💰 The Quality Compounder Watchlist: 7 Businesses I’d Buy on a 20% Pullback

🚀7 Compounders with a long runway for growth

High-Conviction Names for the Next Decade

The best quality companies rarely go on sale. Their moats, capital allocation, and reinvestment power are too obvious to the market.

But even the best compounders can see a 20%+ decline in a panic, recession, or moment of fear. That’s your chance — not to run, but to back up the truck.

Below, I’m sharing 7 companies I would gladly buy on a 20% pullback — because their long-term quality is unquestionable, and a temporary markdown is a gift.

⚙️ 1. Atlas Copco (ATCO-A.ST)

Why I want it on sale:

Global leader in industrial compressors, vacuum solutions, and automation tech

Strong pricing power, resilient margins, and unmatched service network

Highly diversified end markets, with exposure to electrification and semiconductors

Long-term earnings compounding with high ROCE and steady dividend growth

Buy trigger: If the PE drops below 20x, I’d be ready to load up on this industrial powerhouse.

The compounder touched the sub 20x PE briefly in 2019 and 2020:

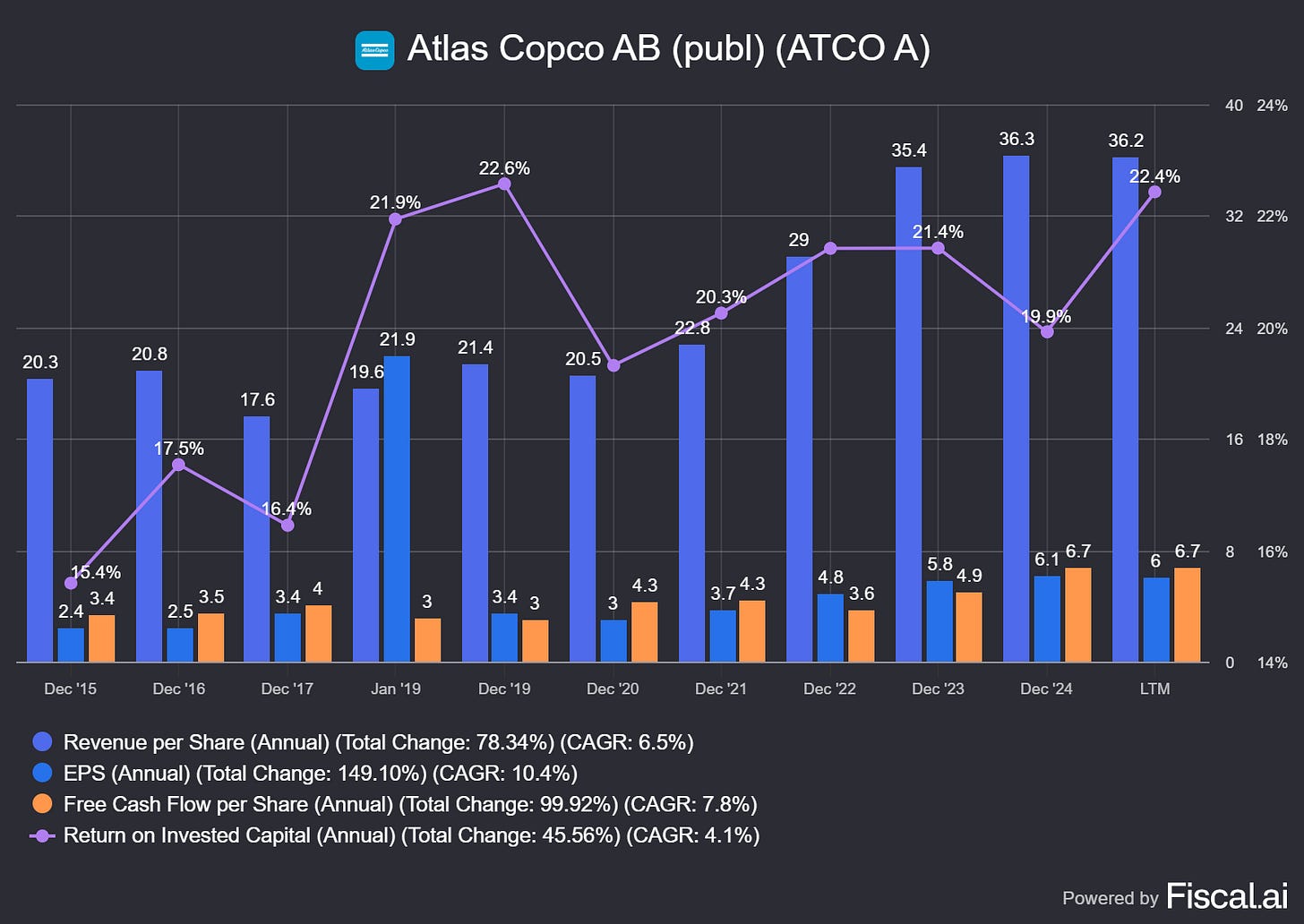

Atlas Cocp is a steady growing business with high returns on capital, reinvestment opportunities, and a wide moat to protect its compounding:

🧑💻 2. Cadence Design Systems (CDNS)

Why I want it on sale:

Dominant player in electronic design automation (EDA) for semiconductors and systems

Deep moat from IP and high switching costs

Vital to every major chipmaker, riding AI, automotive, and IoT tailwinds

Asset-light, high-margin business with consistent high EPS growth

Buy trigger: A correction driving it below 30x forward earnings would be a rare chance to own a compounding tech enabler.

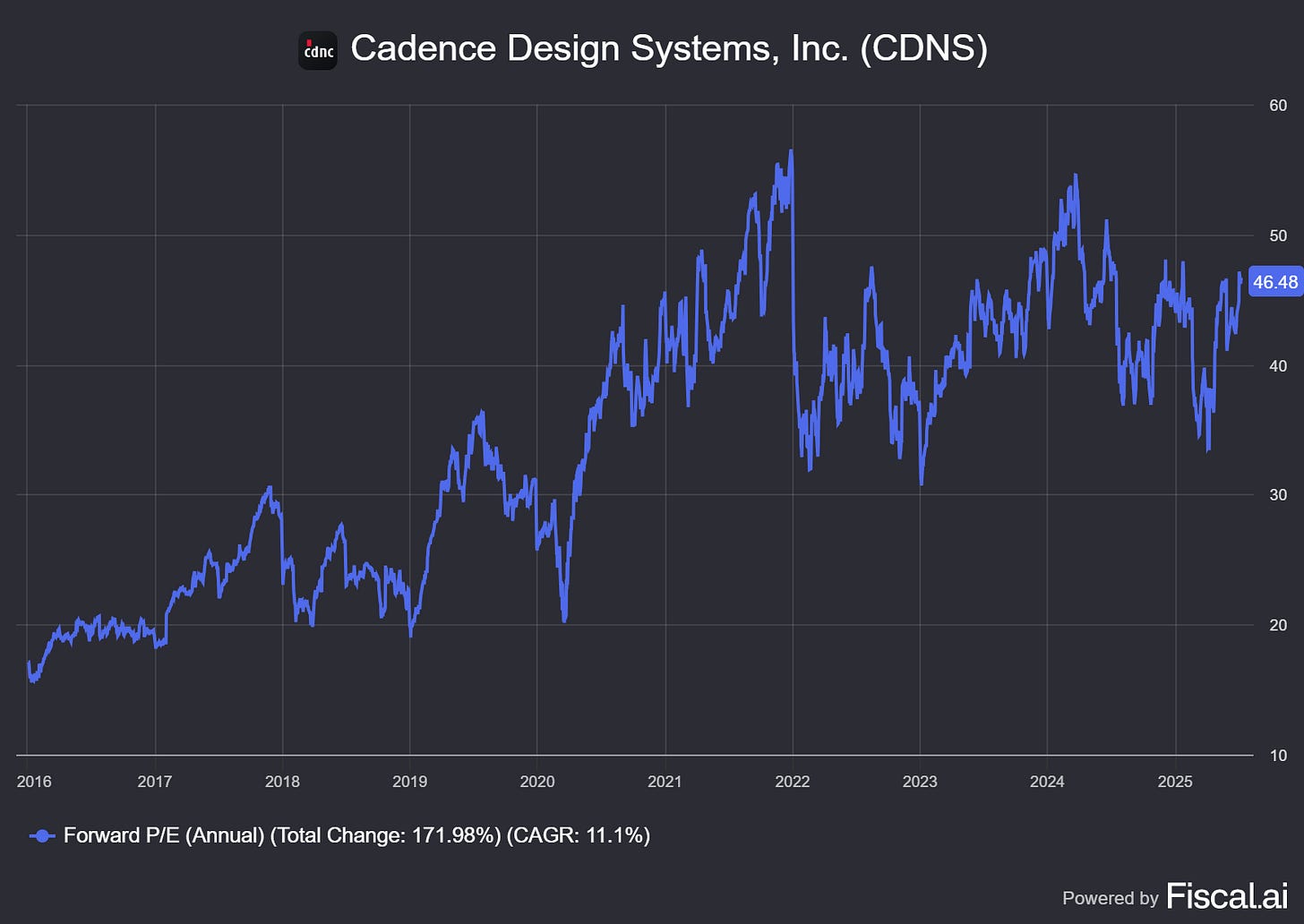

The stock rarely trades below 40x forward earnings, reflecting a premium set by the market due to its high-quality compounding abilities:

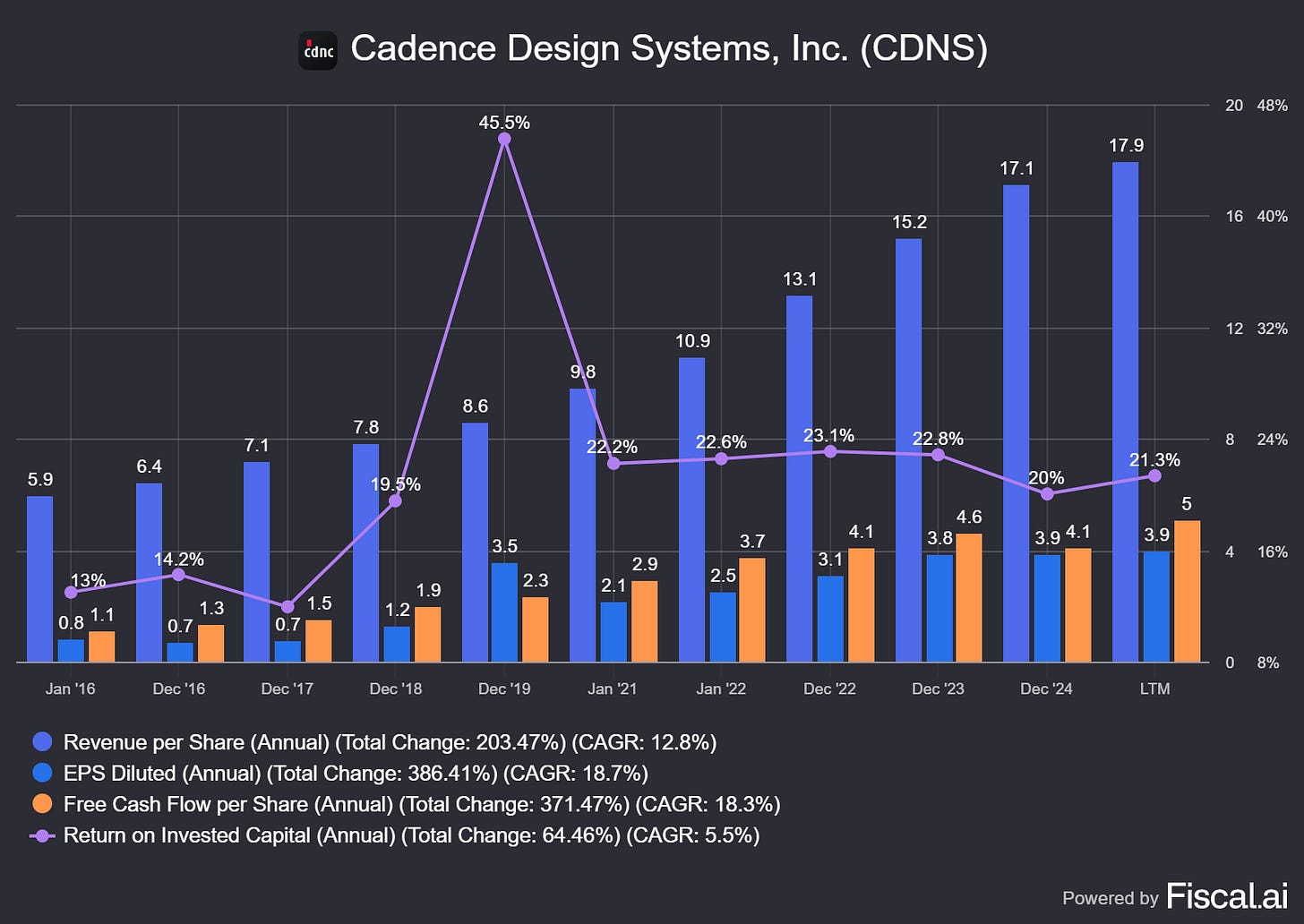

Cadence Design Systems compounding is like clockwork, revenues, earnings, and cash flow compound year-on-year (almost) every year with attractive returns on capital: