Undervalued Technology Leader in a Growing Market 🔐

6 min read 🧠

Seeking Alpha is sponsoring this article. Level up your investing game by leveraging some of the greatest financial writers in the world. Get $50 off your purchase or try it 7 days for free. Click here to get the offer.

Fortinet: The business

As the world gets more interconnected and digitalized, we see a large increase in cyber attacks on businesses and private consumers. This trend is alarming. However, it also creates a large demand in the market for great organizations that can help businesses and individuals create secure environments digitally. Fortinet is the leading global cybersecurity company. In the last 20 years, they have capitalized on this growing trend. In this article we will dive into what makes Fortinet a great business, and whether or not it is currently an attractive investment.

Business Model

Fortinet specializes in delivering integrated and automated security solutions to small and large businesses and organizations. The business offers a suite of products and services that are designed to help its customers against different cyber threats.

Fortinet’s business model consists of 3 business segments:

Subscription-Based Model

Fortinet sells both hardware products and software licenses to its clients. The software licenses are the more attractive business, as the revenue is recurring on a subscription-based model.

Customer-Centric Approach

Fortinet focuses on understanding the unique needs and challenges of its customers. The company provides training, support, and threat intelligence services to ensure that its clients can effectively deploy and manage their security solutions. They also provide consulting to make sure their clients have the best security setup in their organization.

Security Fabric

One of Fortinet's core strengths is its Security Fabric, a framework that connects and integrates all security solutions within an organization. This allows for better visibility, control, and automation, ultimately improving overall security posture. In turn, this deepens the relationship Fortinet has with its clients and increases its switching costs.

Key Growth Drivers

Several factors have driven Fortinet's remarkable growth within the cybersecurity industry. Let's delve into 4 key drivers:

Rapidly growing demand: Fortinet participates in several markets. Secure Network & Security Operations is expected to grow by 9% and 14% annually for the next 5 years. SASE on the other hand is expected to grow by 20% annually as more companies switch to a more modern way of handling security. Fortinet is also making efforts to enter the fast-growing cloud security market.

The total addressable market for Fortinet is expected to grow to $199Bn in 2027:

Global Reach: Fortinet has a global presence, with offices and partners in over 170 countries. This expansive reach allows the company to tap into diverse markets and industries, further fueling its growth.

Strong Partnerships: Fortinet has established strategic partnerships with other technology and security companies, such as Microsoft, IBM, and AWS. These partnerships enhance the integration of Fortinet's solutions with other technology stacks, making it more attractive to potential customers.

Threat Intelligence and Real-Time Updates: Fortinet's threat intelligence capabilities, combined with real-time updates to its products, provide customers with up-to-the-minute protection against new threats. This responsiveness fosters trust among customers and encourages them to remain loyal.

Market Share

Fortinet, together with Palo Alto Networks are the clear market leaders within the Security Appliances market. As we can see from the image below, Fortinet is the market leader in Security Appliances with a growing market share.

Revenue spit

Fortinet is well diversified and gets 41% of its revenue from the Americas, 38% from EMEA, and 21% from APAC:

34.9% of Fortinet’s revenue comes from the product segment, and 65.1% comes from the service segment. The product segment detracted by 0.6% in Q3 of 23 while Services soared by 27.6%. Services are the higher margin business, but product is the leading indicator of increased service revenue.

The fundamentals

Capital efficiency: Fortinet has expanded its ROIC and ROCE substantially since 2016. The continuous expansion suggests that Fortinet has a competitive advantage.

Per share growth (8-Year CAGR)

Revenue per share: 24.82%

Earnings per share Diluted: 91.47% (Low base)

Free cash flow per share: 33.41%

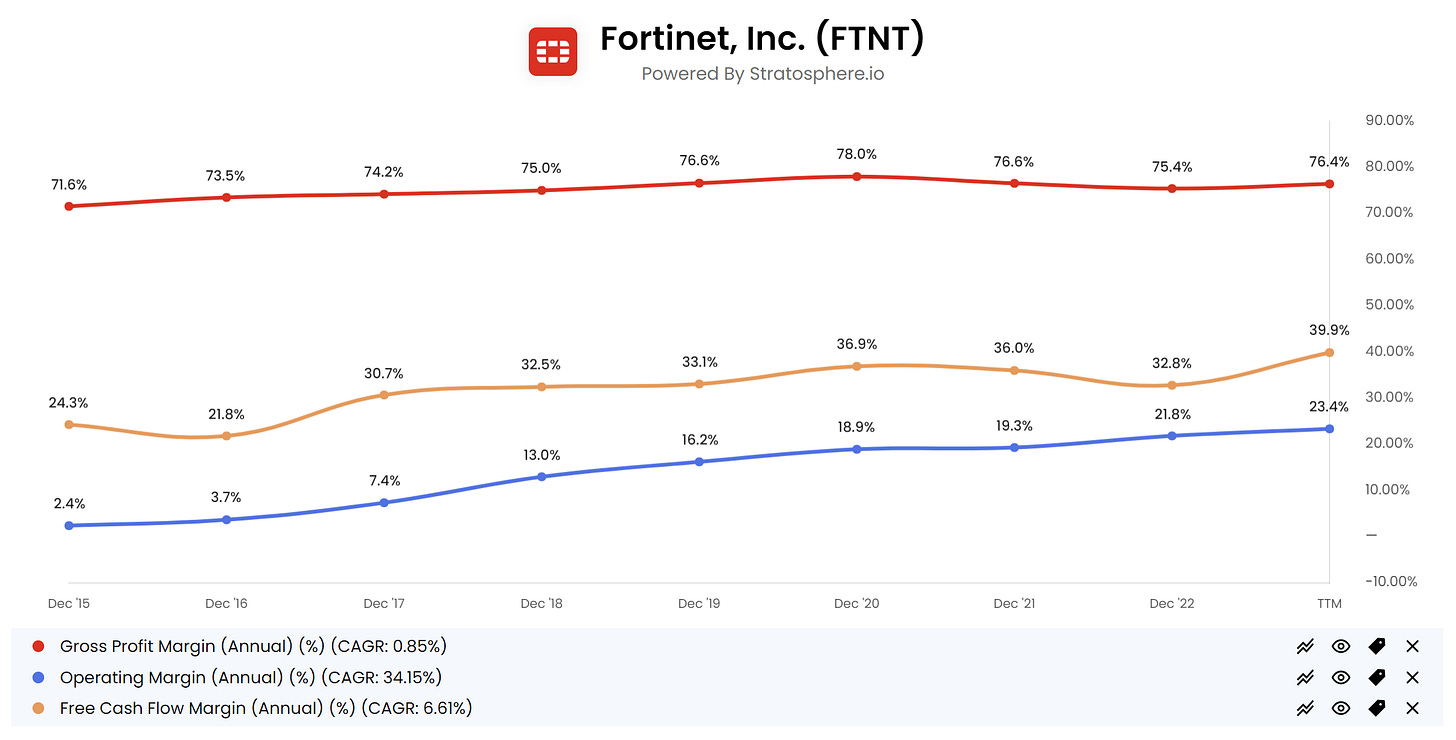

Margins: Steady gross margins and expanding operating and FCF margins over the last few years. The management is expected to further margin expansion in the second half of 2024.

Additionally, Fortinet translates more than its net income into free cash flow, indicating well-managed working capital. Cash conversion (FCF/Net Income): 179%

The Stock

In the last 10 years, Fortinet has returned 1,156.27%, a CAGR of 28.8%.

Management

Ken Xie founded the company 24 years ago and has been the CEO ever since. Fortinet is a founder-led business, which we like. Insiders own 17.5%. The business has substantial skin in the game and is run by its founder. As we know, founder-led businesses tend to outperform businesses with low/no skin in the game over the long term.

Sustainable competitive advantage

Ken Xie (CEO & Founder) says that their competitive advantage derives from their unique ability to converge networking and security on-premises and in the cloud using a FortiOS operating system.

Switching costs

Once a customer is set up with Fortinet systems, like the FortiOS, they are unlikely to switch vendors unless there is a major reason to do so. The argument against this is that more and more clients want to have their security services in the cloud instead of on-prem. However, cloud-based security has its performance issues, and clients that have a focus on performance will prefer on-prem solutions. Fortinet is expanding into the cloud segment. This is something investors should look for in the coming years. Will Fortinet be able to enter this segment successfully without cannibalizing the other segments?

Network effects

More clients mean that Fortinet is able to get better data and fine-tune its cybersecurity systems. This means that their algorithms and products are getting better every day, increasing their competitive edge and increasing the barriers to entry in the industry.

Expanding margins and returns on capital

Fortinet’s margins and returns on capital have steadily been increasing over the last decade. This indicates that the business has something special going on and can often be attributed to a competitive edge. The business is getting more profitable as it grows.

Why own Fortinet?

Well-positioned in a growing industry

A sustainable competitive advantage

Low debt & capital intensity

High returns on capital & margins

Founder-led business

High insider ownership

The Risk

Competition: Fortinet’s main competitor is Palo Alto Networks, but they also compete against Crowdstrike in the cloud segment. Additionally, Microsoft is increasing its focus on security which can be a future threat.

Disruption: Cloud security segment if they are unable to enter it successfully

Valuation: The price is still high given its guidance for no growth in the first half of 2024. Given The market is afraid that Fortinet will become an ex-growth business.

Stock-based compensation: SBC is high in the technology industry, especially in cybersecurity. This will dilute investors over time, as is something to keep an eye on.

Economic environment: Higher rates & inflation is putting pressure on Fortinets existing and potential clients. Spending on cybersecurity is a must for some businesses, but most will cut their spending on security to protect their cash flows.

Valuation

Fortinet currently trades at a 4.7% FCF yield. Historically, the 4%-6% range has been a good entry. However, the environment and business have changed in the last few years. We should rather compare Fortinets FCF yield to the risk-free rate, which is 4.5%.

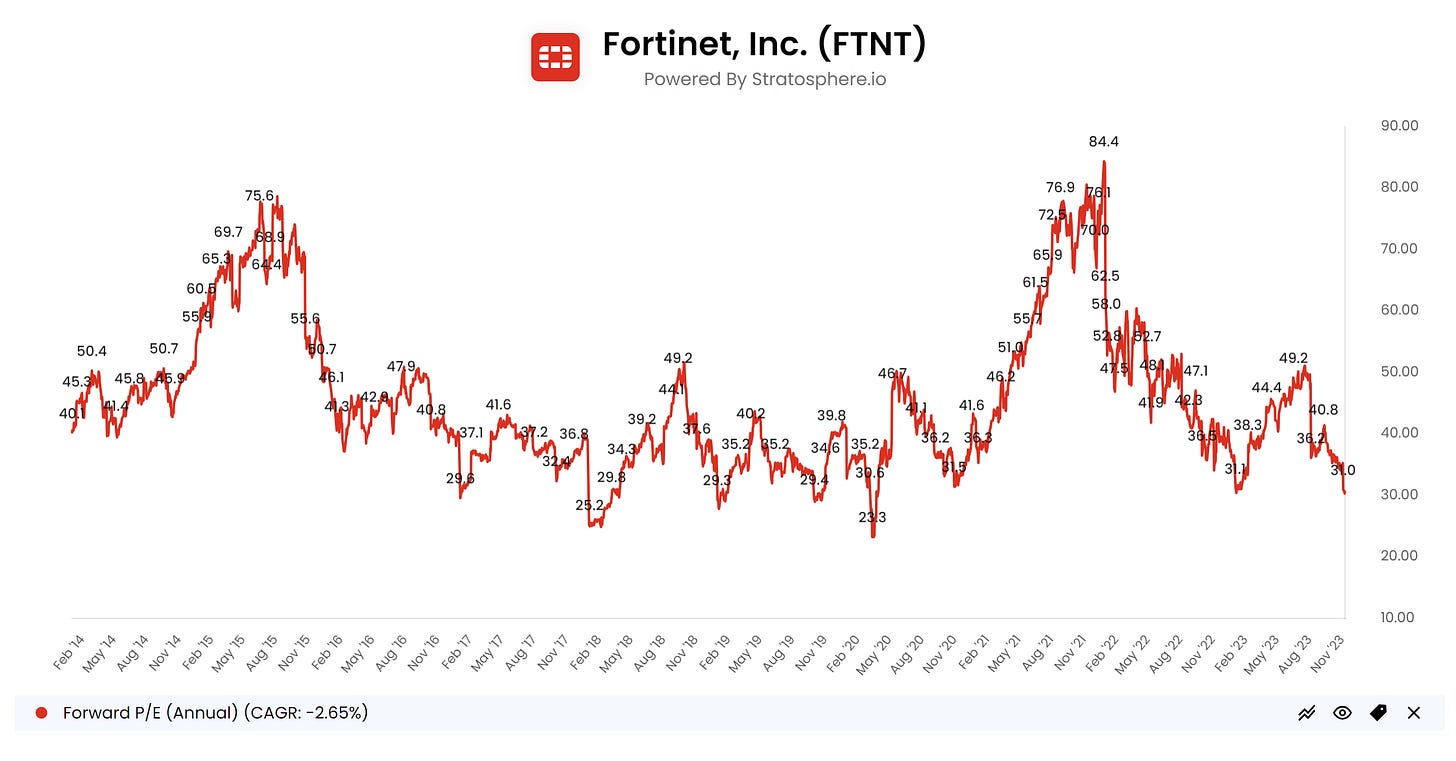

The forward PE ratio is trading at the low end of what it has in the last 10 years. The current forward PE is 30.8, while the lowest in the last 10 years has been 23.3 for a brief moment when the pandemic hit the markets.

Discounted cash flow analysis

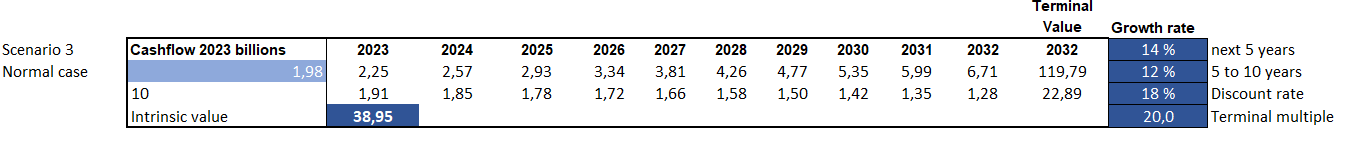

Using a simple DCF analysis with 3 different scenarios to determine the intrinsic value of the business.

Worst case: 10% growth for 5 years, then 8% for the next 5 years, and an exit multiple of 15.

Best case: 16% growth for 5 years, then 14% for the next 5 years, and an exit multiple of 25.

Normal case: 14% growth for 5 years, then 12% for the next 5 years, and an exit multiple of 20.

Our estimate of the value is $64.46Bn given the inputs above. The current market capitalization is $38Bn suggesting a 69% upside in the stock if it can continue to grow.

At the current valuation, Fortinet looks attractive. For the Normal scenario, we can expect an above 15% annual return given the growth rates of 14% for the next 5 years.

The risk is that Fortinet becomes an ex-growth business, meaning the growth stops or flattens. In this scenario, we would not do well on this investment. However, given its strong competitive position in a growing industry, we find it more likely that the growth will continue after a brief pause in the first half of 2024.

Conclusion

Fortinet is a great business trading at a fair price. It has several positives: i) it’s an owner-operator, ii) it has a competitive advantage, iii) it is highly profitable with expanding margins, iv) it is set to grow as its markets grow, and v) it is trading at a fair price.

The risk when investing in technology companies is always that the environment is always shifting, and new and emerging technologies can disrupt the old legacy tech. The risk for Fortinet is that the market moves towards more cloud-based security solutions and SASE while they are not able to penetrate those markets and become a market leader or gainer.

Overall, the risk and reward look attractive.

Disclaimer: The author does not own any shares in this company at the time of writing. Always do your own due diligence. This should not be considered financial advice.

Whenever you are ready, this is how I can help you:

Essentials of Quality Growth — Join more than 200 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

Promote yourself to +5,000 stock market investors (48% open rate) — Contact us via: investinassets20@gmail.com

Thanks for your feedback

Hi, the terminal multiples used in FTNT valuation model are P/FCF right?