Beauty pays - L'Oréal is a quality business with high return on capital, high margins and a wide moat

L’oréal $OR.PA

The Business

L’oréal is the largest beauty company in the world. It has consumer products in makeup, skincare, hair care, and fragrance. The company is more than 100 years old, founded in 1909. It has a track record of quality compounding.

The company has a global presence, with about 25% of sales from the EU, 25% from the NA, and 50% from emerging markets.

L’oréal’s return on invested capital is 17.5%, and they have compounded their Free Cash Flows by ~10% per year for the last 10 years. Their gross margin is currently 74% which is close to their 5-year average of 73%.

Competitive advantage

The sustainable competitive advantage that has made them relevant for more than 100 years, is their strong brands. L’oreal has 8 brands that generate more than $1BN per year. They continuously invest in R&D to stay on top of their industry, resulting in countless patents and integration of technology into beauty - the company is experimenting with AI and beauty among other R&D initiatives.

Why own L’oréal?

The high versatility of the earnings

Wide moat

Deep knowledge of beauty set into system (with patents to protect their revenue streams)

Effective brand/product management

Consistently high returns on capital and growth

Doesn’t need debt to earn superior returns

What price would I consider L’oréal?

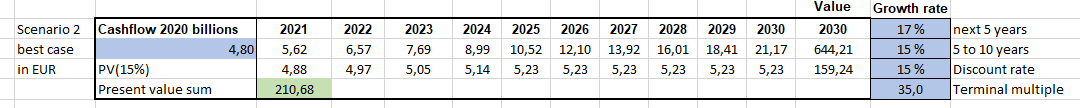

Based on my DCFA I believe the stock is currently somewhat overvalued. Of course, if you hold a quality company long enough (Where the ROIC > WACC) you will do fine. I’m looking for above 15% pa. investments, and at current levels I don’t believe this company will give me that.

The growth required in FCF to meet my 15% annual returns is 17% pa:

The price of the company would have to be ~£128BN to meet my requirement (-36% from current levels):

I’d love to own L’oréal, but at the right price - fantastic company.

Conclusion

L’oréal is a fantastic quality company with many strong brands and a firm grip on the beauty industry. Their brands and product in different beauty categories solidify them as the king of beauty products. L’oréal shows stellar fundamentals, with high margins, high returns on capital, and decent growth. This is not a fast grower, but a quality slow-grower that will likely hold up during a recession.

The pricing of the business is currently above my requirement, it would have to drop 35% to meet it. So for now, L’oréal will stay on my watch list. If the business would have a temporary fallback in the future, I’m there to pick up the discounted shares.