The Market Is Re-Pricing Quality 💎

Why these four stocks are suddenly back in favor.

Hi partner👋

In this article we’re breaking down 4 quality companies showing significant momentum. The following companies are showing momentum 👇

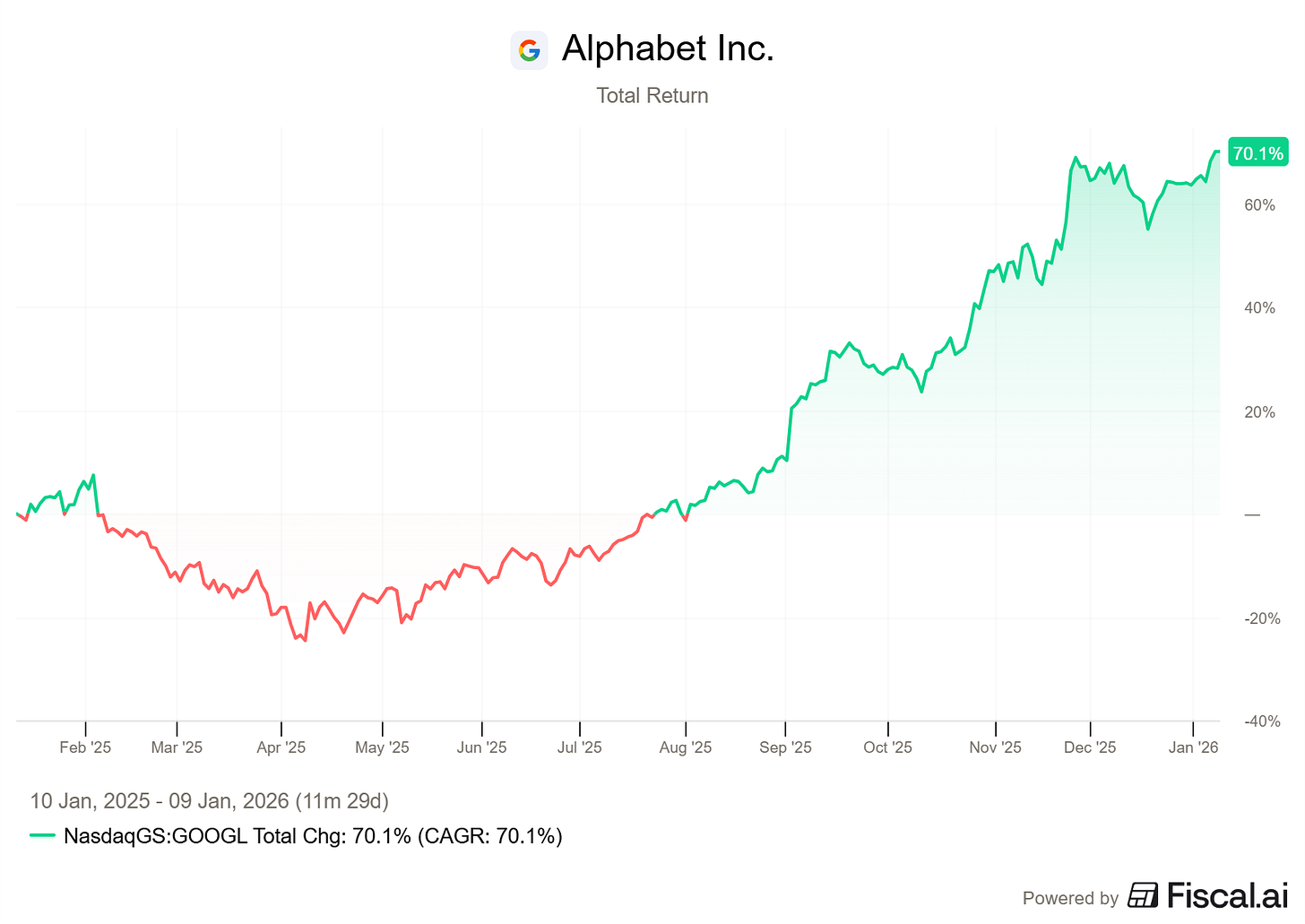

Alphabet (+70.1% in the last 12 months)

ASML (+59.1% in the last 6 months)

Mercado Libre (+8% in the last 30 days)

Novo Nordisk (+26.8% in the last 30 days)

Let’s dig deeper into why these stocks are up and if anything has changed in the story 👇

🔎 Alphabet GOOGL 0.00%↑ : Growth Re-acceleration and Cloud Momentum

Alphabet’s stock had an incredible journey last year, after a brief detour in April, increasing its value by +70.1% in the last 12 months

So, what drove the returns? And why did Alphabet go from a “AI loser” to a market share gainer? Let’s dive into it 👇

📈 AI leadership and product momentum

In 2025, Alphabet’s stock price was rewarded for its progress on artificial intelligence. Their advancement of the Gemini AI models and how they managed to integrate it into core products like Search was a game-changer in 2025.

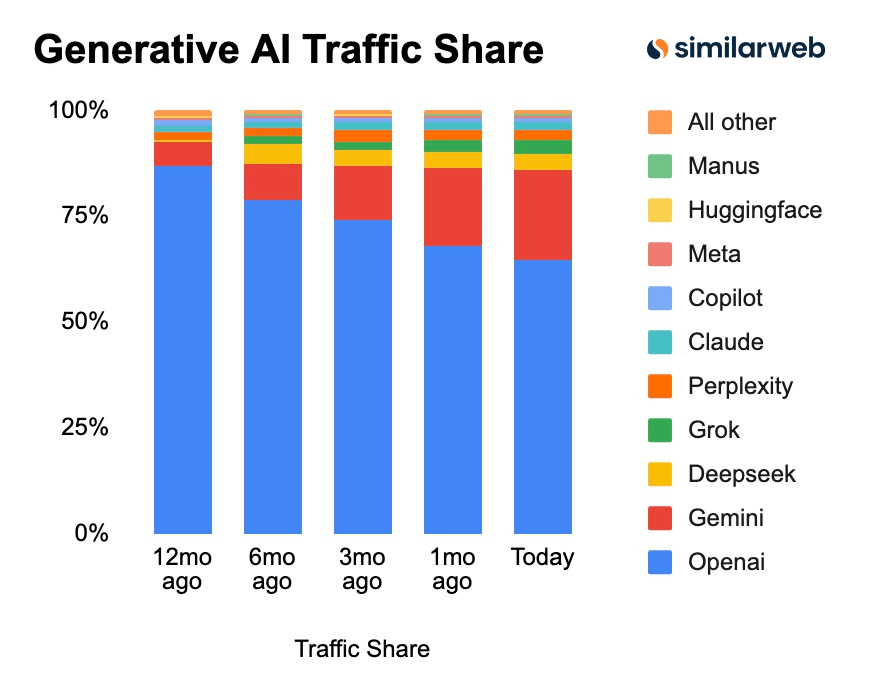

Gemini is taking major market share due to the easy-to-use integration in Search. The market is still huge, and OpenAI is the clear market leader, but Gemini and Alphabet are the clear market share gainer 👇

🚀 Strong business results

Alphabet delivered better-than-expected earnings throughout 2025. In particular:

Revenue topped $100 billion for the first time in a quarter.

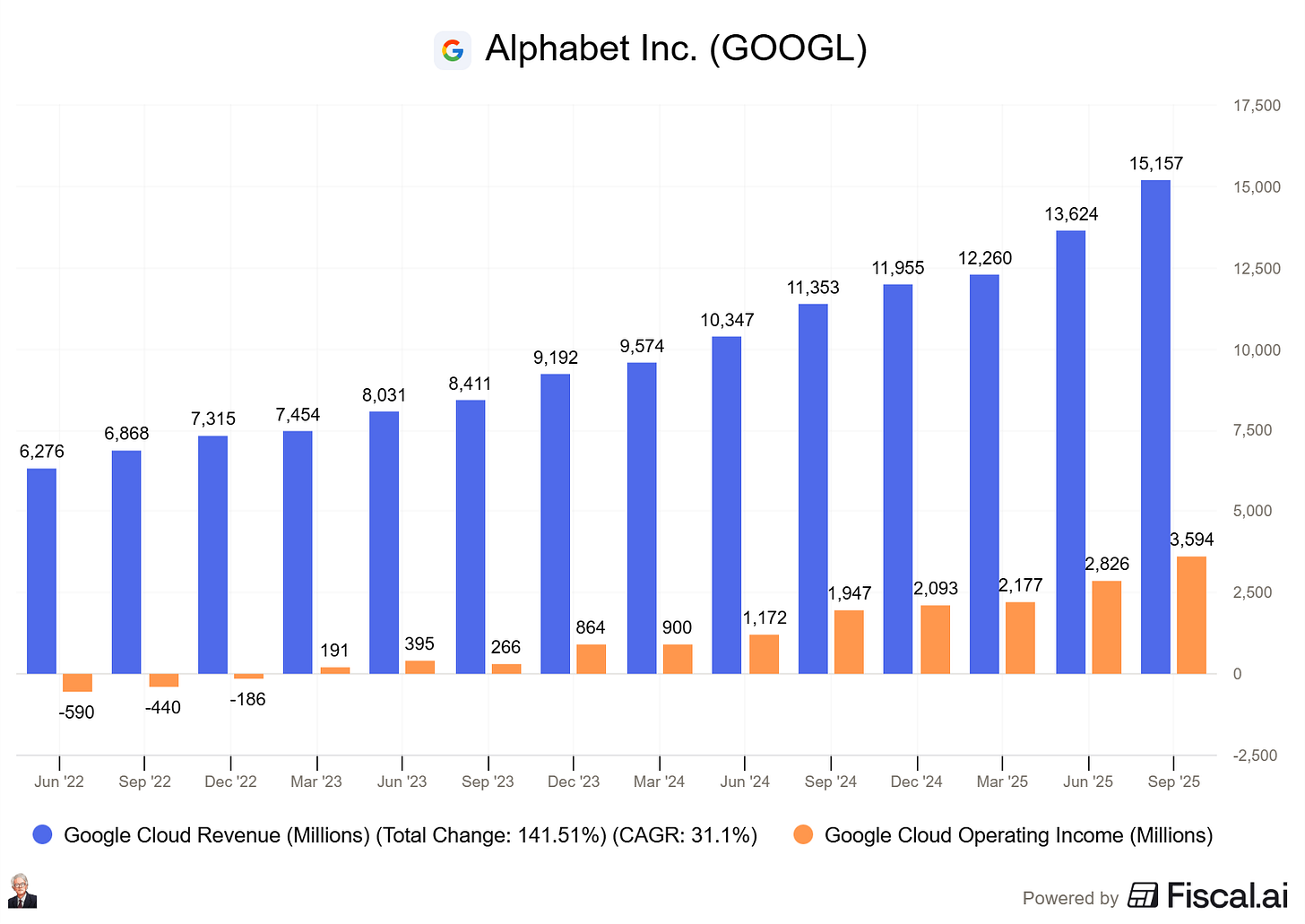

Google Cloud grew rapidly (often 30%+ YoY), helped by AI infrastructure spending. Cloud growth also has operating leverage, where operating income is growing faster than the top line. Q2 2025 operating margins were 20.7%, and Q3 2025 operating margins were 23.7%. This is an incredible business segment within Alphabet.

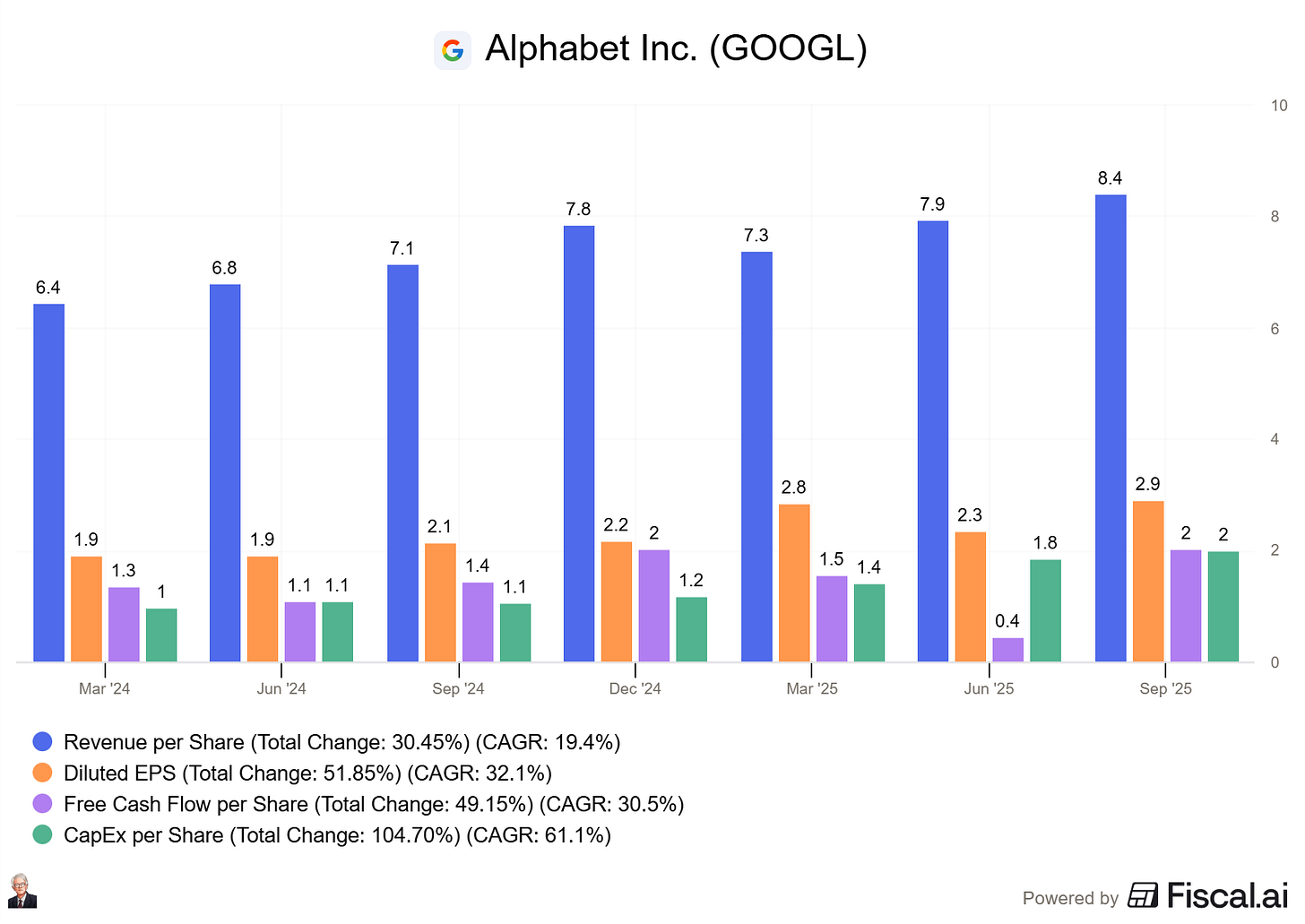

Strong earnings per share on all fronts in the last year and a half:

Revenue per share +19.4% CAGR

Diluted EPS +32.1%

Free Cash Flow per share +30.5%

Capex per share +61.1% (This one will eat away the free cash flows in the coming quarters as Alphabet is ramping up its investments alongside the other big tech names).

How the market views Alphabet in 2026:

AI market share gainer ✅

Full-stack AI value chain ✅

Improving fundamentals ✅

Multiple sources of premium growth ✅

Unmatched distribution for AI services ✅

Management team executing on a high level ✅

Just remember: Not too long ago, Alphabet was written off as a ‘has-been’ company, falling way behind OpenAI and Microsoft.

The narrative was clear, and everyone believed it at the time (reflected in the stock price).

Turns out the market was wrong, and the narratives were just noise, not attached to the reality of what was going on inside Alphabet and its technological advancements.

🧠 Diversified growth

Beyond search and ads, the market started to price in Alphabet’s potential across:

Cloud computing

YouTube monetization

AI tools and chip technology

Other bets, such as Waymo

The multiple sources of growth are ideal for investors, as they increase growth while also reducing risk. Relying too much on one single source of revenue can be risky for steady cash flows.

🛠 ASML Holding ASML 0.00%↑: Monopolistic Technology Leader with New Growth Wave