Visa - A Quality Growth Compounder 💳

<5 min read

Introduction

The world is becoming ever more interconnected, and the role of payment processing companies has never been in higher demand. In this article, we will take a look at Visa, its business model, growth strategies, and whether or not Visa is an attractive investment at current levels.

Business Model

Visa operates as a middleman in the payments ecosystem. It connects consumers, businesses, financial institutions, and governments, enabling them to engage in secure, electronic financial transactions. Its core business model revolves around three primary components:

Issuers: Banks or financial institutions that provide Visa-branded credit, debit, or prepaid cards to consumers. Visa partners with thousands of these issuers globally.

Merchants: Merchants and businesses accept Visa payments from consumers. They pay a fee, known as the interchange fee, to Visa for processing these transactions securely.

Consumers: Visa provides consumers with a convenient and secure method of payment, whether through physical cards or digital wallets.

Here is a complete view of how Visa creates value in the market:

Revenue Streams

Visa generates revenue through various channels:

Service Fees: Visa charges issuers and acquirers for its payment processing services.

Data Processing Fees: These fees are generated from transactions that Visa processes, including authorizations and settlements.

International Transaction Fees: For cross-border transactions, Visa charges a fee to both issuers and acquirers.

Licensing Fees: Visa earns fees by licensing its brand and technology to financial institutions.

Other Fees: Visa diversifies its income streams with fees related to value-added services, such as fraud protection and consulting services.

Visa has a diversified revenue stream. The main driver behind these revenue streams is the number of cashless transactions made globally. Statista’s numbers for cashless transactions show that this is likely to grow at a rapid rate in the coming years:

Essentials of Quality Growth Investing is live!

I wrote a book to help you:

Identify quality growth compounders

Methods to value businesses

Give you the tools to outperform

As a loyal read, I want to give you a special deal.

Use this discount code for a 50% discount (Available until sunday 17th 23:59 ): P15AT1D

Grab your copy here: https://investinassets.gumroad.com/l/wgkrip

Growth Strategies

Visa's continued success hinges on its ability to adapt to a rapidly changing payment landscape. Here are some key strategies Visa employs to maintain and expand its market presence:

Investment in Technology: Visa continuously invests in cutting-edge payment technologies to ensure its offerings remain secure and convenient for users.

Expanding Digital Payments: The rise of digital wallets and mobile payments is a significant trend Visa is capitalizing on, with services like Visa Checkout and partnerships with digital wallet providers.

Global Expansion: Visa is consistently exploring new markets and opportunities for growth, particularly in emerging economies where electronic payments are still on the rise.

Acquisitions and Partnerships: Visa has a history of strategic acquisitions and partnerships to expand its service offerings and strengthen its market position.

Diversity and Inclusion: Visa emphasizes diversity and inclusion in its workforce and business operations, reflecting a commitment to social responsibility.

The fundamentals

ROIC: 30%

ROIIC: 65%

Reinvestment rate 2017-2022: ~18.3%

Compounding intrinsic value rate: 11.9%

Gross Margin: 80%

Operating Margin: 67%

FCF/Net Income 5Y: 107%

Net debt / FCF: 0.107x (1 year of FCF can pay Visa’s debt ~10 times over)

Interest coverage: 27x

The Stock

Visa’s stock has increased by 446% in the last 10 years, if you include its dividend payments, it has returned ~492% in the same time period. That is a compounded annual growth rate of 17.3%, outpacing the S&P 500 by a wide margin.

The Growth (5-Year / 10-Year CAGR)

Revenue: 9.81% / 10.9%

Earnings per share: 20.1% / 15.6%

Free cash flow: 9.85% / 11.76%

Dividends: 16.9% / 18.5%

Visa’s growth has decreased from its 10Y average, but not by much. It is quite impressive that Visa keeps growing ~10% annually on its top line while providing great per-share figures due to its stock repurchasing.

Sustainable competitive advantage

Network effects: Visa has built a system and network around its processing activities that harness trust among its partners and customers. Visa has built trust with a network of financial institutions and merchants for decades. New merchants join Visa because of this, attracting more end-users.

Barriers to entry: Visa is operating in an oligopoly market, where Visa and Mastercard are the two dominant actors. Oligopolies are attractive markets to invest in, as they often have massive barriers to entry. The payment processing industry is no different. The barriers to entry can be summed up with 3 elements:

Trust built over decades with financial institutions and merchants

Brand equity for the end users

Technology and systems built around delivering billions of transactions annually

Trying to replicate or compete with Visa is extremely hard. Billions have been spent to try and disrupt the financial system, and hence Visa’s position. But systems like this don’t change in a heartbeat like someone thought Bitcoin would, it changes over decades. And what company does the industry trust to be their partner in this change? I’d say Visa is a clear candidate.

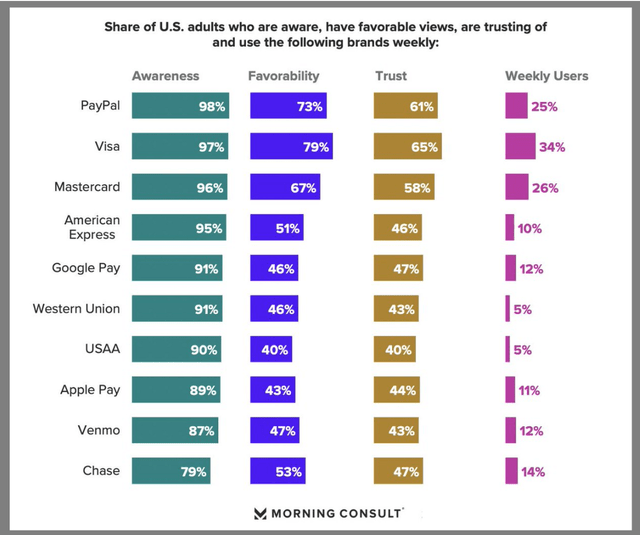

Visa’s trust and weekly users are amongst the highest vs. its peers:

Why own Visa?

Strong future growth prospects as more underdeveloped countries grow their middle-class

One of the widest moats out there

Doesn’t need debt to achieve superior returns

A quality compounder

High return on capital

High FCF margins, meaning most earnings are transferred into cash

Great capital allocation - Low reinvestment rate as its opportunities are limited, but continuous dividends and stock repurchases are creating shareholder value above the S&P 500 index.

The Risk

Disruption: New technology and substitutes - Billions of dollars are spent every year to disrupt this lucrative industry.

Global recession: A global recession will hurt Visa and all consumer-dependent companies. Consumers spend less money, which means fewer transaction fees for Visa.

Reduced globalization: We’ve seen this trend over the last 5 years, as countries are becoming more nationalistic. This can be a negative for Visa, as its future growth depends on expanding into new areas and emerging economies.

Valuation

Visa is trading below its 10-year average forward PE:

The FCF yield is ~3.8%, vs. the risk-free rate of 3.875%. Visa is a bit more expensive, but it has stable and growing free cash flows. The FCF yield is historically high for Visa:

Discounted cash flow analysis

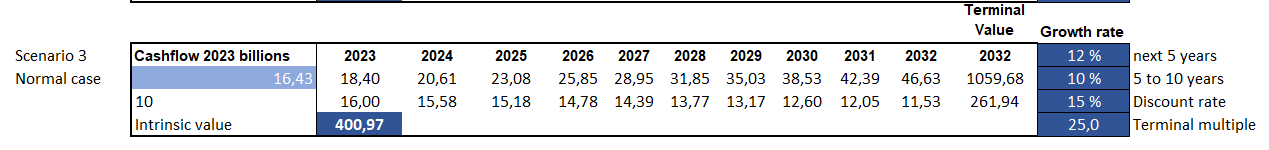

Using a simple DCF with 3 scenarios:

Worst case: 8% followed by 6% growth, with a multiple of 20 at the end.

Best case: 15% followed by 12% growth, with a multiple of 30 at the end.

Normal case: 12% followed by 10% growth, with a multiple of 25 at the end.

As Visa has very high-profit margins and returns on capital, it is unlikely that it will be valued under 20 times FCF in my opinion.

My fair value estimate is $545.43 billion. Visa is trading at $491.5 billion today, a small upside of 11% from its fair value. Current valuations suggest a 12% annual return from here, in line with our compounding intrinsic value rate earlier in this article.

For Visa to achieve a 15% annual return moving forward, with the normal scenario growth rates, we would have to buy it around $400 billion, an 18.6% discount from today’s levels:

Conclusion

Visa is a fantastic company, with a deep moat, a fantastic business model, and unmatched margins and returns on capital.

The main weakness of a business like Visa is that its opportunities for reinvestments are rather low, as our estimate is that it has reinvested ~18% of earnings over the last 5 years. The rest of the capital is used for stock repurchases, dividends, and capital expenditure.

Visa is a great business to have in one’s portfolio, as it brings stability and consistent returns. For the long-term compounder, Visa is a company to consider.

Based on our estimate, Visa will return 12% annually if it continues to grow. However, this estimate can increase or decrease depending on future growth in earnings.

Disclaimer: Invest In Quality holds a position in the stock discussed in this article.