Microsoft: Quality Compounder at a discount? 💎

Quality compounder finnally trading at a fair valuation? 📊

Noise, Signal, or Opportunity?

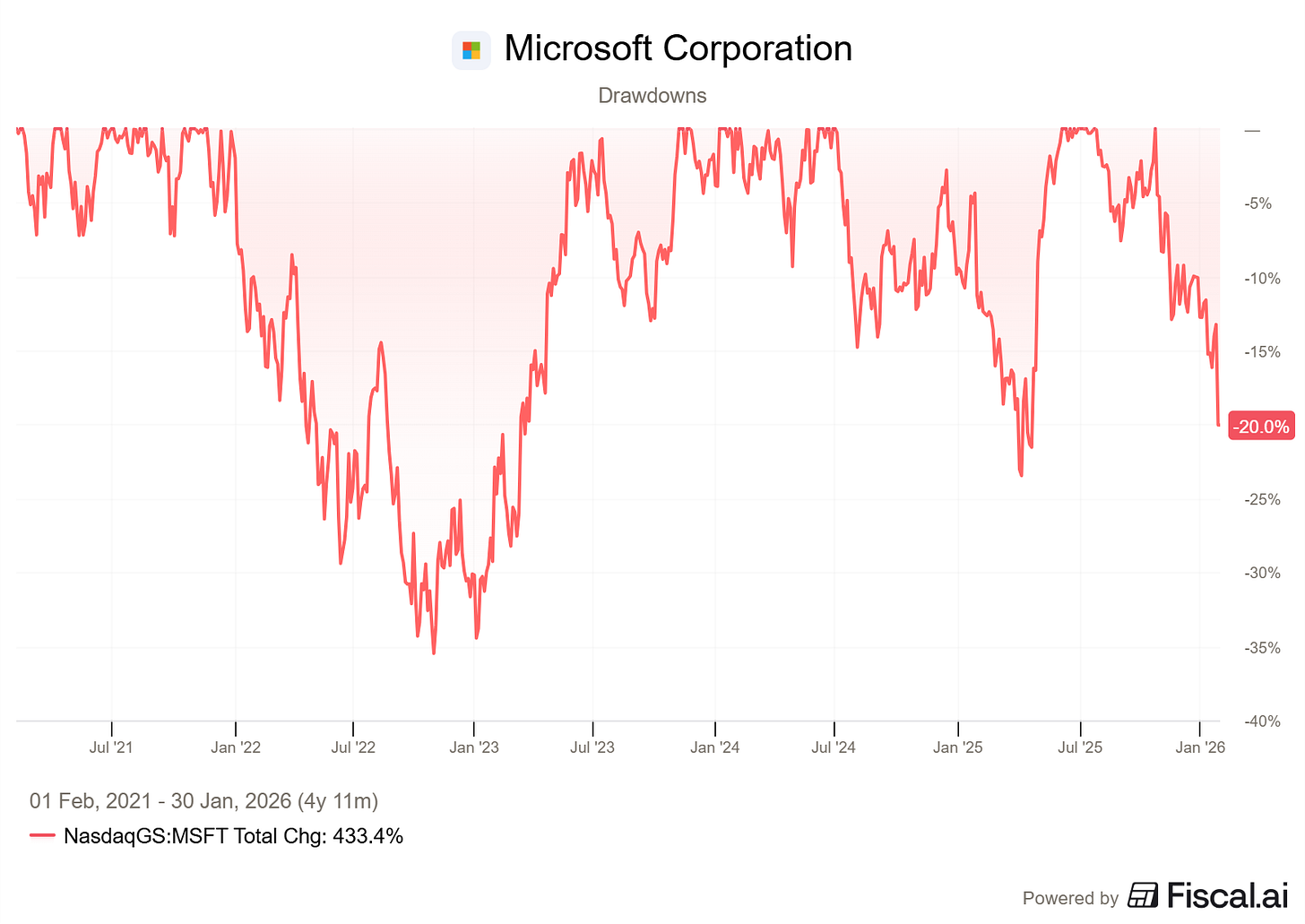

This week, Microsoft dropped roughly -10% after its earnings report.

Microsoft is now down -20% since its recent all-time highs — not something that happens often for this quality business.

The real question for long-term investors is simple:

Did something break, or did expectations simply run ahead of reality?Let’s break it down 👇

What Caused the Fall?

Microsoft didn’t miss earnings in any dramatic way. The sell-off was driven by expectations, not fundamentals.

Three things stood out to me:

1. Azure Growth: Still Strong, but at what Cost?

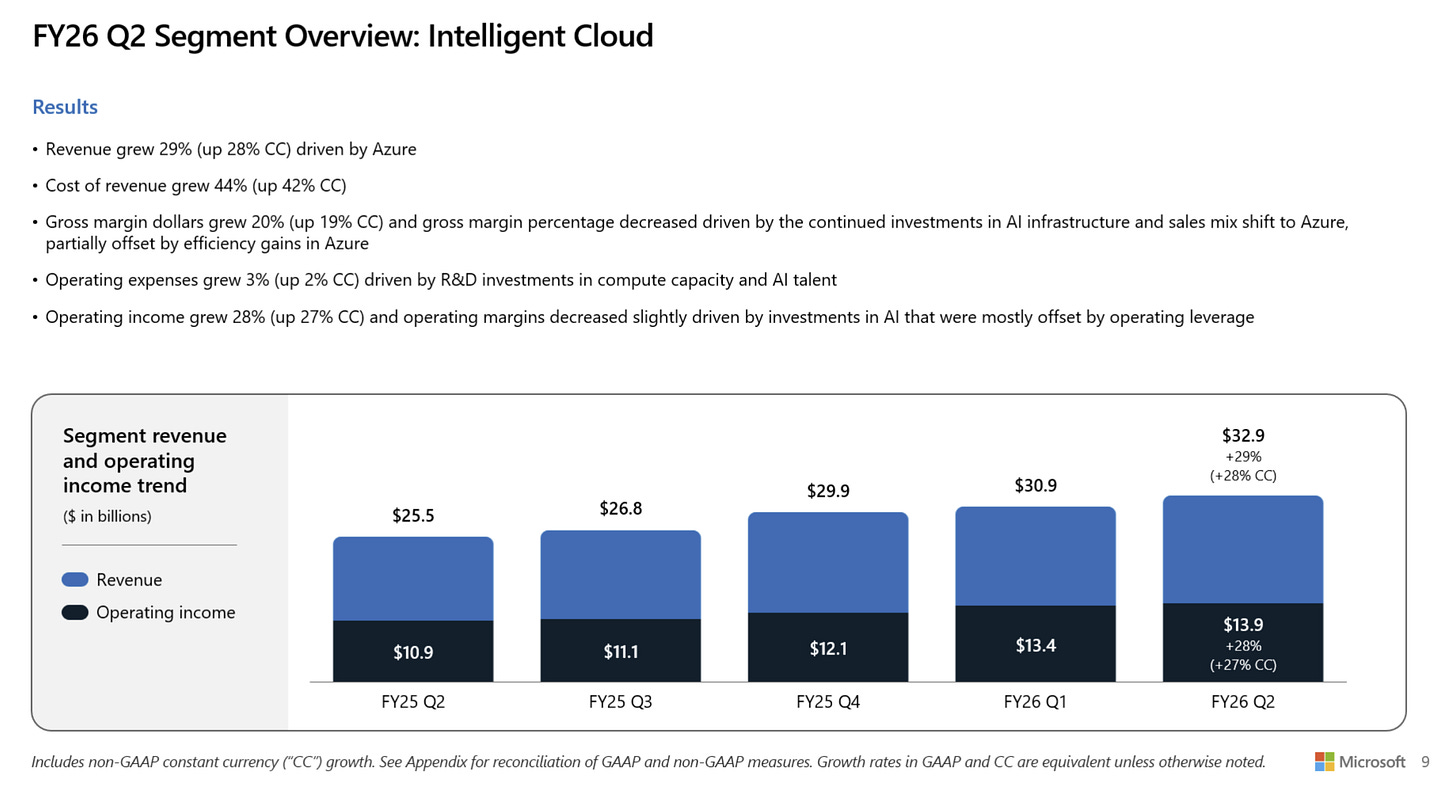

Revenues for Microsoft’s ‘Intelligent Cloud’ segment surged 29%, primarily driven by Azure.

The kicker? Costs of revenue grew 44%.

When the costs of revenue grow faster than the revenue itself, we get a gross margin compression, and Wall Street does not like that at all.

Growth is still extremely strong at +29%

But the market had priced in flawless acceleration

In a stock trading at a premium multiple, “slightly less amazing” can be enough to trigger a reset.

Despite rapid growth in cost of revenue in the Cloud segment, Azure is firing on all cylinders.

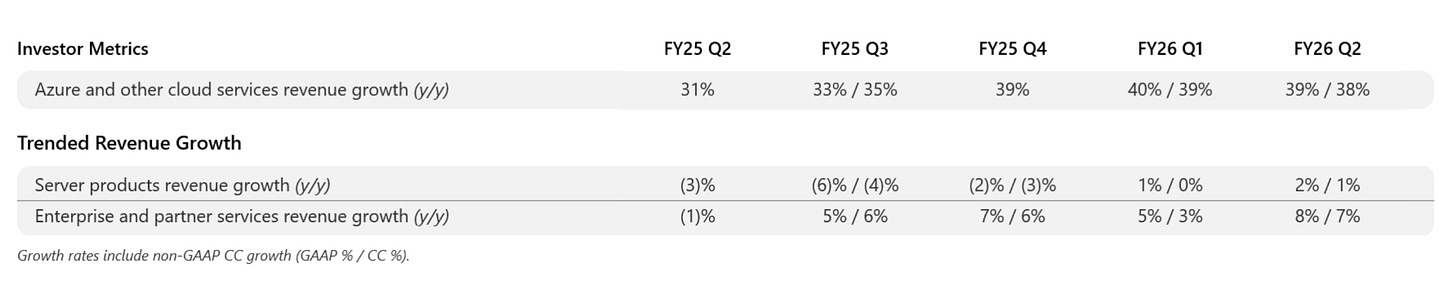

It grew 39% YoY (38% CC) and keeps up its strong revenue growth and acceleration compared to Q2 2025, where revenues ‘only’ grew 31%:

Azure and Intelligent Cloud are still the growth engines in Microsoft, but we will likely see increased costs in the coming 12 - 36 months due to heavy investments in infrastructure and AI.

Microsoft is making investments for the next decade of growth.

In the short term, this can be a bit volatile, but management has proven its ability to execute remarkably in the past.

2. AI Capex Is Rising Faster Than Near-Term Profits

Microsoft is spending aggressively on:

Data centers

GPUs

AI infrastructure tied to OpenAI and Copilot

This compresses margins in the short term, even if it expands the moat long term.

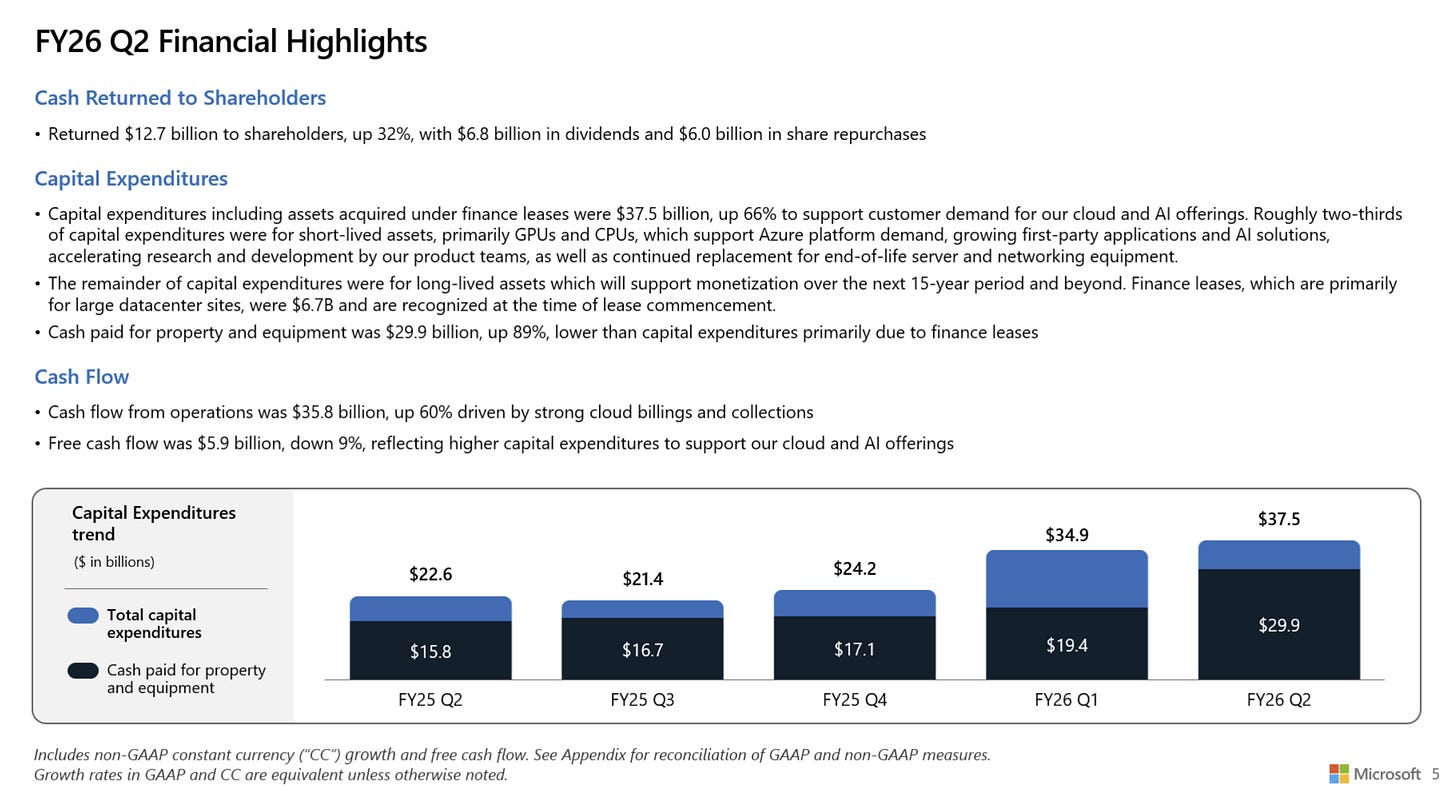

The market essentially wants to see AI profits now, not later. But that will have to wait, because Microsoft is planning to ramp up its capital expenditure significantly.

The key thing to note from Microsoft’s earnings report is:

Cash flow from operations was $35.8 billion (+60% YoY)

Free cash flow was $5.9 billion (-9%)

Of course, the increase in cash from operations is amazing and reflects an incredible underlying business.

The free cash flows are obviously compressed due to high and increasing capital expenditure.

Another thing to note here is that most of the capital expenditure increase is what we call ‘growth capex’ — capital expenditure invested for future growth, not to maintain current revenues and cash flows.

The increased CapEx is, however, the main concern of Wall Street.

As one Morgan Stanley analyst put it:

“CapEx is growing faster than we expected… concerns about the ROI on this CapEx over time.”If you can look past the headline numbers of -9% FCF YoY and increasing CapEx, you can see that the business is booming.

3. Valuation Left No Room for Error