Charlie Munger’s Top 10 Principles for Smarter Investing 🧭

The Architect of Berkshire Hathaway 🏰

Hi Investor! 👋

Today, we’ll break down 10 fundamental lessons from billionaire investor Charlie Munger.

Let’s get into it 👇

10 Key Lessons from the Wisdom of Charlie Munger That’ll make you a better investor

Charlie Munger, the late Vice Chairman of Berkshire Hathaway, was known for his business prowess and his invaluable words of advice. With his rational thinking, extreme buy-and-hold investments, and financial discipline, he’d achieved what most of us can only dream of.

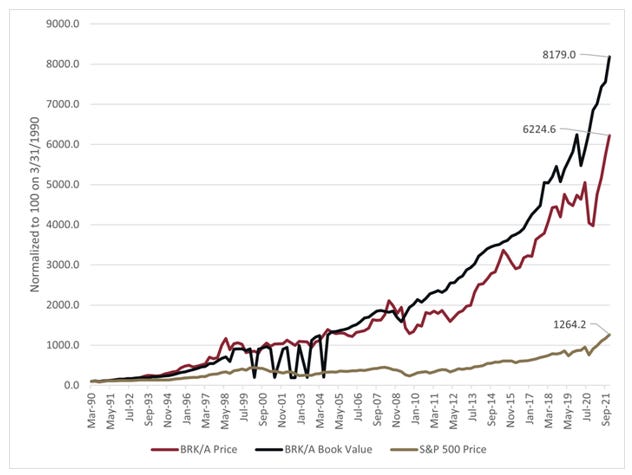

His partnership with Warren Buffett managed to transform Berkshire Hathaway into a conglomerate valued at a whopping +$780 billion. With each other’s wisdom, they made a small textile firm grow into the Berkshire Hathaway we know today.

Using his judgment, Munger could prevent psychological biases from clouding his investment decisions in a way that very few can. Fortunately for us, he has shared many pearls of wisdom with the world.

His investment philosophy emphasized the following:

Patience

Ethical business practices

The importance of continuous learning

Do you seek long-term success? Well, then, the following insights will surely come in handy 👇

Lesson 1: Prioritize Patience

“The big money is not in the buying or the selling, but in the waiting.” - Charlie Munger

It’s no secret that Charlie firmly believed in the idea of long-term holding of quality investments. From his knowledge and experience, it often yields better returns than frequent trading.

Great investment opportunities and businesses are hard to come by. Munger himself was famous for having extremely long positions in quality stocks. We mean decades! Including Berkshire Hathaway, The Washington Post, and Costco Wholesale.

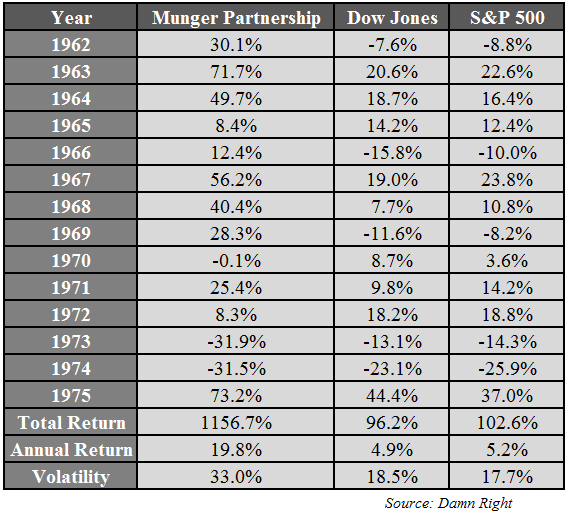

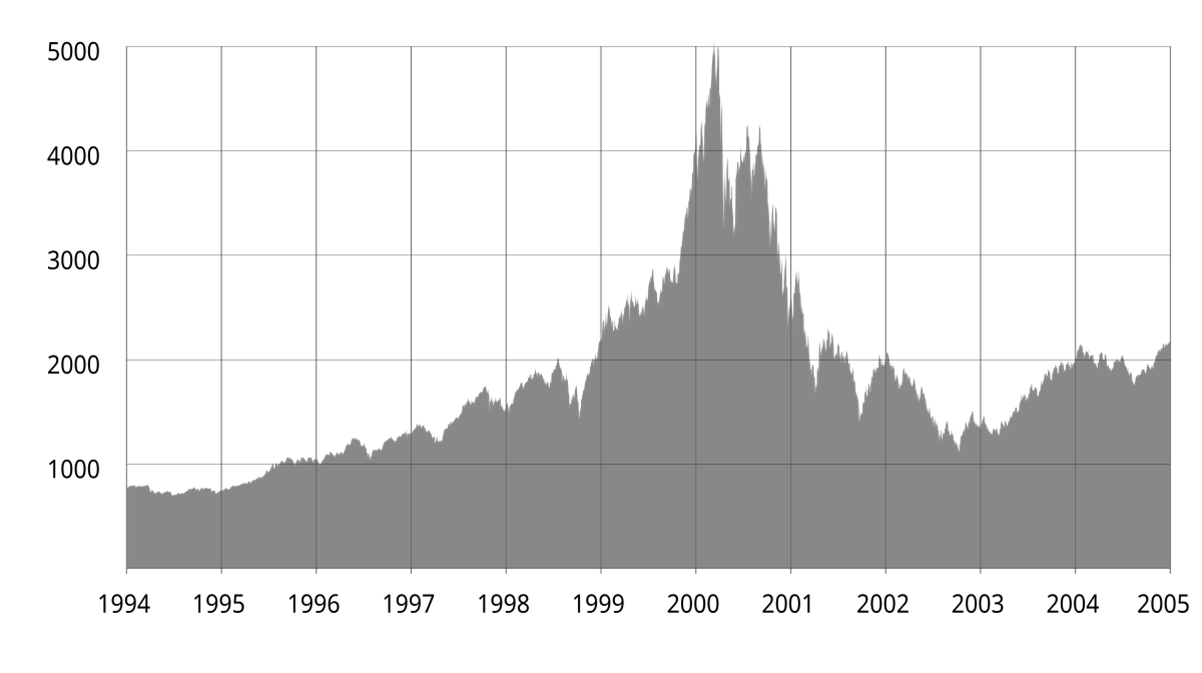

The performance of Munger’s partnership shows his investing intelligence, although the volatility of his portfolio was much higher than the indexes:

Lesson 2: Embrace Inversion as a Way of Thinking

“All I want to know is where I'm going to die so I'll never go there.” - Charlie Munger

He recalled a rustic saying and emphasized its importance for anyone who wants to avoid misery. He advocated that you can solve problems by inverting them.

You just have to identify what to avoid to achieve success. In common investing terms, this means steering clear of common pitfalls, such as:

Investing in businesses, you don't understand.

Allowing emotions to dictate your investment decisions.

Engaging in frequent trading that incurs high fees and taxes.

As simple as that!

Lesson 3: Leverage the Power of Incentives

“Show me the incentive and I will show you the outcome.” - Charlie Munger

Are you looking to thrive as an investor in the long run? Then surely, recognizing how incentives drive your behavior is crucial. Munger, too, believed that misaligned incentives often lead to poor decisions.

You can observe how he applied this with his $88 million investment in BYD Company through Himalaya Capital. All because he was impressed with the incentive structures and management. He felt it aligned employee performance with company success perfectly by offering equity-based incentives and profit-sharing principles in the company.

Now, his investment is valued at nearly $400 million!

Lesson 4: Stay Within Your Circle of Competence

“Knowing what you don't know is more useful than being brilliant.” - Charlie Munger

He recommends investing in areas where you have knowledge and understanding. However, if you take the risk of venturing beyond that, it might lead to some costly mistakes.

A prime example of this principle can be observed in 1999 when Berkshire refrained from investing in Tech stocks. That, too, during the dot-com boom. Later, in the 2000s, when that bubble inevitably burst, Berkshire emerged unscathed!

That being said, you must always strive to learn what you don’t know. Just the way Berkshire and Charlie have. And now, Berkshire owns a significant stake in Apple.

Lesson 5: Seek High-Quality, Ethical Businesses

“It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” - Charlie Munger

Are you still blindly chasing undervalued stocks? It’s time to stop and invest in strong, ethical companies that have sustainable models. For starters, look at Charlie’s personal investment portfolio at the time of his death. It consisted mainly of four high-quality stocks:

1. Wells Fargo

2. Bank of America

3. Alibaba

4. US Bancorp

Other than these, he also loved 3 other stocks:

BYD Company

Daily Journal Corporation

Costco

Lesson 6: Value Continuous Learning

“In my whole life, I have known no wise people who didn't read all the time - none, zero.” - Charlie Munger

Charlie, a lifelong learner himself, emphasized the importance of reading. Thus, to make informed investment decisions, you must expand your knowledge base. It will help you keep up with the ever-evolving investment world.

Lesson 7: Focus on the Long Term

“The world is full of foolish gamblers, and they will not do as well as the patient investor” – Charlie Munger

This lesson is probably the crux of Charlie’s long journey as an investor. Thus, you must focus on long-term business performance. Short-term market fluctuations are rarely important, and you must not get swayed.

Lesson 8: Recognize the Role of Psychology

“If you don't get elementary probability into your repertoire, you go through a long life like a one-legged man in an ass-kicking contest.” - Charlie Munger

You can easily avoid common errors if you have a great understanding of psychology and human biases. For instance, take Berkshire’s investment in See’s Candies’ brand strength and pricing power. Despite its low book value, he saw a high-probability return.

As a result, it led to a $25 million investment that generated over $2 billion. Extraordinarily sweet, indeed!

Lesson 9: Avoid Over-Diversification

“The idea of excessive diversification is madness.” - Charlie Munger

This is not something that we, as investors, get to hear often. But, look at it this way. If you concentrate your investments on well-understood businesses, it can lead to better outcomes, right? Especially when compared to spreading your resources too thin.

What happens as a result of spreading your portfolio among hundreds of businesses is that you, at the very best, will trail the index, and at the very worst, will underperform due to taxes and fees.

Lesson 10: Maintain Rationality

“A lot of people with high IQs are terrible investors because they've got terrible temperaments.” - Charlie Munger

Maintaining your rationality and discipline as an investor is paramount. When faced with market volatility, it is key to investment success. Charlie displayed an unmatched rationality and discipline through multiple booms and busts. This is one of the traits we’ve come to love from Charlie.

For instance, right after the 1987 crash, Munger stayed rational. As a matter of fact, he pushed Buffett to invest heavily in Coca-Cola. Ignoring the panic and noise around them, they focused on the fundamentals.

As a result, their billion-dollar stake had blossomed by more than 11% in annualized gains by 2018. Hence, proving that discipline beats emotion in long-term investing.

Charlie Munger’s principles are not just theoretically sound. Rather, they’re practically effective for investors. As evidenced by his investments. He offers us a thoughtful roadmap to help navigate the complexities of this market.

That was it for today. Do tell us what you think about these lessons!

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 300 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +13,000 stock market investors (42% open rate) — Contact us via: investinassets20@gmail.com

Do you really think Charlie Munger believed in portfolio rebalancing? That requires trimming your winners to free up cash to put into your positions that aren’t doing so well. Can you please provide some examples of him doing this, or urging Buffett to do it?

Hi, we’d love if you checked out Stock Analysis and our affiliate program! We can even get you a Stock Analysis Unlimited account if you sign up. Email kyle@stockanalysis.com if interested!