Top 10 Buys 2024 [Updated]🏆

Quality Compounders for 2024 🧠

Hi Partner 👋

Today, we are updating our Top 10 List for 2024.

The Top 10 List for 2024 (Monthly updates) 🏆

Certain companies in our investable universe stand out for their innovative approaches and transformative impact within their industries.

From e-commerce giants and luxury brands to cybersecurity and tech conglomerates, these ten companies are reshaping the way we live, shop, and interact with the digital world.

Let’s get into the top 10 buys for 2024 👇

3 Bonus picks 🏰

BONUS: #13 LVMH: The King of Luxury

LVMH Moët Hennessy Louis Vuitton embodies luxury across its numerous high-end brands in fashion, leather goods, wines, and cosmetics. By maintaining rigorous quality standards and embracing innovative branding, LVMH continues to captivate an upscale market while expanding its global presence.

LVMH has multiple strong business segments with world-class premium luxury brands. The business is producing high levels of cash and has been a successful serial acquirer of global luxury brands.

Valuation and Buy Area

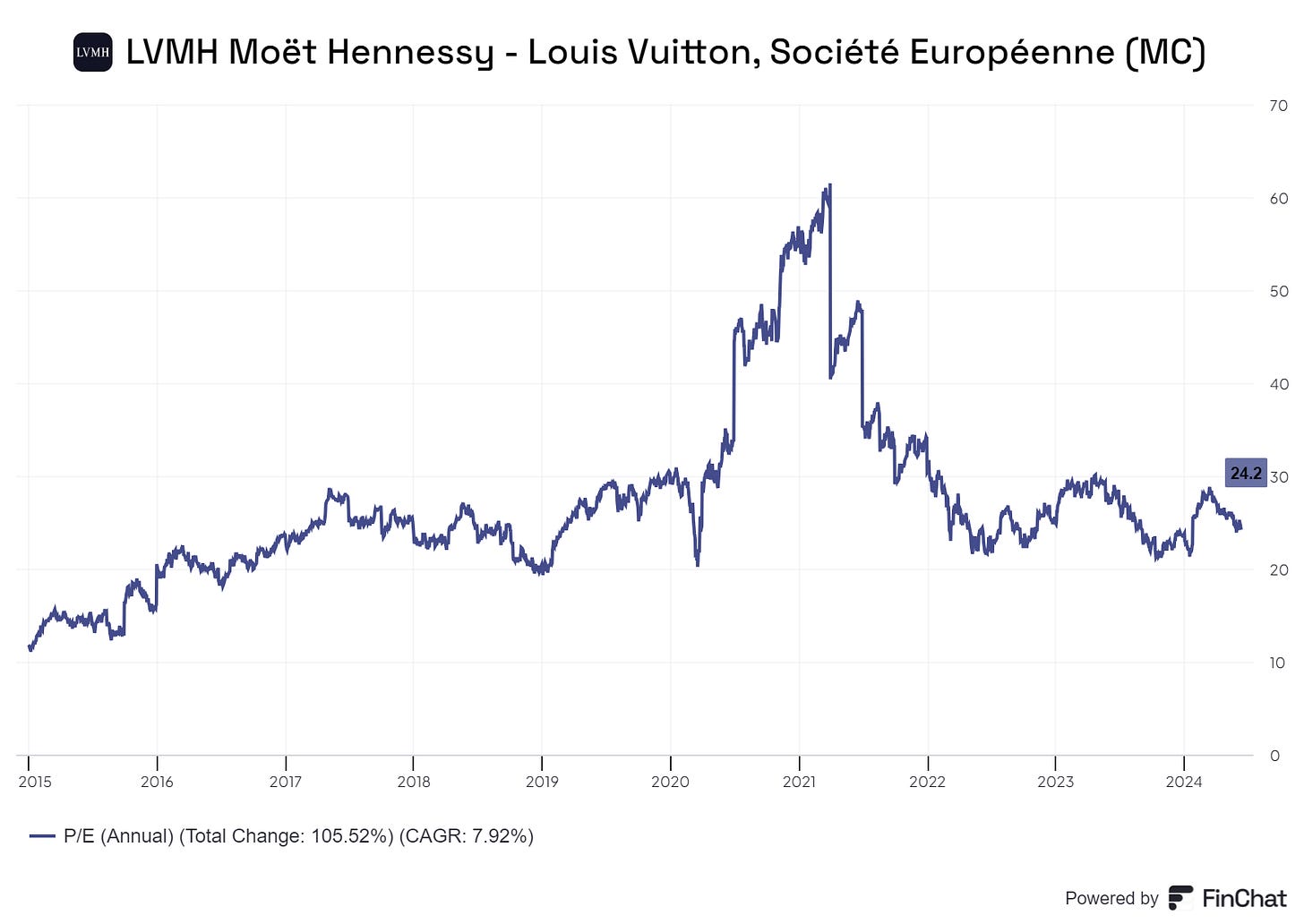

LVMH is trading close to its average range in terms of historical PE ratio.

The PE is 24.2, and the forward PE is 23.

Simple discounted cash flow analysis

We want to be conservative in our estimates to create a margin of safety.

We expect LVMH to return 12% annually from today’s valuation.

+9.6% long-term EPS growth is what analysts expect.

Fair value estimate: EUR819.03

Current share price: EUR735.4

Upside: 11.37%

BONUS: #12 MSCI MSCI 0.00%↑ 📊

MSCI is a leading provider of critical decision support tools and services for the global investment community.

MSCI has rapidly expanded its product offerings and market presence and is set to continue growing its global reach.

The founder and current leadership team retain significant ownership and influence over the business.

CEO Fernandez owns 2.67% of the business and has been CEO for 30 years (!)

Key Fundamentals:

Gross Margin: 82.17%

Operating Margin: 53.99%

ROCE 5-Year: 30.15%

EPS 5-Year CAGR: 17.67%

FCFPS 5-year CAGR: 17.37%

CAGR Since Inception: 20.6%

Interest Coverage: 7.5x

Valuation and Buy Area

MSCI is trading close to its low range in terms of historical PE ratio.

The PE is 33.66, and the forward PE is 32.69.

Simple discounted cash flow analysis

We want to be conservative in our estimates to create a margin of safety.

Using the FCFPS from the last twelve months (LTM) as a proxy for earnings ($15.70).

With 3 different scenarios for growth between 9%-13% EPS growth in the next 5 years.

We expect MSCI to return 11% annually from today’s valuation.

+11.69% long-term EPS growth is what analysts expect.

Fair value estimate for MSCI: $503.29

Current share price: $484.48

Upside: 3.9%

BONUS: #11 Alphabet: Shaping the Future of Technology

Alphabet, the parent company of Google, continues to influence nearly every facet of the digital economy through its array of services and investments in multiple areas. Alphabet’s commitment to innovation and market dominance makes it a key player in shaping future technological landscapes.

Alphabet has been a large winner since its inception. Its per-share compounding and high ROIC make it an attractive business to invest in. We also believe that AI will benefit Google more than other businesses, as Google’s reach and distribution of AI is significantly larger than most companies. Their business model of making high-quality free products is well suited to integrate AI as a value add for end users—driving growth in the years ahead.

Alphabet is trading at 22x NTM earnings. The 2022 sell-off provided an even better opportunity to enter Google. However, we can’t always wait for a business to make new lows to enter. We believe there is a significant upside in Alphabet, and 22x NTM earnings is a fair price to pay for a quality technology business.

Valuation and my buy area

The current price of Alphabet is $176.55.

We’re expecting Alphabet to produce a 12% annual return from the Normal scenario.

Alphabet is expected to grow its long-term EPS by 17.21% annually.

Current price per share (As of this writing): $176.55

Intrinsic value estimate per share: $191.98

Suggested upside: +8.7%

Now we move into the top 10 Buys of 2024 🏆

The rest of the article is for Premium Subscribers, join us, and read more: