Five Factors of Business Greatness 👑

<3m read 🧠

In this article, we will discuss a simple framework from Warren Buffett’s 2019 letter, illustrated by Vishal Khandelwal of five factors of business greatness.

Try Stockopedia 14 days for free using our link (Sponsored).

The Invest In Quality team uses the platform to:

Research Global Stocks

Get weekly ideas from the Stockopedia team

Use their stock screener to find hidden global gems

Try it 14 days completely free, if you like it, you will get 25% off your purchase using our link: Stockopedia (You also have 30-day money-back guarantee after the 14 days)

Attractive return on capital

Return on capital and the rate at which a business can reinvest its excess capital is the most important factor for long-term compounding.

The data is convincing, higher ROIC has outperformed over time:

Companies that can have a higher return on their invested capital, than the cost of capital are creating value.

Companies that have a lower return on their invested capital, than the cost of capital are destroying value for investors.

The magic formula: ROIC - WACC = >0

High-quality managers

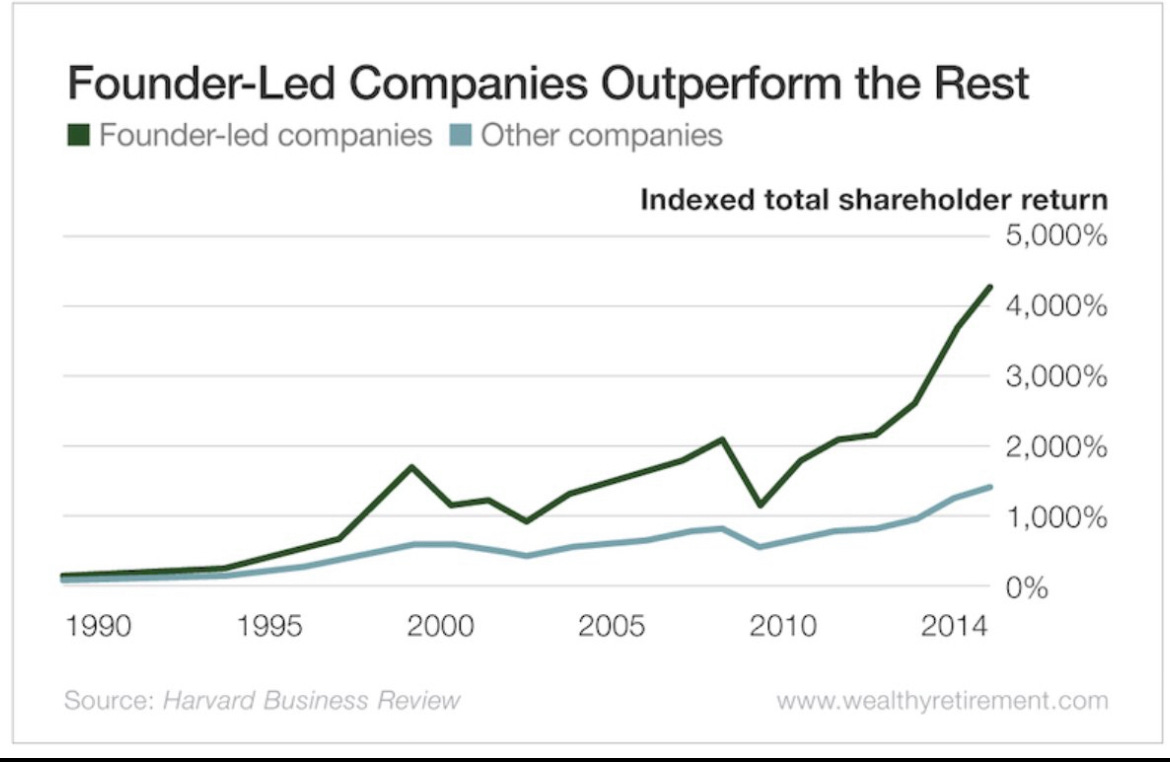

The data supports the importance of high-quality managers. Founder-led businesses with skin in the game tend to outperform:

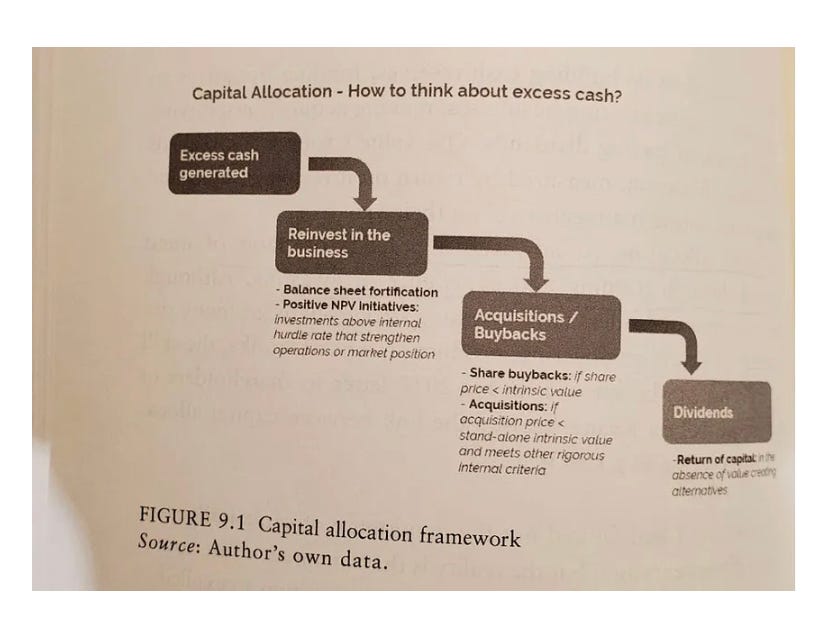

Capital allocation is how a management team shows its competence, and it is reflected in the returns on capital numbers the business delivers:

Top-notch culture

Culture is how an organization drives its growth, innovation, and adaptation for decades. The data is clear, companies with better company cultures produce better financial results:

Financial strength

Companies that translate most of their earnings into cash tend to outperform their peers according to “What Works on Wall Street”.

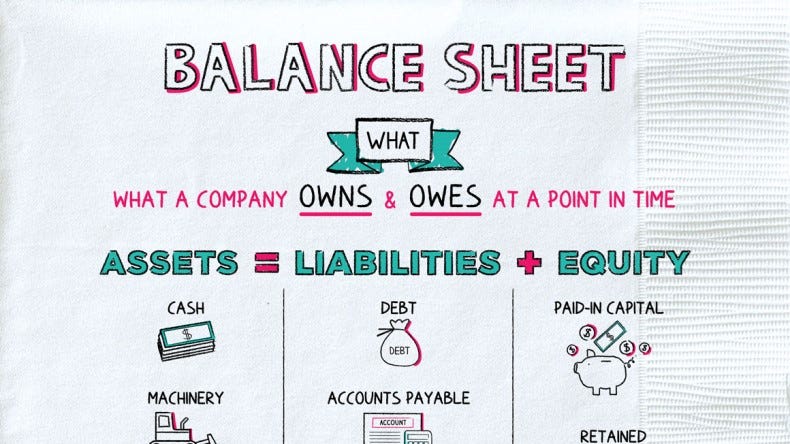

Additionally, having a healthy balance sheet with plenty of cash and low debt & obligations provides the business with flexibility to:

Take advantage of reinvestment opportunities

Take advantage of strategic acquisitions

Optimize for growth and invest aggressively

Survive recessions and market draw downs

Enduring economic advantages

The data suggests that companies with an enduring competitive advantage is able to protect their “above average” returns for long-time periods, resulting in a fantastic result:

The results are mixed between companies with a “wide moat”, and companies with a “narrow moat”, but companies with “no moat” are the clear underperformers:

5 Companies that fit the description:

Microsoft

Accenture

Mercado Libre

Meta Platforms

Constellation Software

Appropriate price

Valuation is a complicated topic, check out my free valuation cheat sheet where I simplify the process so even my mother would be able to value a business.

A lazy way to look at valuation is to look at historical multiples, such as the price to earnings, price to sales, and price to book, and compare it to today’s multiple.

That’s it, hope you enjoyed the post - if you did, please like, comment, and restack this article!

Short and sweet. Thank you for the great insights man.