Top 5 Quality Buys January 💎

5 quality businesses trading at fair valuations 📈

Hi partner! 👋🏻

Welcome to the January edition of Top 5 Buys ✅

In this article, we will discuss our top stock picks for January 2025.

Let’s get into it 👇

The Market Sentiment: Fear

The market is showing short-term volatility due to geopolitical events, primarily Trump’s comments and rhetoric about Greenland, which threaten the NATO alliance.

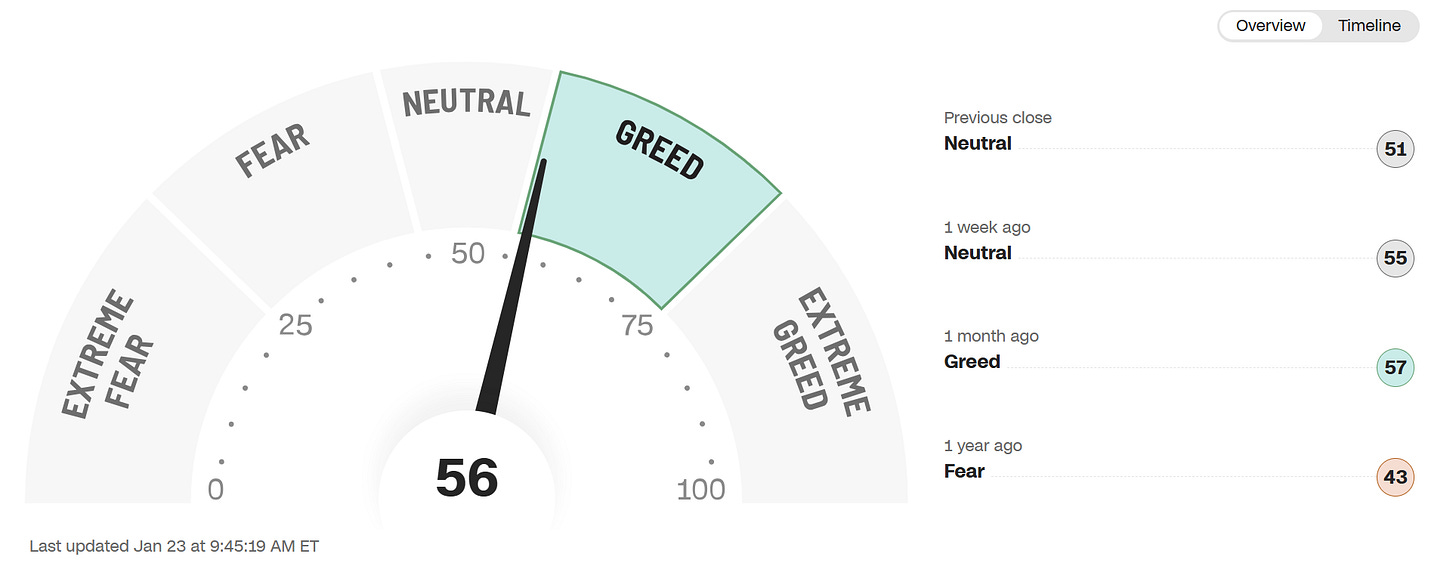

Despite this, all major indices are trading close to all-time highs, and the greed-to-fear index is still pointing towards ‘Greed’:

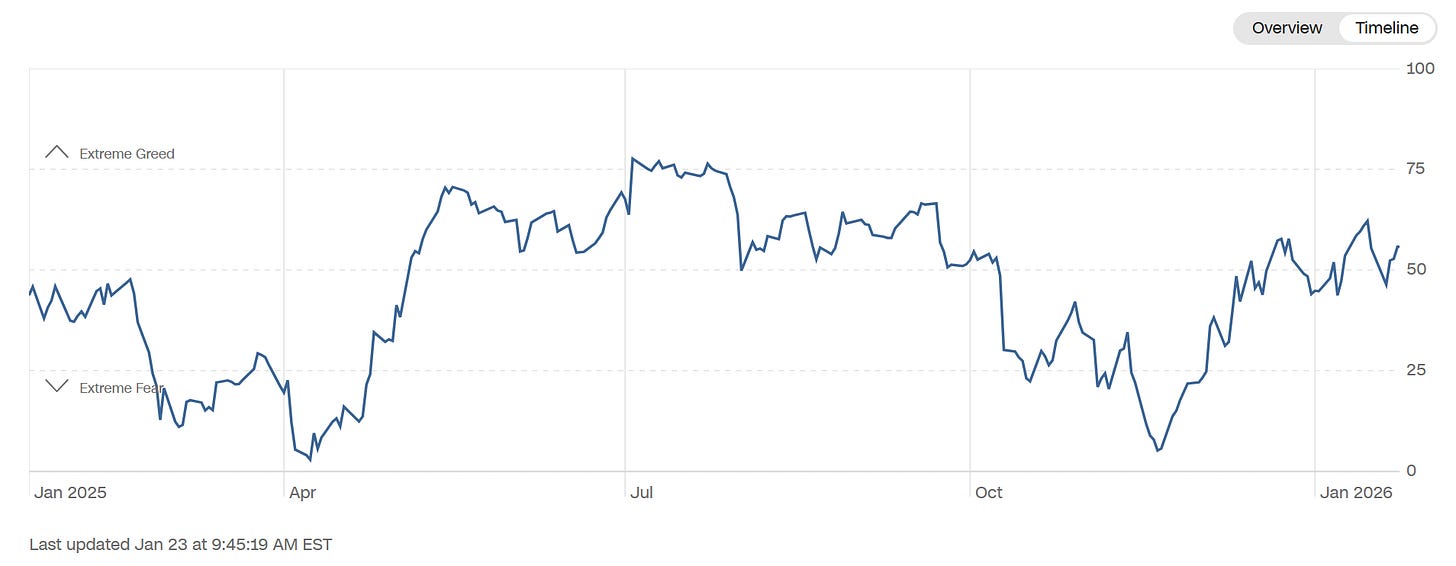

Investor sentiment has gone from extreme fear in November to Greed (Although close to Neutral):

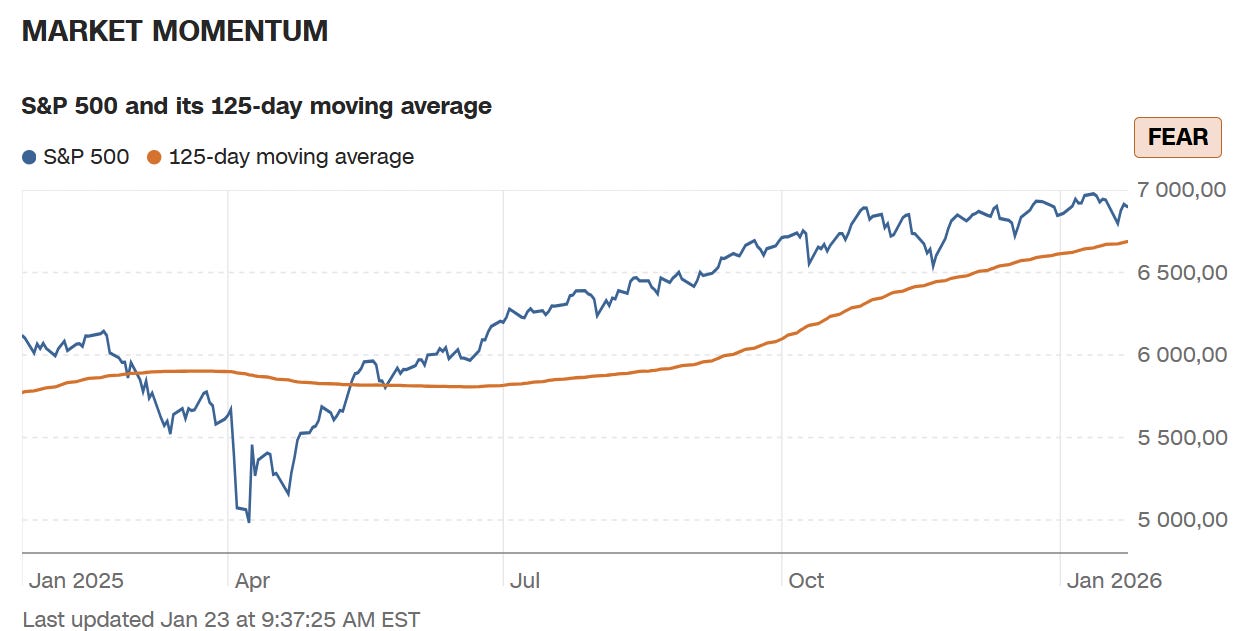

The S&P 500 is still well above its 125-day moving average. This indicates that the market is in an uptrend:

Predicting the future is impossible, but we can point to 5 quality growth businesses that continue to compound regardless of the market’s mood.

The businesses we look at continue to grow, have wide moats, great business models, and modest valuation levels.

Here are this month’s Top 5 Buys 👇

Disclaimer: This is not investment advice. Always conduct your due diligence and make your own investment decisions.

Top 5 Quality Buys January 2025 🚀

#1 Euronext ENX 0.00%↑

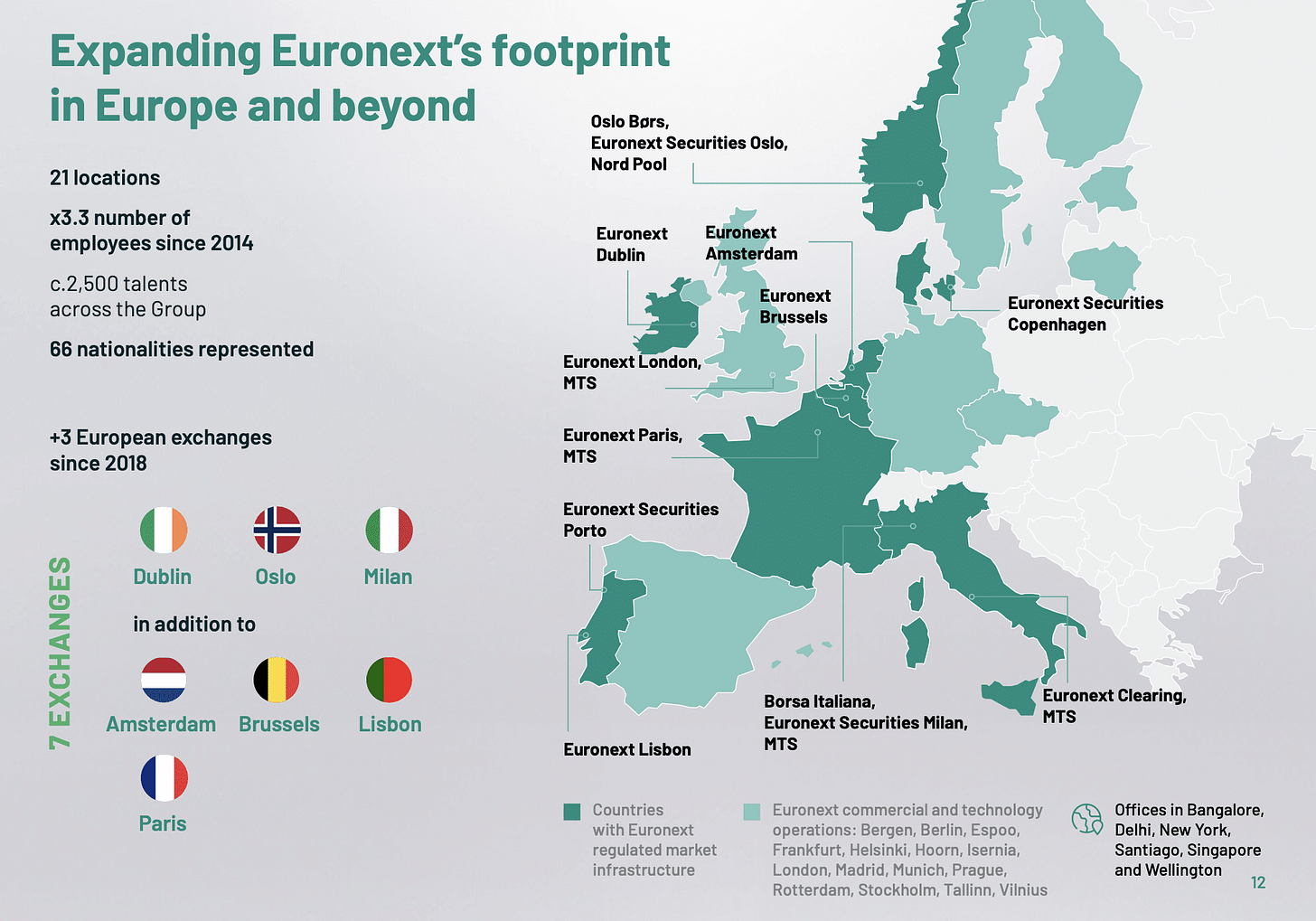

Euronext runs stock exchanges.

When people buy or sell shares, bonds, or derivatives in Europe, Euronext often earns a fee.

It operates major exchanges in countries like France, the Netherlands, Italy, Norway, Ireland, and Belgium.

This is not a bank or a broker. It’s the marketplace where trading happens.

How Euronext Makes Money

Euronext earns money every time its markets are used.

Main revenue sources:

Trading fees when investors buy and sell securities

Listing fees from companies listed on its exchanges

Market data fees (prices, indexes, analytics)

Clearing and settlement services after trades

Many of these revenues are recurring.

More activity = more fees for Euronext.

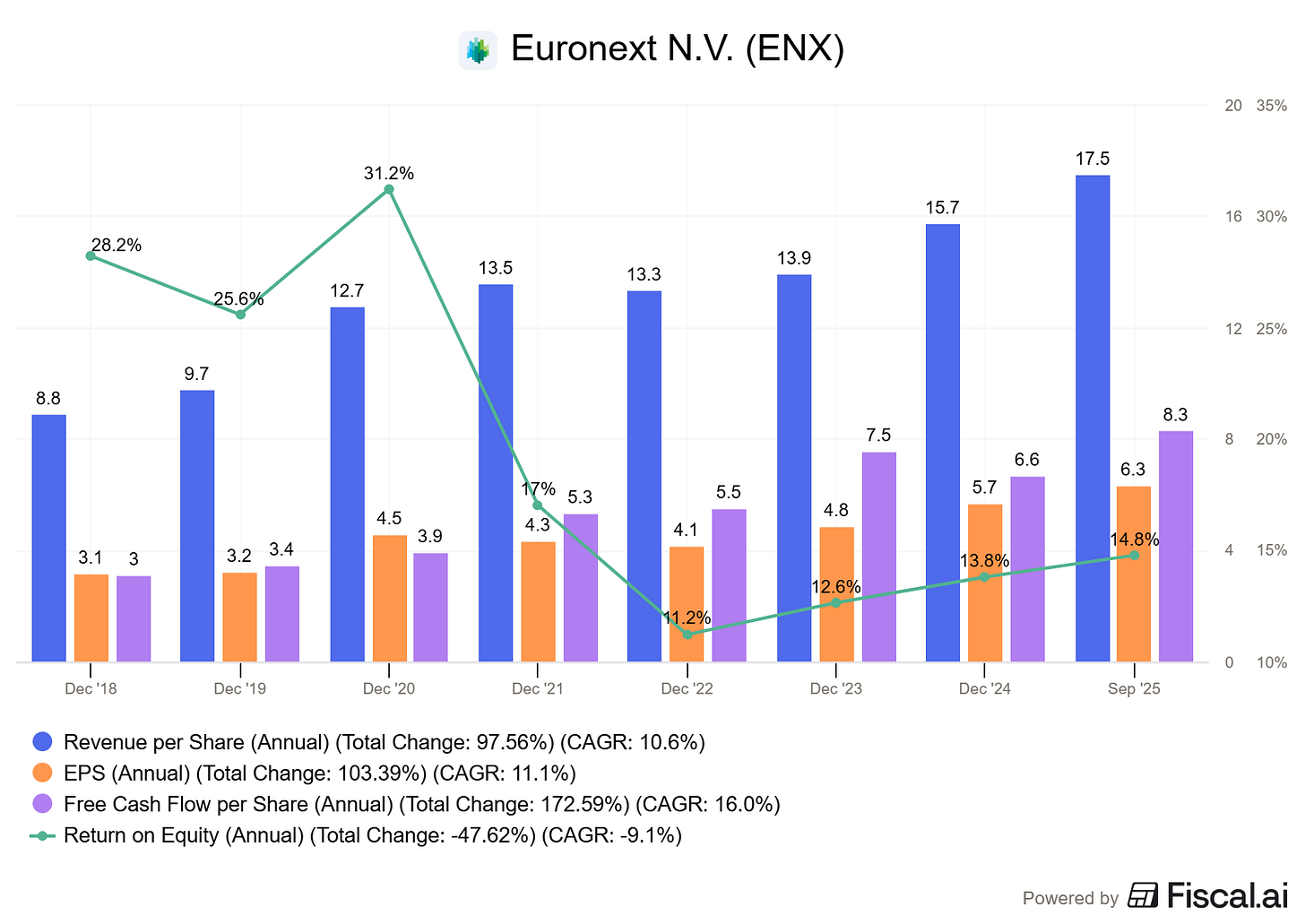

This provides a steady and predictable growth in revenues and cash flows:

Why Euronext Has a Strong Moat

Stock exchanges are natural monopolies.

Key advantages:

Barriers to entry: You can’t easily start a new exchange

Liquidity: Buyers go where sellers already are

Trust: Markets must be reliable and regulated

Scale: Large exchanges are cheaper and faster to run

Once a company is listed on Euronext, switching exchanges is costly and rare.

That makes the business very sticky.

Why the Business Can Grow 🚀

Euronext grows in durable ways:

More listed companies

Higher trading volumes over time

Growth in passive investing and ETFs

Selling more data and post-trade services

Even in bear markets, people still trade. That makes Euronext resilient across cycles. Monetizing activity in the stock market.

Financial Quality

Euronext is a high-quality cash generator.

Over time:

Strong operating margins of 53.4%

Low capital requirements (<30% of operating cash flows)

High free cash flow margins of 47.9%

Once the exchange is built, extra trades cost almost nothing.

That creates operating leverage.

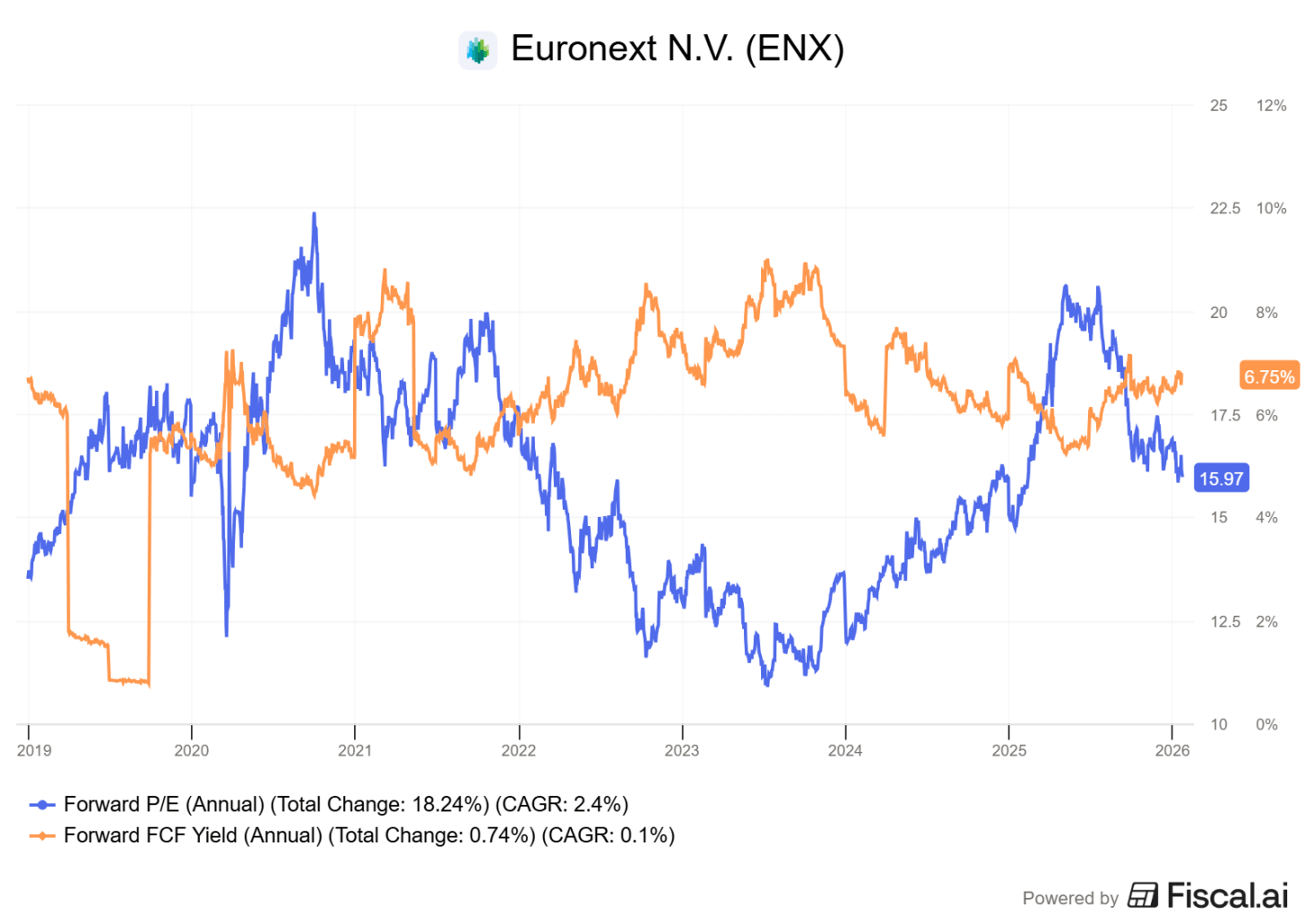

Valuation

Euronext trades at a reasonable valuation:

Forward P/E: 15.97x

FCF yield: 6.75%

While Euronext trades close to its historical PE/FCF yield, it is an undemanding valuation for a high-quality, cash-generating business:

Euronext is a toll booth on European capital markets.

It has:

High barriers to entry

Recurring revenue

Strong cash generation

Long-term relevance

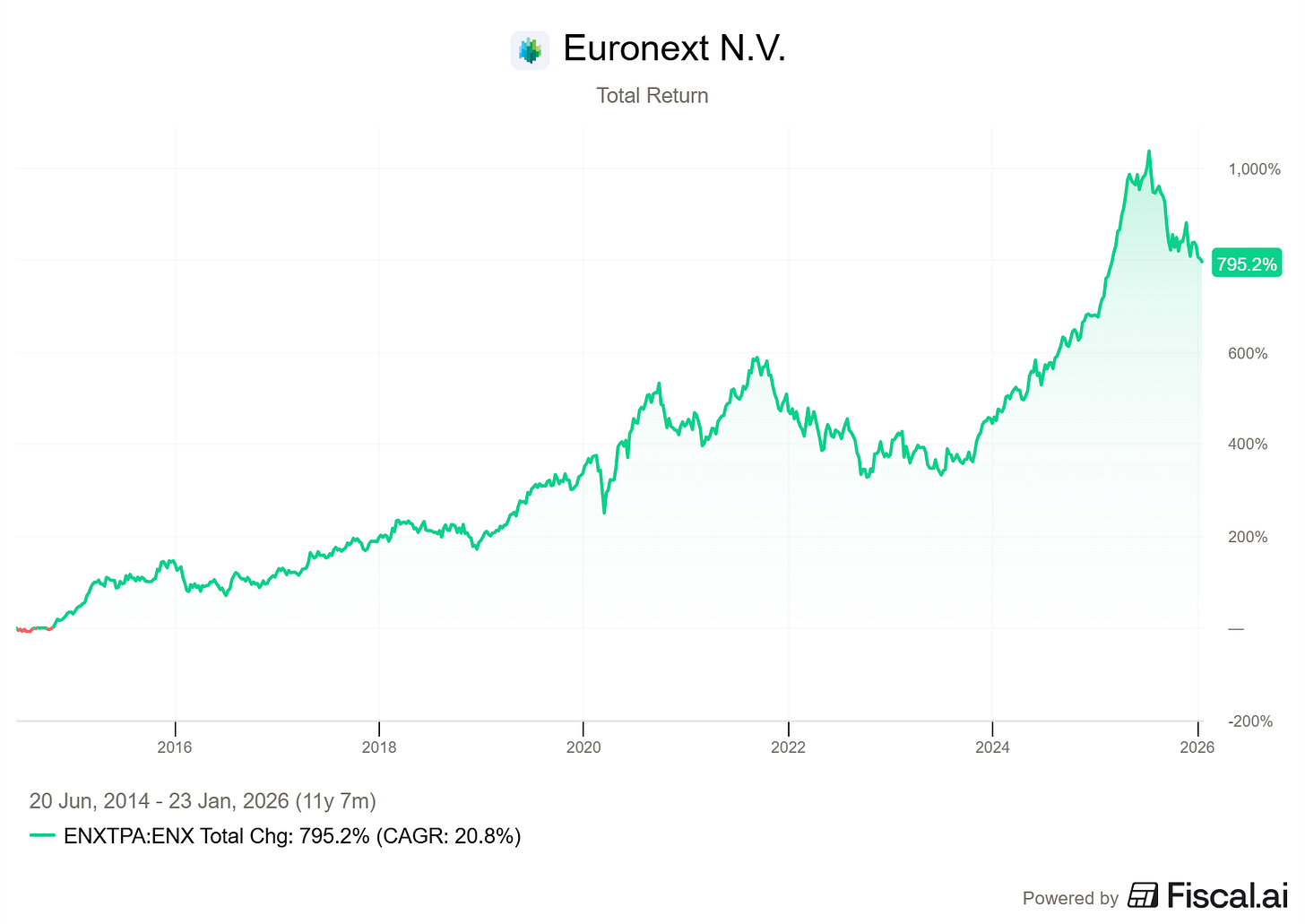

Euronext is a great example of a boring but powerful compounder that benefits from markets simply existing and growing over time.

Since its inception, Euronext has a compounded annual growth rate of 20.8%:

#2 Gartner IT 0.00%↑

Gartner is a global research and advisory company focused on technology and business decisions.

Its customers are CIOs, CTOs, and senior executives at large companies.

They use Gartner to decide what technology to buy, when to buy it, and from whom.

Gartner serves thousands of enterprises worldwide and is deeply embedded in corporate decision-making.

This is not a flashy AI company. It’s a high-trust information business.

How Gartner Makes Money

Gartner makes its money from selling subscriptions.

Companies pay an annual fee to access:

Research reports

Benchmarks and frameworks

Analyst calls and advice

Once subscribed, customers tend to renew.

Why?

Decisions are high-stakes

Switching providers is risky

The cost is small relative to IT budgets

This creates recurring, predictable revenue.

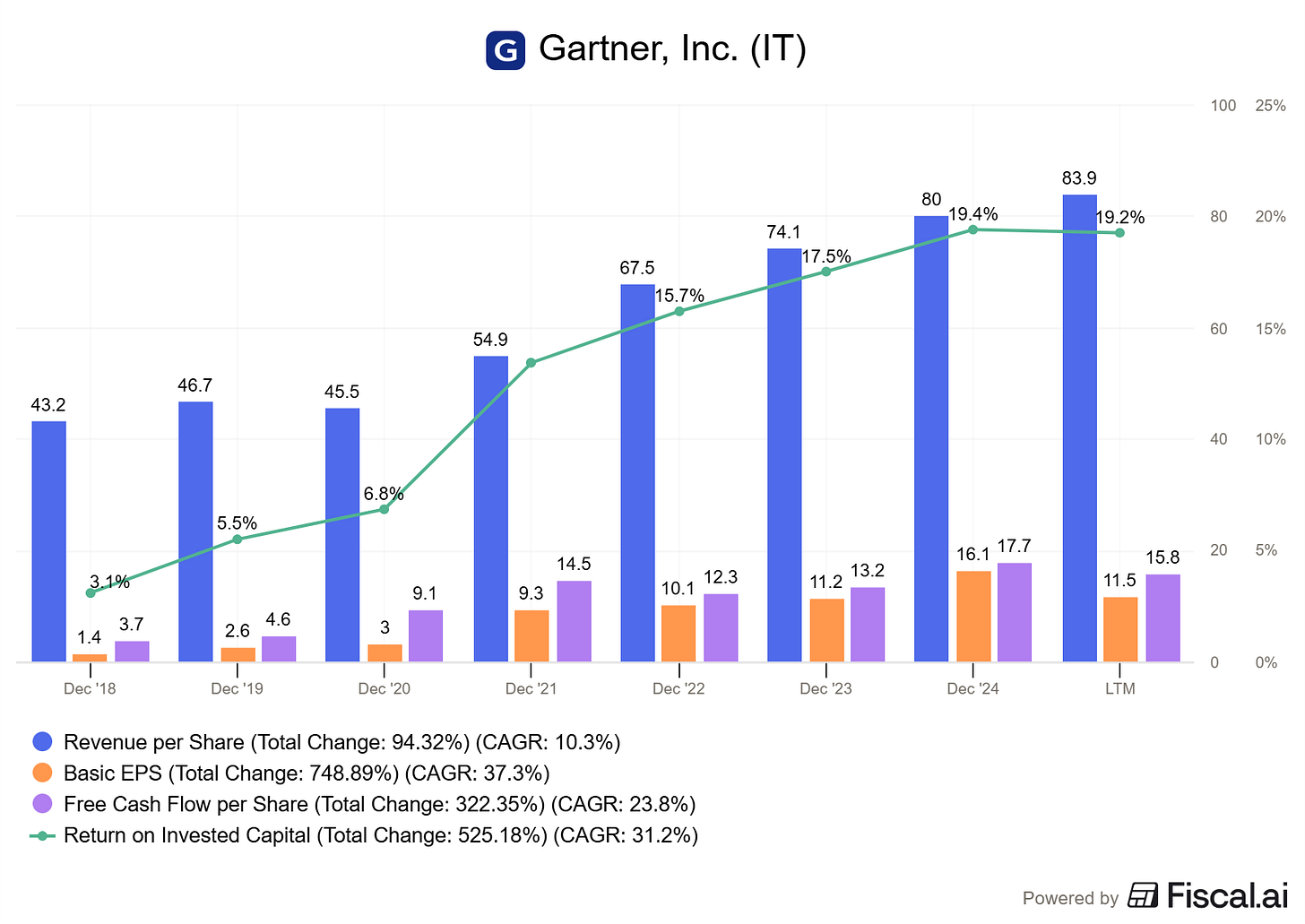

Gartner has compounded its EPS by 37.3% and FCF per share by 23.8% since 2018, while significantly expanding its ROIC:

Why Gartner Has a Strong Moat

Gartner’s moat is credibility, trust, and scale.

Decades of proprietary research

Thousands of analysts and data sources

Neutral, vendor-independent advice

A brand executives trust

Gartner’s insights often influence multi-million-dollar decisions.

Very few companies can match that level of trust.

Once a company relies on Gartner, it’s hard to stop.

This shows up in its retention rates of +95% for its business segment.

Why the Business Can Grow 🚀

Gartner benefits from long-term trends:

Rising IT complexity

More cloud, AI, and cybersecurity spending

Executives needing external guidance

Expansion within existing customers

Most growth comes from:

Price increases

Selling more seats and services

High renewal rates

This leads to steady per-share compounding.

Financial Quality

Gartner is a capital-light cash generator.

Over time, it has shown:

High operating margins of +18.1%

Strong free cash flow growth (10-year CAGR: +16.6%)

Capital light business model with Capital Expenditure representing less than 10% of operating cash flows

That makes Gartner a capital-light compounder.

Valuation

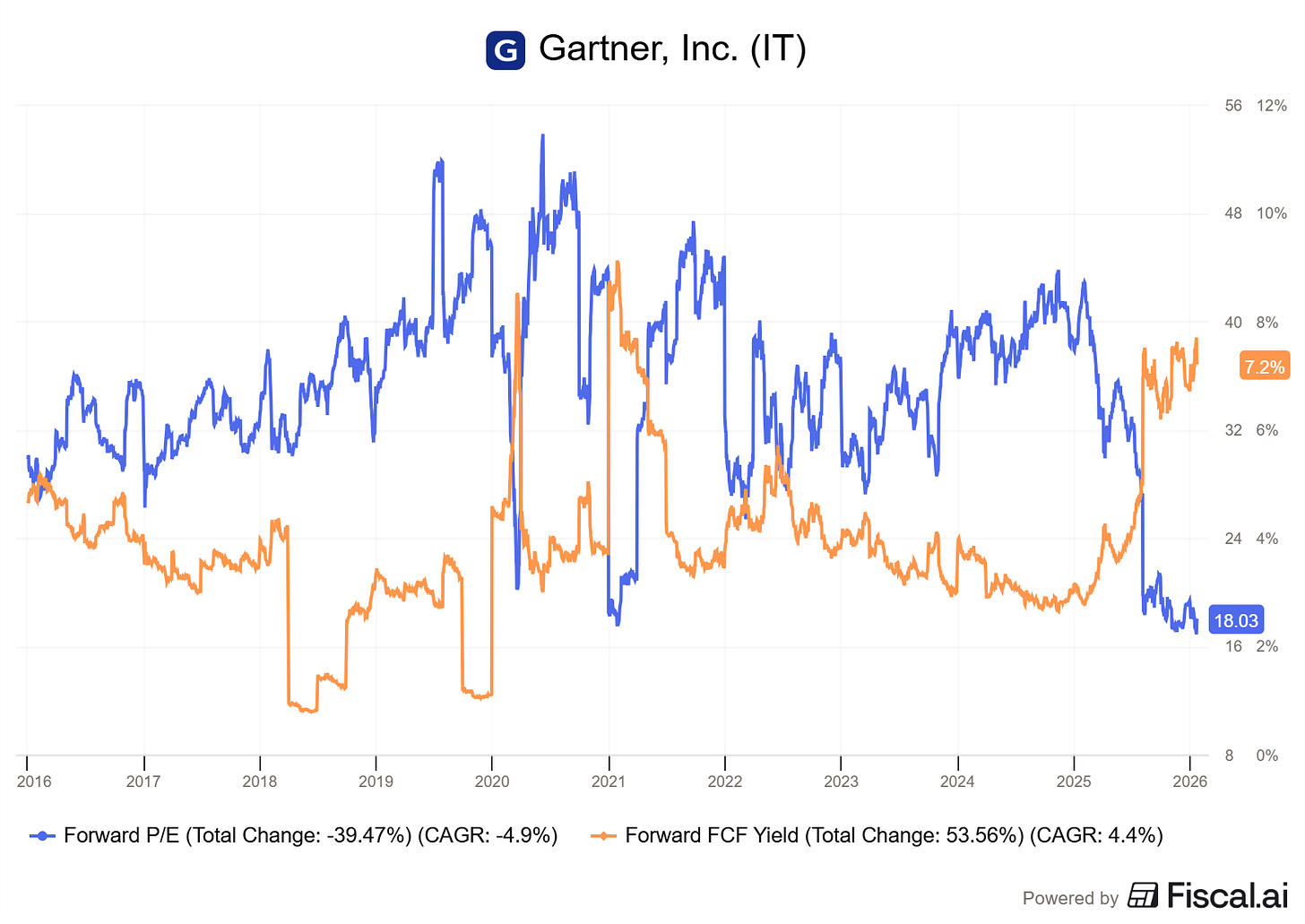

Gartner usually trades at a premium valuation, but has recently fallen to a multi-year low:

Forward P/E: 18x

Forward FCF yield: 7.2%

Investors pay up because:

Revenue is recurring

Churn is low

Cash flows are predictable

Forward PE and FCF yield are currently at historical low levels for Gartner:

Gartner sells trusted advice, not software.

It has:

Sticky subscriptions

Strong pricing power

Minimal capital requirements

Long-term growth tailwinds

Gartner is a great example of a quiet, high-quality business that compounds steadily over time.

Despite the recent sharp fall in share price, Gartner has compounded by 13.9% CAGR since inception:

Now, let’s get into the top 3 👇