Uber: An Undervalued Compounding Machine?

Why Bill Ackman bet the farm on Uber 💰

Hello Investors! 👋

Uber has become a household name worldwide due to its diverse range of functionalities. From ride-hailing and food delivery to freight logistics.

What’s even more intriguing is how it moved from a loss maker to a multibillion-dollar, profitable company. And superinvestors like Bill Ackman think it’s only just getting started.

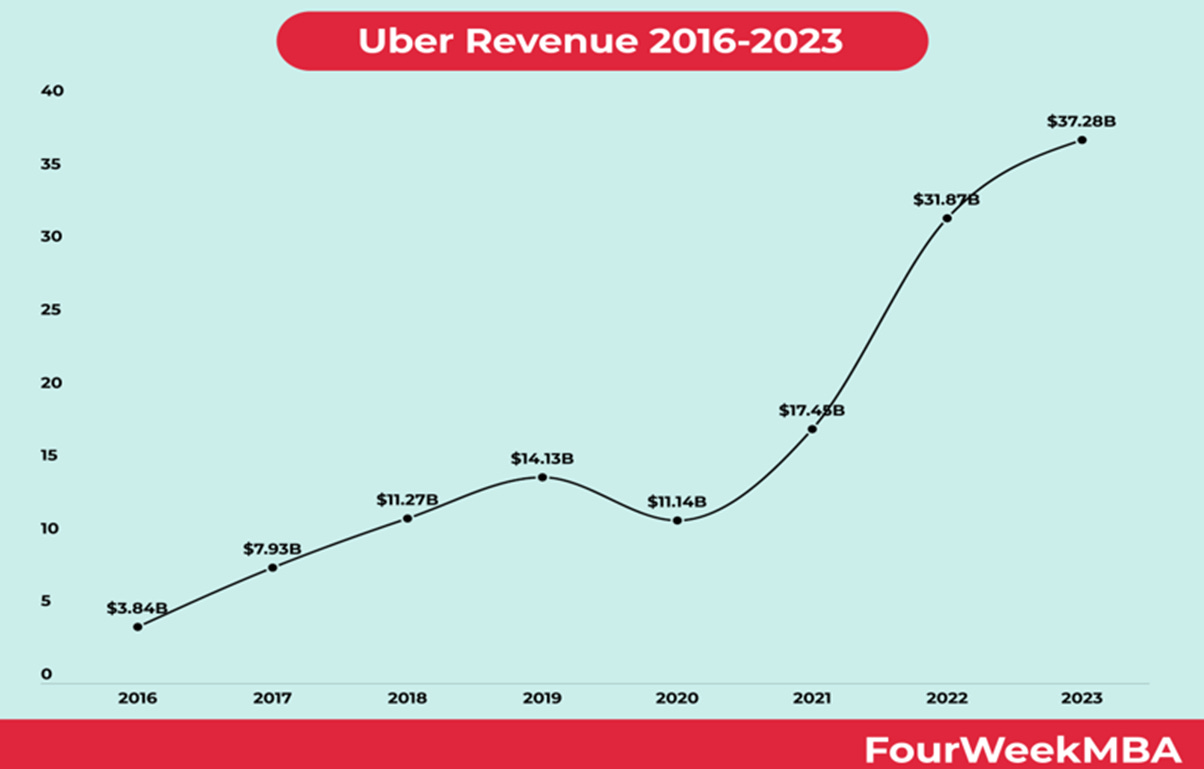

The growth story of Uber is undeniable:

In 2023, Uber posted around $37.28 billion in revenue. Moreover, it managed to deliver its full-year net profit of $1.89 billion.

This marked a turning point for Uber as a profitable company. Since then, the net income and free cash flow have exploded.

As a result, in February 2025, Bill Ackman’s Pershing Square announced a whopping $2.3 billion stake in the giant. He even said that it was trading at a “massive discount.”

“We believe that Uber is one of the best managed and highest-quality businesses in the world. Remarkably, it can still be purchased at a massive discount to its intrinsic value.” - Bill Ackman

That kind of blatant endorsement from a renowned value investor adds not only credibility but also powerful velocity to Uber's narrative.

Let’s dig deeper into why that is 👇

The Uber Business Model 💰

Uber primarily runs a well-recognized global marketplace that’s asset-light. Mainly, it involves rides, meals, and truckloads.

Mobility (Ride‑hailing): $25.1 billion in 2024 revenue (57%)

Delivery (Uber Eats & grocery): $13.8 billion (31%)

Freight (Uber Freight): $5.1 billion (12%)

Uber earns via take-rates—28.7% on mobility and 18.3% on delivery—consistent with peers but at far greater scale. Additional high-margin levers include:

Uber One: Memberships drive loyalty and recurring revenue

In-app advertising: Monetizing traffic through sponsored listings

Premium ride bundles: Pricing optimization at work

All this is executed via a single app interface across 70+ countries, without vehicle ownership. That’s cost-efficiency and margin protection by design.

The Main Growth Drivers 🚀

There are many factors at play that define Uber’s constant outperformance and recent growth. Primarily, it’s delivery scale, global footprint, and AV investments that fuel its upward trajectory.

Multiple Growing Segments: Mobility, Eats, and Freight generated nearly $44 billion in combined revenue in 2024. It was an 18% increase from 2023.

Autonomous Vehicles Partnerships: Rather than competing, Uber partners with AV leaders like Waymo, aiming to integrate autonomous cars within its huge platform, tapping into a trillion-dollar opportunity

Global Presence: It is fully functional across 70 global countries. Ultimately serving 161 million monthly users in 2025. This is a straight 14% increase, year on year.

Here is some of the latest data for a more comprehensive analysis:

Q1 2025 Highlights:

Gross bookings: $42.8 billion (+14% YoY)

Revenue: $11.5 billion (+17% YoY)

Despite consistent growth, Uber stock has traded somewhat sideways for the last year.

Competitive Advantage 🏰

With so many giants circling the field, Uber must have a competitive advantage to thrive in the future. So, what gives Uber an edge? Well, it’s Uber’s network density and technological mastery that create a strong economic moat.

Here’s how:

Network Effects:

Driver density reduces the wait times for users and boosts reliability. This leads to Uber attracting more riders. It also ends up fueling delivery and freight use.

Currently, over 7.8 million drivers are working with the giant, which is no small number. And replicating this cycle demands massive investment in users and drivers, which raises the stakes.

The main argument for riders to use Uber compared to Lyft (The main competitor) is more frequent ride requests and “surge zones”. This allows the riders to be continuously booked, boosting their earning potential.

The loop that boosts Uber’s competitive position:

More drivers = shorter wait times = better customer experience = more demand

Deep Tech Integration:

There are many high-tech integration points:

Uber’s solid backend dispatch system

Dynamic pricing models powered by AI

AV (autonomous vehicle) and logistics integrations

Platform scale allows for superior data & machine learning

This isn’t just “software”, it’s infrastructure-as-a-platform. It is sticky and very hard to replicate at this scale.

Management 🏢

CEO Dara Khosrowshahi steered Uber to profitability. It was made possible through a clear vision that was rooted in strategic discipline.

Here’s a clear timeline:

Took over in 2017 as CEO and led the 2019 IPO.

Smartly shifted focus to enhancing operational efficiency. Before him, the main focus was on growing, at any cost,

Delivered a $1.89 billion net income in 2023. Proving that the shift in focus had worked, marking 2023 as an “inflection point.”

Since 2023, the profitability has increased a lot—in the last twelve months, Uber has delivered an EPS of $5.9, and a free cash flow per share of $3.6.

Uber is now a profitable growth machine.

Risk Factors ❌

1. Regulatory Risks: Driver classification lawsuits are a common occurrence in a business of this nature. This is despite the fact that it doesn’t force 12-hour, intense shifts. It may increase labor costs and reduce flexibility.

2. Thriving Competition: Competitive pricing from rivals and regional platforms puts pressure on margins. Lyft has more satisfied riders, which can be a risk long-term for Uber if many decide to drive for Lyft instead.

3. Autonomy execution risk: AV investments are large and pay-off timelines are uncertain; delays may impair projections. We’ve heard about AVs for many years, but there is still major uncertainty about when this will be in the market and provide revenue and earnings for Uber.

Other risks include:

Discretionary consumer spending: When consumers have less money to spend, they might choose cheaper options, like taking the bus/train instead of ordering an Uber.

Foreign exchange: Large fluctuations will impact Uber as it operates on a global scale.

Geopolitical exposure: Risk of being banned or regulated in key markets can put a damper on growth and profitability.

Valuation ⚖️