📈Howard Marks’ 10 Rules Smart Investors Actually Follow (But Rarely Talk About)

How Howard Marks consistantly beats the market 🚀

Hi Investor! 👋

Today, we’ll break down 10 essential lessons from Howard Marks, the world-renowned co-founder of Oaktree Capital Management. And, the author of the famed “The Most Important Thing” memos.

Let’s dive in 👇

10 Key Lessons from the Mind of Howard Marks That’ll Refine Your Investment Thinking

Howard Marks is known not just for generating solid returns at Oaktree Capital. Rather, it’s how he actually thinks about investing. His memos are a treasure trove of investment wisdom. He’s hell-bent on emphasizing thoughtful risk assessment, cyclical thinking, and second-level decision-making.

Since founding Oaktree in 1995, Marks has grown the firm into a global alternative investment powerhouse—that too, with over $203 billion in assets under management as of 31st March 2025.

Not an easy feat, is it? Well, 64 out of 100 of the largest pension plans in the USA are the firm’s clients.

“You can’t predict. You can prepare.” — Howard Marks

Marks doesn’t try to forecast the future. He focuses on preparing for what might happen. His biggest edge? Superior thinking, not superior forecasting.

And if Marks can, you can too. Here’s how:👇

Lesson 1: Understand Risk Beyond Numbers

“Risk means more things can happen than will happen.” — Howard Marks

Most investors confuse volatility with risk. Marks disagrees. Instead, he clarifies: Real investment risk is the likelihood of permanent capital loss.

His 2008 memo, “Nobody Knows”, explained how investors ignored risk in the run-up to the financial crisis. And ultimately, they paid the price. While most chased returns, Oaktree preserved capital and bought distressed assets post-crash.

In 2008–09, distressed debt returned over 20% while equity markets were negative. And, by 2009, the gain was nearly $19.1 billion. All because the firm decided to pounce in 2008 with a $5.3 billion investment.

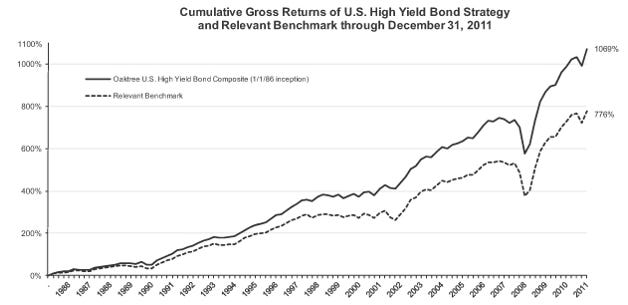

Hence, Marks didn’t avoid risk; he understood it. It then even outperformed its benchmark significantly by 2011.

Lesson 2: Master Market Cycles

“You can’t predict the future, but you can observe where you are in the cycle.” — Howard Marks

One of his core frameworks is cyclical awareness. He believes markets are inherently cyclical: driven by emotion and excess. In 2006–07, when everyone was euphoric, Oaktree cut back on risk.

Post-2008, when others panicked, they invested heavily in credit. So, by 2011, 17 of Oaktree’s distressed debt funds posted returns averaging 19% annually. That too after fees, and for 22 consecutive years.

Lesson 3: Think Second-Level

“First-level thinking says, It’s a good company, let’s buy it. Second-level thinking says, It’s a good company, but everyone thinks it’s great, so it’s overpriced.” – Howard Marks

Second-level thinking separates amateurs from pros. It’s not just about being right. Instead, it’s about being right when others are wrong.

Marks used this during the 2011 European debt crisis. While others avoided Greek bonds entirely, Oaktree bought at deeply distressed levels. The contrarian bet paid off as the panic subsided.

Oaktree’s European Principal Fund III returned massively during this period. It did so by raising EUR 2.5 billion.

Lesson 4: Avoid Herd Mentality

“You can’t do the same things others do and expect to outperform.” – Howard Marks

Marks repeatedly warns against groupthink. Following the crowd feels safe but leads to average returns or worse.

In 2005, while investors piled into real estate-backed securities, Oaktree scaled back its exposure. By 2008, these positions imploded. Oaktree had dry powder ready. Between 2007–2009, Oaktree raised nearly $11 billion in distressed funds. A timing that few matched.

Hence, discomfort often marks opportunity. But conformity rarely builds wealth.

Lesson 5: Focus on Capital Preservation

“If you avoid the losers, the winners will take care of themselves.” – Howard Marks

Marks believes that defense wins games in investing. Avoiding big losses is more powerful than chasing huge wins.

Oaktree's flagship distressed debt fund has performed exceptionally in its 25-year history. Success isn’t just about brilliance; it’s about not blowing up.

Lesson 6: Embrace Intellectual Humility

“We never forget that we don’t know what’s going to happen.” – Howard Marks

Marks doesn’t try to be a prophet. Instead, he builds portfolios that are resilient across scenarios.

In his 2001 memo, he explains how accepting uncertainty frees you from dangerous forecasts. Instead of betting big, Oaktree sizes positions modestly. It then builds in margins of safety.

Their approach helped them navigate the 2020 COVID market crash. The result? They escaped with minimal drawdown and rapid recovery.

Lesson 7: Don’t Confuse Price with Value

“Investment success doesn’t come from buying good things, but from buying things well.” – Howard Marks

Marks urges investors to distinguish between quality and price. As per him, a great company at a terrible price is still a bad investment.

In 2020, when everyone rushed into high-growth tech stocks, Marks remained cautious. By 2022, many of those companies saw valuations collapse. One such prime example is Zoom, which fell by over 90%.

Oaktree, meanwhile, continued buying high-yield credit at discounts. These stocks came with asymmetric return potential.

Lesson 8: Patience Pays

“The biggest investing errors come not from factors that are informational or analytical, but from those that are psychological.” – Howard Marks

Marks also emphasizes temperament. He often reminds investors that returns come in bursts, not in a smooth line. Trying to time them perfectly leads to frustration and underperformance.

According to Marks, Oaktree’s greatest returns often came from “waiting out” the cycle and buying when others were desperate. Let others chase. You prepare and wait.

Lesson 9: Prepare for the Unexpected

“Experience is what you get when you didn’t get what you wanted.” – Howard Marks

Howard Marks believes resilience matters more than precision. Rather than building perfect forecasts, he recommends building flexible portfolios.

This was evident in 2022. As inflation spiked and rates rose, many portfolios cracked. Resultantly, traditional 60/40 portfolios fell by almost 16%.

Meanwhile, Oaktree’s strategy, holding floating-rate debt and distressed credit, still held firm. Their Global Credit Fund remained nearly flat in 2022.

Thus, plan for surprises. Because they always show up.

Lesson 10: Know Thyself

“It's not my point that emotional people can't be good investors, but it will require a great deal of self-awareness and self-restraint.” – Howard Marks

Marks focuses on where most investors fail: self-awareness. He stresses that behavioral mistakes cause more damage than a bad stock pick. These mistakes include:

Fear

Greed

Impatience

In his memos, he shares mistakes he made by chasing returns or acting too early. His edge came from learning to recognize those moments and do less.

A 2016 memo, “On the Couch,” revealed how avoiding action during market euphoria helped preserve client capital. As a matter of fact, it worked better than any fancy model.

The lesson? Know your temperament, as it may be your greatest edge.

His real-world track record of avoiding losses and returning capital across cycles speaks louder than theory. Study these lessons and bookmark his memos. And, prepare, don’t predict.

That was it for today. Do tell us what you think about these lessons!

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 300 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +15.000 stock market investors (42% open rate) — Contact us via: investinassets20@gmail.com

The psychological aspect really is an essential part of investing.

Thanks for sharing. Indeed very interesting and enriching article.