📈 10 Lessons from Quality Compounders

From Amazon to Nvidia, here is what the past decade’s winners teach us about building lasting wealth.

Hi there, investor 👋

Today, we’re giving you 10 compounding lessons from the last decade!

Let’s get into it 👇

Stories from the last decade’s most impressive compounders (And what we can learn from them).

Think back over the last 10–15 years. The rise of cloud, mobile, AI, digital payments, and biotech breakthroughs. Each secular trend breeds new winners. These are the true compounders with multi-decade runways.

Here are 10 lessons from world-class businesses, we can apply to our own investing 👇

1. Amazon: The Power of Riding a Secular Wave

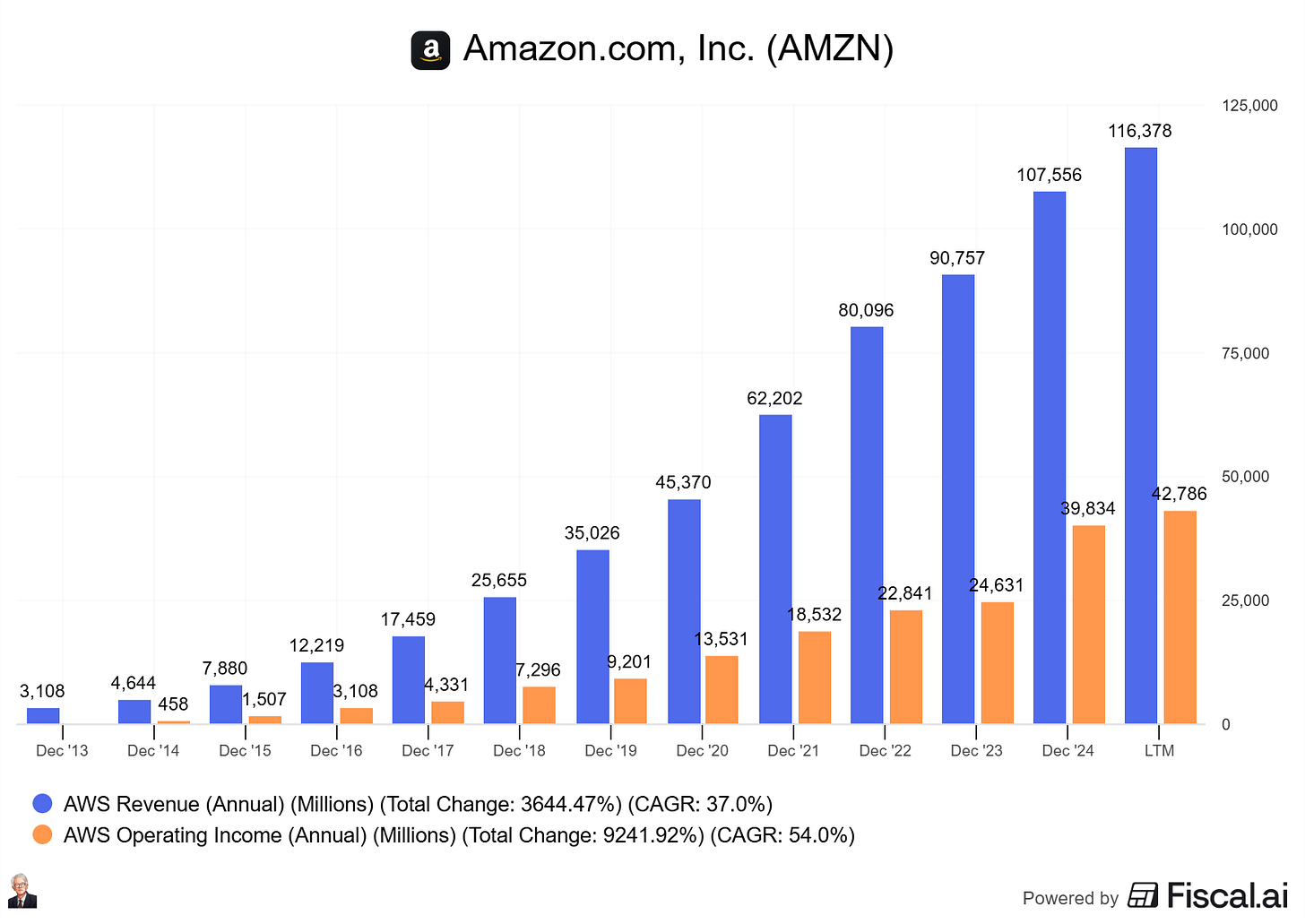

In 2006, Amazon launched something called “Amazon Web Services.” It seemed like a side project to sell spare computing power. Fast forward to 2025 and AWS generates +$116 billion annually in revenues and +$42 billion in operating income (!).

At the same time, Amazon’s core marketplace kept expanding as e-commerce went from niche to mainstream. Bezos didn’t create the internet, but he placed his company at the center of its growth.

The statistic that inspired Jeff Bezos to start Amazon was that internet usage was growing at a rate of 2,300% per year in 1994, creating a massive opportunity to sell products online, particularly books, which had a universal demand and a vast selection that physical stores couldn't match.

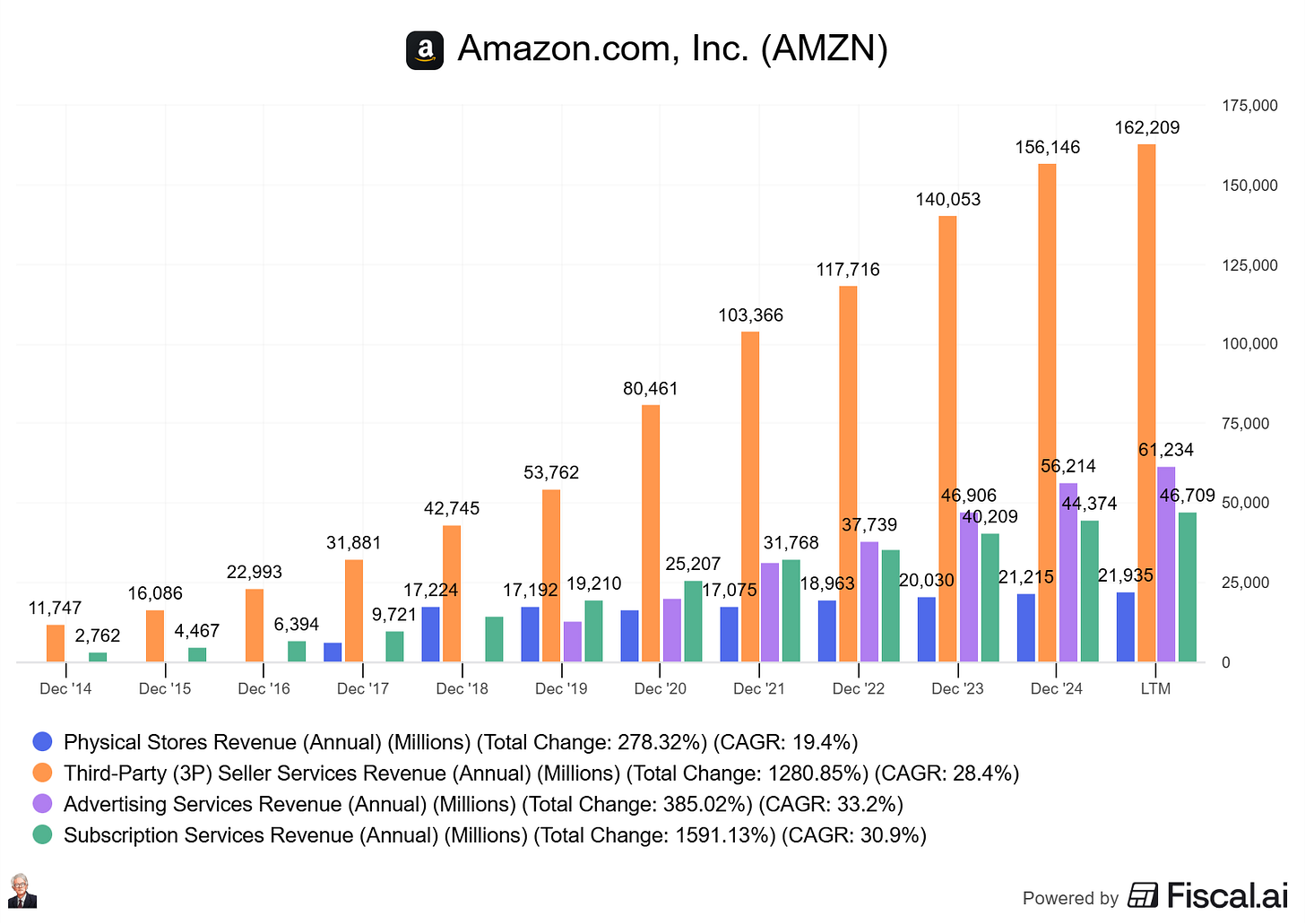

The incredible growth of Amazon’s e-commerce business has fueled multiple business segments that could be multi-billion-dollar companies if they were “standalone”.

👉 Lesson: The best compounders jump on massive opportunities (Like the statistic Bezos saw in 1994) and put everything into becoming the dominant market leader in the market.

👉 Lesson: The best compounders reinvest their proceeds into new business ventures. Amazon famously looked at its cost centres and asked, “How can these become profit centres?”. This was how AWS was born.

2. TSMC: The Backbone of Tech

TSMC is one of those companies you’ll never see the logo of on your phone or laptop, yet if you own an iPhone, drive a Tesla, or prompt ChatGPT, you depend on TSMC’s chips.

Apple, Nvidia, Amazon, and the giants of tech line up at TSMC’s foundries in Taiwan. Their extreme ultraviolet (EUV) machines produce semiconductors so advanced that no rival can catch them. Without TSMC, modern computing grinds to a halt.

But the real story behind TSMC is that it has +30 years of reputation for near-perfect yields and on-time delivery. In the fast-moving world of tech, this is crucial. TSMC is the factory that produces all the chips and technological devices that companies like Nvidia, AMD, and Tesla rely on to scale.

👉 Lesson: TSMC is a mission-critical foundry for the largest and fastest-growing technology firms in the world. Its competitive advantage is solidified by its production capabilities and a +30-year flawless reputation.

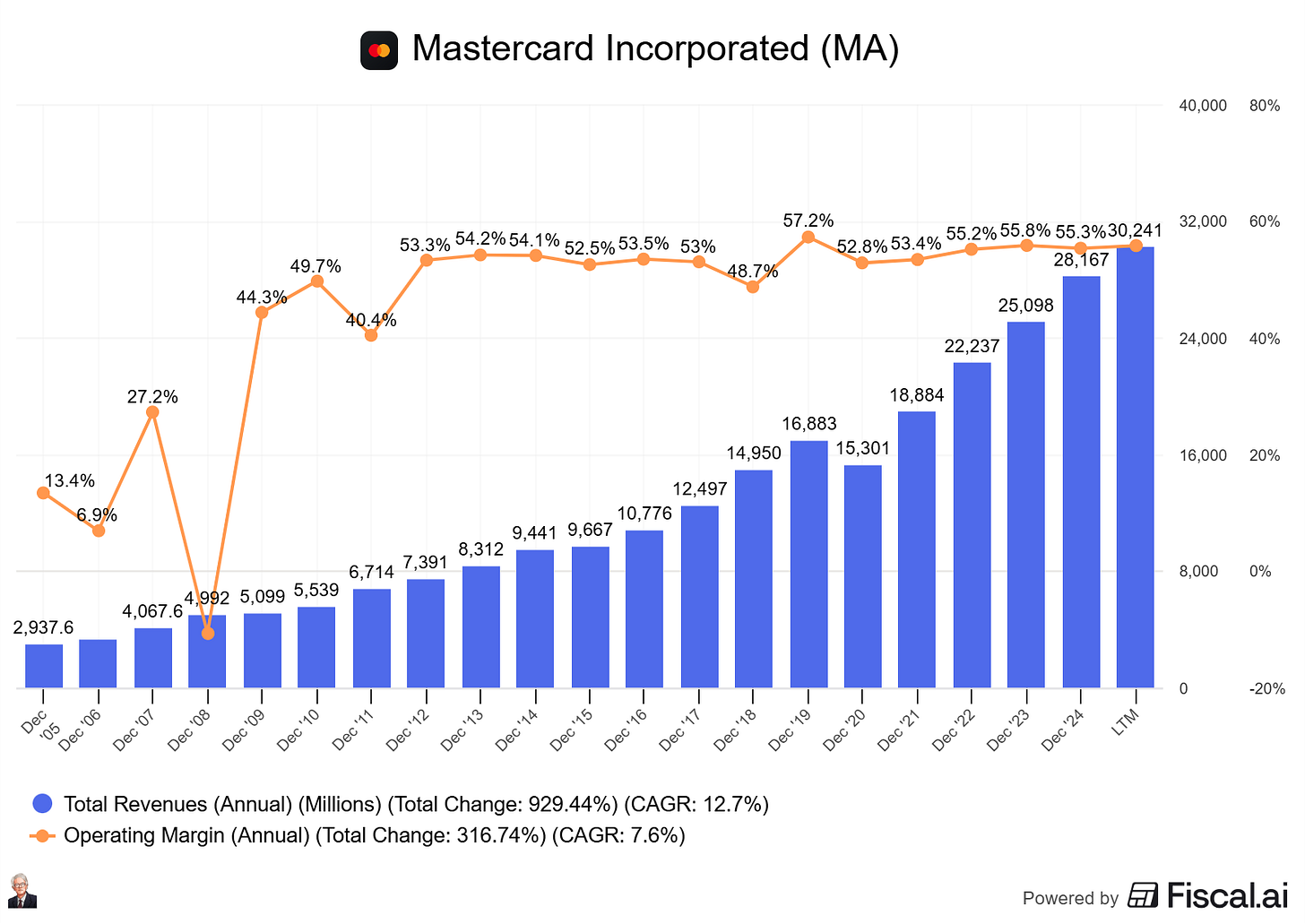

3. Mastercard: Pricing Power Supreme

Imagine running a business where you make money every time someone pays for groceries, books a flight, or grabs a coffee. That’s Mastercard. Their network is so entrenched that raising fees barely causes a ripple.

Most consumers don’t even realize Mastercard is taking a cut — but shareholders do. That’s what makes it one of the most reliable compounders of all time.

👉 Lesson: By owning the infrastructure or platform that other actors have to use to operate in an industry, Mastercard has a unique (almost) impossible to replicate advantage that allows it to raise prices without losing volume.

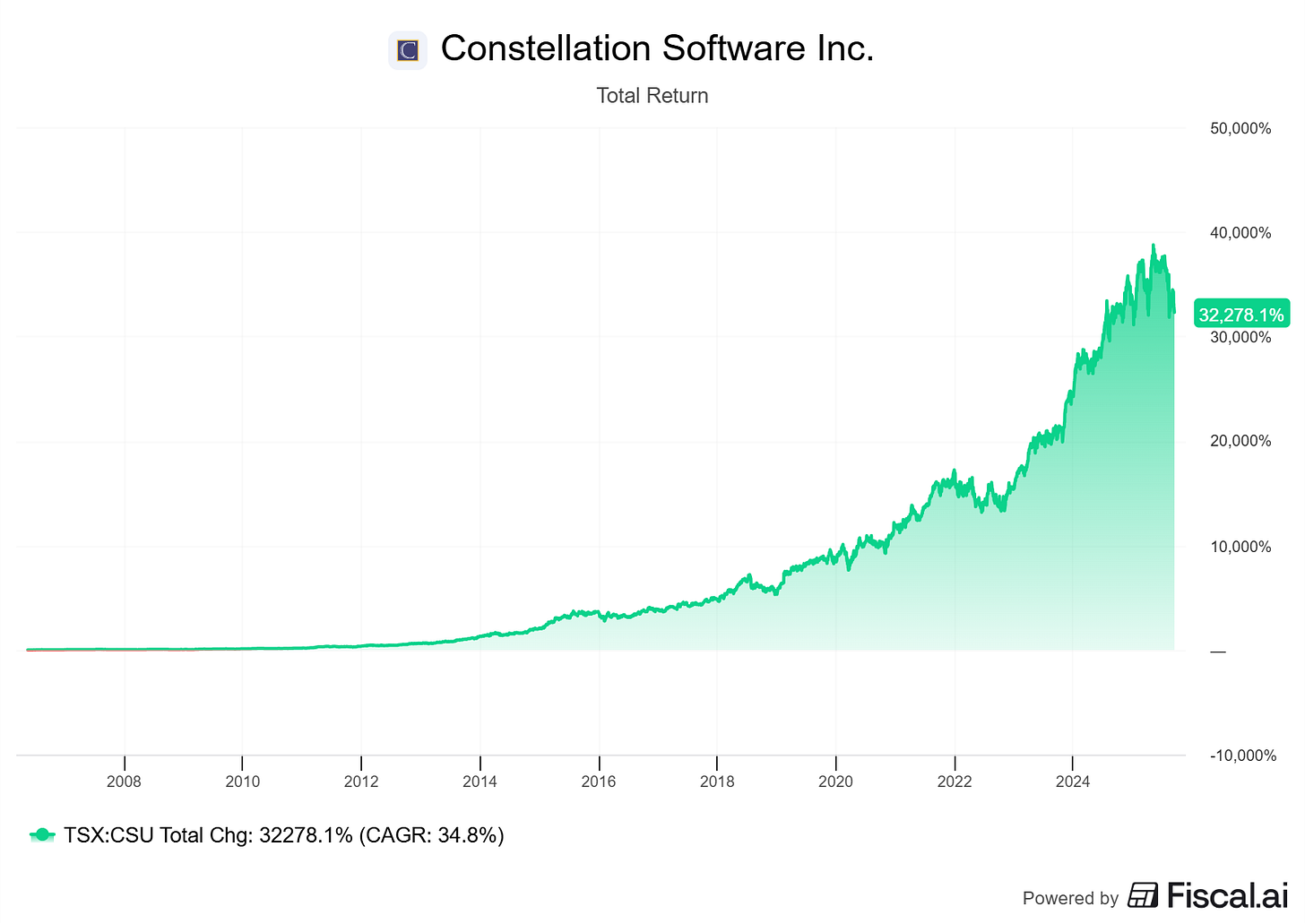

4. Constellation Software: Capital Allocation

Mark Leonard looks more like a philosopher than a CEO. He built Constellation not by chasing growth, but by buying hundreds of boring, niche software companies and running them efficiently.

It sounds dull — until you see the 34.9% CAGR returns since IPO. Leonard’s secret is an intense focus on finding high IRR, mission-critical companies that others are not interested in—this way, he can buy them on the cheap.

👉 Lesson: Sometimes the best compounders are built on boring businesses and extraordinary discipline.

👉 Lesson: Founder-led businesses tend to perform well, especially when you have a founder with a multi-decade track record of outperformance.

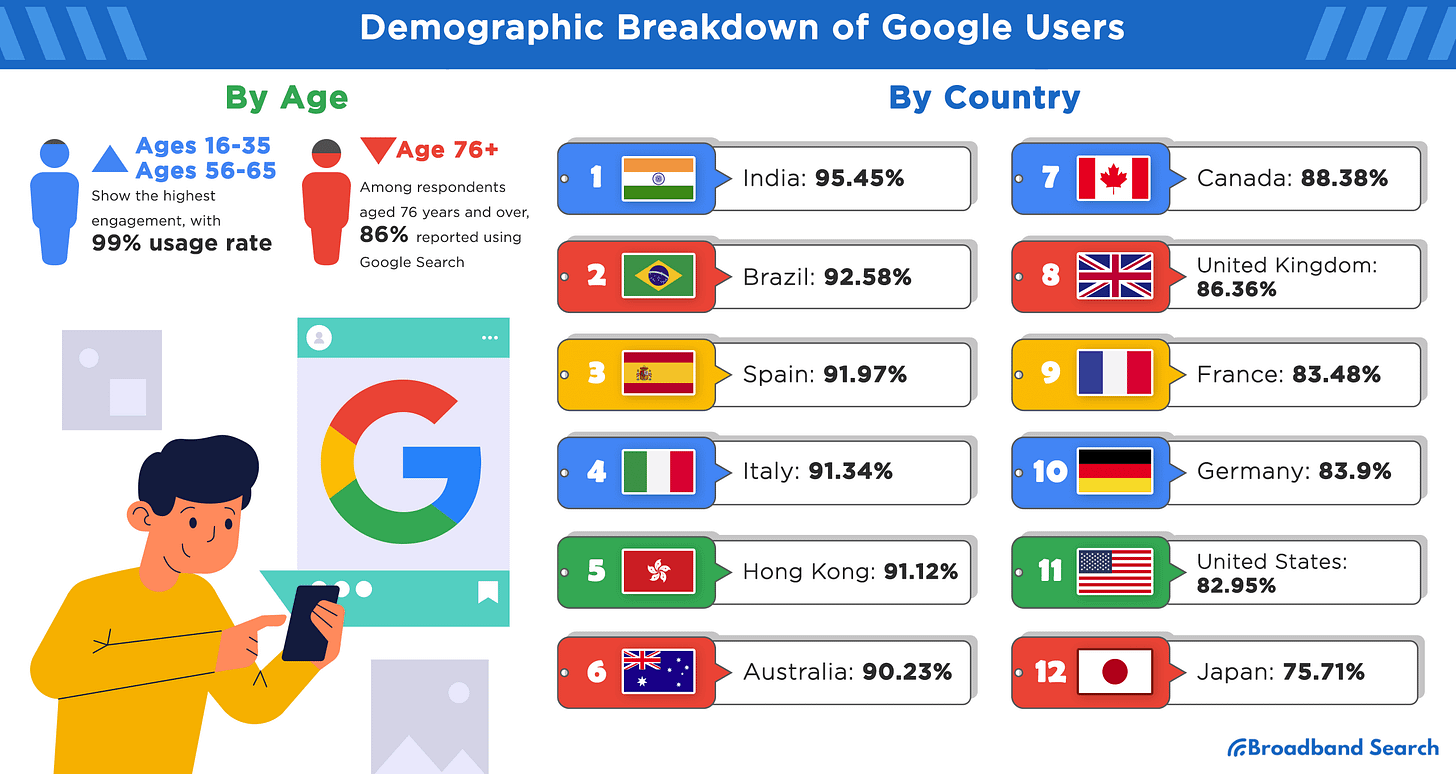

5. Alphabet: Google is hard to kill

Alphabet used its success with Google Search to build other digital assets like YouTube, Android, Google Maps, and now Google Cloud. Each became a billion-dollar-plus business. Few companies have created so many parallel growth engines.

Alphabet’s strategy has always been to create free products that are so good that everyone wants to use them. The result? Billions of users across multiple platforms.

This has positioned them to become a dominant leader in digital ads.

Alphabet pioneered the “If it’s free, you are the product” business model and keeps building on this business model.

👉 Lesson: Companies that own the platforms where millions or billions of consumers use every day have incredible growth potential and optionality. If you can spot these early, you can find many multi-baggers.

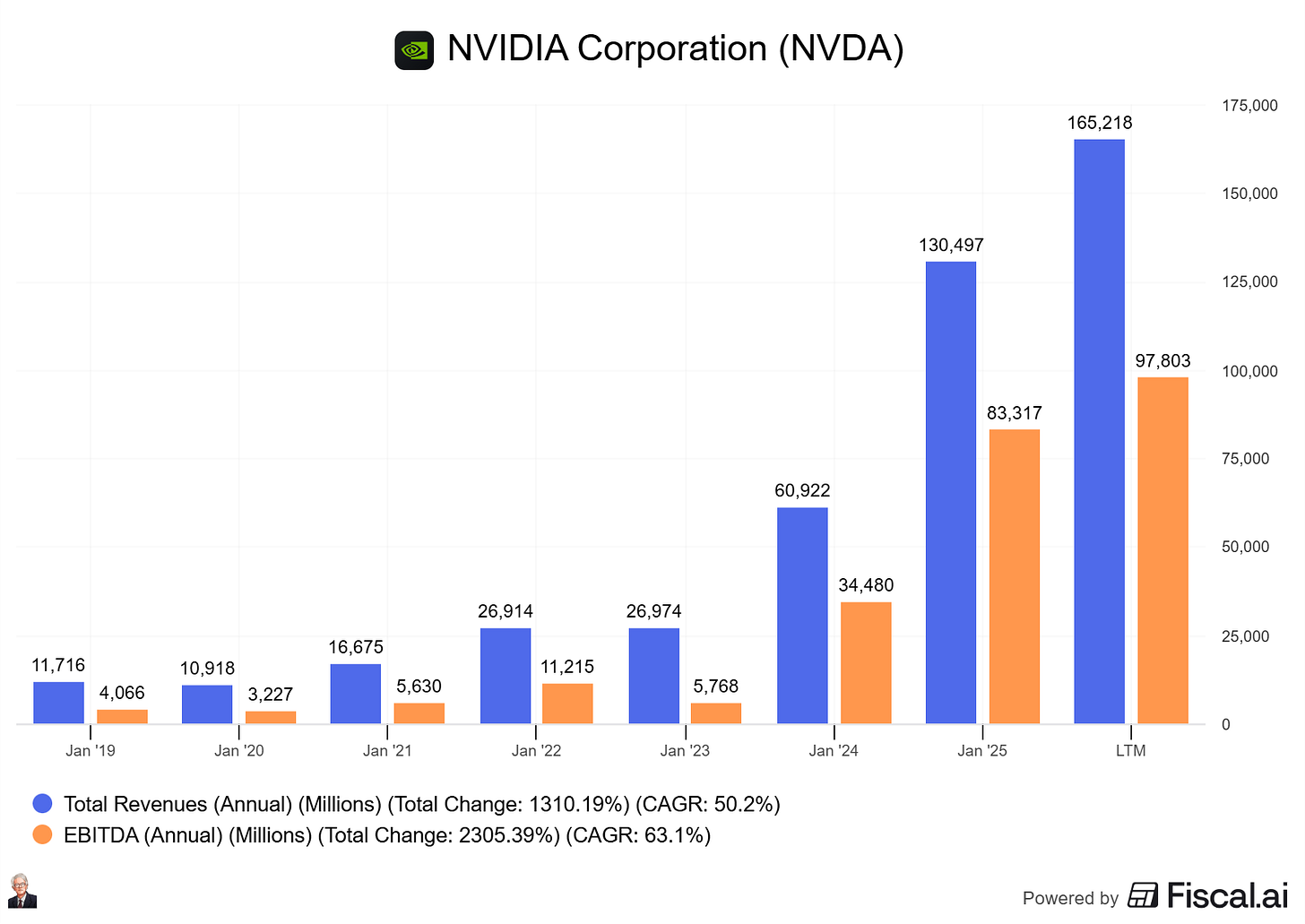

6. Nvidia: Asset-light business model

Nvidia designs the best chips. They outsource the manufacturing to TSMC. This ensures an asset-light business model with explosive upside. Their unique intellectual property and understanding of high-performance computing allow them to have incredible returns on capital and high margins.

When the demand for advanced GPUs exploded due to AI, Nvidia was ready with GPUs that every cloud provider and startup needed. Their capital efficiency turned R&D into one of the most profitable stories of the decade.

The growth was fueled by the “hyperscalers” with hundreds of billions in Capex budgets to become the AI leaders. Nvidia is selling the high-performing shovels for the hyperscalers to build their networks on.

Just look at how large a percentage of Nvidia’s revenue is turned into EBITDA:

👉 Lesson: Asset light market leaders that are uniquely positioned to offer the “shovels” to the “gold rush” are potential multibagger compounders (Still kicking myself for missing this one).

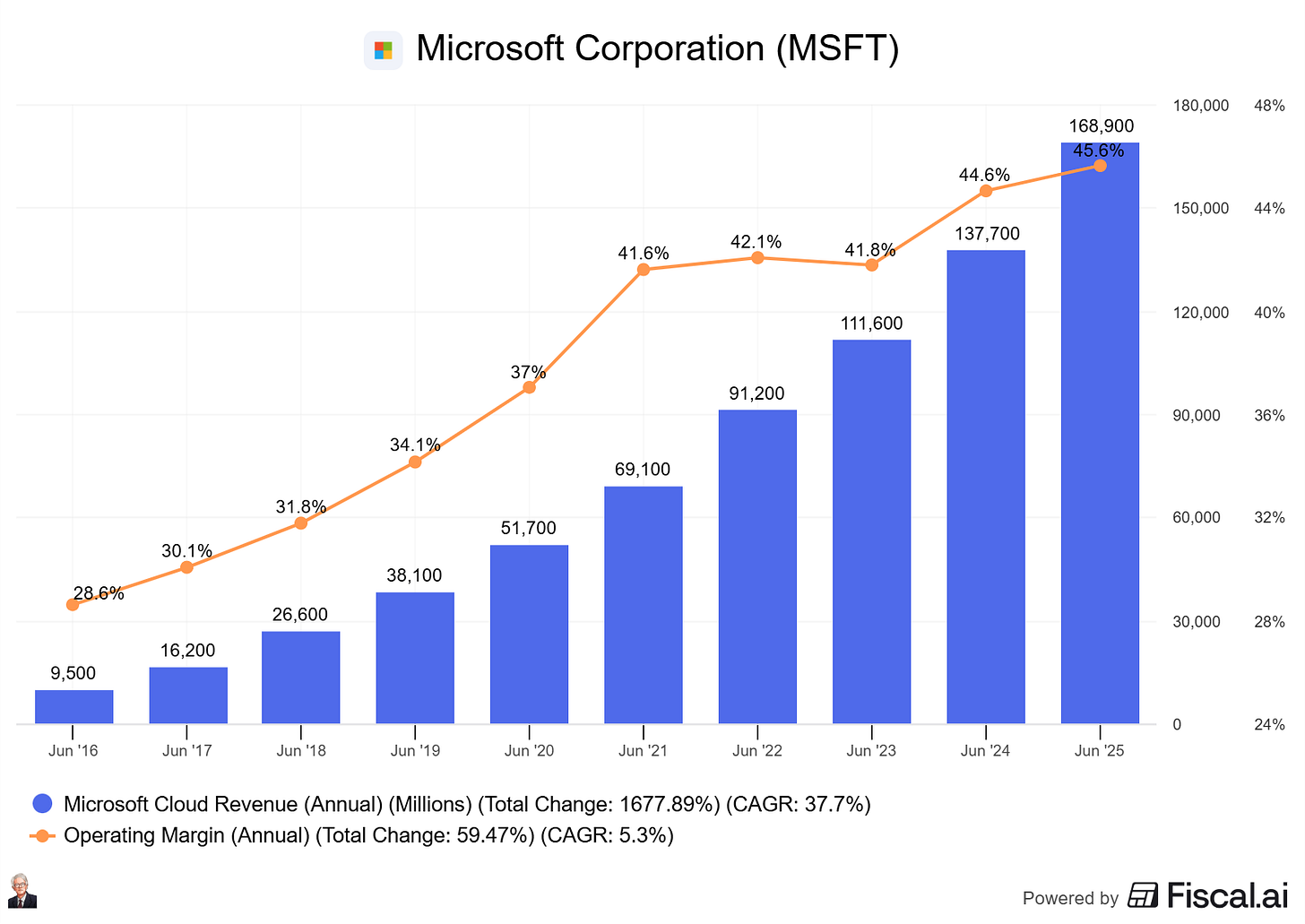

7. Microsoft: Turning Legacy into Cloud Lock-In

Microsoft’s empire was built on Windows and Office. For years, those products looked like legacy cash cows — useful, but uninspiring.

Satya Nadella flipped the script. By extending Office into the cloud (Office 365) and bundling it with Azure, Teams, and security services, Microsoft transformed its installed base into a growth engine.

The genius wasn’t just the cloud bet — it was leveraging entrenched habits. Every enterprise already relies on Word, Excel, and Outlook. Adding Azure or Teams wasn’t a hard sell; it was the path of least resistance.

Today, the switching costs are immense. Companies that standardize on Microsoft’s stack face massive disruption if they leave. They have to retrain the staff, migrate data, and break existing workflows. That pain keeps customers locked in and keeps Microsoft’s flywheel spinning.

👉 Lesson: A large installed base can be a unique opportunity if coupled with executives with the right vision and capabilities to add revenue and earnings from the existing base. Satya is a prime example of this.

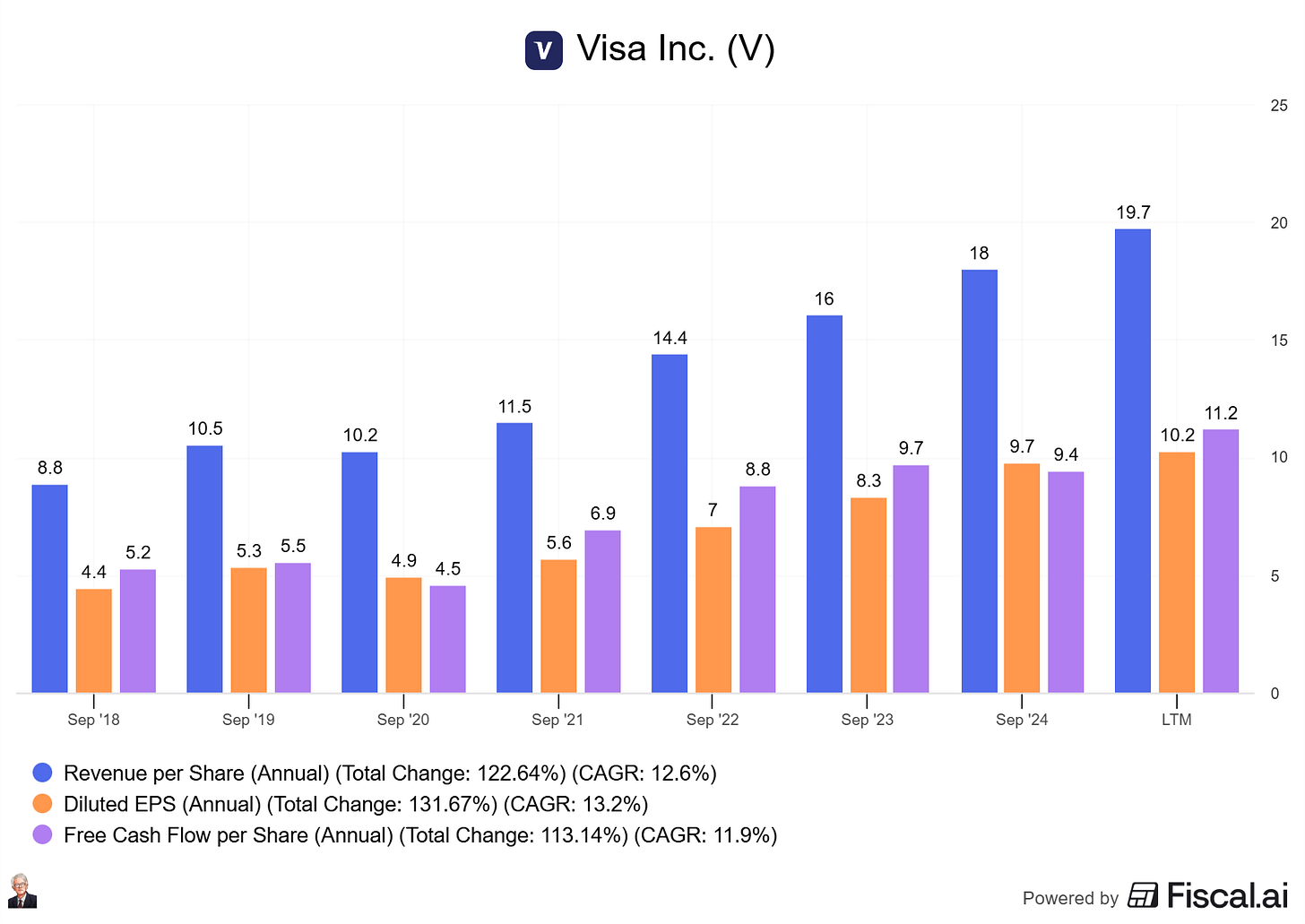

8. Visa: Anti-Fragile Business Model

During COVID, global travel collapsed. Cross-border transactions, Visa’s most profitable segment, dropped significantly overnight. Many thought earnings would be crushed for years.

Yet Visa’s moat was wider than expected. As the world reopened, transactions came roaring back. The shift from cash to cards continued, untouched by short-term shocks.

The low impact of the pandemic on Visa’s earnings can be attributed to its robust business model:

Visa has multiple streams of income. Cross-border revenues fell, domestic payments surged.

Digital payments accelerated in the pandemic. This pulled forward the adoption of contactless payments and e-commerce, benefiting Visa.

Visa does not lend money, meaning it has no credit risk to blow up in a crisis.

Visa’s model has operating leverage. Its network is already built; extra volume means extra flows into earnings and cash flows (Resilient model).

👉 Lesson: The best compounders have anti-fragile business models that bend during a crisis, but don’t break. Visa exemplifies this with an asset-light, low-risk business model that keeps compounding.

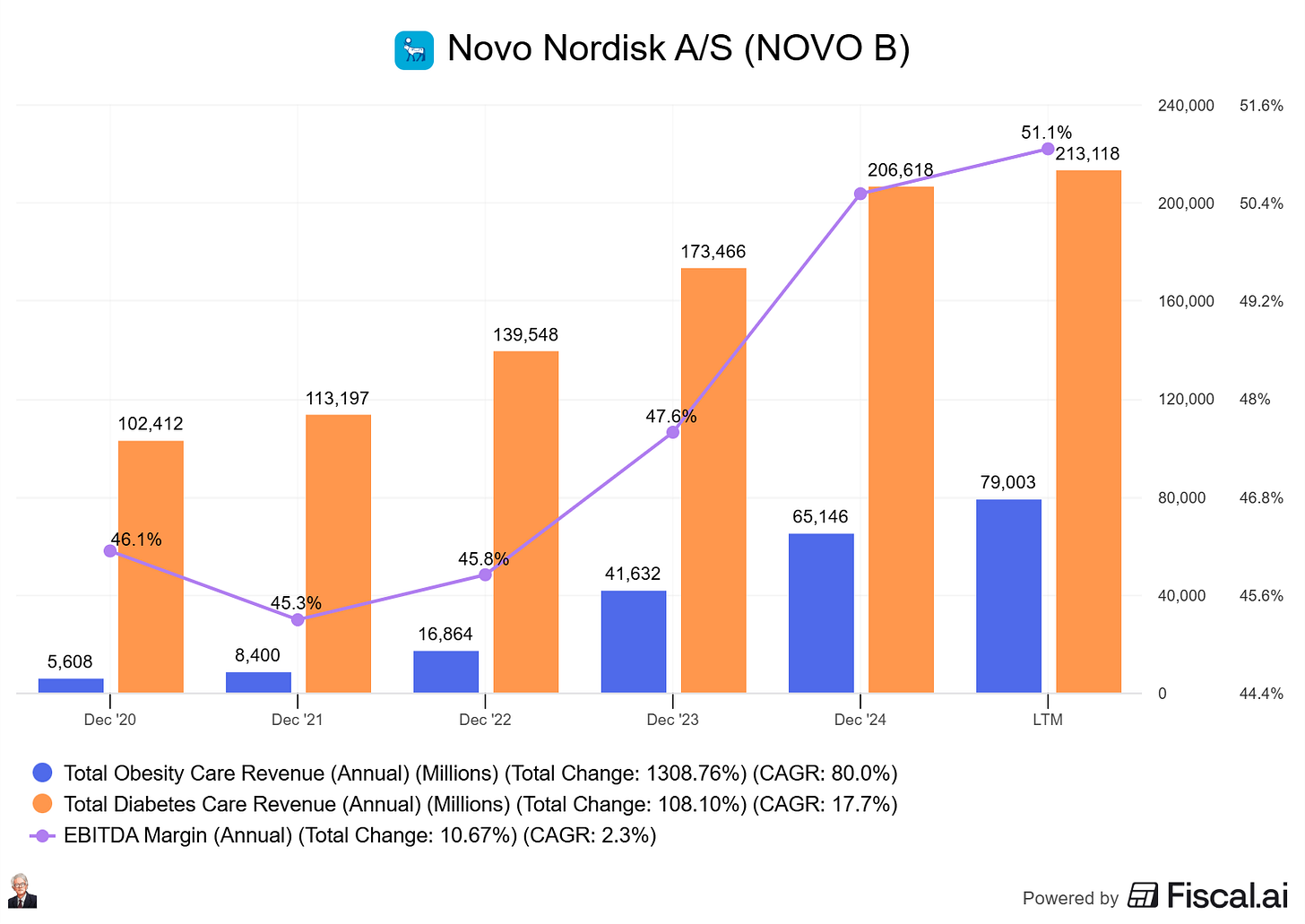

9. Novo Nordisk: Regulation as a Barrier

Launching a drug is brutally hard: years of trials, endless costs, constant regulatory hurdles. For Novo Nordisk, that difficulty became an advantage.

Once treatments like Ozempic or Wegovy made it through, patents and regulatory barriers locked out competition for years. Novo is now the market leader in one of the world’s biggest health challenges: obesity.

👉 Lesson: Regulation hurts the weak. But for experienced leaders, it becomes part of the moat. Companies that can handle hard problems will continue to win.

10. Shopify: Even Compounders Have a Price

At the peak of the pandemic e-commerce boom, Shopify traded at over 50x sales (!). The story was irresistible. Growth was off the charts. Investors piled into the stock.

Then reality hit: Growth normalized, margins shrank, and the stock fell 70%. This had more to do with the market’s expectations of Shopify than its operation itself. The extreme greed for “pandemic winners” at the time sent many digital leaders to totally insane valuations.

Shopify remained a great business, but a poor investment for those who bought at euphoric valuations.

From its low of $26 per share in 2022, Shopify is now trading at ~$150 per share, a +477% increase.

👉 Lesson: A world-class company can still be a terrible investment if you pay too much. A great business and market leader is not enough; price has to be taken into account.

👉 Lesson: Buying market leaders at depressed levels is a no-brainer strategy for great investment returns.

💡The recipe is simple, but not easy: Find durable, essential businesses. Watch for leadership and capital efficiency. Pay a fair price. Then let time do the compounding.

💬 Which of these lessons resonates most with you? And which company today do you think will be the Amazon or Microsoft of the 2030s? Share in the comments below 👇

Ready to take the next step? Here’s how I can help you grow your investing journey:

Go Premium — Unlock exclusive content and follow our market-beating Quality Growth portfolio. Learn more here.

Essentials of Quality Growth — Join over 300 investors who have built winning portfolios with this step-by-step guide to identifying top-quality compounders. Get the guide.

Free Valuation Cheat Sheet — Discover a simple, reliable way to value businesses and set your margin of safety. Download now.

Free Guide: How to Identify a Compounder — Learn the key traits of companies worth holding for the long term. Access it here.

Free Guide: How to Analyze Financial Statements — Master reading balance sheets, income statements, and cash flows. Start learning.

Get Featured — Promote yourself to over 24,000 active stock market investors with a 35% open rate. Reach out: investinassets20@gmail.com

Would you choose to invest in assets that gives you dividends back ? Or you'll rather go for mo dividends

Thanks for the lesson, how does one discover the next $NVDA, $AMZN or $GOOGL?