🏰10 Incredible Lessons from Quality Investing

🧠<5 min read

Seeking more investment ideas?

Capital Employed publishes an excellent bi-weekly newsletter that features a curation of the best stock pitches from both professional and talented private investors.

Join thousands of investors who receive this free newsletter. You can automatically subscribe with the button below

10 Incredible Lessons from Quality Investing

The author of Quality Investing, Lawrence A. Cunningham is a corporate director, advisor, author, professor, and lawyer. Cunningham is the founder of the “Quality Shareholders Group” and a special counsel with Mayer Brown LLP, an international law firm. Cunningham has served on the board of quality businesses like Constellation Software, Kelly Group Partners, and Markel Group.

Quality Investing (The book) addresses the challenges and distills years of practical investing into a comprehensive book on this investing philosophy.

The book teaches us how to identify prospering companies with high-quality traits that will increase our probability of good long-term investments.

Through a series of real-life case studies, the book illustrates the traits that signify quality, as well as how these traits can be used to deceive investors.

This book is highly recommended to read and study.

Let’s dive into the 10 most impactful lessons from the book:

1. Success leaves clues

The book identifies many patterns to look for in a quality business. The book talks about 12 specific patterns we should look for in businesses:

Recurring Revenue (Netflix)

Friendly Middlemen (Brown & Brown)

Toll Roads (S&P Global)

Low Price – Plus (Costco)

Pricing power (Apple)

Brand Strength (Coca Cola)

Innovation Dependence (Alphabet)

Forward Integrators (Dominoes)

Market Share gainers (Tesla)

Global capabilities and leadership (McDonald’s)

Corporate Culture (Cadence Design Systems)

Cost to Replicate (Boeing)

There are countless examples in each of these patterns. If you want me to write a longer article on the above subject, let me know in the comments.

2. The best companies have the same foundation

The "building blocks" outlined in the book are:

Capital Allocation - This can be determined by looking at measures of ROIC/ROCE over time & management decisions on excess cash.

Return on Capital - Ideally, the return on capital over time is above 15% with few off years.

Multiple Sources of Growth - Multiple growing business segments are a trait of the best businesses in the world. Example: LVMH

Good Management - It is preferred that the management holds a stake in the business. Their track records should also be examined and their integrity questioned.

Industry Structure - Some industries are just better to be in than others. We prefer to invest in industries with low competition, where a few actors have a significant market share (Oligopolies).

Customer Benefits - At the end of the day, if the end-user of your product or service is not happy, eventually, it will show up in the financials.

Competitive Advantages - We want to invest in businesses that return an above-average rate of return and are able to protect that above-average return from competitors, hence, a moat is needed.

These points are covered in detail in Essentials of Quality Growth.

3. Product & Service Quality

Behind every stock is a business that sells products and/or services to a group of customers. The book suggests determining the quality of the products by:

Measuring brand strength: There are many ways to measure brand strength, but an obvious one is to view customer satisfaction, loyalty, and ultimately the Net Promoter Score (NPS) vs. its competitors.

Innovative dominance: Companies that invest significantly in their innovative efforts, and deliver results on that investment, can continuously increase the accuracy of their value proposition to their customers, winning market share and gaining an advantage.

Global capabilities: In the digital age of the internet, a global reach has never been more available. The best companies are not only successful with their product in one region, they have expanded it globally.

Cost to replicate: The product or service should be very hard and incur a significant cost to replicate. Ideally, there are imitative resources that the business has that are hard or impossible to replicate by others. An example here is the IP of Blizzard (Now part of Activision Blizzard & Microsoft).

Pricing power: Even if the business only has local reach, pricing power can make it one hell of an investment. See’s Candy has made Berkshire more than $1 billion in cash flows, and the initial investment was only $25 million in 1972.

4. Use a Management Checklist

AKO checks several points on the management teams:

Disciplined M&As: Example - Constellation Software with hurdle rates of +20%.

Prudent Balance Sheets - Meta Platforms with a net cash position.

Counter-cyclical investments - Copart buys back shares as the stock drops below intrinsic value (And not at all-time highs).

Incentive programs with a focus on ROC - Texas Instrument incentivize management to grow the free cash flow per share (Counteracting excessive stock-based compensation packages).

Honest & transparent in the light of bad news

5. Financial Traits to look for

1. Strong & Predictable cash generation

There are many companies with strong cash flows, but a fewer number with predictable cash flows. Finding businesses less affected by economic downturns is hard, but necessary if we want superior returns.

2. Sustainably high returns on capital:

Sustained returns on capital above +15% are what we look for. If the business has 40% one year, and -10% the next, we don’t like to look at the average, as the business is destroying value in some years while creating value in others. Instead, we want to look for consistent value creators with high ROIC/ROCEs:

3. Attractive growth opportunities

Ideally, we can see a positive secular trend that the business is well positioned for. This ensures that we invest in companies with a growing demand for their product & services.

All of these are important, but if you combine all 3 you get a powerful combination.

6. Patterns of superior leaders

The book warns about following so-called "Celebrity CEOs" that are frequently portrayed in the media (Anyone come to mind?)

A study cited in the book found that award-winning CEOs subsequently underperformed non-award-winning CEOs in the following period.

Instead of being blinded by the flashy CEO, we should go back to our management checklist in lesson 4.

7. Pitfalls of quality investing

Companies may appear temporarily attractive on quantitative measures - but the book advises us to look deeper. The attractiveness might be due to:

Disruption risk

Cyclical growth

Temporary tailwinds

Fickle consumer trends

We must identify the underlying trend as attractive. If it has not been proven over several years, we may fall victim to investing in an industry experiencing temporary tailwinds built on fickle consumer trends.

8. Quality investing cannot be reduced to numbers alone

“It is easier to explain that a stock is cheap than that a company is great.”

The book argues that simple valuation models provide little value compared to the qualitative research needed to identify a quality business.

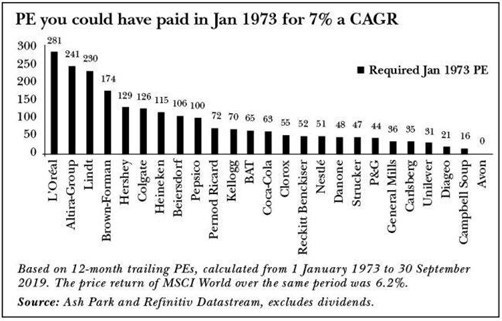

As investors, we should always aim to identify the truly best businesses we can, then look at the valuation after. Although I would argue that valuation plays an important role in a great investment.

9. Quality investing is not about discovery

AKO focuses on well-known companies and brands that have delivered results for a long time. Successful investing in their view is the dull practice of analyzing companies that are in plain view.

We are not looking for a business that can become a winner, we are looking for businesses that have already won.

This can be boring to some investors, which is why this approach is not for everybody.

10. Preference for oligopolies

Fragmented markets are usually more volatile and have fierce competition.

AKO looks for stable markets that have persisted over long time periods Additionally, they prefer the market leaders in these markets over the #2 or #3 player.

A few examples:

Payment processing: Visa & Mastercard

Smart Phones: Apple & Samsung

Soft Drinks: Coca Cola & Pepsico

Fast Fashion: H&M & Zara

Digital Advertising: Google & Meta Platforms

Summary of the 10 lessons:

Growth, ROC, Moats & Management matters

Product quality is essential

Successful CEOs leave clues

Cyclical earnings can deceive us

Investing is more than just numbers

Quality is already in plain sight

Checklists are essential

Oligopolies are the place to be

If you enjoy Invest in Quality, please leave a testimonial - it means the world to us! Click here: Testimonial

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 250 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +6.500 stock market investors (48% open rate) — Contact us via: investinassets20@gmail.com