🏰 10 Hidden Compounders from UK

UK Compounders trading at a discount to intrinsic value

Hello investor!👋

The UK stock market has been unloved for years, but behind the scenes, that’s starting to change. Momentum has been picking up in small and mid-caps, and institutional capital is returning.

Behind the scenes, a range of overlooked UK shares are quietly breaking out.

Stockopedia just released a new free report revealing 10 UK stocks with the financial traits most associated with outperformance.

These are not “blue-sky” story stocks. They’re companies with:

Increasing earnings

Attractive valuations

Strong stock price momentum

Some names you may know - like the household name retailer turning around fast with 37% profit growth and a return to dividends.

Others are under-the-radar movers - like the supermarket cleaning products supplier, up over 270% since late 2023, or the small-cap transport technology stock, which just landed a £2.7m U.S. infrastructure contract.

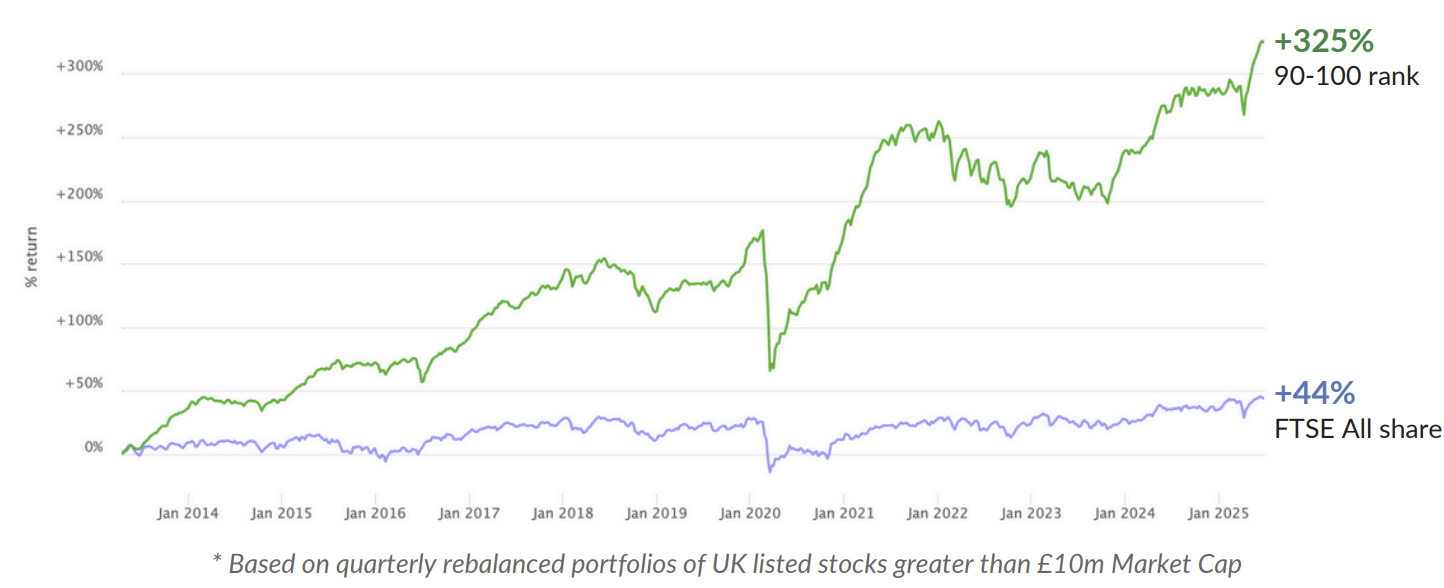

All ten were selected using Stockopedia’s StockRanks framework - a rules-based system identifying stocks with the optimal characteristics, backed by 100 years of market back testing.

Last year’s Top 10 stocks have now returned more than 25%, while the track record of all 90+ StockRank stocks since launch in 2013 has been a 12% annualised return.

And this list? It’s a first look at where the data says smart investors should be paying attention.

No bias. No guesswork. Just the facts and ten stocks backed by the numbers.

Happy compounding!

Marius from InvestInAssets

PS: If you'd like to sign up and try out Stockopedia today, Invest In Assets readers can obtain an exclusive 14-day free trial and 25% discount on any annual plan via the link here.

This is a sponsored email in collaboration with Stockopedia, which I’ve been using to assist my stock market research for more than 3 years now.