Top 5 Buys September 💎

5 Fairly priced Quality Businesses 🧠

Hi there partner👋

Welcome to the September edition of Top 5 Buys ✅

You can access our Top 10 Buys 2024 list as a premium member here.

In this article, we will discuss our top stock picks for September 2024.

This list does not include any of the companies on our Top 10 list.

Let’s get into it 👇

The Market Sentiment: Greed Dominates

After a brief moment of nervousness in early September, the Greed to Fear Index is leaning towards Greed again. This indicates that investors are taking on more risk than usual (We like the opposite).

The S&P 500 is Reaching all-time highs

The S&P 500 is in all-time high territory, recovering from the turbulence experienced in early August.

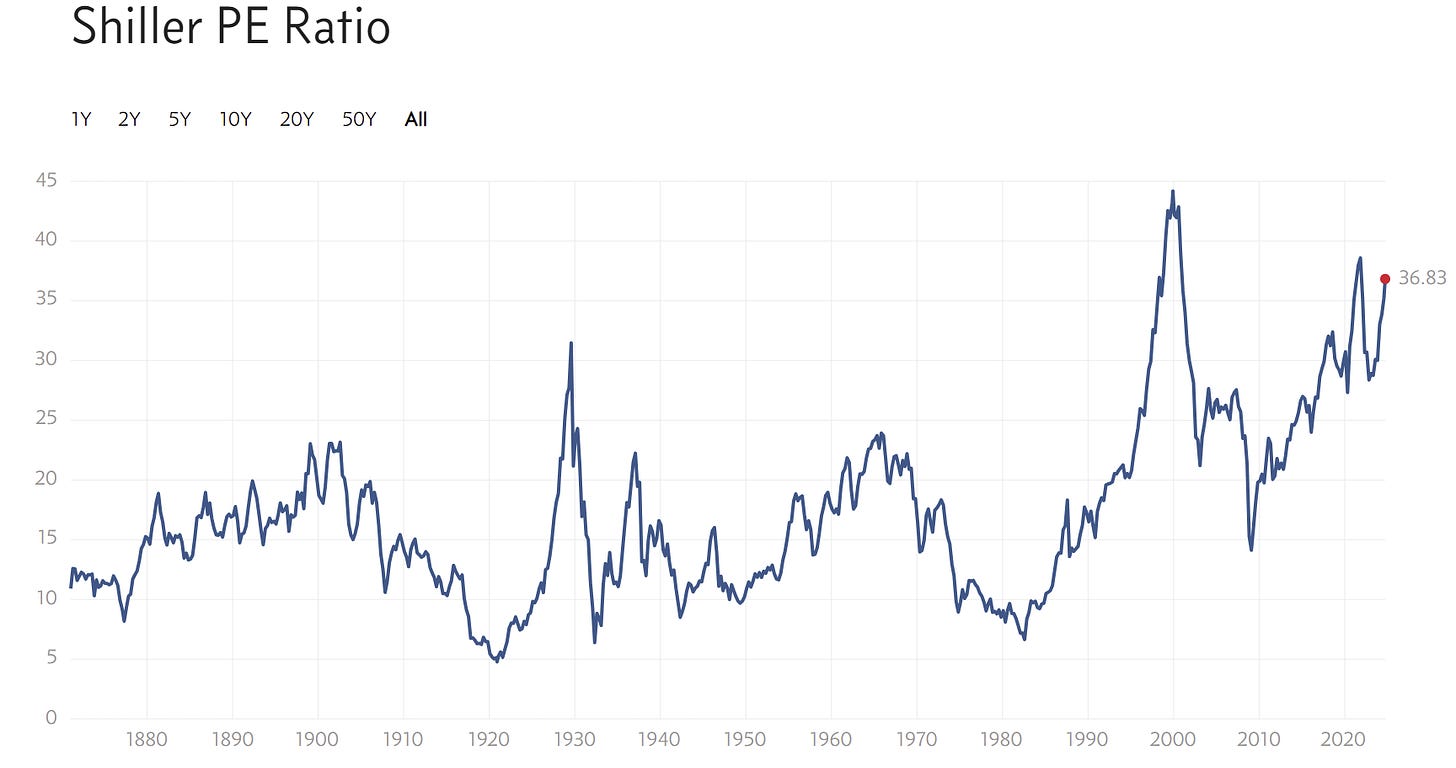

The overall market is looking expensive, with a Shiller PE of 36.83. The only periods with a higher Shiller PE were the dot com era and the post-pandemic boom.

The high market valuation makes it more important to pick your spots and companies that are fairly priced compared to their prospects.

The S&P 500 is unlikely to yield the same returns moving forward as it has done in the last 20 years. The reason for that is that we won’t see the same level of interest cuts and quantitative easing to artificially boost stock market returns.

What is a Good Buy? 🧠

We emphasize understanding the fundamentals before investing. If you prefer an in-depth analysis, check out our guide, trusted by over 300 investors. We also offer a free valuation cheat sheet for a straightforward approach to determining a company’s intrinsic value.

We assess a company's quality based on its business model, revenue generation, margins, return on capital, management, and competitive advantages. We then analyze its historical valuation to identify attractive buying opportunities.

Disclaimer: This is not investment advice. Always conduct your due diligence and make your own investment decisions.

Now, let's get to our Top 5 Buys for September 2024 💎

Top 5 Buys September 2024 💎

1. Visa (NYSE: V 0.00%↑ ) 💳

Visa is a global leader in digital payments, enabling consumers, businesses, and governments to make secure electronic payments across 200+ countries.

Key fundamentals:

Gross Margin: 97%

Operating Margin: 67%

Return on Invested Capital (ROIC): 29%

Revenue growth (3Y): 15.5%

Earnings per share growth (3Y): 23.6%

Forward PE: 25.5

Forward FCF yield: 4.16%

Why we like Visa: Visa is a dominant player in a duopoly with Mastercard, benefiting from the global shift towards digital payments. Its consistent revenue growth, high margins, and solid cash flow make it a compelling investment. Despite market fluctuations, Visa’s network effect and international expansion offer long-term growth potential.

3 reasons why Visa is an interesting investment case:

Global Reach: Visa’s extensive network provides a competitive advantage and positions it to capture the continued shift from cash to digital payments worldwide.

Strong Fundamentals: High margins, high (and sustained) return on invested capital, a solid balance sheet, and a history of generating strong cash flows.

Resilient Business Model: Visa earns a fee on every transaction, making it less sensitive to economic downturns compared to other companies.

Simple Discounted Cash Flow Analysis

Fair value estimate $290.99

Current price: $273.4

Upside: +6.4%

Expected CAGR: 11.5%

2. Comfort Systems USA (NYSE: FIX 0.00%↑ ) 🏗️

Comfort Systems USA provides mechanical and electrical contracting services, specializing in HVAC, plumbing, and building automation systems.

Key fundamentals:

Gross Margin: 20%

Operating Margin: 9.5%

Return on Invested Capital (ROIC): 16.3%

Revenue growth (3Y): 29.5%

Earnings per share growth (3Y): 41.8%

Forward PE: 26.7

Forward FCF yield: 4.02%

Why we like Comfort Systems USA: As a leader in the fragmented HVAC services market, Comfort Systems benefits from recurring service revenue and long-term contracts. The company’s strong ROIC and disciplined capital allocation make it an attractive investment in the industrial sector.

3 reasons why Comfort Systems USA is an interesting case:

Recurring Revenue Model: A significant portion of its revenue comes from ongoing maintenance contracts, providing stability.

Fragmented Market: Opportunity to consolidate smaller players, driving growth through strategic acquisitions.

Steady Service Demand: HVAC systems require regular maintenance and upgrades, ensuring steady demand even during economic downturns.

Simple Discounted Cash Flow Analysis

Fair value estimate $463.07

Current price: $388.18

Upside: +19.55%

Expected CAGR: 13.5%