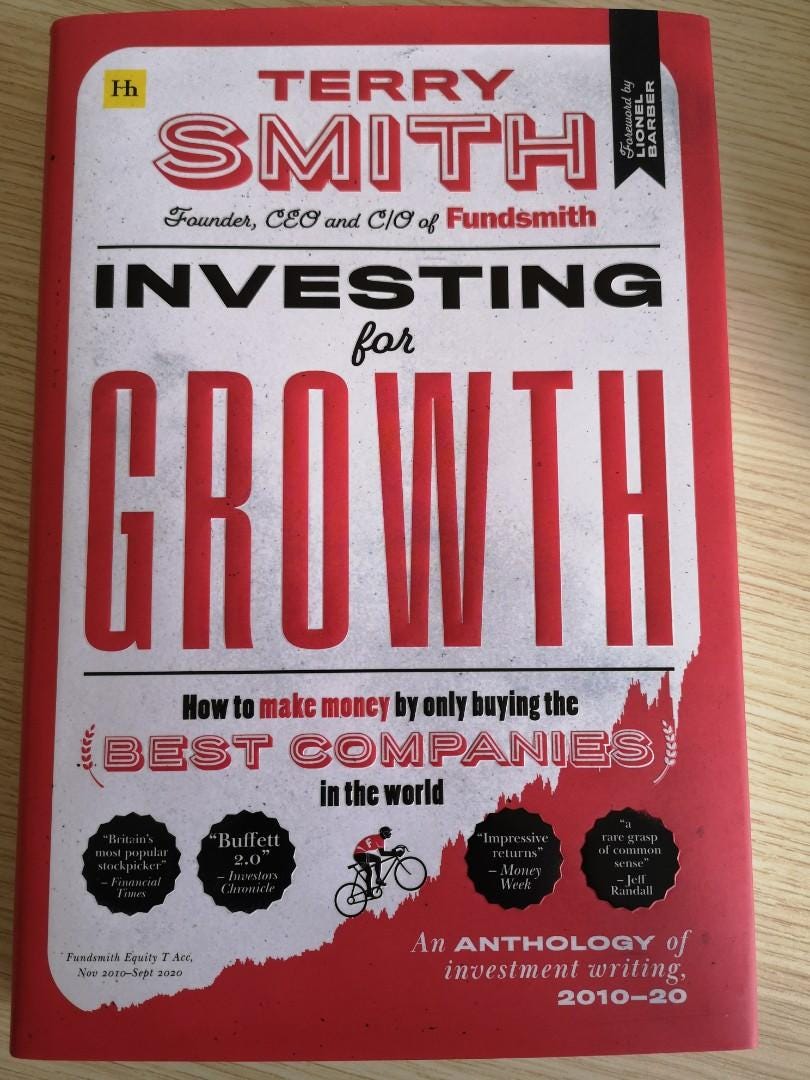

10 Lessons from Investing for Growth by Terry Smith 👑

10 Lesson to Sharpen your Investing skills 🧠

Today’s sponsor: Seeking Alpha

Seeking Alpha Premium will increase in price from $214 to $299 October 1st.

If you act now, you can get a 28.4% discount on one year of Seeking Alpha.

Seeking Alpha gives you access to some of the best analysts in the business, screeners, financial data, and much more. Read more here:

Hi there investor!

Today we’re bringing you 10 lessons from Terry Smith’s book, “Investing for Growth” that every investor should know.

Lesson 1: Business quality + Time invested > Valuation ⚖️

This point illustrates that a high-quality, durable business with plenty of room to grow can justify a high valuation.

Smith is not telling you to buy a 281 PE stock, but he suggests looking at the business quality and long-term growth prospects before looking at the price.

Lesson 2: Keep it simple ✅

Investing is simple, but not easy. The framework outlined in the book focuses on 3 key points to get right when investing:

Invest in good companies ✅

Don't overpay ✅

Do nothing ✅

All 3 are essential for superior results Quality + fair price + long-term

Lesson 3: High-return companies are usually hidden in plain sight 📈

You don't have to invest in micro-cap biotechnology stocks to achieve great returns.

Apple, Microsoft, and Chipotle are examples of superior businesses that have been in plain sight for years and produced great returns for shareholders.

Take Constellation Software as an example. Many have known about Constellation Software for years, yet failed to invest in a great business. They’ve missed a 31.56% CAGR in the last 10 years. Sometimes the best investing opportunities are not hidden in the pink sheets (Microcaps).

Lesson 4: Boring businesses are the superior investments 🥱

Boring = stable and predictable cash flows.

We tend to underestimate high-probability events and overestimate low-probability events. This is also why investors are likely to underestimate fantastic, but boring businesses like Watsco, Waste Management, Atlas Copco, and Assa Abloy.

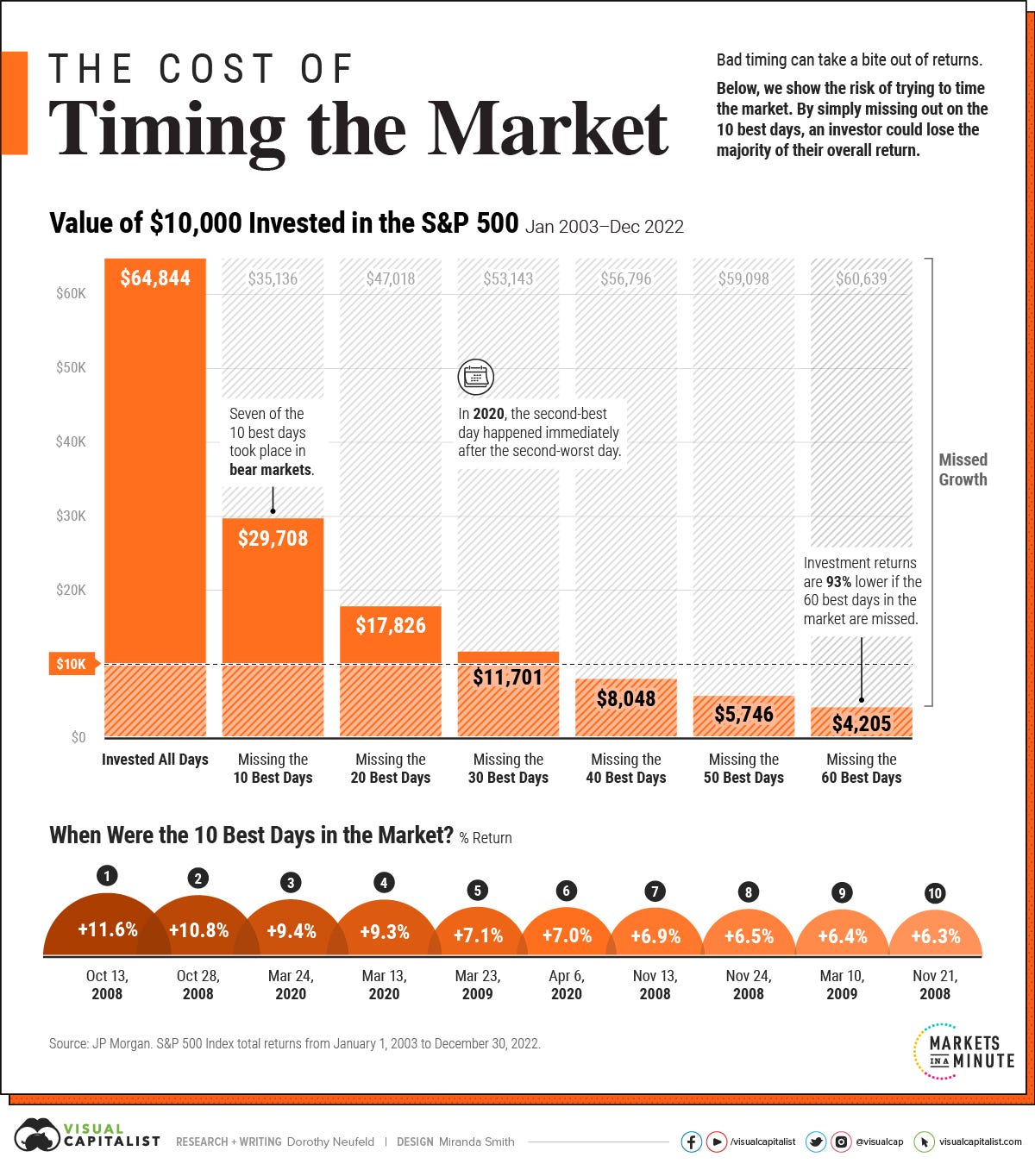

Lesson 5: Don't try timing the market ⌛

Time in the market beats timing the market.

For most investors, staying fully invested in productive assets is the best approach. This does not mean that you shouldn't take advantage of market drawdowns. Terry Smith makes portfolio changes based on these opportunities. You might just want to reposition your portfolio from expensive-looking businesses with limited growth ahead, for a cheap-looking business with plenty of growth ahead of it.

Lesson 6: Over-diversification leads to underperformance 📉

Boring quality businesses are usually diversified in terms of product and geography. This is achieved due to their global nature, having business in North America, Europe, and Asia. In addition, these companies often have multiple business segments that grow and diversify the cash flows of the business.

Having 10-20 quality businesses is likely enough diversification to take away most company-specific risk

Lesson 7: Pick companies that have already won 🏆

By picking a company that has already won, you will:

1) Reduce the risk as the company just needs to keep doing what it always has done. It is way easier to anticipate a business keeping the status quo than to expect a large change (E.g. predicting the next “Facebook”).

2) Achieve higher returns as the business is likely to have a sustained competitive advantage. If not, it would not be able to keep such a high return profile for a sustained period.

Winners keep on winning

Lesson 8: Don't watch your stock's price every day 💆🏻♂️

If you are losing sleep because of how your stocks are acting, turn off the screen and delete the app.

What determines a business's long-term price, are the fundamentals (earnings, cash flows).

In the short term, anything can happen

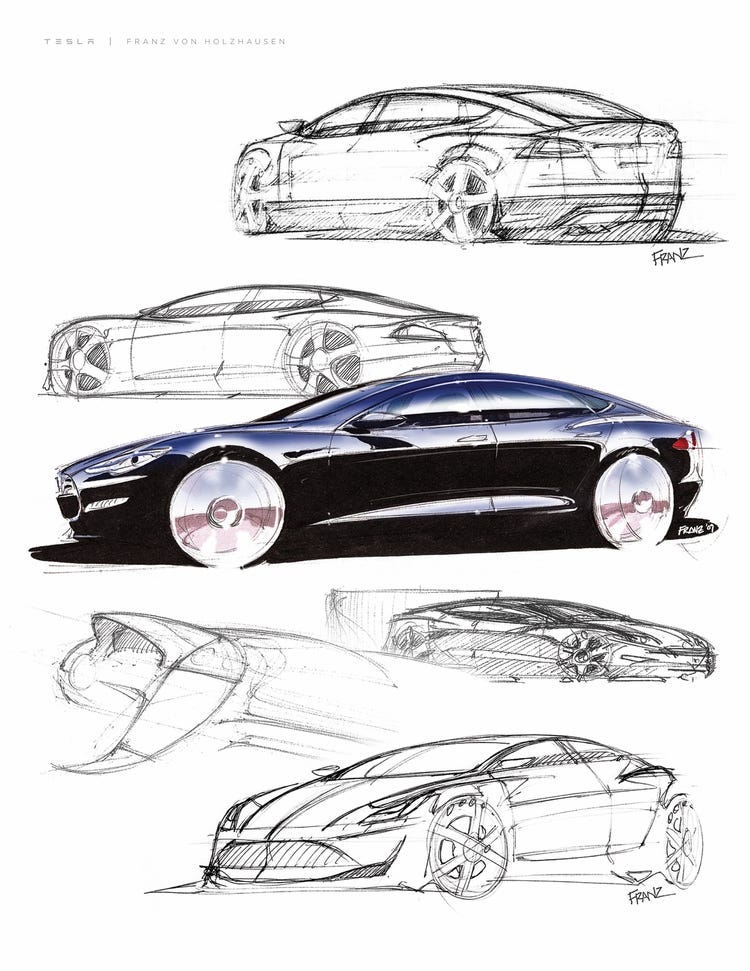

Lesson 9: Identify businesses that are producing superior products 🥇

Long-term winners have unique assets that their customers love or must have.

If these products were easy to replicate, someone would have done it already.

These businesses often have a moat that protects their earnings.

Examples of product excellence: Apple iPhone, Tesla EVs, Louis Vuitton/Hermes.

Lesson 10: Deal as infrequent as possible 😴

Consider this:

Investors are bad at timing the market

Fees will eat our returns if we deal too often

Our psychological biases will often lead to us selling and buying at bad times, creating a gap between our planned action and what we do when we execute trades/orders

Given this, the logical thing to do is to put a lot of effort into the investing decision. But once the decision is made, you should not change your mind on a whim. Great businesses tend to pay off over time.

Bottom line: Lower turnover in the portfolio is likely good for your returns

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 250 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +10.000 stock market investors (45% open rate) — Contact us via: investinassets20@gmail.com