The Everything Store has a Strong Competitive Advantage, Multiple Growing Business Segments, and is on a 40% Pullback from its all time highs

Strong long term prospects, wide moat, well positioned in several growing markets, optionality and a focus on innovation and future growth. Let's take a look at Amazon.

The business

Amazon.com was founded in 1994 by Jeff Bezos. The young entrepreneur saw a big opportunity as the internet was growing by ~200% annually, and he had the vision to capitalize on this, by starting an online bookstore.

The business has grown to more than $1 trillion market cap, and Jeff Bezos has since stepped down as CEO, although he remains the executive chairman of the board.

Today Amazon is the leading online retailer and cloud service provider in the world. Amazon makes money in several different ways: online stores (Amazon.com), physical stores, third-party sales on their platform, subscriptions, advertisements, Amazon web services, and “other”.

In 2022 Amazon had revenues of $509 billion, divided by business segment:

Online stores: 42,8%

3P: 22,9%

AWS: 15,6%

Advertisement: 7,3%

Subscriptions: 6,9%

Physical stores: 3,7%

Other: 0,8%

Amazon has managed to diversify its revenue streams by having a relentless focus on innovation and reinvesting all profits into the business.

Amazon’s revenue split:

North America: 61%

International: 23%

AWS: 16%

Amazon's growth driver is AWS, but segments like 3P, subscriptions, and advertisements have had impressive growth rates over the last few years. These segments also have much better margins than the online store segment.

The fundamentals

ROIC 5 years: 12.3%

Gross Margins: 13.16%

Operating Margins: 2.38%

Cash conversion 5Y: 215%

Net debt / Operating cash flows: 6.87

Interest coverage: 8.88x

Capex / Sales: 12.4%

The fundamentals have been deteriorating post-pandemic. There are several reasons for this that we will get into later. At the moment, Amazon does not look attractive based on traditional operating and valuation metrics.

The market

The e-commerce market is dominated by Amazon. They had a market share of 37.8% in 2022 (eMarketer). Followed by Walmart all the way down at 6.3%, followed by smaller niche players like Apple, eBay, Target, and Home Depot.

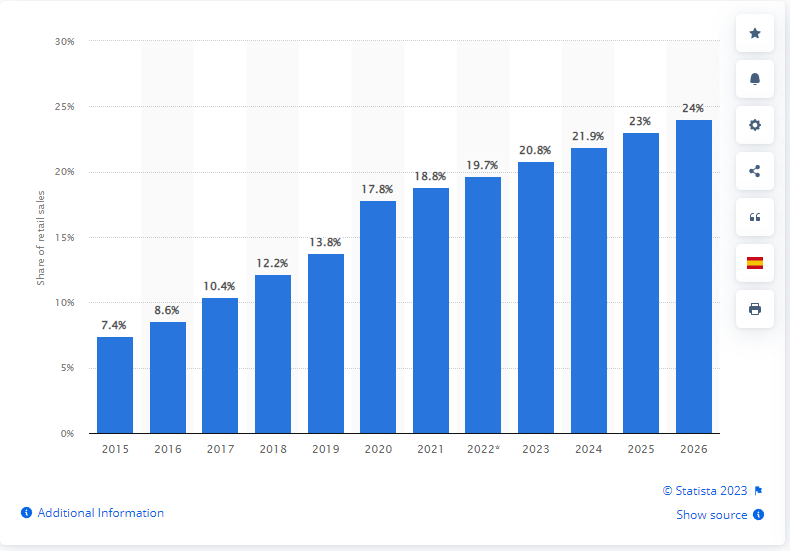

In the US, only 13% of retail sales are from e-commerce, the rest is from physical store sales. This is lower than the global average, which according to Statista is estimated to be around 20% in 2022. This means that e-commerce still has plenty of runways to grow in different niches.

E-commerce as a percentage of total retail sales worldwide from 2015-2026:

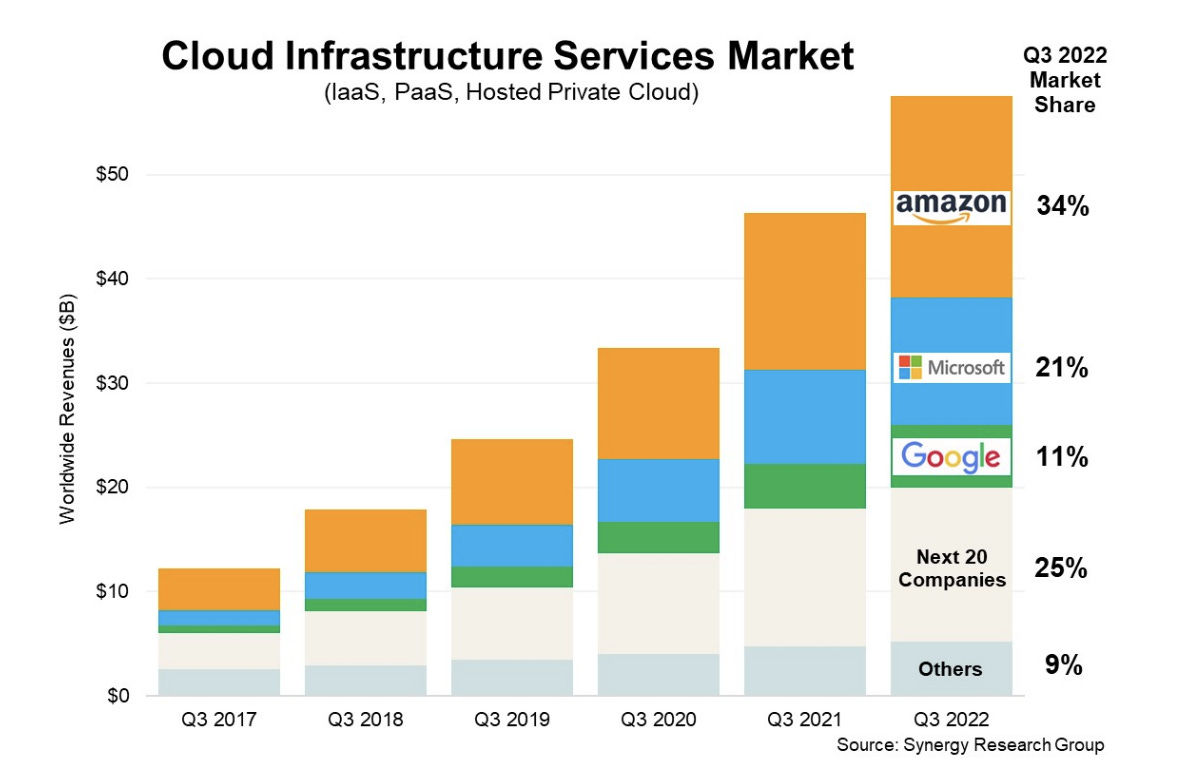

Cloud: Amazon Web Services

Amazon is the market leader in cloud infrastructure services. They have a market share of 34%, followed by Microsoft’s Azure, which has 21%, and Google Cloud at 11%.

Cloud has for a long time been a part of the Amazon growth story, but critics are telling us that the growth will slow down and that Azure will take the crown as market leader in a few years. The reason for this is that Microsoft has grown at a higher clip than AWS in the last few years:

I for one believe AWS will continue to be market-leading in the cloud segment. A few reasons why:

First mover advantage: Amazon has already built out a substantial network worldwide and thousands of businesses depend on their solutions

Innovations: Amazon continues to improve its cloud product and they bring their innovative culture into AWS as well.

Price drops: Since Amazon launched AWS in 2006, they have dropped their prices 50 times. As their network increases in size, scale economics kick in, meaning that they can offer even lower prices to their customers.

The Stock

Even after a big decline from its 2021 highs, Amazon has been a 7-bagger over the last 10 years. A compounded annual growth rate of 23.1%. It has outperformed the indexes by a mile.

The Growth (5Y CAGR)

Revenue: 23.6%

EBITDA: 28.3%

Book value: 39.4%

Cash from operations: 20.5%

Free cash flows 2017-2022:

Everything has been growing in Amazon over the last 5 years, except the profitability proxies like EBIT, Net income, and Free cash flows.

Sustainable competitive advantage

Amazon has a strong competitive advantage over its competitors.

Strong brand: Their brand has consumer preference after decades of delivering on a high level. Amazon’s Net Promoter Score is 73 according to CustomerGauge. An NPS score above 70 is considered excellent. A few drivers for NPS:

Customer retention

Customer growth

Word of mouth

Economics of scale: Amazon is able to use its size to its advantage when negotiating with suppliers and partners.

Economics of scale shared: A Nick Sleep concept. Amazon is using its economics of scale to negotiate better prices, but they are transferring its superior prices to its customers. Having a cost advantage is one of the strongest advantages a business can have, as selling products cheaper than the competition never will go out of style.

Supply chain: Amazon has one of the most efficient supply chains and logistics operations in the world. Their investments in infrastructure and technology have solidified their position as the clear #1 e-commerce player. It’s very hard for new entrants to compete with Amazon when they can deliver products faster and more reliably than any other e-commerce platform.

Innovation: Amazon is constantly innovating and creating new products and potential business segments. Their focus on innovation is unmatched, and has resulted in some spectacular results such as i) Amazon Web Services which today is a ~$100Bn business with operating margins of ~25-30%, ii) Amazon Prime, and iii) Alexa.

Culture: Amazon is obsessed with its customers, and its main objective is to keep them satisfied and loyal. Its customer-centric approach helps them build trust and loyalty with its customers which shows up on the net promoter scores.

Network effects: Amazon has network effects on its e-commerce platform. The more customers that shop there, the more sellers are attracted to sell on the platform. Sellers on the platform mean increased revenues and income from their third-party services, as sellers have to pay Amazon a fee to sell on their platform. This effect goes both ways, because the more seller that is on Amazon, and the wider the product range is, the more customers are attracted to shop there and go to Amazon.com for their every need.

Intellectual property: Amazon holds countless patents and owns the right to content on their streaming service “Amazon Prime”.

Lollapalooza moat: Much like Costco, Amazon is doing thousands of small things just right. They have a wide moat due to the reasons explained above. But Amazon also uses customer data to understand the specific customer’s needs and wants, and then they are able to present the customer with products that they are much more likely to purchase. This is just one example of a small thing that supports that they have a lollapalooza moat.

Why own Amazon?

Strong future growth prospects (Strong secular trend(s))

Wide (Lollapoloza) moat

Strong growth in operating cash flows and equity

Potential to achieve high ROC if they want to optimize for profitability

It is the mega-cap with the clearest path to a $10 trillion market cap

Optionality

The Risk

Susceptible to macroeconomic effects:

Inflation - higher costs on everything from fuel to electricity, to employees. For a capital-heavy company like Amazon, this has caused its cost to increase. Amazon’s margins are already thin, and this has led to a major outflow of cash (Negative FCF + SBC)

Less disposable income consumer- Customers have less disposable income to use on recreational items that Amazon and sellers on Amazon make their money from. Amazon does sell some essential items, but this is low in terms of revenue. Therefore, we can assume that Amazon will take a hit in terms of revenue growth as people are struggling to pay their bills.

B2B customers forced to focus on cost - Amazon’s business customers have less cash to invest in cloud infrastructure through AWS. This has already started to materialize in reduced growth rates for AWS in the most recent quarter. We might see a slowdown in AWS in the coming years.

Higher interest rates - This is the gravity of growth stocks. When it is at zero, there is no gravity, and growth stocks run into the stratosphere (2020 post covid bull run). When the interest rates go up, it changes how growth is valued and the risk-free rates get more attractive. This leads funds and big money to move out of stocks in general, especially growth stocks with their earnings far in the future. Amazon also has some debt that will become more expensive to carry ($147.5Bn).

Increased competition - Walmart, and Costco, could increase their e-commerce efforts to take more market share. Microsoft Azure seems to be catching up with AWS in terms of revenues and operating margin.

Valuation

Amazon is hard to value, and we cannot use traditional methods of valuation to understand its value. So we will look at different data to give us a better understanding.

Superinvestors are piling up on Amazon

Amazon is one of the most bought stocks from super investors from dataroma.com, to me this implies that there is something interesting going on for the investing case of Amazon:

No FCF, increased debt, and stock-based compensation

We cannot value Amazon based on what they are currently producing, as their FCF has been negative for a while. As the company invested heavily post pandemic, the FCF has been negative, and in the MRQ the negative outflows was $3.3BN, not accounting for the $4.7BN of stock-based compensation for the quater.

In other financial metrics, Amazon has more than doubled since 2018, although the price remain somewhat flat. This is most likely due to the change in liquidity and economic environment with higher rates, but we can also see a steep decline in FCF from 2018: $17BN, to 2022: -$8.5BN. Not to mention the SBC:

Amazon’s balance sheet has worsened since 2020 (@Brian_stoffel_):

Investors should look for better FCF, lower debt levels, and the most important thing in my opinion, lower stock-based compensation in the coming quarters. SBC in particular has been out of hand in the last few years.

Sum of all parts

By analyzing each business segment and valuing it as a standalone business, we can grasp the potential value in Amazon. This valuation method, as all valuation methods, are not perfect, but it can helpful for our understanding.

AWS

Using the 2022 numbers, AWS had ~80 BN of net sales and 22.8 BN in operating income. Their operating margins were 28.5%. AWS growth rates have been impressive, but in the MRQ margins are contracting and growth is decelerating. Let’s assume a EV/Sales of 8 for this business unit. That would give us a value of 80x8= ~$640Bn.

AWS has more than doubled since 2019.

Third-party

Using the 2022 numbers, 3P had a revenue of $117.7Bn. Comparing this business segment to Etsy with 5 EV/S and eBay with 2.5 EV/S, we’ll assume a multiple in between of 3.5.

117.7x3.5 = $411.95Bn

3P has doubled since 2019.

Advertising

Ads had a revenue of $37.7Bn in 2022. Comparing the ads business to Google, we can assume a 5x EV/sales. 37.7x5= $188.5Bn.

Ads revenue have trippled since 2019.

Subscriptions

Subs were $35.2Bn in 2022. Comparing this segment to Netflix, which currently has an EV/sales of 5.1.

35.2x5= $176Bn

Online store, physical store, and other

Combining these last 3 segments, from the 2022 numbers, we get: 220+18.9+4.2= $243.1 BN. Walmart has an EV/sales of 0.8. Let’s use the same. $194.5Bn

640 + 411.95 + 188.5 + 176 + 194.5 = $1,610.95 Billion enterprise value

Current enterprise value: $1.160 Billion

Suggesting a 38.9% upside in Amazon.

It’s unrealistic to believe that these businesses would be able to spin out without losing their competitive advantages, but a sum-of-all-parts analysis is a good way of getting an overview of the value of the business.

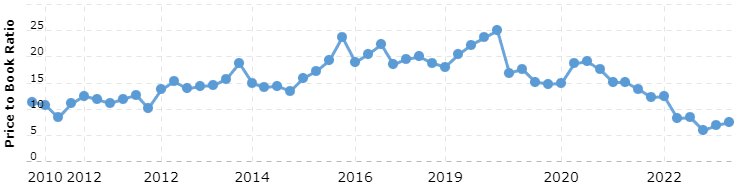

Historical multiples

Amazon is currently trading at a PS of ~2. Historically this has been a great entry into Amazon. The last time was in 2014/2015.

The same goes for PB, which is near an all-time low at 7.4

Post-pandemic investing

We know that Amazon has invested heavily in its own infrastructure in the post-pandemic environment. They made some miscalculations in terms of over-investing and over-hiring. Still, the investments made will benefit Amazon in the years to come and solidify its competitive advantage by increasing the barriers to entry for competitors and increasing its reach and speed to customers in all their business segments. In my opinion, this will eventually benefit Amazon’s bottom line.

R&D spend

If Amazon were to cut back on R&D and go into “Cash cow mode” the business would be worth a lot more than it is today. Their TTM R&D spend is $78BN. Imagine if they cut back on this to maximize profits. They would have an FCF yield of ~7%.

Amazon is still optimizing for growth by continuing to invest in new growth initiatives. This is a cost and tax-efficient strategy for the company and its shareholders, especially if the return on their investments is great like they have been in the past.

This is why I don’t buy the “Amazon can’t turn a profit argument”

Conclusion

Amazon is a fantastic business, with massive growth in many different business segments, and with one of the widest moats in the market. The competitive position has been solidified by making huge investments into their infrastructure in the last few years. It is hard to see who will compete with its e-commerce platform, although AWS is seeing increased competition. Growth is likely to continue, allthough we’re seing a global economic slowdown. Based on historical numbers and a sum-of-all-parts analysis, I think the business is undervalued and have a decent upside. I expect this upside to be bigger once (and if) Amazon can get their cost under control, and thereby increasing cash on balance sheet through a positive FCF, reducing debt and SBC.

Amazon’s strategy has always been to use all available profits to reinvest into the business. Some of their projects turn to dust, while others turn into AWS. I believe Amazon will be a good investment in the next 5 years, which is why I’m long.

Long too