I was confronted with the thought experiment of putting together a portfolio of companies I believe will thrive in the next decade.

With the short-term focus from the market, often looking at the next quarter ahead, it is a useful exercise to think about investing on a higher level.

This is not about guessing; it is about building a portfolio of resilient businesses with structural demand that can compound quietly over 10 years.

The fundamentals I look for in these businesses are:

Management: Excellent capital allocators with skin in the game.

Business model: Capital-light with a recurring revenue model that is hard to replicate.

Competitive advantage: A sustainable advantage that protects a business’s cash flows.

Growth: Revenue, earnings, and cash flow growth from a steady and predictable underlying business that has organic demand.

Risk factors: The business is not sensitive to economic cycles and is profitable even during tough economic periods.

Valuation: The valuation suggests a +12% CAGR upside on a discounted cash flow and historical multiple basis.

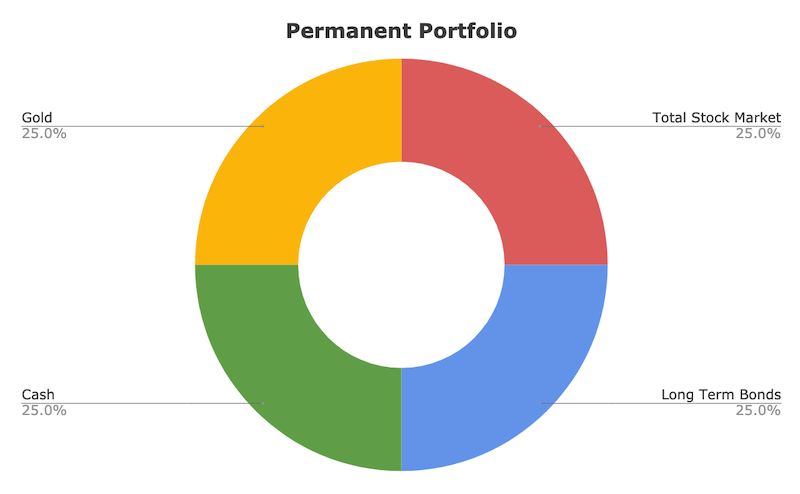

🔍 Rethinking "Permanent" for a New Era

Harry Browne’s classic Permanent Portfolio focused on asset class diversification — gold for inflation, bonds for deflation, stocks for growth, and cash for recessions. But in 2025, that simplicity doesn’t cut it.

The next decade demands more than asset class exposure. It demands selective ownership of compounding machines — companies with integrity, advantage, adaptability, and staying power.

Why?

True compounding comes from business quality, not market beta.

Over a decade or more, the biggest returns come from companies that reinvest internally at high rates — not from broad exposure to gold, bonds, or commodities.

Let’s break down the 10 businesses I believe will perform well over the next 10 years and why:

🧩 A Durable Portfolio for the Next Decade

In a financial world filled with noise, hype stocks, and unrealistic narratives, truly durable stock portfolios are increasingly rare.

My goal is not to chase narratives, time interest rates, or predict what country Trump decides to put a tariff on next. It’s to build a concentrated portfolio of world-class businesses that are resilient and strong enough to survive and thrive in the next decade.

Below are 10 companies selected using the six-pillar framework mentioned above.

Let’s get into it 👇

🛍️ 1. Amazon (AMZN)

Amazon is the backbone of modern commerce and cloud infrastructure. Its e-commerce empire is vast, but the real engine is AWS — powering the internet for startups, enterprises, and governments alike. Competition is rising, but so is Amazon’s reinvestment flywheel and its grip on digital infrastructure.

Even without AWS, Amazon has multiple strong business segments, like 3rd party sellers on their online platform, advertisements, and Prime subscriptions.

The customer-obsessed, day 1 mentality and culture of Amazon make it a special mega-cap stock for the next decade.

The stock has compounded at 29.9% annually since its inception. While it’s not likely to continue this trend in the future, due to its scale, it is likely to continue to grow and expand its business.

The valuation of Amazon is OK, but the increased CapEx and hence, lower free cash flows are likely to bring some turmoil to the stock price in the short term. However, this is to seize the long-term opportunities in AI and Cloud.

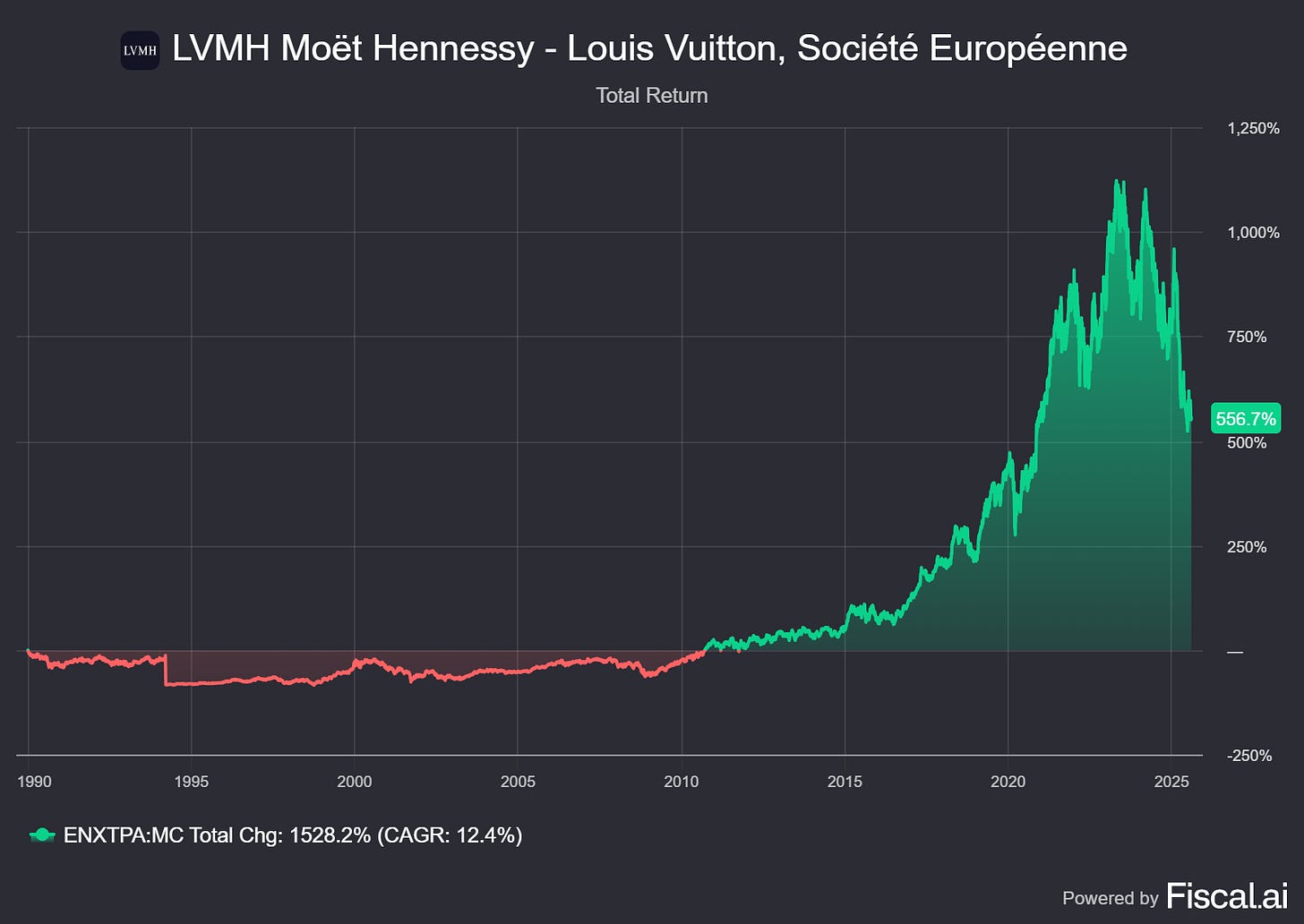

👜 2. LVMH (MC.PA)

When it comes to durable brand power, no one matches LVMH. With brands like Louis Vuitton, Dior, and Dom Pérignon, it’s not selling fashion — it’s selling cultural status. Moat widens with time and scale. Luxury is not cyclical for the ultra-wealthy.

LVMH has compounded by 12.4% since inception, but it has been a fantastic performer since the great financial crisis in 2008.

LVMH at this point is a serial acquirer of luxury brands. And, given human nature, there will always be a demand for luxury items. Vanity is a strong driver for spending among the rich and the upper middle class.

LVMH is trading close to its 10-year low PE levels. With decent EPS growth and a small multiple expansion over the next decade, LVMH is likely to provide a substantial upside.

💻 3. MSCI Inc. (MSCI)

A hidden compounder in plain sight. MSCI owns the backbone of institutional investing through its indexes and analytics platforms. Its customers are sticky, its margins are well above average, and its revenue base is recurring and global.

MSCI has multiple strong business segments with high margins and strong growth.

The demand for cheap index funds and financial analytics is in structural demand, and it is not likely to lessen over the next decade.

MSCI has been compounding capital for its shareholders by 19.8% since its inception.

The valuation for MSCI is in line with its median P/E ratio. The defensive nature of this business, coupled with structural demand and multiple growing high-margin business segments, makes it a strong holding for the next decade.

💾 4. ASML (ASML)

The beating heart of advanced chipmaking. ASML’s EUV lithography machines are unrivaled — without them, the modern semiconductor supply chain collapses. It’s not just a monopoly; it’s a tollbooth on innovation itself.

The EUV machines are so complex that it would take 10.000 of the world’s best engineers decades to replicate it.

The stock has compounded by 18.2% for shareholders since inception.

In a world driven by technological developments in AI, automation, 5G, and new emerging technology, ASML sells the spades and shovels to the technological revolution we are witnessing.

ASML’s valuation is undemanding, trading at its lowest range in more than 6 years. This just adds to the possibility of a dual engine of growth:

EPS growth + multiple expansion

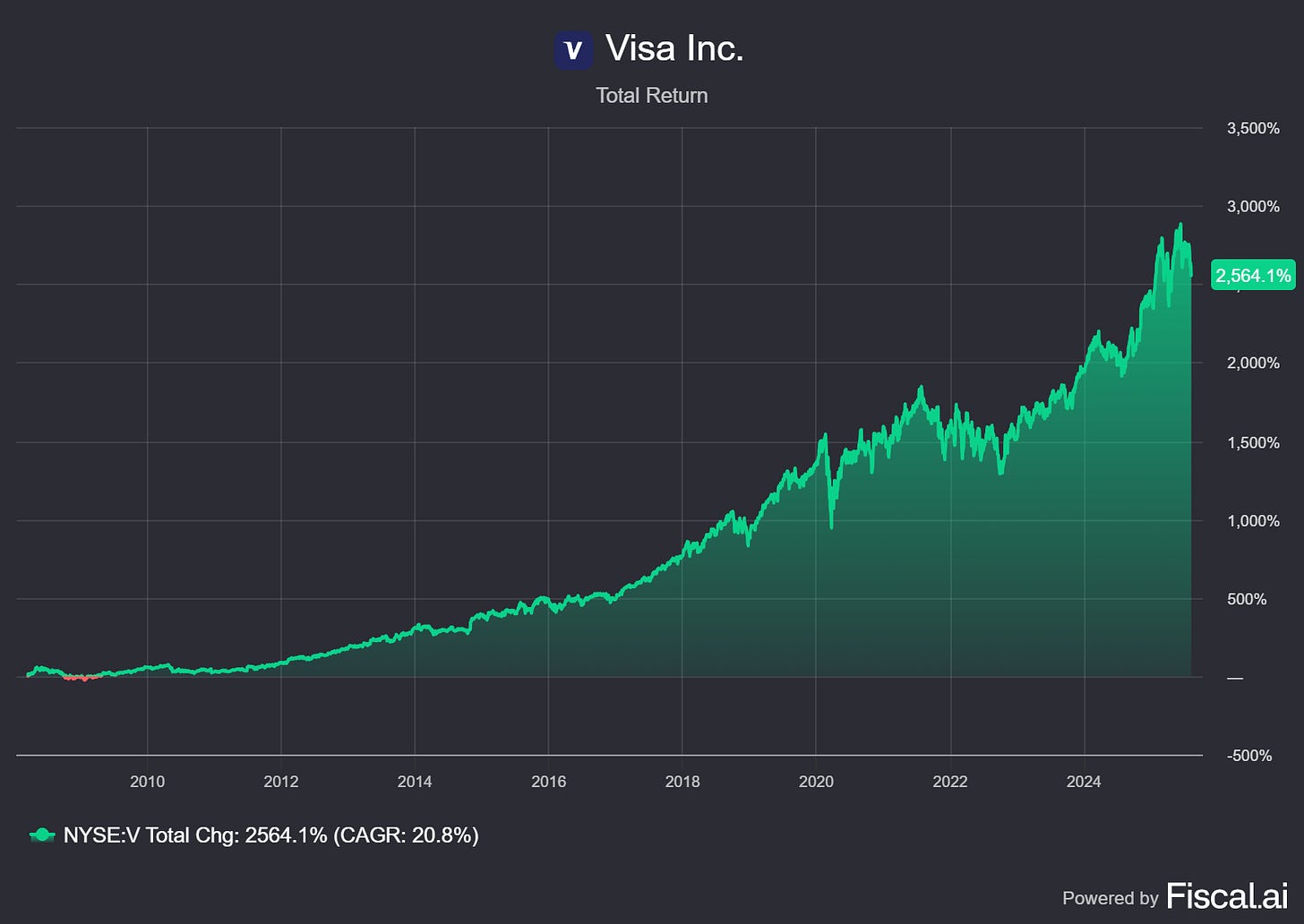

💳 5. Visa (V)

Visa operates the rails of the global economy. The brand, trust, and network effects it enjoys are virtually irreplaceable. While fintechs nibble at the edges, Visa quietly collects its toll — every swipe, every second, every day.

Visa gets transaction fees from credit and debit cards, sure. But it also earns a transaction fee from emerging digital wallets and payment systems. This is because Visa owns the infrastructure behind processing payments.

Crypto and stablecoins can be a future threat to Visa’s dominance, but right now, stablecoins represent less than 1% of global money transfer volumes.

Visa has been steadily compounding capital for its shareholders by 20.8% since its inception.

While Visa’s valuation at the current state is not very attractive, the business is likely to continue to grow EPS in the mid-teens for the next decade.

This is a stable and capital-light business with a very strong moat.

The rest of the article is for Premium subscribers only.