📈Undervalued SaaS Business with Fantastic Fundamentals

8 min read 🧠

I’m creating a digital course for investors, I would love your feedback on what subjects you want me to cover, be kind and take the survey (Less than 2m): Click here

As a thank you, here is a free Guide on how to Read & Analyze the financial statements: Click here

Table of content

Introduction

What Text SA does

How Text SA makes money

Stock price

Fundamentals

Customers

Management

Competitive position & advantage

Financial development

Key performance indicators (KPIs)

Risks

Valuation

Introduction: Text SA

The story of Text SA starts with Mariusz Cieply and Szymon Klimczak, two college students in Poland who wanted to figure out how companies could communicate better with website visitors. The duo was passionate about finding a better solution than what was in the market at the time (2002). Text SA has emerged as a winner in the market of communication services, beating peers in Europe and the US on its way.

What Does Text SA Do?

Text SA is a leading provider of innovative communication solutions that revolutionize the way businesses interact with their customers online. The company specializes in cutting-edge messaging services, offering a suite of tools designed to enhance communication efficiency and effectiveness online.

How Does Text SA Make Money?

Geographic Split

Text makes most of its monthly recurring revenue (MMR) from the UK (47.3%), the US (34.3%), and “Others” (9.1%). The revenue is somewhat diversified, but Text is dependent on the US & UK markets.

Business segments

Text SA has 3 primary business segments:

LiveChat represents 91.2% of sales

Livehat is the flagship product that the business is built on. Livechat allows companies to interact with visitors to its website easily and intuitively. The software has helped businesses get more personal with their customers, by offering help or assisting sales while the customer is browsing the website. Not only does this increase customer satisfaction, it also boosts sales.

ChatBot represents 6.4% of sales

ChatBots are annoying. However, they save companies a bunch of money by directing customers who have easy-to-answer questions to the right resources online. A customer service request to a human can cost a business anywhere from $10-$25 depending on the industry and value chain. If the business can redirect 1000 customers per month from calling the support, they save 1000 x $10-$25 = $10k to $25k per month. This can be a significant OpEx saver for companies.

HelpDesk represents 2% of sales

HelpDesk is an application used by companies to organize their support efforts. It’s a ticketing system that makes it easier for support teams to follow up on requests from customers and set the appropriate status for the activity. This application in combination with the other software Text SA offers, can be a large cost saver for businesses.

Stock Price

Text IPO’ed in 2014, since then, the stock has had a total return of 673%, a 23.1% CAGR. In the last 5 years, the stock has a CAGR of 34.4%. The stock price took off after the pandemic along with many other internet businesses. Text SA has maintained its share price for the most part:

Fundamentals

Quality:

ROIC 5Y: 113%

Gross Margin: 84%

Operating Margin: 59%

FCF/Net Income 5Y: 87%

Growth:

Revenue 5Y: 29.26%

EPS 5Y: 29.38%

FCF per share 5Y: 30.84%

Dividend growth 5Y: 21.51%

Valuation:

Forward PE: 14.7

Forward FCF Yield: 6.8%

EV/Sales: 7

Customers

Text has 37.700 customers from 150 different countries. More than 25 of the Fortune 500 companies use Text’s software solutions. To name a few large businesses that use Text: PayPal, Ikea, Atlassian, Mcdonalds, Adobe, and Unilever.

Their clients are from a wide range of industries, from retailing to financial services and software as a service provider. This provides good diversification from a customer standpoint.

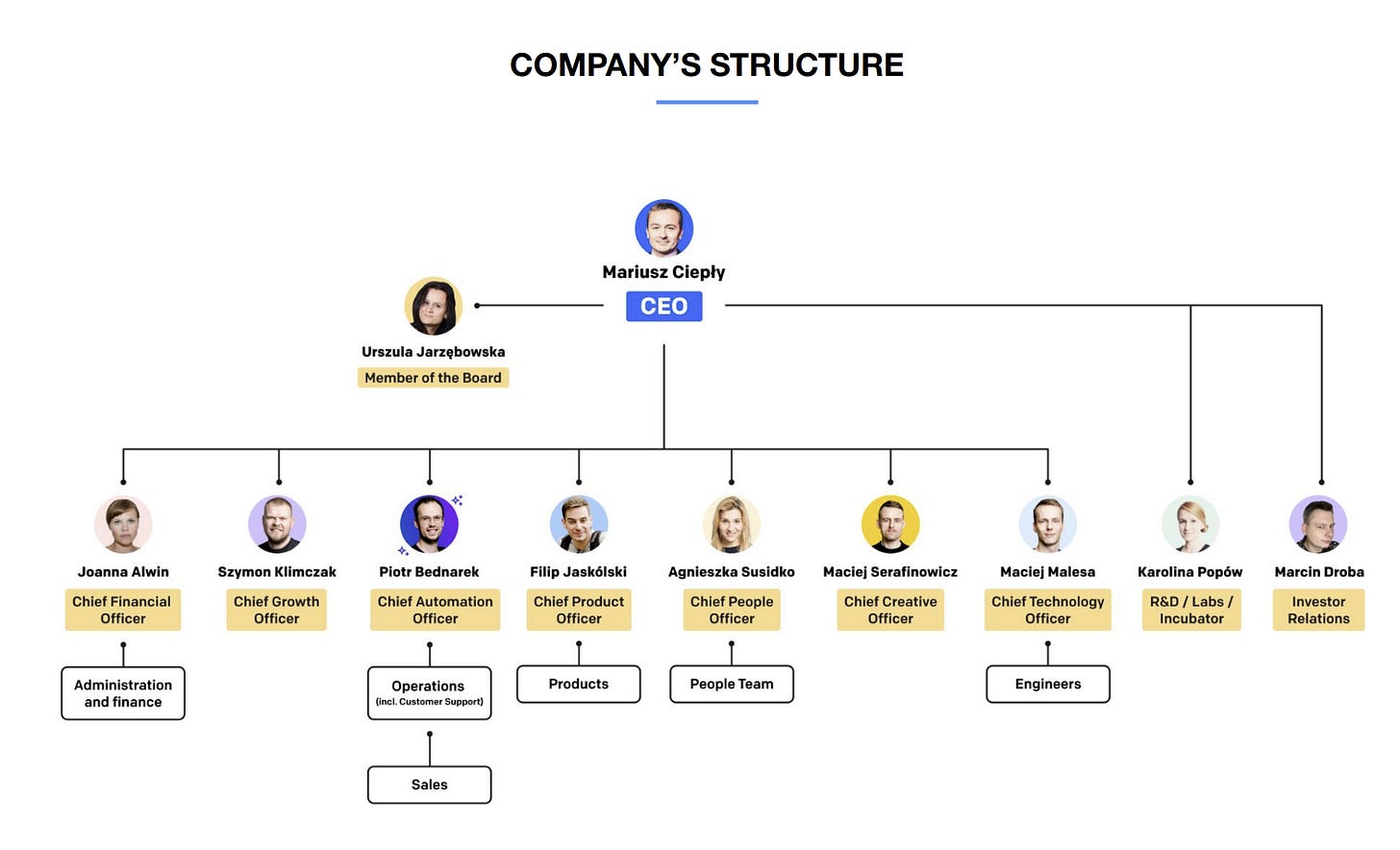

The Management Team

The success of any business hinges on the capabilities of the management team. Text SA boasts a leadership team with a proven track record in the technology and communication sectors. The executives bring a wealth of experience, strategic vision, and a demonstrated ability to navigate the complexities of the industry.

Both founders are still involved, Mariusz Cieply runs the show as CEO, and Szymon Klimczak is the Chief Growth Officer. This is a major plus for the investing case, as we know founder-led businesses tend to outperform their hired gun counterparts.

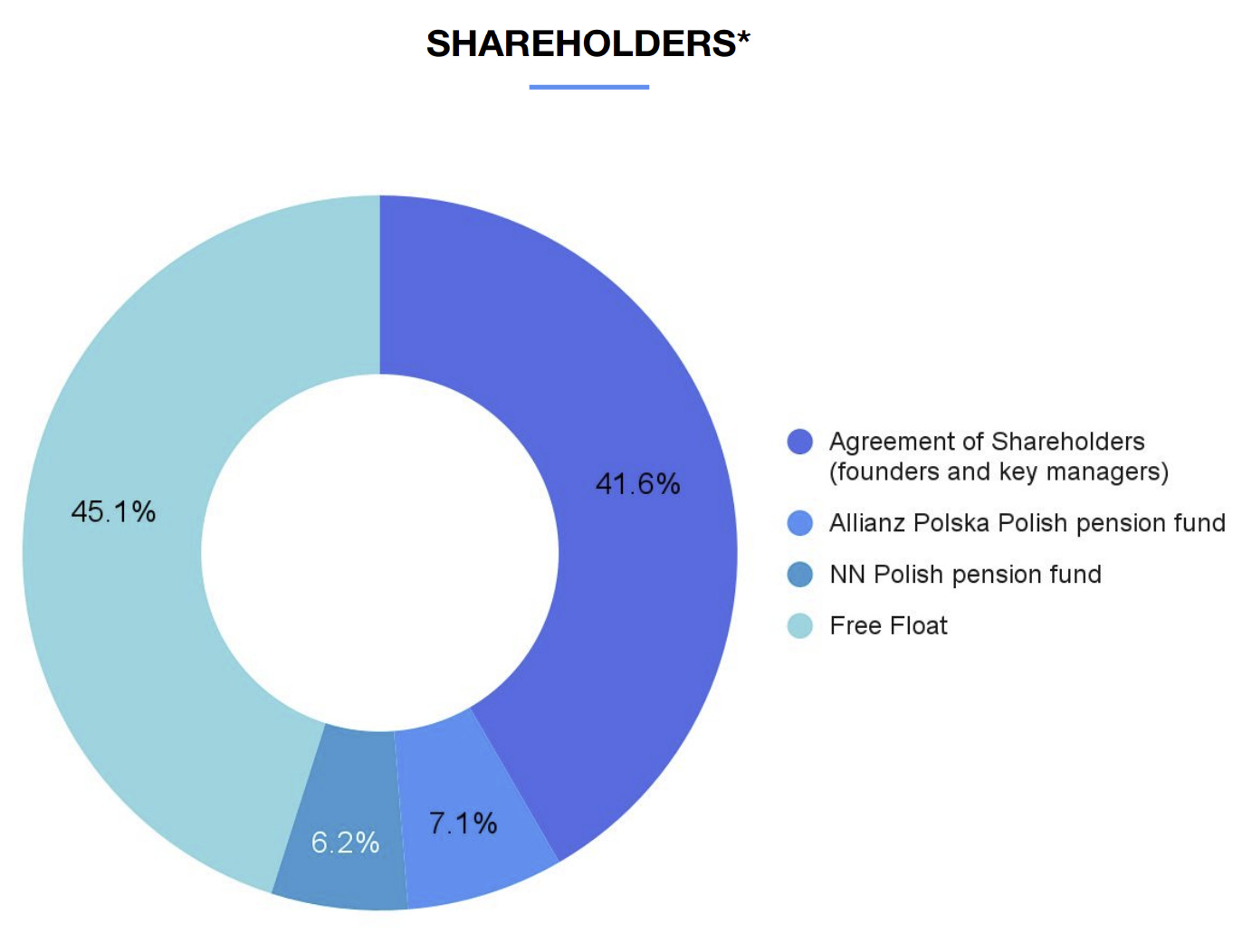

Insider ownership

Founders & key managers own 41.6% of the business:

To be precise, these insiders own significant stakes:

Mariusz Ciepły (CEO & Founder): owns 13.1% of Text SA

Jakub Sitarz: owns 11.7% of Text SA

Maciej Jarzębowski: owns 9.2% of Text SA

Urszula Jarzębowska: owns 4.7% of Text SA

Other insiders: own 2.9% of Text SA

I’m creating a digital course for investors, I would love your feedback on what subjects you want me to cover, be kind and take the survey (Less than 2m): Click here

Competitive Position & Advantage

Text SA occupies a strong competitive position in the communication technology sector. Its innovative solutions, global reach, and customer-centric approach set it apart from competitors. The company's commitment to security and compliance adds a layer of competitive advantage in an industry where trust and reliability are paramount.

Pricing Power

You would think that Text SA has no moat or pricing power. But if we look at their recent price hike, it tells a different story:

“Our pricing power would seem low at first glance. There are a lot of solutions offered in the free or freemium model on our market. However, in November 2022 we increased the prices of LiveChat effectively by an average of 25% (the first increase in 8+ years). Customer churn increased to 4% (the long-term average is 3% per month), but then decreased every next month”.

This change suggests that Text has pricing power and a competitive advantage. If not, the customers would all leave after a 25% price hike.

Network effects

Text has elements of network effects, as they can tune their software based on the data they receive from customers. More customers yield more data and input and help improve the services they offer.

Switching costs

Text also has an element of switching costs. Their customers would rather take a 25% price hike than switch to a competitor. I believe this is partly due to the hassle of changing software vendors. Once Text is integrated into the value chain of a business, it will cost the business more to change vendors than to just take the price increase.

Churn is always important to look at, especially around price hikes. It provides essential information into the pricing power of the business. This is something I will follow in the future for Text.

Financial development

Monthly recurring revenue is the preferred source of revenue. All revenue that is recurring in nature is a plus for a business. As we can see from the chart below, Text saw impressive growth from 2020 to the end of 2022. The price hike sure boosted the MMR, however, the price hike in combination with a slow economic backdrop has put the breaks on the growth. YoY growth in MRR is only 2.2%.

If we look at the long-term, Text has done amazingly, boasting a revenue CAGR of 36%, net income CAGR of 37%, and growing its FCF from 0 to 169 million in 2023.

If we look more recently, we can see that the business has been struggling as of late, with a decrease in revenue, net income, and FCF over the last 2 quarters. We should not pay attention to short-term noise, but we need to find out if Text is a great business that will rebound, or if it will struggle over the coming years.

Dividends