Top 5 Buys December 2024 💎

5 Quality Businesses at a fair price ⚖️

Hi there partner!👋

Welcome to the December edition of Top 5 Buys ✅

You can access our Top 10 Buys 2024 list as a premium member here.

In this article, we will discuss our top stock picks for December 2024.

Let’s get into it 👇

The Market Sentiment: More Greed.

The Fear to Greed index is pointing at greed (as usual), indicating that investors are willing to take on more risky assets and debt.

Ideally, we want fear to create temporary dislocations in price of high quality companies - but this usually only happens a couple of times per year.

The S&P 500 is making new All Time Highs

The S&P 500 just made a new all time high and is in a strong uptrend.

Let’s take a moment to reflect - in March 2020, everyone thought the economy would crash and that the world never would be the same. Almost 5 years later, the S&P ($SPX) has gone from $2300 → $6032, a gain of +161% (not including dividends).

If anything, this should be a reminder that the best opportunities are acted upon by rational and calculated investors when everyone else are losing their minds.

What is a Good Buy? 🧠

We emphasize understanding the fundamentals before investing. If you prefer an in-depth analysis, check out our guide, trusted by over 300 investors. We also offer a free valuation cheat sheet for a straightforward approach to determining a company’s intrinsic value.

We assess a company's quality based on its business model, revenue generation, margins, return on capital, management, and competitive advantages. We then analyze its historical valuation to identify attractive buying opportunities.

Invest in Quality is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Disclaimer: This is not investment advice. Always conduct your due diligence and make your own investment decisions.

Now, let's get into it 👇🏻

Applied Materials (NYSE: AMAT 0.00%↑) 🤖

Applied Materials is a global leader in materials engineering solutions. The company provides advanced equipment and software for the semiconductor, display, and solar industries.

Applied Material’s growth is driven my high demand in multiple sectors, and although the semiconductor industry is cyclical, the potential future growth is large. In addition, the current valuation is undemanding compared to its historic multiples.

Key fundamentals:

Gross Margin: 47.46%

Operating Margin: 28.95%

Return on Equity (ROE): 48.5%

Revenue growth (3Y): 5.62%

Earnings per share growth (3Y): 10.39%

Forward PE: 18.14x

Why we like Applied Materials:

High demand for Semiconductors: Applied Materials is well-positioned to benefit from increased semiconductor demand. This mega trend is driven by AI, 5G, and IoT technologies.

Diversified Product Portfolio: Applied Material’s product offering includes semiconductors, displays, and solar energy, providing multiple revenue streams and risk mitigation.

Strong Financials: Applied Materials has a strong track record of cash flows, hight return on invested capital, high margins, and significant shareholder returns.

Simple Discounted Cash Flow Analysis

Fair value estimate: $232.50

Current price: $174.7

Upside: +33.1%

Expected CAGR: 14.5%

Kitron ASA (Oslo Børs: $KIT) 💡

Kitron ASA is a global electronics manufacturing services (EMS) provider, specializing in the production of high-tech electronic systems for industries such as defense, healthcare, energy, and telecommunications.

Kitron delivers customized solutions that optimize performance and efficiency for its clients.

The stock has compounded by 30.5% in the last 5 years while still keeping its multiples relatively low. The growth has been significant despite a slower 2024.

Key fundamentals:

Gross Margin: 33.34%

Operating Margin: 7.77%

Return on Equity (ROE): 19.33%

Revenue growth (3Y): 28.97%

Earnings per share growth (3Y): 33.94%

Forward PE: 13.25x

Why we like Kitron AS:

Growing Demand for Electronic solutions: Kitron benefits from rising demand for electronic systems across defense, healthcare, and renewable energy industries.

Industry expertise & trust: Kitron has decades of expertise and has created a network of trusted partners for high-complexity manufacturing solutions. This in turn allows Kitron to secure long-term contracts with global clients.

Global Diversification: Kitron has a galobal presence which spreads its risk and allows it to tap into multiple markets and sectors. This is also a future growth driver for Kitron.

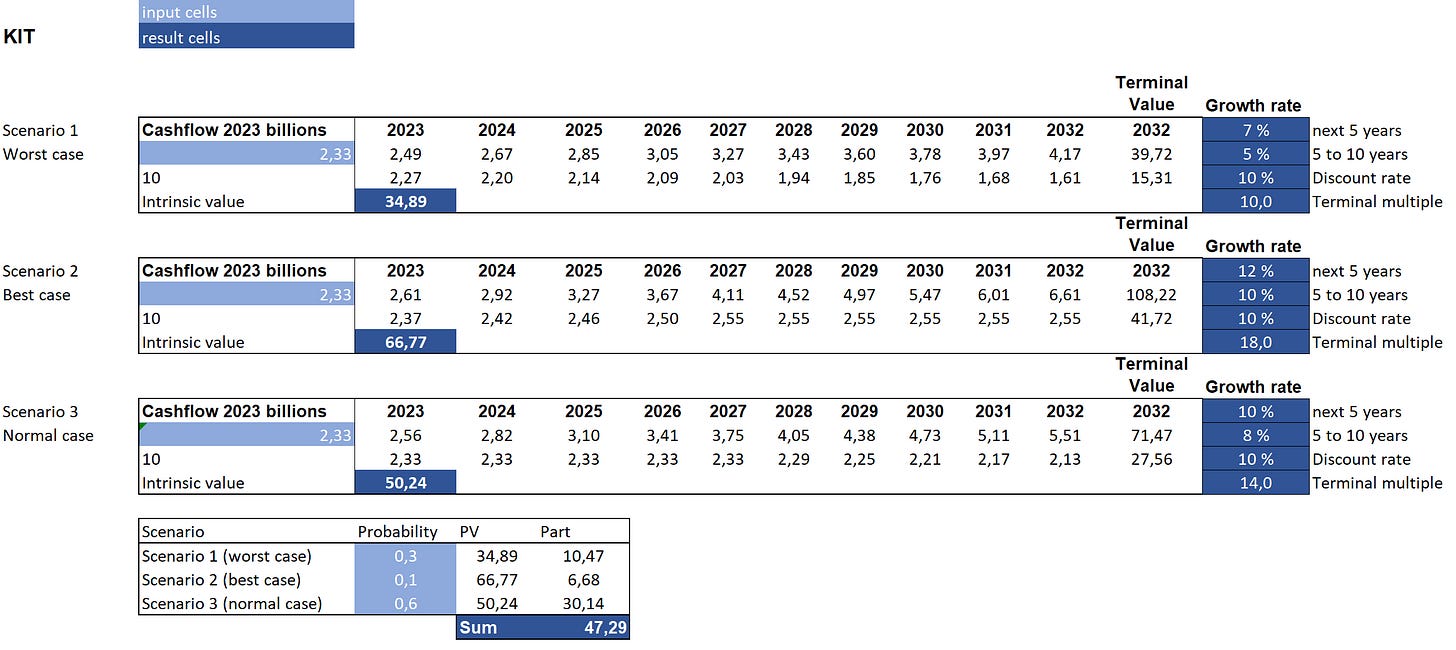

Simple Discounted Cash Flow Analysis

Fair value estimate: NOK 47.29

Current price: NOK 31.5

Upside: +50.1%

Expected CAGR: 16%

The rest of this article is for Premium Invest In Quality Subscriber, join us today to follow our market beating Quality Growth Portfolio: