The Meteoric Rise of Nvidia 🚀

Breaking down the incredible growth story of Nvidia 🧠

Hi there partner! 👋🏻

Today we’re breaking down Nvidia.

Let’s get into it 👇

Nvidia NVDA 0.00%↑ 🚀

Nvidia is a leading technology company founded in 1993 and is headquartered in Santa Clara, California.

Nvidia specializes in designing and producing graphics processing units (GPUs) and related technologies.

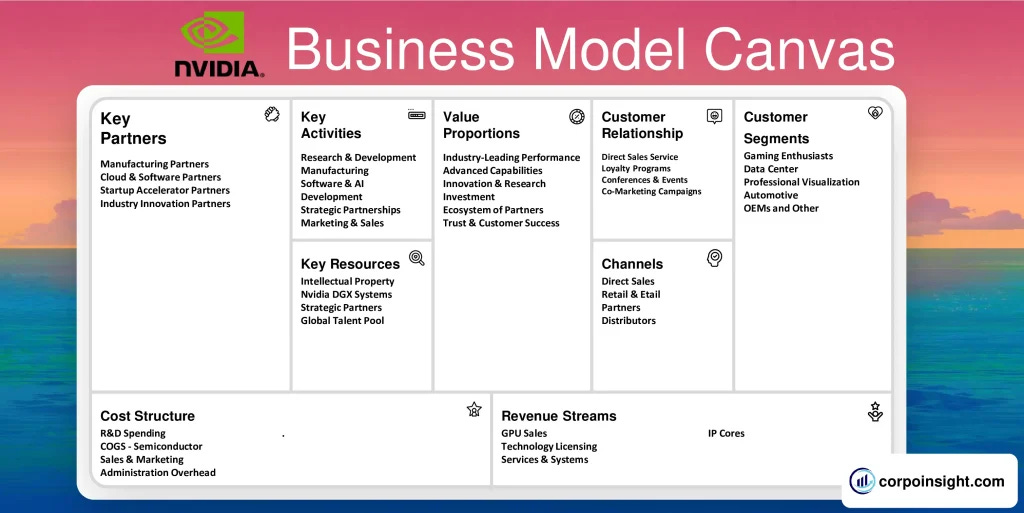

Its business model revolves around innovation in high-performance computing, artificial intelligence (AI), gaming, and professional visualization.

Traditionally, Nvidia’s tech has been most commonly used in the gaming industry. However, it has also played a prominent role in the emergence of artificial intelligence which has helped Nvidia become one of the largest companies in the world.

The company lists has 6 main business segments:

Gaming and Creating

Laptops and Workstations

Cloud and Data Center

Networking

GPUs

Embedded Systems

What Nvidia Does

Nvidia develops GPUs and semiconductor chips for various applications, including gaming, AI, data centers, professional visualization, automotive, robotics, and high-performance computing.

The company’s technologies power immersive gaming experiences, AI research, autonomous vehicles, and scientific simulations.

How Nvidia Makes Money 💸

Nvidia generates revenue primarily through the sale of its GPUs and related hardware. The company licenses its technologies and software, such as the CUDA platform, to developers and enterprises.

Additionally, Nvidia provides solutions and services in AI, autonomous driving, and professional visualization, contributing to its diverse revenue streams.

According to Techopedia, Nvidia earned a quarterly revenue of $26 billion in the first three months of 2024, up by 18% from the previous quarter and 262% from a year earlier. Of this revenue:

$14.5 billion came from its Data Center division

$2.9 billion came from its Gaming division

The rest of its income came from its remaining business lines (Professional Visualization, Automotive & Robotics, OEM & IP).

Together, Nvidia's data center and gaming platforms account for the overwhelming majority of its income. Let’s take a closer look at how Nvidia structures its business.

Business Segments 📈

Here are Nvidia’s specific product lines:

Gaming: Nvidia’s GeForce GPUs dominate the gaming market, providing high-performance graphics and immersive experiences.

Data Center: Nvidia’s GPUs are essential for AI and machine learning, powering data centers with computational efficiency.

Professional Visualization: Quadro GPUs cater to industries like architecture, engineering, and media, supporting complex visual tasks.

Automotive: The DRIVE platform supports autonomous driving and advanced driver-assistance systems (ADAS).

High-Performance Computing (HPC): Nvidia’s GPUs are integral in supercomputing, enabling advancements in scientific research.

Edge Computing and Robotics: The Jetson platform offers solutions for AI at the edge, including industrial automation and smart cities.

Networking: Post-acquisition of Mellanox, Nvidia provides high-performance networking solutions crucial for data centers.

Mobile and Embedded Computing: The ARM Holdings acquisition expanded Nvidia’s reach into mobile devices, embedded systems, and IoT.

The business reports 5 main revenue segments (It’s easy to see where the growth comes from):

The overwhelming majority of Nvidia’s business comes from its Data Center and Gaming divisions. In particular, Nvidia’s income from its Data Center division has ballooned in recent years as the company emerged as the preferred provider of AI software solutions.

Primary Growth Drivers of Nvidia 🚀

1. Artificial Intelligence and Data Centers:

Nvidia’s GPUs are crucial for AI and machine learning applications, powering data centers and supercomputers globally.

The company’s CUDA platform and Tensor Core GPUs provide the computational power needed for AI training and inference, making them indispensable in AI research, autonomous driving, healthcare, and more.

The exponential growth of AI and the increasing demand for data processing capabilities ensure sustained growth in this segment.

Growth since 2019: +83.06% CAGR

Expected growth in the coming years (Fueled primarily by data centers)

2. Gaming:

Nvidia remains a leader in the gaming industry with its GeForce product line. The continuous advancements in gaming graphics, virtual reality (VR), and augmented reality (AR) drive demand for high-performance GPUs.

The gaming market’s expansion, including esports and streaming, fuels Nvidia’s revenue growth. The company’s innovations, such as real-time ray tracing and DLSS (Deep Learning Super Sampling), further solidify its dominance and attract a loyal customer base.