Hi partner 👋

In case you missed it:

As a premium member, you can access our Top 10 Buys 2024 here.

In this article, we will discuss our top stock picks for June 2024.

Let’s get into it 👇

The Greed to Fear index is pointing towards Neutral

The market has been in “Greed” territory for a while, but it has now shifted into “Fear”.

A fearful market tends to offer better entry points for long-term investors as multiples tend to contract in those periods.

“Be greedy when others are fearful, and fearful when others are greedy”

— Warren Buffett

One year ago, the market was in “Extreme Greed”. The current environment is more fearful and investors are more reluctant to pay up for stocks (Expect for Nvidia).

The S&P 500

The S&P has recovered from the short-lived pullback in April/May. The index has made new all-time highs driven by Big Tech, Semiconductors, and AI-related businesses.

The semiconductor ETF VanEck Semiconductor is up 53% this year, led by its overweight in Nvidia:

Fear of missing out (FOMO)

Got your eye on Nvidia as it's making new highs every week? Don’t let FOMO get the best of you. It’s easy to feel the urge to dive in when you see others showing their gains on social platforms. But remember, that’s often a siren song.

Seasoned investors will tell you that discipline trumps impulse. Sticking to your strategy is crucial, even when the allure of outperforming assets tempts you to stray. Sure, you might lag behind the market in some years—expect it one out of every three if you’re playing the long game. That's just part of the game.

Investments might wane in popularity temporarily, but remember, the market ultimately rewards sustainable growth and solid fundamentals over time. And when panic sends weaker hands running, that's your cue. Opportunities abound for those keeping a cool head. Stay sharp, stay patient.

What is a good buy?

Our analysis process is outlined fully in our guide, read by more than 300 investors.

If you prefer video, we are creating a video course — sign up for a deal here.

We have also outlined a simple valuation method in our free valuation cheat sheet. One can use several methods, but we like to keep it simple.

First, we want to determine business quality by understanding the business, how it makes money, the different business segments, the growth potential for each segment or product/service, the margins, return on capital, and competitive advantage.

Second, we want to understand the historical valuation and price to earnings/cash flows the company has traded at. Then we use a simple discounted cash flow analysis to determine what direction the company is heading.

High-quality businesses, bought at fair prices, yield great long-term returns.

Disclaimer: This is not investment advice, always do your own due diligence and make your own investing decisions.

Top 5 Buys June 2024 🏰

Fortinet FTNT 0.00%↑ 🔐

The Business

Fortinet is a global leader in broad, integrated, and automated cybersecurity solutions.

Fortinet's unique security architecture is designed to deliver security without compromise to address the most critical security challenges, whether in networked, application, cloud, or mobile environments.

Key Fundamentals

Gross Margin: 77.13%

Interest Coverage: 58.9x

Operating Margin: 23.8%

ROCE 5-Year: 24.76%

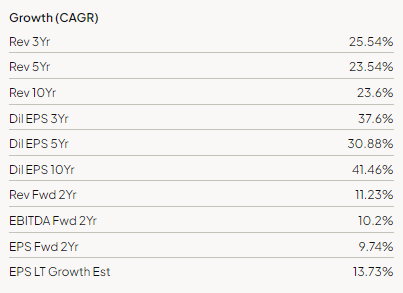

EPS 5-Year CAGR: 30.88%

FCF per share 5-Year CAGR: 26.69%

CAGR Since Inception: 27.6%

Valuation & Buy Area

Using the free cash flow per share (Last twelve months) of $2.2 as a proxy for our discounted cash flow analysis:

Fair value estimate: $73.11

Current share price: $58.69

Upside: +24.56%

Growth expectations for Fortinet:

Bahnhof AB $BAHN-B ⚡️

The Business

Bahnhof AB is a Swedish internet service provider.

Founded in 1994, it offers internet services, data hosting, and related services to both residential and business customers in Sweden.

The company is also known for its distinctive approach to protecting user data and its advocacy for internet freedom and security offering.

Key Fundamentals

Gross Margin: 20.99%

Interest Coverage: 83.7x

Operating Margin: 14.45%

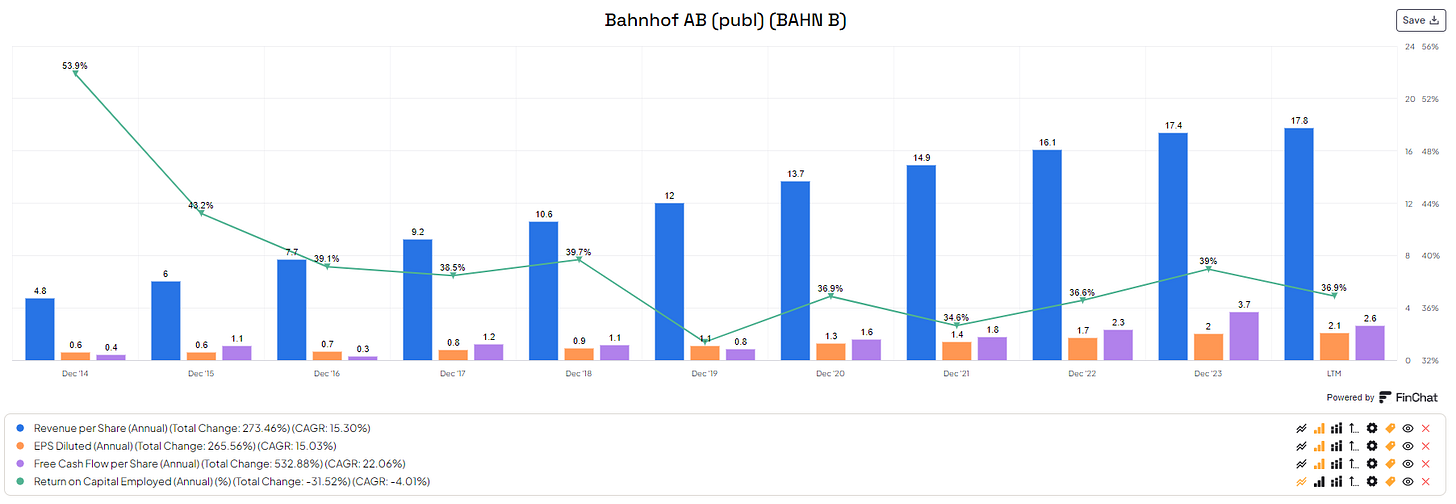

ROCE 5-Year: 39.57%

EPS 5-Year CAGR: 15.62%

FCF per share 5-Year CAGR: 26.64%

CAGR Since Inception: 32.1%

Valuation & Buy Area

Using the free cash flow per share (Last twelve months) of SEK 2.6 as a proxy for our discounted cash flow analysis:

Fair value estimate: SEK 68.32

Current share price: SEK 49.45

Upside: +38.15%

Growth expectations for Bahnhof:

Bahnhof is a small Swedish business that doesn’t have a lot of following, hence there are no growth estimates for the business.

However, judging by their historical growth, the steadiness and predictability of an internet service provider should allow them to continue to grow at a healthy rate.

The rest of the article is for premium members, learn more here.