Texas Instruments: Secular trends, fantastic business model, and competent capital allocators

Texas Instrument is a solid semiconductor play with a wide moat and focus on expanding their business and moat by strategic investments in cost advantage and new technologies.

Texas Instruments TXN 0.00%↑

The Business

Texas Instruments is a leading semiconductor company headquartered in Dallas, Texas. Founded in 1930, the company has grown into a multinational corporation that designs and manufactures a wide range of semiconductor technologies and embedded systems for a variety of applications.

Texas Instruments has a market capitalization of approximately $160 billion and employs over 30,000 people worldwide. The company operates in two primary business segments: Analog and Embedded Processing.

The Analog segment designs and manufactures a wide range of analog and mixed-signal integrated circuits (ICs) that are used in a variety of applications such as power management, signal conditioning, and data conversion. These products are used in industries such as automotive, industrial, healthcare, and communications.

The Embedded Processing segment designs and manufactures microcontrollers, processors, and digital signal processors (DSPs) that are used in a variety of applications such as automotive, industrial, and consumer electronics. These products are used in applications such as motor control, audio processing, and digital signal processing.

Texas Instruments has more than 100.000 clients globally, and 66% of its revenue comes from Asia - ~15% from the EU, the middle east, and Africa, and 10% from the US. Their product portfolio consists of more than 80.000 products, and they deliver products to 5-6 different industries. This gives Texas Instruments great diversification geographically and in terms of industries. A diversified revenue stream indicates stable earnings which is a plus for investors.

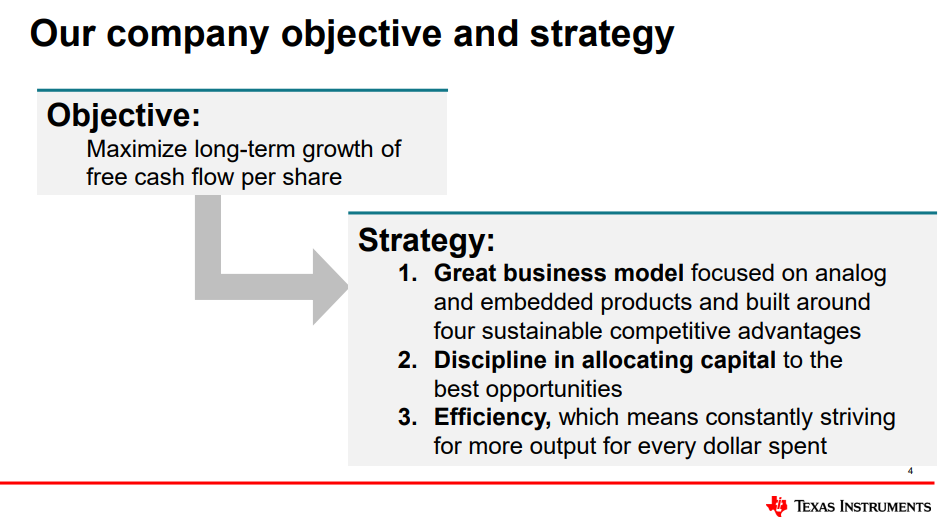

TXN’s main objectives and strategy are based on the long-term growth of free cash flow:

The business model

Texas Instruments is a global semiconductor design and manufacturing company that produces a wide range of products for various applications and industries, including industrial, automotive, consumer electronics, and communications equipment. We will take a look at the following key elements in TI's business model:

Revenue drivers

Cost structure

Value proposition

Competitive advantage

Revenue drivers

Texas Instruments generates revenue from the sale of its semiconductor products and related services. The company has a diversified revenue mix, with a wide range of products that cater to various end markets. The majority of the company's revenue comes from semiconductors, which accounted for approximately 95% of total revenue. 2/3 of this revenue comes from Analog semi, while 1/3 comes from digital semiconductors, while embedded processors and other products accounted for the remaining 5%.

Cost Structure

Texas Instruments' cost structure is driven by the production and distribution of its semiconductor products. The company has a vertically integrated manufacturing model, which allows it to control the entire production process, from the design of the chips to the final assembly of the products. This approach enables Texas Instruments to optimize its costs and improve its manufacturing efficiencies. The company also invests heavily in research and development to maintain its competitive edge and drive innovation in its product offerings.

Value Proposition

Texas Instruments' value proposition lies in its ability to deliver high-quality semiconductor products that meet the specific needs of its customers. The company's broad product portfolio, which includes analog and digital semiconductors, embedded processors, and other products, allows it to cater to a wide range of end markets. Moreover, Texas Instruments' vertically integrated manufacturing model and focus on innovation enable it to offer products that are both high-performance and cost-effective.

Competitive Advantages

Texas Instruments' competitive advantages lie in its strong brand reputation, broad product portfolio, and technological expertise. The company has a long-standing reputation for delivering high-quality semiconductor products, which has helped it establish a strong foothold in the industry. Moreover, Texas Instruments' diversified product portfolio and focus on innovation have enabled it to stay ahead of the competition and remain relevant in a rapidly evolving market. Let’s take a closer look at each element of TI’s competitive advantage:

Brand Reputation - Trust & long-standing relationships

Texas Instruments has a long-standing reputation for delivering high-quality semiconductor products. The company has been in the semiconductor industry for over 90 years and has established itself as a trusted and reliable supplier of semiconductors. Its brand reputation is built on its ability to consistently deliver high-quality products that meet the specific needs of its customers. This reputation has helped Texas Instruments to build a loyal customer base, which provides it with a significant competitive advantage.

Technological Expertise - Intellectual property

Texas Instruments' technological expertise is another competitive advantage that enables the company to stay ahead of the competition. TI has more than 45.000 patents which solidify its competitive advantage and protect its revenues from competitors. The company invests heavily in research and development to develop new technologies and improve its existing product offerings. Texas Instruments has a large team of engineers and scientists who are dedicated to developing cutting-edge technologies that enable the company to deliver high-performance semiconductors. The company's technological expertise enables it to create products that are tailored to the specific needs of its customers.

Vertical Integration - Economics of scale

Texas Instruments' vertical integration is another competitive advantage that enables the company to optimize its costs and improve its manufacturing efficiencies. The company has a vertically integrated manufacturing model, which allows it to control the entire production process, from the design of the chips to the final assembly of the products. This approach enables Texas Instruments to optimize its costs and improve its manufacturing efficiencies. Its vertical integration enables it to achieve economies of scale, which helps TI to reduce its manufacturing costs. The company's focus on continuous improvement and innovation also helps it to maintain its cost advantage and stay ahead of the competition.

Capital allocation

Capital allocation refers to the process of deciding how to allocate the company's financial resources to different investment opportunities, including capital expenditures, research and development, mergers and acquisitions, share repurchases, and dividend payments.

Capital Expenditures - CapEX

Texas Instruments invests heavily in capital expenditures to maintain its competitive edge and drive innovation in its product offerings. The company's capital expenditures primarily include investments in research and development, manufacturing facilities, and equipment. Texas Instruments' will spend $5B per year from 2023-2026. Their capex will primarily focus on new technologies that support revenue growth. TI does not disclose how much % of capex is on maintenance and how much is on growth, but we can assume a significant amount goes towards growth.

Research and Development

Texas Instruments' research and development (R&D) expenditures are critical to its competitive advantage. The company invests heavily in R&D to develop new technologies and improve its existing product offerings. R&D efforts are made to increase the product quality to customers, hence increasing loyalty. It also provides TI with a deeper cost advantage going from 200-mm to 300-mm reducing chip costs, and increasing their gross margins.

Mergers and Acquisitions

Texas Instruments has a disciplined approach to mergers and acquisitions (M&A). The company's M&A strategy is focused on acquiring companies that complement its existing product portfolio or provide access to new markets. Texas Instruments' recent acquisitions include Maxim Integrated, which provides the company with additional capabilities in power management, and National Semiconductor, which strengthens the company's position in the industrial and automotive markets.

Share Repurchases

Texas Instruments has a history of returning value to shareholders through share repurchases. The company's share repurchase program enables it to return excess cash to shareholders while also supporting its stock price. Texas Instruments repurchased $ 3,374 billion worth of shares in 2022 (2,1% of shares outstanding).

Dividend Payments

Texas Instruments also returns value to shareholders through dividend payments. The company has a long history of paying dividends and has consistently increased its dividend payout over the years. Texas Instruments' current dividend yield is around 2.82%.

The fundamentals

Texas Instruments currently has a return on invested capital of 37%, and the ROC has been in the high 30s for the last 5 years. Their free cash flow per share has grown from $2.63 to $6.42 over the last 5 years, a CAGR of 19.54%. TXN has a gross margin of ~69%. This means that TXN buys material for $31 and sells it for $100 after they have applied their value to it.

Valuation - Discounted Cash Flow Analysis

Using a simple DCFA to determine the value of the future cash flows of Texas Instruments.

The DCFA is set up using 3 scenarios:

Worst: 8% growth, then 6%, terminal multiple of 15

Normal: 12%, 10%, 18

Best: 15%, 12%, 25

The different scenarios are weighted 30% for the worst case, 10% for the best case, and 60% for the normal case.

Texas Instruments’ market cap is as of this writing $160BN, my fair value estimate of the business based on a simple DCFA is $162BN. This means that TXN is currently trading close to fair value, and we can expect a 9-10% annual return from current levels.

Given a future terminal multiple of 18 and a 12% growth rate (10% after 5 years), we can expect an 11,5% annual return.

TXN FCF Yield is currently at 3.7% vs. the risk-free rate of 3,52%. The business provides a higher FCF yield than the risk-free rate and has a 10-year FCF growth of 10% pa. If it can keep up this growth, I believe it is showing decent value at the current price. But it doesn’t quite reach my personal requirement of 15% annual returns.

Conclusion

Texas Instruments (TXN) is positioned to thrive in a growing industry, with solid competitive positioning and high business quality. The company has consistently delivered stable earnings and impressive fundamental results, making it an attractive investment opportunity.

While some investors may demand a high margin of safety, TXN's strong performance and potential for continued growth warrant a more modest requirement. A 25% margin of safety is desired, allowing for potential errors in judgment.

Given this attractive investment opportunity, I might initiate a position in TXN if the market cap falls to the $112-$118BN range, representing a 25%-22% discount from current levels.

With a commitment to holding quality investments over the long term, investors in TXN are likely to achieve market-beating results. While a strict requirement of a 15% annual return on a discounted cash flow basis may be desired, the stability of TXN may justify initiating a position earlier.